Daniel Zozula / Profil

- Bilgiler

|

9+ yıl

deneyim

|

0

ürünler

|

0

demo sürümleri

|

|

0

işler

|

1

sinyaller

|

0

aboneler

|

Daniel Zozula

Copymaschine hinzufügen TP und SL işi için geliştiriciye geri bildirim bıraktı

Super sehr schnelle Lieferung

Daniel Zozula

Lotsize Volumen Multiplikator işi için geliştiriciye geri bildirim bıraktı

Sehr guter Entwickler schnelle Programmierung

Daniel Zozula

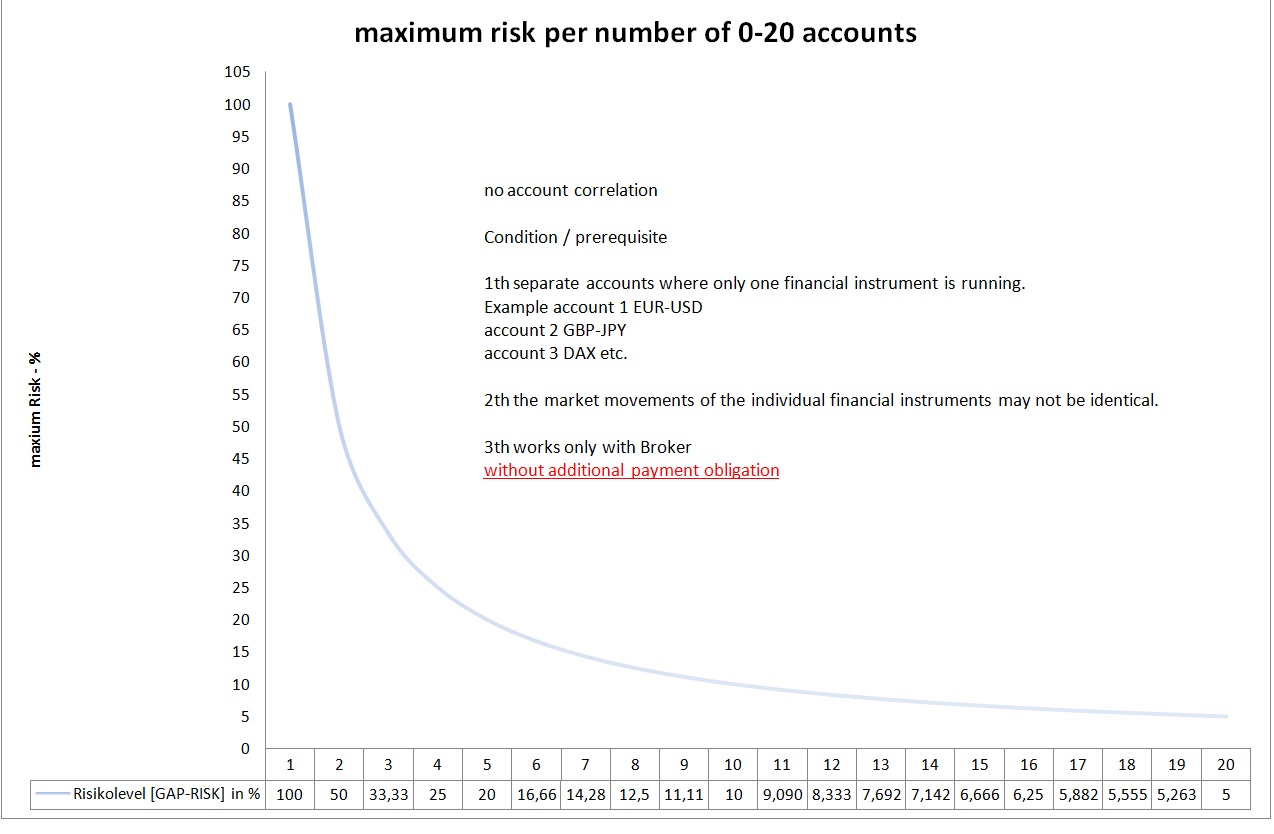

Risk diversification through many trading accounts

without additional payment obligation

no account correlation

Condition / prerequisite

1th separate accounts where only one financial instrument is running.

Example account 1 EUR-USD

account 2 GBP-JPY

account 3 DAX etc.

2th the market movements of the individual financial instruments may not be identical.

3th works only with Broker

without additional payment obligation

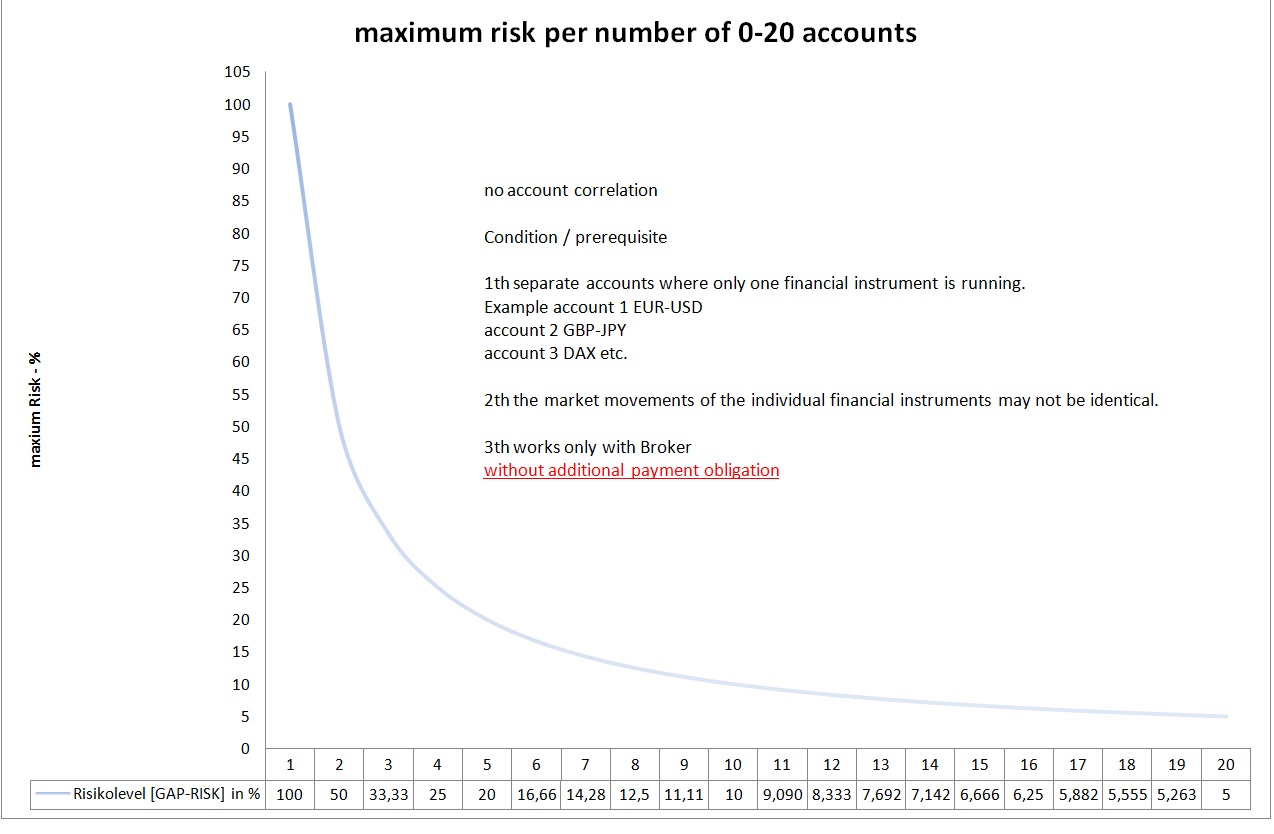

without additional payment obligation

no account correlation

Condition / prerequisite

1th separate accounts where only one financial instrument is running.

Example account 1 EUR-USD

account 2 GBP-JPY

account 3 DAX etc.

2th the market movements of the individual financial instruments may not be identical.

3th works only with Broker

without additional payment obligation

Daniel Zozula

Characteristics

My name is Daniel am 34 years working at the Dusseldorf Stock Exchange and have 8 years practical experience with CFDs / portfolio allocation

and have developed a system that is equally stable in sideways and trend markets.

Contact trading1985@web.de

Unique selling points USP features

Strategy works direction independent through hedging system

System works in sideways and trend markets alike.

Strategy can be used in all indices, forex markets, government bonds, commodities and kyrgyt currencies.

-Portal allocation can be operated with the fully automatic system [Creation of large commercial portfolios] See GAP Risk

- By risk diversification, the overall risk of the portfolio can be reduced to less than 5% of the total investment.

-it is not high-risk grid strategies or gambling systems.

Draw Dawn

DD stabilizers

SW stabilizers

Draw-Dawn phases can be determined by these stabilizers and are a special feature and reduce the maximum risk.

DD phases arise in sideways phases in H4

and can be completely canceled by trend phases in H4 or can be greatly reduced.

This happens in the alternating cycles between sideways and trend phases.

Due to the DD stabilizers, the draw dawn will not be strategically [technically] greater than 30%.

performance

The monthly performance averages between 3-6% per month.

special instructions

-there is a risk of the CAP strategy works the safest when risk is spread by portfolio allocolation

Retention of the positions may be longer.

-DD phases can last longer.

-I only accept brokers who have no duty of disclosure

Systems also work with a lever of 1:30.

customer benefits

-Customers can use my system fully automatically for a cheap monthly price of $ 30 per signal

As soon as I offer multiple signals risks can be spread

https://www.mql5.com/en/signals/544707

My name is Daniel am 34 years working at the Dusseldorf Stock Exchange and have 8 years practical experience with CFDs / portfolio allocation

and have developed a system that is equally stable in sideways and trend markets.

Contact trading1985@web.de

Unique selling points USP features

Strategy works direction independent through hedging system

System works in sideways and trend markets alike.

Strategy can be used in all indices, forex markets, government bonds, commodities and kyrgyt currencies.

-Portal allocation can be operated with the fully automatic system [Creation of large commercial portfolios] See GAP Risk

- By risk diversification, the overall risk of the portfolio can be reduced to less than 5% of the total investment.

-it is not high-risk grid strategies or gambling systems.

Draw Dawn

DD stabilizers

SW stabilizers

Draw-Dawn phases can be determined by these stabilizers and are a special feature and reduce the maximum risk.

DD phases arise in sideways phases in H4

and can be completely canceled by trend phases in H4 or can be greatly reduced.

This happens in the alternating cycles between sideways and trend phases.

Due to the DD stabilizers, the draw dawn will not be strategically [technically] greater than 30%.

performance

The monthly performance averages between 3-6% per month.

special instructions

-there is a risk of the CAP strategy works the safest when risk is spread by portfolio allocolation

Retention of the positions may be longer.

-DD phases can last longer.

-I only accept brokers who have no duty of disclosure

Systems also work with a lever of 1:30.

customer benefits

-Customers can use my system fully automatically for a cheap monthly price of $ 30 per signal

As soon as I offer multiple signals risks can be spread

https://www.mql5.com/en/signals/544707

: