US DOLLAR TECHNICAL ANALYSIS Prices pushed higher for a third consecutive day but negative RSI divergence casts doubt on follow-through. A daily close above the 38.2% Fibonacci expansionat 11577 exposes the 50% level at 11648...

USDJPY USD/JPY has moved steadily higher over the past few days since finding support from just above the 38% retracement of the October low Our near-term trend bias is higher in USD/JPY while above 117.40 A confluence of Gann and Fibonacci levels around 120...

This year gold has come up 12 per cent against the yen, 9.5 per cent against the euro and for Russian holders - up 80 per cent. The precious metal has always been an ideal hedge amid currency wars, and investors stocking up on bullion at current depressed prices know what they are doing...

US DOLLAR TECHNICAL ANALYSIS Prices arestruggling to breach December’s high, with negative RSI divergence warning a double top may be forming. A daily close below the 14.6% Fibonacci retracementat 11489 exposes the 23.6% level at 11379...

2014-12-23 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - GDP] past data is 3.2% forecast data is 3.0% actual data is 2.6% according to the latest press release if actual > forecast (or actual data) = good for currency (for GDP in our case...

Forecasts For EUR/USD, USD/JPY, AUD/USD, NZD/USD, AUD/NZD — Westpac Westpac (abbr. From the English...

With all the "talk" of diverging paths of monetary policy... one could be forgiven, if glancing at the chart above, for thinking the inevitable endgame of Keynesianism is very much at hand as first The BoJ, then The Fed, then Europe all enter ZIRP... and now NIRP...

A slowdown in Canada’s Consumer Price Index (CPI) may spur fresh monthly highs in USD/CAD especially as the Bank of Canada (BoC) remains reluctant to further normalize monetary policy...

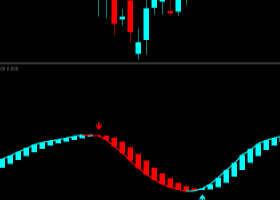

D1 price is on primary bearish market condition with good breakdown of the price movement: The price is located below Ichimoku cloud/kumo with Senkou Span A line as the nearest kumo border which is indicating the primary bearish Chinkou Span line broke the price from above to below which is indic...

ISM Index (Institute of Supply Management's index, former NAPM — National Association of Purchasing Managers) is the index of business activity. ISM figures above 50 are usually considered as an indicator of expansion, while values below 50 indicate contraction...

D1 price is on primary bullish market condition with secondary ranging: The price is inside Ichimoku cloud/kumo above Senkou Span A line which is indicating the ranging market condition within the primary bullish Nearest support level is 1183.66 Nearest resistance level is 1232...

Since 1 AD, a "Biblical tetrad" has occurred on these holy days a total of 7 times. In 2014-2015, it will be the 8th time. It won't occur again for another 500 years. Are we going to witness some crazy things on the market due to this event...

2014-12-17 19:30 GMT (or 21:30 MQ MT5 time) | [USD - FOMC Press Conference] past data is n/a forecast data is n/a actual data is n/a according to the latest press release [USD - FOMC Press Conference] = It's among the primary methods the Fed uses to communicate with investors regarding monetary p...

GBPUSD Intra-Day Fundamentals - BoE Monetary Policy Meeting Minutes and 34 Pips Range Price Movement

2014-12-17 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - BoE Minutes] past data is n/a forecast data is n/a actual data is n/a according to the latest press release More hawkish than expected = Good for currency (for GBP in our case...

Italy began an general strike at the call of two large unions to protest the rapid pace of economic and social reform introduced by premier Matteo Renzi...

Last week marked the moment when a full-blown financial crisis caused by falling oil prices, came to the United States. Here are some records that have been established over the past week: It was the worst week for the Dow over the past three years...

Generalising the opinions of 35 analysts from world leading banks and broker companies collected in a table as well as forecasts based on different methods of technical and graphical analysis, the following can be concluded: - regarding the EUR/USD pair a short continuation of the increasing tren...

Dear friends and readers, As a rule, today’s forecast will contain information about how my last forecast worked out and forecast for the coming week (15-19.12.2014). Results of the last forecast The last forecast had worked for 86,36...

Since this is a long-term forecast, I would suggest you take a look at the weekly chart of the currency pair, because, in my opinion, it is a large-scale formed symmetrical structure dictates the rules of further rate. Center structure is located in the middle of 2012, at the level of 1...