당사 팬 페이지에 가입하십시오

- 조회수:

- 8802

- 평가:

- 게시됨:

- 2011.06.28 11:32

- 업데이트됨:

- 2016.11.22 07:32

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Author: Andrey N. Bolkonsky

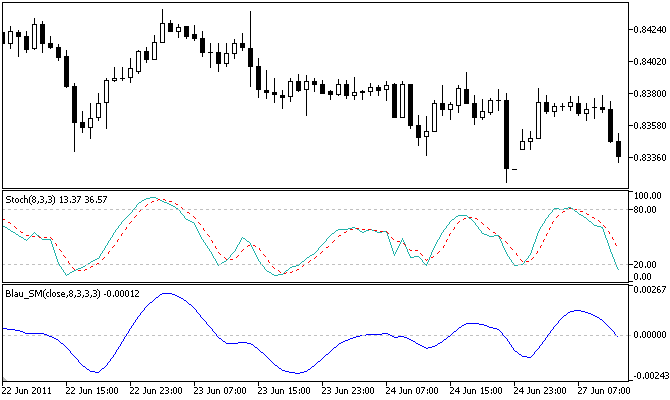

Stochastic Momenum (Stochastic Momentum, SM) by William Blau (see Momentum, Direction, and Divergence: Applying the Latest Momentum Indicators for Technical Analysis).

The q-period Stochastic Momentum is defined as a distance of the current close from the midpoint of q bars.

- The value of Stochastic Momentum indicates the distance between the midpoint of q-period price range.

- The sign of Stochastic Momentum indicates the price position relative to the midpoint of price range: the positive values if the price is higher than midpoint, the negative if the price is lower than midpoint of price range.

Definition of Stochastic Momentum by William Blau

- WilliamBlau.mqh must be placed in terminal_data_folder\MQL5\Include\

- Blau_SM.mq5 must be placed in terminal_data_folder\MQL5\Indicators\

Calculation:

The formula for calculation of q-period Stochastic Momentum is following:

sm(price,q) = price - 1/2 * [LL(q) + HH(q)]

where:

- price - close price;

- q - number of bars, used in calculation of Stochastic Momentum;

- LL(q) - minimal price (q bars);

- HH(q) - maximal price (q bars);

- 1/2*[LL(q)+HH(q)] - midpoint of the q-period price range.

The smoothed q-period Stochastic Momentum is calculated by formula:

SM(price,q,r,s,u) = EMA(EMA(EMA(sm(price,q),r),s),u)

where:

- price - close price;

- q - number of bars, used in calculation of Stochastic Momentum;

- sm(price,q)=price-1/2*[LL(q)+HH(q)] - q-period Stochastic Momentum;

- EMA(sm(price,q),r) - 1st smoothing- exponentially smoothed moving average with period r, applied to q-period Stochastic Momentum;

- EMA(EMA(...,r),s) - 2nd smoothing - EMA of period s, applied to result of the 1st smoothing;

- EMA(EMA(EMA(sm(q),r),s),u) - 3rd smoothing - EMA of period u, applied to result of the 2nd smoothing.

- q - period of Stochastic Momentum (by default q=5);

- r - period of the 1st EMA, applied to Stochastic Momentum (by default r=20);

- s - period of the 2nd EMA, applied to result of the 1st smoothing (by default s=5);

- u - period of the 3rd EMA, applied to result of the 2nd smoothing (by default u=3);

- AppliedPrice - price type (by default AppliedPrice=PRICE_CLOSE).

- q>0;

- r>0, s>0, u>0. If r, s or u =1, smoothing is not used;

- Min. rates =(q-1+r+s+u-3+1).

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/370

Stochastic Oscillator Blau_TS_Stochastic

Stochastic Oscillator Blau_TS_Stochastic

Stochastic Oscillator by William Blau.

Stochastic Index Blau_TStochI

Stochastic Index Blau_TStochI

Stochastic Index Indicator (normalized smoothed q-period Stochastic) by William Blau.

Stochastic Momentum Index Blau_SMI

Stochastic Momentum Index Blau_SMI

Stochastic Momentum Index by William Blau.

Stochastic Momentum Oscillator Blau_SM_Stochastic

Stochastic Momentum Oscillator Blau_SM_Stochastic

Stochastic Momentum Oscillator by William Blau.