Zaimi Yazid / Profil

- Bilgiler

|

11+ yıl

deneyim

|

0

ürünler

|

0

demo sürümleri

|

|

0

işler

|

0

sinyaller

|

0

aboneler

|

Arkadaşlar

1066

İstekler

Giden

Zaimi Yazid

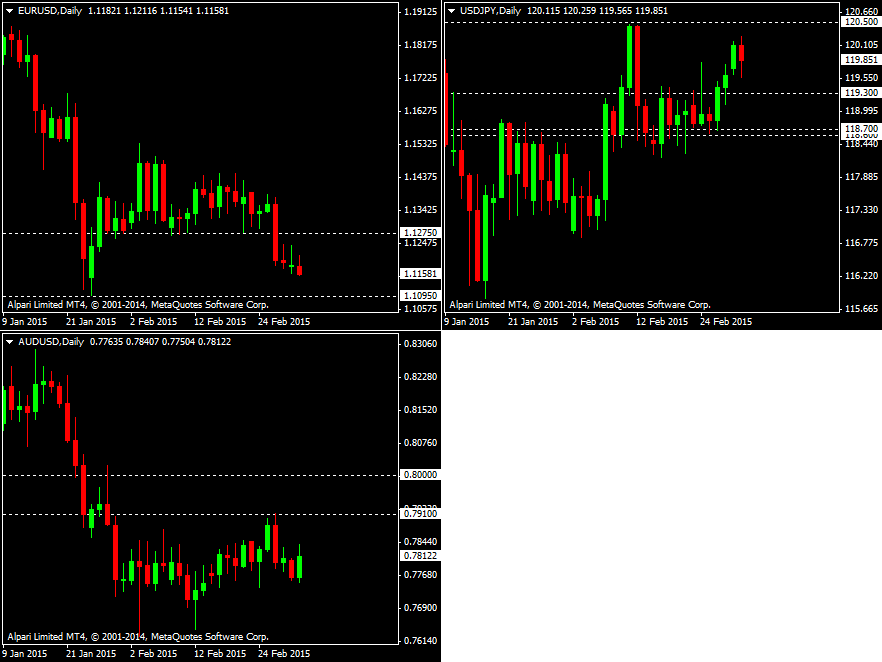

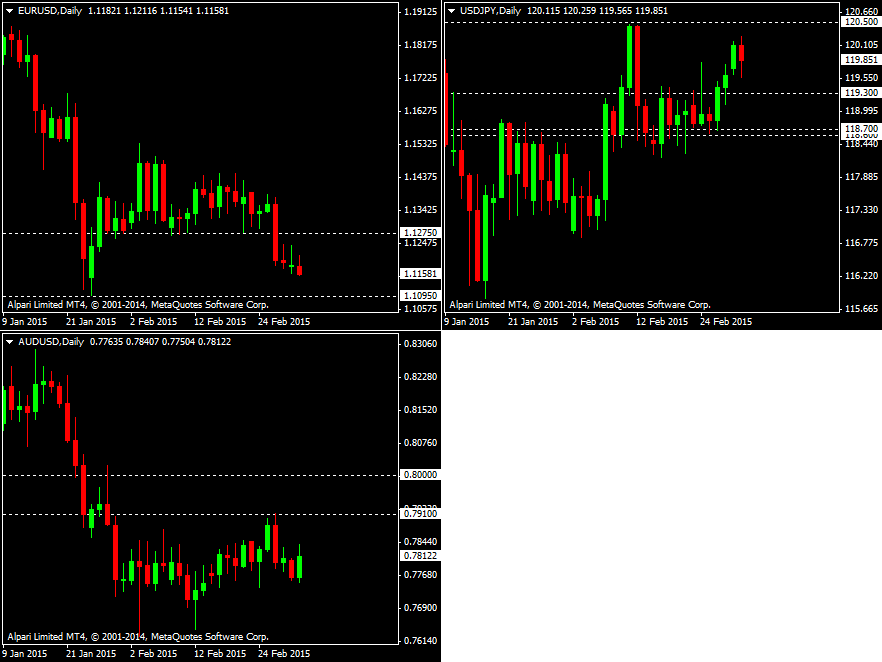

The following are latest short-term (mostly intraday) trading strategies for EURUSD, USDJPY, and AUDUSD.

EURUSD: The ECB decision on Thursday and US payrolls on Friday remain in focus. Still prefer to short but intraday, fade 50-60pip moves in either direction with a close stop at 1.1095 and 1.1275.

USDJPY: remains rangebound for now with higher highs and higher lows. USDJPY is probably a buy at yesterday's low, at least in the short term, with UST yields marching ahead. First support lies at 119.30 ahead of 118.60/70. Trim longs ahead of resistance at 120.50.

AUDUSD: was in focus in Asia with the RBA staying on hold against the market pricing in 60% chances of a cut. Still expect better levels to sell and AUDUSD to trade on bid now that RBA is out of the way. Start fading the rally around 0.8000. The first resistance is at 0.7910.

EURUSD: The ECB decision on Thursday and US payrolls on Friday remain in focus. Still prefer to short but intraday, fade 50-60pip moves in either direction with a close stop at 1.1095 and 1.1275.

USDJPY: remains rangebound for now with higher highs and higher lows. USDJPY is probably a buy at yesterday's low, at least in the short term, with UST yields marching ahead. First support lies at 119.30 ahead of 118.60/70. Trim longs ahead of resistance at 120.50.

AUDUSD: was in focus in Asia with the RBA staying on hold against the market pricing in 60% chances of a cut. Still expect better levels to sell and AUDUSD to trade on bid now that RBA is out of the way. Start fading the rally around 0.8000. The first resistance is at 0.7910.

Zaimi Yazid

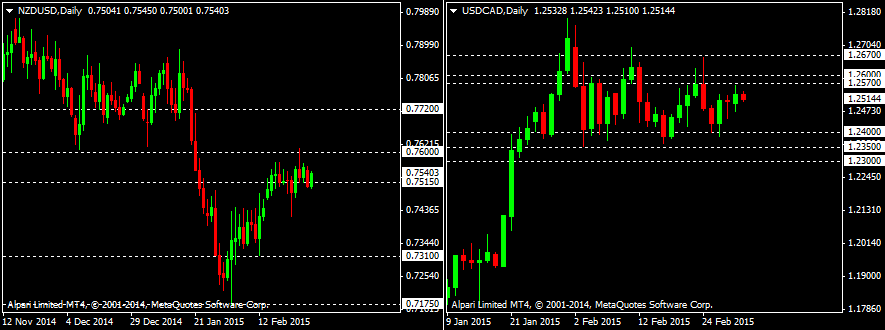

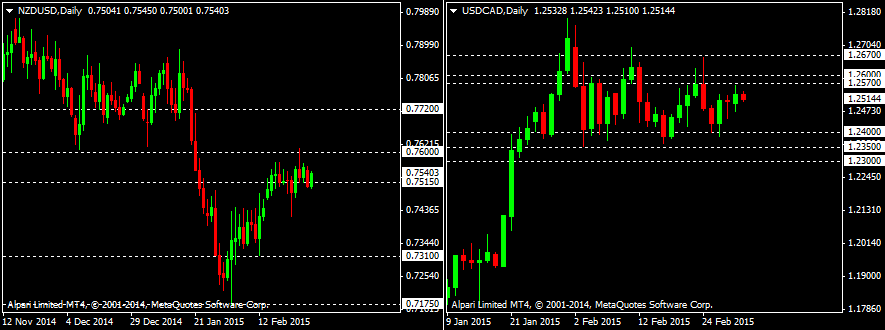

The following are short-term trading strategies for NZDUSD and USDCAD.

NZDUSD: prefer to remain short. The pair is right on top of a short-term support, at 0.7515. Add on rallies above 0.76 with stops above 0.7720. Key supports remain 0.7310 and 0.7175.

USDCAD: is right in the middle of the recent 1.2350-1.2600 range. The BoC meets on Wednesday and is widely expected to stay on hold after Governor Poloz's comments last week. Play the range - selling toward 1.2570 with stops above 1.2670 and buying on dips toward 1.24 with stops below 1.23.

NZDUSD: prefer to remain short. The pair is right on top of a short-term support, at 0.7515. Add on rallies above 0.76 with stops above 0.7720. Key supports remain 0.7310 and 0.7175.

USDCAD: is right in the middle of the recent 1.2350-1.2600 range. The BoC meets on Wednesday and is widely expected to stay on hold after Governor Poloz's comments last week. Play the range - selling toward 1.2570 with stops above 1.2670 and buying on dips toward 1.24 with stops below 1.23.

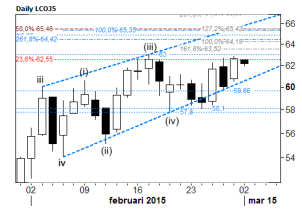

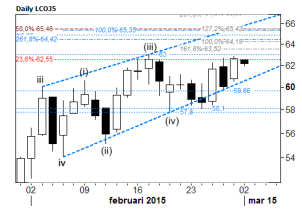

Zaimi Yazid

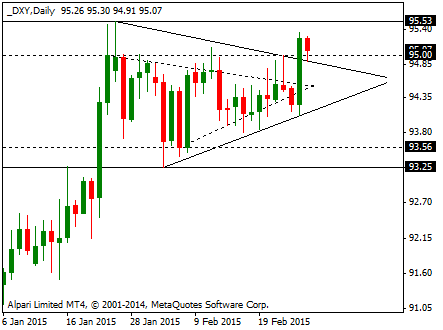

Brent Crude: Headed into a 63.00/65.45 test. Trendline support seems to be respected still. Price action is mixed to bullish and a wider 63.00/65.45 zone of resistance seems to be in for a test. It is worth noting that the Feb monthly candle is potentially bullish and is posting a task for trend-following bears to neutralize. Current intraday stretches are located at 60.00 & 63.70.

Zaimi Yazid

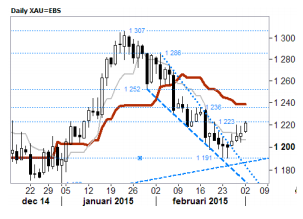

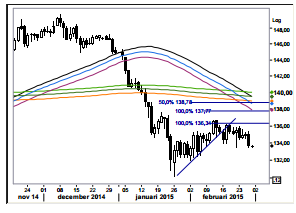

Spot Gold: Looks set to test the $1,240s. From an Elliott wave perspective it's hard to make out what's currently unfolding, but for a near-term trader/bull a break over 1,223 should be encouraging for an attempt to also break resistance at 1,236/38. Those bulls would be less happy if local support at 1,204/01 is lost again. Current intraday stretches are located at 1,204 & 1,229.

Zaimi Yazid

USDCAD: Soon ready to burst higher. With the bullish key day reversal on Thursday the final subwave, e, within the triangle was put in place. The next step should accordingly be a break higher exiting the triangle and taking aim up into the 1.30's. Dips down to the 1.2450/60 area should be seen as buying opportunities.

Zaimi Yazid

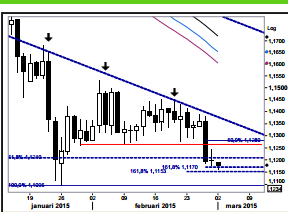

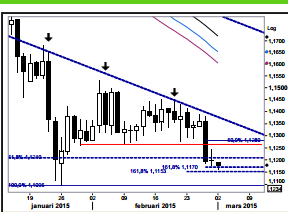

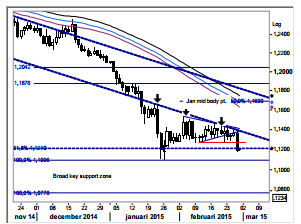

EURUSD: Small pause before lower. Since the break of 1.1262 on Thursday the pair has continued lower albeit at a much slower pace. The slowing momentum, an hourly five wave pattern and a couple of 161.8% Fibo projection points all points to a possible minor upside reaction (1.1240?) before making a go at the 1.1098 low point.

Zaimi Yazid

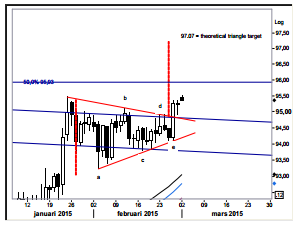

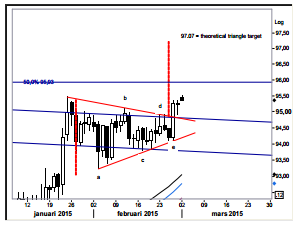

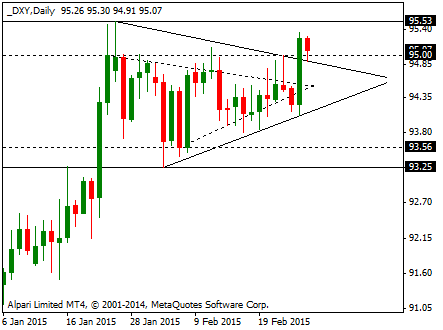

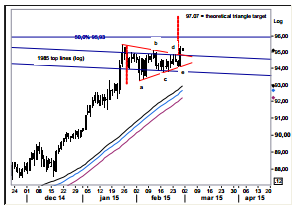

USD INDEX: An absolute minimum target met. With the move above 95.48 the absolute minimum target for the bull triangle, a new trend high has been achieved. The ideal target is however set at 97.07 so there's still ample room to advance should the market decide to do so. For today it is also essential that we don't close below 94.91, creating a bearish key day reversal hence indicating a premature ending to the current ascent. Ideally buyers at the low end, 95.25, of the weekend gap to prevent a deeper drop.

Zaimi Yazid

The following are latest short-term (mostly intraday) trading strategies for EURUSD, USDJPY, and GBPUSD.

EURUSD: Although prefer shorts, stay flexible and play the intraday moves given important data releases this week. Have net been buyers over the past week but with very limited impact and see no reason to fight the trend.

USDJPY: Had fairly muted interest in the last few days and steady headed higher since Fed Chair Yellen's testimony last week in line with the US dollar and UST yields. Buy USDJPY below 119.50 with a stop below 118.60/70, the 50-day moving average and daily Ichimoku cloud.

GBPUSD: Cable had a slow start this week. The pair has short-term support around 1.5400 but the first stronger support is around 1.5330-40. Buy on dips closer to that level.

EURUSD: Although prefer shorts, stay flexible and play the intraday moves given important data releases this week. Have net been buyers over the past week but with very limited impact and see no reason to fight the trend.

USDJPY: Had fairly muted interest in the last few days and steady headed higher since Fed Chair Yellen's testimony last week in line with the US dollar and UST yields. Buy USDJPY below 119.50 with a stop below 118.60/70, the 50-day moving average and daily Ichimoku cloud.

GBPUSD: Cable had a slow start this week. The pair has short-term support around 1.5400 but the first stronger support is around 1.5330-40. Buy on dips closer to that level.

Zaimi Yazid

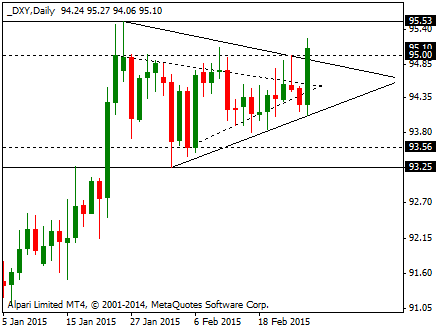

USD: After breaking through and closed above triangle resistance line, it did retrace down until previous resistance line now became support line. Next challenge line will be 95.53 (Jan-26 high).

Zaimi Yazid

Brent Crude: Is the $63-level out of reach now? Sellers responded yesterday and cut a 2nd 63.00 attempt short with a little margin. But as long as holding above 57.80 this option remains open. For today, a double 58.10/62.63 watch seems appropriate. Current intraday stretches are located at 59.05 & 62.70.

Zaimi Yazid

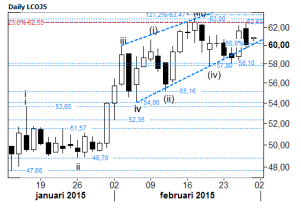

EURJPY: On a slippery slope. After three days of failed upside attempts above the mid body point of Monday's bearish engulfing candle the sellers stepped up to the plate and aggressively pushed the cross lower. More supply is expected to hit the market once the 133.56 support has been cleared (thereafter focus will be turning to the 132.57 – 132.00 area. Upside reactions should be limited to the 134.30-area.

Zaimi Yazid

EURUSD: Finally a directional move. With the break of 1.1262 the green light has been given for a move down to a fresh trend low. The triangle's theoretical target is 1.0840 (minimum target is marginally pass the recent low point 1.1098) so there should be ample of room for the pair to move lower in the near term. However as triangles often tends to be the last congestion in a trend move the following low point (below 1.1098) will also be a somewhat more lasting one creating the foundation for a profound bounce (back to 1.15?).

Zaimi Yazid

USD INDEX: On the road again. After a little more than a month of consolidation in a bull triangle the greenback yesterday made an impulsive and successful exit hence confirming the resumption of the bull trend. The next obstacle will be the January peak, 95.48, but it will probably not cause much of a problem for the market to pass. The theoretical target for the triangle is 97.07 and once met the risk of a more substantial correction will start increasing.

Zaimi Yazid

The following are latest short-term trading strategies for EURCHF, EURGBP, and USDCAD.

EURCHF: Fade dips to 1.0670-00; rallies should run out of steam above 1.08. Play the ranges with tight stops.

EURGBP: Sell rallies with stops above 0.7350- 75, for a final break lower.

USDCAD: remains a buy on dips to 1.2310-1.2400 with stops below 1.2250.

EURCHF: Fade dips to 1.0670-00; rallies should run out of steam above 1.08. Play the ranges with tight stops.

EURGBP: Sell rallies with stops above 0.7350- 75, for a final break lower.

USDCAD: remains a buy on dips to 1.2310-1.2400 with stops below 1.2250.

Zaimi Yazid

USDCAD: Bullish Engulfing; EURUSD: Breakout

Evidence says that the Greenback is resuming its long term bulltrend after 3-4wks of consolidation.

In the USD Index, today's break of Triangle resistance confirms a return to trend.

Upside targets are seen to 97.01 and potentially beyond. Pullbacks should not break the 34d avg, while a move below the Feb-03 low at 93.25 invalidates the bullish setup.

Meanwhile, in USDCAD it looks to be completing its 3wk range trade with today's reversal higher.

Indeed, a close above 1.2487 would complete a Bullish Engulfing Candle on daily charts, adding to the bullish body of evidence. A break of 1.2643/1.2665 would confirm a resumption of the bull trend for 1.3035.

Finally, bearish breakout in EURUSD indicates an end to its consolidation and a resumption of its larger bear trend arguing that following this break, price action should not trade above the Feb-19 high at 1.1451.

EURUSD break of 1.1270 (the Feb-09 low) targets 1.1098 (Jan-25 low) ahead of the Sep’03 low at 1.0765 and eventually below.

Evidence says that the Greenback is resuming its long term bulltrend after 3-4wks of consolidation.

In the USD Index, today's break of Triangle resistance confirms a return to trend.

Upside targets are seen to 97.01 and potentially beyond. Pullbacks should not break the 34d avg, while a move below the Feb-03 low at 93.25 invalidates the bullish setup.

Meanwhile, in USDCAD it looks to be completing its 3wk range trade with today's reversal higher.

Indeed, a close above 1.2487 would complete a Bullish Engulfing Candle on daily charts, adding to the bullish body of evidence. A break of 1.2643/1.2665 would confirm a resumption of the bull trend for 1.3035.

Finally, bearish breakout in EURUSD indicates an end to its consolidation and a resumption of its larger bear trend arguing that following this break, price action should not trade above the Feb-19 high at 1.1451.

EURUSD break of 1.1270 (the Feb-09 low) targets 1.1098 (Jan-25 low) ahead of the Sep’03 low at 1.0765 and eventually below.

Zaimi Yazid

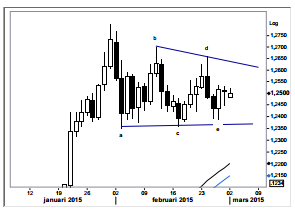

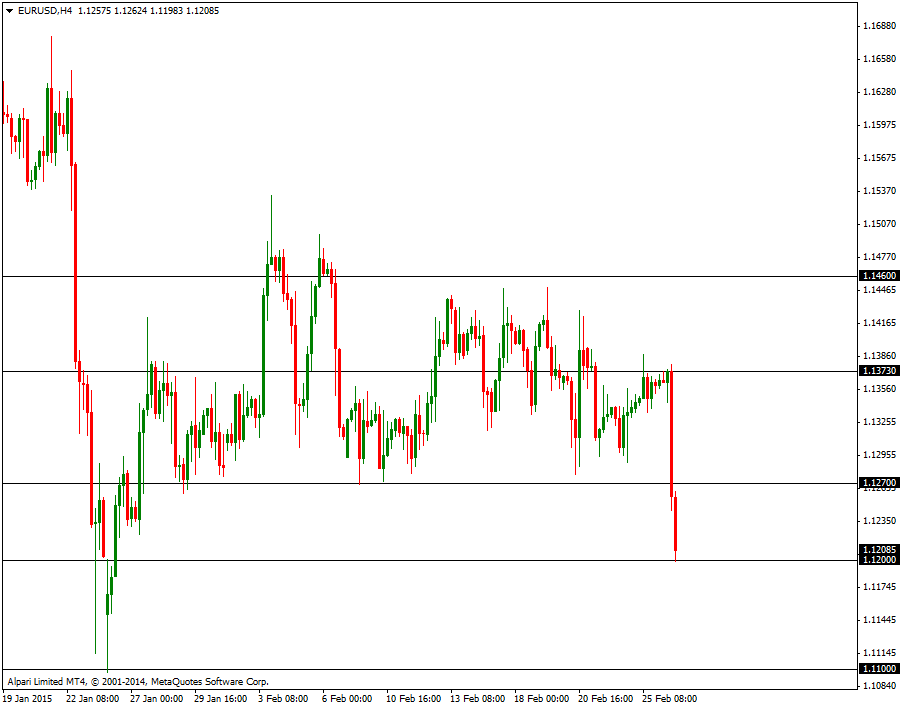

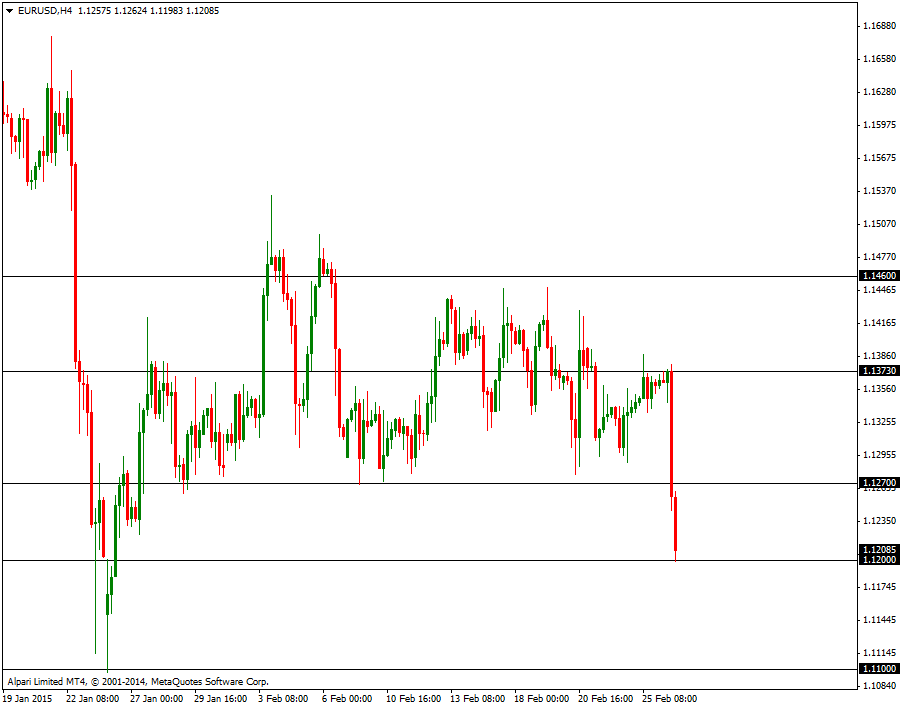

EURUSD finally falls out of range – more to come?

EURUSD was stuck in a narrow range throughout February. However, in the penultimate day of the month, the pair finally moves lower and trades at the lowest since January 27th.

The trigger was a one-two punch from the US: bullish words from Bullard and solid inflation data, that emerged as a winner from a big bulk of figures.

James Bullard, the president of the Saint Louis Fed, referred to both sides of the currency: he said the strong dollar will only have a marginal effect on growth. And, he added that the ECB’s QE is likely to push the euro further to the downside.

Once the Greek story is moved to the back burner, there is still this monetary policy divergence issue which weighs on the pair.

Janet Yellen was perceived as dovish, but she was actually preparing markets on for a removal of forward guidance in March.

With core inflation at 1.6% and job creation still solid, a June hike is still on the table.

EURUSD dropped below support at 1.127 and reached a low at the round number of 1.12, followed by 1.11. On the topside, 1.127 turns into resistance, followed by 1.1373 and 1.146.

Here is how it looks on the chart:

EURUSD was stuck in a narrow range throughout February. However, in the penultimate day of the month, the pair finally moves lower and trades at the lowest since January 27th.

The trigger was a one-two punch from the US: bullish words from Bullard and solid inflation data, that emerged as a winner from a big bulk of figures.

James Bullard, the president of the Saint Louis Fed, referred to both sides of the currency: he said the strong dollar will only have a marginal effect on growth. And, he added that the ECB’s QE is likely to push the euro further to the downside.

Once the Greek story is moved to the back burner, there is still this monetary policy divergence issue which weighs on the pair.

Janet Yellen was perceived as dovish, but she was actually preparing markets on for a removal of forward guidance in March.

With core inflation at 1.6% and job creation still solid, a June hike is still on the table.

EURUSD dropped below support at 1.127 and reached a low at the round number of 1.12, followed by 1.11. On the topside, 1.127 turns into resistance, followed by 1.1373 and 1.146.

Here is how it looks on the chart:

Zaimi Yazid

USD: How long its consolidation mode?

Break and close above 95.00 or below 93.56 will end its consolidation mode.

Break and close above 95.00 or below 93.56 will end its consolidation mode.

Zaimi Yazid

The following are latest short-term (mostly intraday) trading strategies for EURUSD, USDJPY, and GBPUSD.

EURUSD: While the buying interest below 1.1300 seems powerful, sellers are lined up around 1.1500. This indicates that the recent range will remain intact. Stay flexible and fade 50-60pip moves on either side with stops at 1.1240 or 1.1460.

USDJPY: Has been rangebound since Fed Chair Yellen's speech. Dollar weakness over the past few sessions provides a good opportunity to buy USDJPY around 118.30-118.50, for a break of 119.30 and toward 119.80. Flows are fairly balanced. Support comes in at 118.00.

GBPUSD: Cable confirmed the break above 1.5500 yesterday and ran stops through 1.5510-20 up to 1.5538. Stay on the sidelines in cable for now to see whether the market targets 1.5600 or fades the recent moves.

EURUSD: While the buying interest below 1.1300 seems powerful, sellers are lined up around 1.1500. This indicates that the recent range will remain intact. Stay flexible and fade 50-60pip moves on either side with stops at 1.1240 or 1.1460.

USDJPY: Has been rangebound since Fed Chair Yellen's speech. Dollar weakness over the past few sessions provides a good opportunity to buy USDJPY around 118.30-118.50, for a break of 119.30 and toward 119.80. Flows are fairly balanced. Support comes in at 118.00.

GBPUSD: Cable confirmed the break above 1.5500 yesterday and ran stops through 1.5510-20 up to 1.5538. Stay on the sidelines in cable for now to see whether the market targets 1.5600 or fades the recent moves.

: