Shahzad Ali Ali / Profil

- Bilgiler

|

yok

deneyim

|

0

ürünler

|

0

demo sürümleri

|

|

0

işler

|

0

sinyaller

|

0

aboneler

|

🕶Just providing analyzes on regular basis.

Not Financial Advice

Telegram Contact @Professort1

Telegram Channel Link: https://t.me/anthonygoldtrades

Exness Partner Link: https://one.exnesstrack.net/a/l36gq2sv9q

Not Financial Advice

Telegram Contact @Professort1

Telegram Channel Link: https://t.me/anthonygoldtrades

Exness Partner Link: https://one.exnesstrack.net/a/l36gq2sv9q

Arkadaşlar

16

İstekler

Giden

Shahzad Ali Ali

Gold Price Retreats Toward $2,650 Amid Market Jitters

Gold prices are pulling back from recent highs near $2,670, trading around $2,650 early Thursday. Despite strong demand for safe-haven assets amid rising risk aversion, the US Dollar’s resurgence and mixed market sentiment are weighing on the precious metal.

Key Drivers Behind Gold’s Retreat

Haven Demand Shift to USD:

Risk aversion sparked by global uncertainties has boosted demand for the US Dollar. This has countered gold’s typical safe-haven appeal, keeping XAU/USD gains in check.

Trump’s Tariff Speculations:

Reports suggest President-elect Trump may invoke the International Economic Emergency Powers Act (IEEPA) to impose sweeping tariffs, further unnerving markets. While this news rattled sentiment, it simultaneously supported the Greenback.

FOMC Minutes Awaited:

Investors are looking ahead to the Federal Open Market Committee (FOMC) Meeting Minutes for insights into the Fed’s decision to cut rates and its future policy path.

What’s Next for Gold?

With holiday-thinned liquidity and growing geopolitical uncertainties, gold traders will closely monitor Fedspeak and any updates on Trump’s tariff plans.

Gold prices are pulling back from recent highs near $2,670, trading around $2,650 early Thursday. Despite strong demand for safe-haven assets amid rising risk aversion, the US Dollar’s resurgence and mixed market sentiment are weighing on the precious metal.

Key Drivers Behind Gold’s Retreat

Haven Demand Shift to USD:

Risk aversion sparked by global uncertainties has boosted demand for the US Dollar. This has countered gold’s typical safe-haven appeal, keeping XAU/USD gains in check.

Trump’s Tariff Speculations:

Reports suggest President-elect Trump may invoke the International Economic Emergency Powers Act (IEEPA) to impose sweeping tariffs, further unnerving markets. While this news rattled sentiment, it simultaneously supported the Greenback.

FOMC Minutes Awaited:

Investors are looking ahead to the Federal Open Market Committee (FOMC) Meeting Minutes for insights into the Fed’s decision to cut rates and its future policy path.

What’s Next for Gold?

With holiday-thinned liquidity and growing geopolitical uncertainties, gold traders will closely monitor Fedspeak and any updates on Trump’s tariff plans.

Shahzad Ali Ali

🖥 Understanding Liquidity in Trading: A Key Element for Success

Liquidity is a fundamental concept in trading, influencing everything from order execution to market stability. Whether you're trading Forex, stocks, or commodities, understanding liquidity can significantly enhance your strategy.

💎 What is Liquidity?

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. High liquidity means there are many buyers and sellers, ensuring smooth transactions and stable prices. Conversely, low liquidity can lead to price gaps and increased volatility.

❓ Why is Liquidity Important?

📈 Tight Spreads:

High liquidity reduces the difference between the bid (buy) and ask (sell) price, saving costs for traders.

📈 Faster Execution:

Markets with high liquidity execute orders quickly, minimizing the risk of slippage.

📈 Stability:

Liquid markets are less prone to sudden, sharp price movements, offering more predictable trading environments.

📈 Liquidity in Forex Markets

The Forex market is known for its high liquidity, especially in major currency pairs like EUR/USD or USD/JPY, driven by constant global trading. However, liquidity can vary:

- High during overlap sessions: For instance, during the London-New York overlap, trading volumes peak.

- Low during holidays or weekends: This can lead to erratic price movements and wider spreads.

💡 Spotting Liquidity Zones in Price Action

In technical analysis, liquidity zones are areas where price frequently reverses or consolidates due to a high concentration of orders.

- Support and Resistance Levels: Indicate potential zones where buyers or sellers are likely to dominate.

- Stop-Loss Hunting: Big players may drive the price to trigger stop-loss orders in low-liquidity conditions, creating false breakouts.

🔖 Risks of Low Liquidity

❗️ Slippage: Your order executes at a worse price than expected.

❗️ Wide Spreads: Increased transaction costs.

❗️ Market Manipulation: Lower liquidity can enable large players to move prices significantly.

❗️ Tips to Trade with Liquidity in Mind

- Trade during high-liquidity sessions to reduce slippage and spread costs.

- Use liquidity zones to set entry and exit points effectively.

- Avoid trading during major news events if you're unfamiliar with high-volatility strategies.

By integrating liquidity awareness into your trading plan, you can improve efficiency, reduce costs, and make more informed decisions. 💡 In trading, understanding liquidity is not just an advantage—it’s a necessity.

Liquidity is a fundamental concept in trading, influencing everything from order execution to market stability. Whether you're trading Forex, stocks, or commodities, understanding liquidity can significantly enhance your strategy.

💎 What is Liquidity?

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. High liquidity means there are many buyers and sellers, ensuring smooth transactions and stable prices. Conversely, low liquidity can lead to price gaps and increased volatility.

❓ Why is Liquidity Important?

📈 Tight Spreads:

High liquidity reduces the difference between the bid (buy) and ask (sell) price, saving costs for traders.

📈 Faster Execution:

Markets with high liquidity execute orders quickly, minimizing the risk of slippage.

📈 Stability:

Liquid markets are less prone to sudden, sharp price movements, offering more predictable trading environments.

📈 Liquidity in Forex Markets

The Forex market is known for its high liquidity, especially in major currency pairs like EUR/USD or USD/JPY, driven by constant global trading. However, liquidity can vary:

- High during overlap sessions: For instance, during the London-New York overlap, trading volumes peak.

- Low during holidays or weekends: This can lead to erratic price movements and wider spreads.

💡 Spotting Liquidity Zones in Price Action

In technical analysis, liquidity zones are areas where price frequently reverses or consolidates due to a high concentration of orders.

- Support and Resistance Levels: Indicate potential zones where buyers or sellers are likely to dominate.

- Stop-Loss Hunting: Big players may drive the price to trigger stop-loss orders in low-liquidity conditions, creating false breakouts.

🔖 Risks of Low Liquidity

❗️ Slippage: Your order executes at a worse price than expected.

❗️ Wide Spreads: Increased transaction costs.

❗️ Market Manipulation: Lower liquidity can enable large players to move prices significantly.

❗️ Tips to Trade with Liquidity in Mind

- Trade during high-liquidity sessions to reduce slippage and spread costs.

- Use liquidity zones to set entry and exit points effectively.

- Avoid trading during major news events if you're unfamiliar with high-volatility strategies.

By integrating liquidity awareness into your trading plan, you can improve efficiency, reduce costs, and make more informed decisions. 💡 In trading, understanding liquidity is not just an advantage—it’s a necessity.

Shahzad Ali Ali

During the Christmas holiday period, the market may experience low liquidity, making it prone to gaps and slippage. Additionally, deposit and withdrawal processing might be delayed. Please manage your risks carefully and exercise extra caution during this time. The market is scheduled to close today at 20:30 London time (GMT+2); ensure all your trades are closed before this time to avoid holding positions overnight.

Shahzad Ali Ali

☄️ Gold Remains on Edge Ahead of US Nonfarm Payrolls Report

❗️ Gold prices (XAU/USD) slipped to an eight-day low of $2,615 early Friday, extending their decline as the market braces for the highly anticipated US Nonfarm Payrolls (NFP) report. The precious metal has been trading within a narrow range, caught between mixed economic signals and a cautious market sentiment.

❗️ Geopolitical Tensions Support Gold, but Not Enough

Persistent global uncertainties, including the Russia-Ukraine conflict, ongoing trade disputes, and political instability in France and South Korea, continue to provide some support for gold’s safe-haven appeal. Additionally, a weaker US Dollar (USD) has helped prevent steeper losses for the commodity.

❗️ Fed’s Cautious Stance Keeps Gold Under Pressure

On the other hand, expectations for a less dovish Federal Reserve (Fed) have capped any significant upside for gold. Recent remarks by Fed Chair Jerome Powell and other FOMC members signaled a cautious approach toward monetary policy adjustments. Rising US Treasury yields, spurred by these comments, have further weighed on the non-yielding gold.

❗️ Focus Shifts to Nonfarm Payrolls

Traders are now looking ahead to the US NFP report, set to be released later today. The data is expected to provide critical insights into the health of the labor market and influence the Fed’s next policy moves. A stronger-than-expected jobs report could bolster the USD, putting additional pressure on gold, while a weaker reading might revive demand for the yellow metal.

Until the NFP release, gold is likely to remain under pressure, with its path closely tied to market expectations for US economic performance

❗️ Gold prices (XAU/USD) slipped to an eight-day low of $2,615 early Friday, extending their decline as the market braces for the highly anticipated US Nonfarm Payrolls (NFP) report. The precious metal has been trading within a narrow range, caught between mixed economic signals and a cautious market sentiment.

❗️ Geopolitical Tensions Support Gold, but Not Enough

Persistent global uncertainties, including the Russia-Ukraine conflict, ongoing trade disputes, and political instability in France and South Korea, continue to provide some support for gold’s safe-haven appeal. Additionally, a weaker US Dollar (USD) has helped prevent steeper losses for the commodity.

❗️ Fed’s Cautious Stance Keeps Gold Under Pressure

On the other hand, expectations for a less dovish Federal Reserve (Fed) have capped any significant upside for gold. Recent remarks by Fed Chair Jerome Powell and other FOMC members signaled a cautious approach toward monetary policy adjustments. Rising US Treasury yields, spurred by these comments, have further weighed on the non-yielding gold.

❗️ Focus Shifts to Nonfarm Payrolls

Traders are now looking ahead to the US NFP report, set to be released later today. The data is expected to provide critical insights into the health of the labor market and influence the Fed’s next policy moves. A stronger-than-expected jobs report could bolster the USD, putting additional pressure on gold, while a weaker reading might revive demand for the yellow metal.

Until the NFP release, gold is likely to remain under pressure, with its path closely tied to market expectations for US economic performance

Shahzad Ali Ali

Gold Holds Ground as Markets Await Key US Jobs Data

Gold prices edged higher on Wednesday, trading at $2,652 per ounce (+0.35%), supported by mixed U.S. economic data. However, gains were limited as Federal Reserve Chair Jerome Powell signaled caution on inflation and monetary policy.

Powell’s Inflation Warning

Powell emphasized that while the U.S. economy remains resilient, inflation remains far from the Fed’s 2% goal. His remarks suggested a cautious approach to further monetary easing, keeping markets uncertain.

US Jobs Data in Focus

Key labor market reports, including Initial Jobless Claims and Nonfarm Payrolls (NFP), are set to be released this week. These reports could heavily influence gold’s direction, with weaker-than-expected data likely boosting gold prices as the USD weakens.

Conclusion: Gold remains stable for now, but upcoming U.S. jobs data could spark significant market moves. Traders should stay alert to potential volatility ahead.

Gold prices edged higher on Wednesday, trading at $2,652 per ounce (+0.35%), supported by mixed U.S. economic data. However, gains were limited as Federal Reserve Chair Jerome Powell signaled caution on inflation and monetary policy.

Powell’s Inflation Warning

Powell emphasized that while the U.S. economy remains resilient, inflation remains far from the Fed’s 2% goal. His remarks suggested a cautious approach to further monetary easing, keeping markets uncertain.

US Jobs Data in Focus

Key labor market reports, including Initial Jobless Claims and Nonfarm Payrolls (NFP), are set to be released this week. These reports could heavily influence gold’s direction, with weaker-than-expected data likely boosting gold prices as the USD weakens.

Conclusion: Gold remains stable for now, but upcoming U.S. jobs data could spark significant market moves. Traders should stay alert to potential volatility ahead.

Shahzad Ali Ali

Gold prices drop due to a strong US Dollar, boosted by ISM improvement❗️

- Gold prices decline as the final month of the year begins, pressured by a strong US Dollar driven by Trump's tough rhetoric on BRICS countries and easing geopolitical tensions. XAU/USD trades at $2,635, down 0.58%.

- After the start of Monday's Asian session, XAU/USD fell to a daily low of $2,621 before recovering slightly, but the rise in US Treasury bond yields and the US Dollar Index (DXY) limited gold's recovery.

- The US ISM Manufacturing PMI for November rose to its highest level since June.

- The CME FedWatch Tool shows that the odds of a 25-basis point rate cut stand at 63%, down from 66% last Friday.

- This week, the US economic docket will feature speeches from Fed officials, including Chairman Jerome Powell, the JOLTs Job Openings for October, S&P and ISM Services PMI surveys, and Nonfarm Payroll data.

- Gold prices decline as the final month of the year begins, pressured by a strong US Dollar driven by Trump's tough rhetoric on BRICS countries and easing geopolitical tensions. XAU/USD trades at $2,635, down 0.58%.

- After the start of Monday's Asian session, XAU/USD fell to a daily low of $2,621 before recovering slightly, but the rise in US Treasury bond yields and the US Dollar Index (DXY) limited gold's recovery.

- The US ISM Manufacturing PMI for November rose to its highest level since June.

- The CME FedWatch Tool shows that the odds of a 25-basis point rate cut stand at 63%, down from 66% last Friday.

- This week, the US economic docket will feature speeches from Fed officials, including Chairman Jerome Powell, the JOLTs Job Openings for October, S&P and ISM Services PMI surveys, and Nonfarm Payroll data.

Shahzad Ali Ali

Where Will Gold Prices Go on Thanksgiving?

⚡️Despite growing concerns over global tariffs and US President-elect Trump’s announcements, the USD remains weak against major currencies, as markets expect the Fed to cut interest rates by 25 basis points in December.

⚡️The US PCE Price Index data, in line with expectations, did not alter the Fed’s rate cut outlook. The CME Group’s FedWatch Tool now shows a 63% chance of a December rate cut, up from 55% last week.

⚡️The dovish Fed outlook supports gold, which benefits from being a non-interest-bearing asset.

⚡️Gold also gains from heightened geopolitical tensions, especially between Russia and Ukraine, following Putin’s threat to attack Kyiv with new ballistic missiles.

⚡️Looking ahead, gold’s recovery could face challenges with thin trading volumes during the Thanksgiving weekend, but it may benefit if the USD weakens further. The Eurozone inflation report could also influence sentiment and gold’s price action.

⚡️Despite growing concerns over global tariffs and US President-elect Trump’s announcements, the USD remains weak against major currencies, as markets expect the Fed to cut interest rates by 25 basis points in December.

⚡️The US PCE Price Index data, in line with expectations, did not alter the Fed’s rate cut outlook. The CME Group’s FedWatch Tool now shows a 63% chance of a December rate cut, up from 55% last week.

⚡️The dovish Fed outlook supports gold, which benefits from being a non-interest-bearing asset.

⚡️Gold also gains from heightened geopolitical tensions, especially between Russia and Ukraine, following Putin’s threat to attack Kyiv with new ballistic missiles.

⚡️Looking ahead, gold’s recovery could face challenges with thin trading volumes during the Thanksgiving weekend, but it may benefit if the USD weakens further. The Eurozone inflation report could also influence sentiment and gold’s price action.

Shahzad Ali Ali

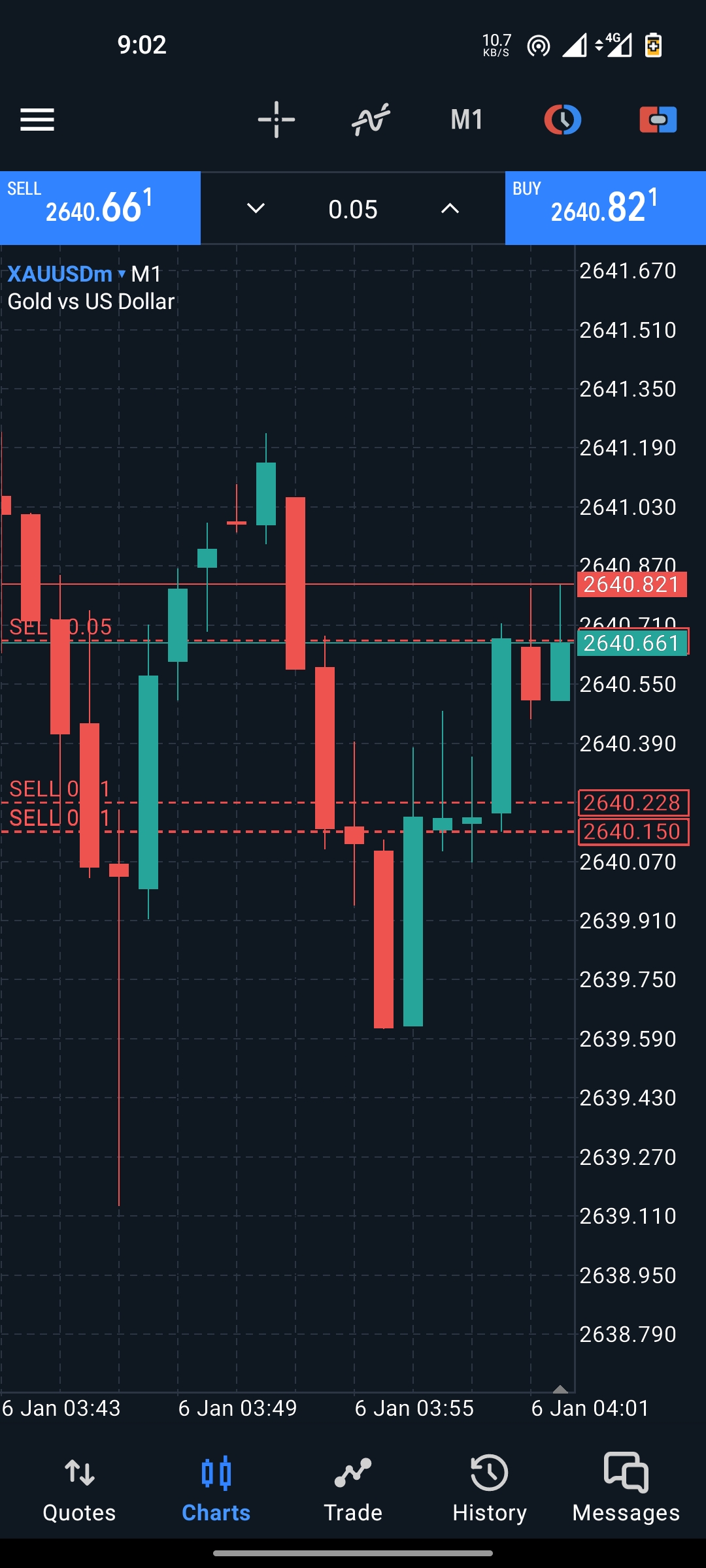

Gold H1

Gold is entering a strong correction. Currently, market liquidity needs accumulation, so it may take time for the price to settle. We will observe this price range and if there is intervention, Buy again. will send a notification to you ✅

- High possibility of going sideways -> continuing to fall to zone 2722

Gold is entering a strong correction. Currently, market liquidity needs accumulation, so it may take time for the price to settle. We will observe this price range and if there is intervention, Buy again. will send a notification to you ✅

- High possibility of going sideways -> continuing to fall to zone 2722

Shahzad Ali Ali

The price is reacting strongly in the 2736-2739 area, we will wait for the H1 and H4 candles to close. If there is intervention from the Seller side, we will resell if the Buy force continues to push the price up strongly, continue to observe. more and don't rush into the transaction

Shahzad Ali Ali

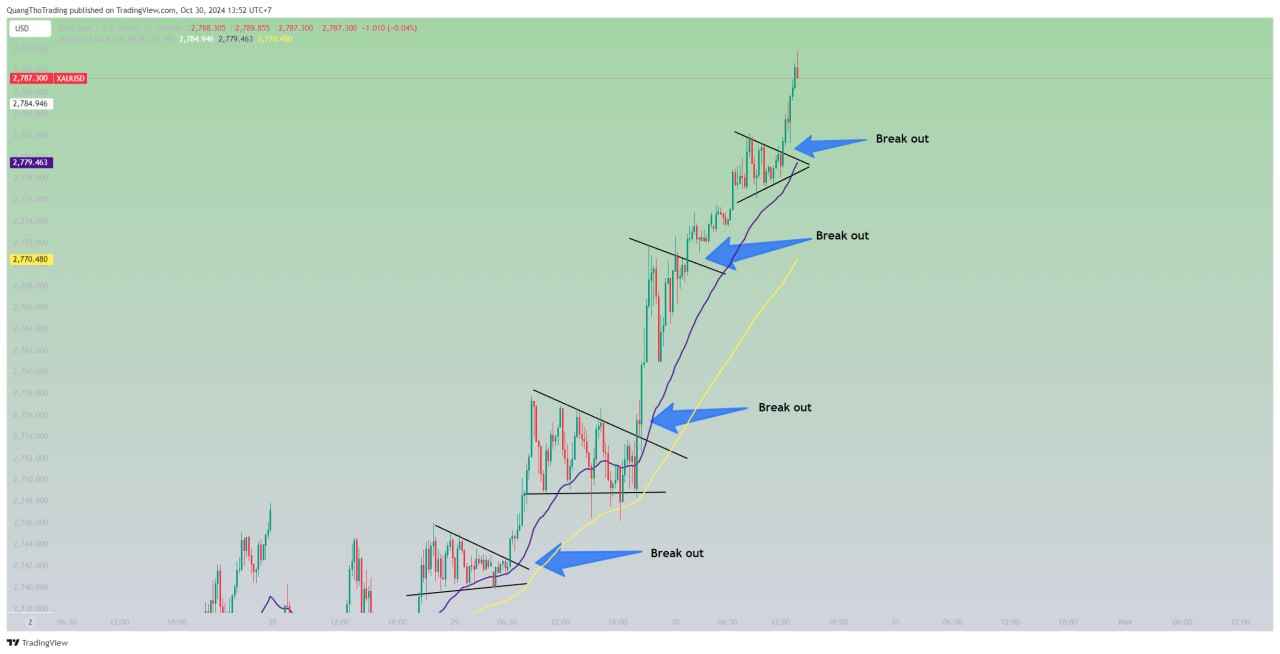

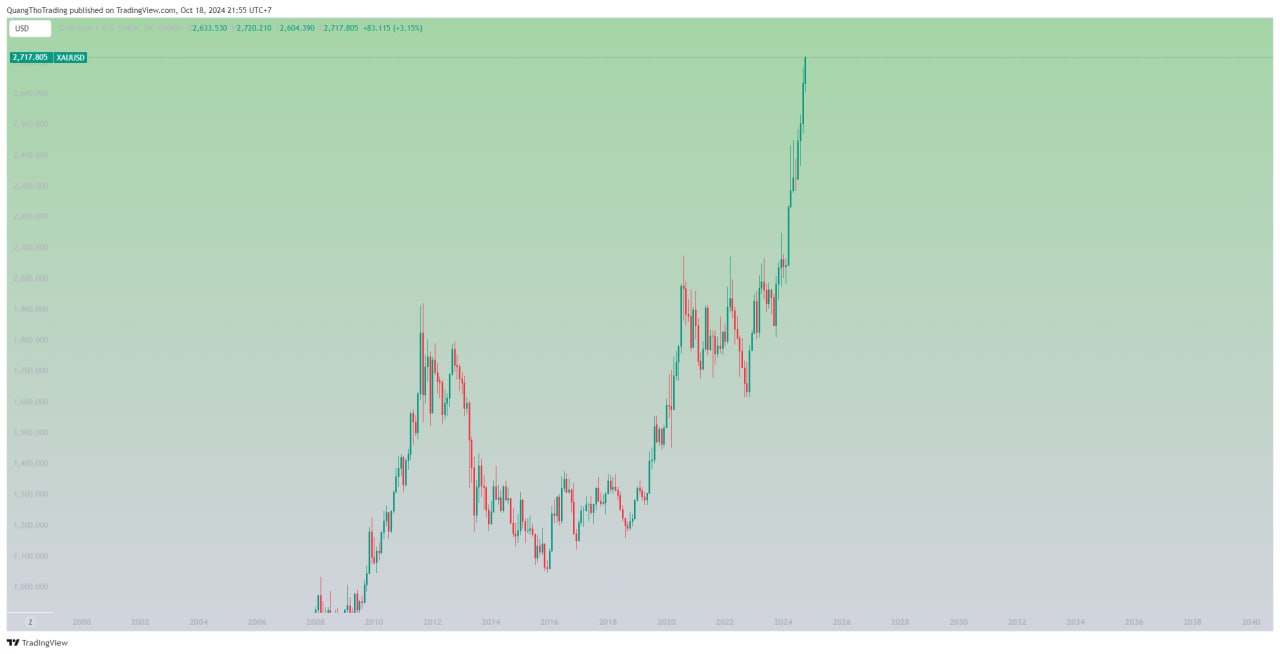

Gold's peak has been warned to you many times, for an investor like me, considering the long-term trend is very important.🥰

Telegram Contact Link 🔗

https://t.me/SecF8om5lj9jMGRk

Telegram Contact Link 🔗

https://t.me/SecF8om5lj9jMGRk

: