Yegor Koshechko / Profil

- Bilgiler

|

9+ yıl

deneyim

|

0

ürünler

|

0

demo sürümleri

|

|

0

işler

|

0

sinyaller

|

0

aboneler

|

Trader

konum:

FOREX

Arkadaşlar

725

İstekler

Giden

Yegor Koshechko

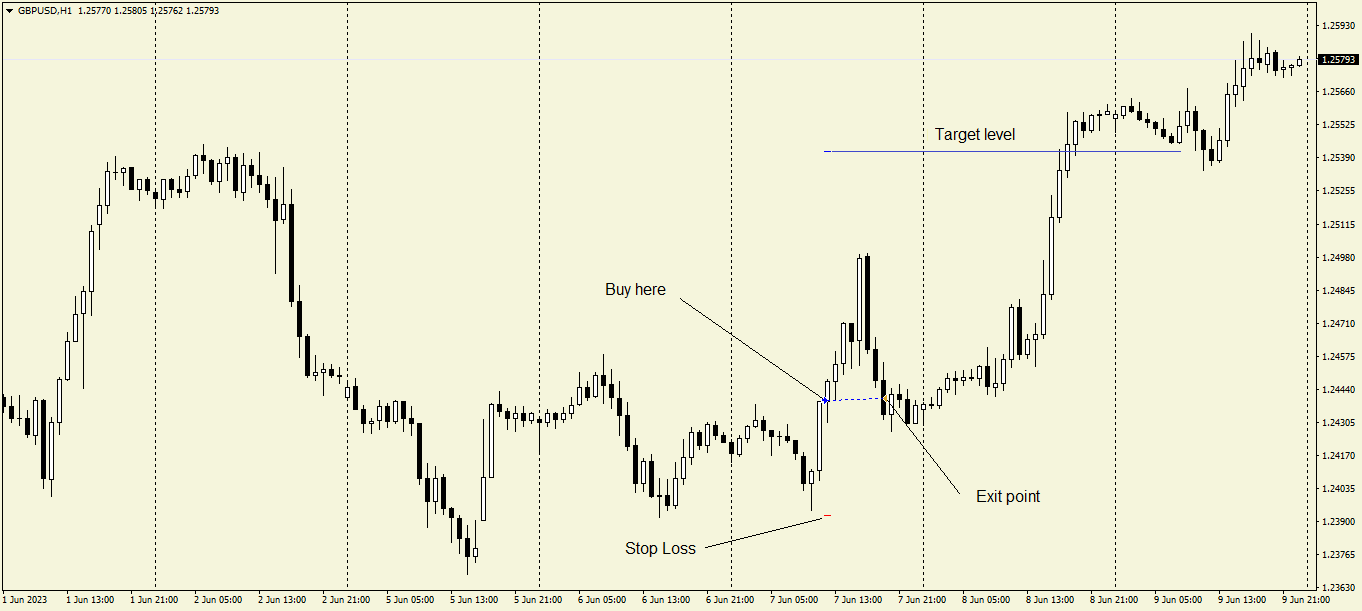

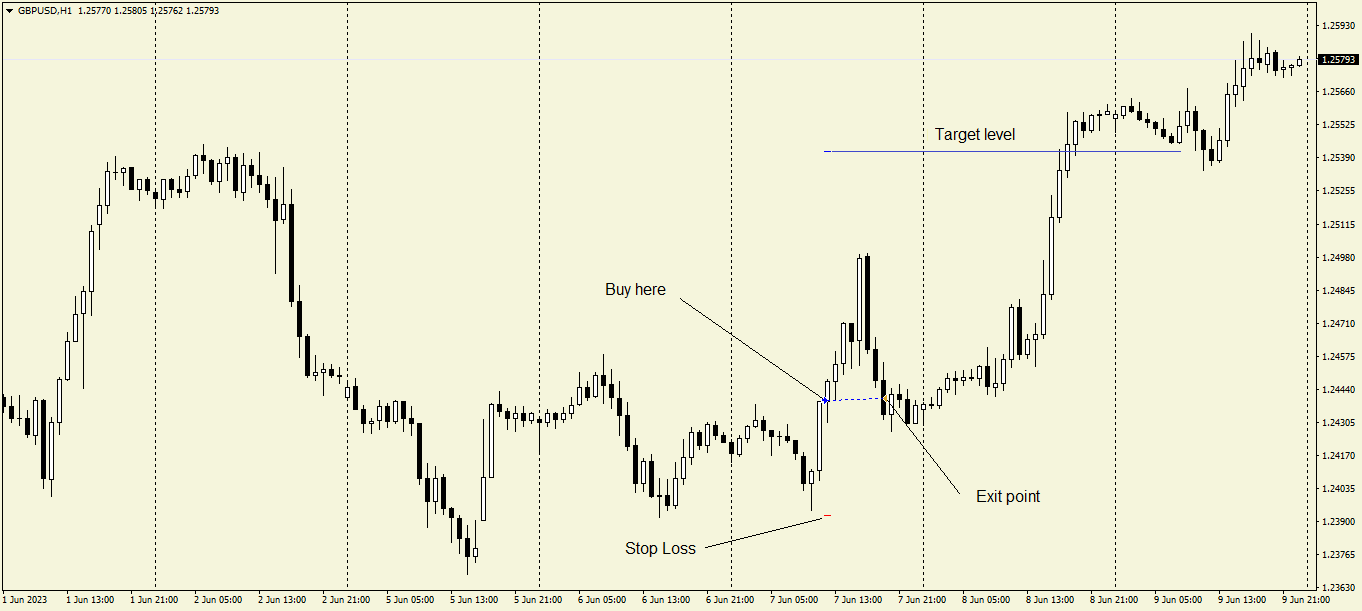

An example of how important the exit point of a trade is.

The best opportunity of the week was missed.

The best opportunity of the week was missed.

Yegor Koshechko

Success is usually associated with some right action, but for some reason it is not associated with the absence of wrong actions, unnecessary ones that drag you down.

If you find something that pulls you down, then by stopping doing it, you automatically become more successful.

Success is not only the right action, it is also the right inaction.

If you find something that pulls you down, then by stopping doing it, you automatically become more successful.

Success is not only the right action, it is also the right inaction.

Yegor Koshechko

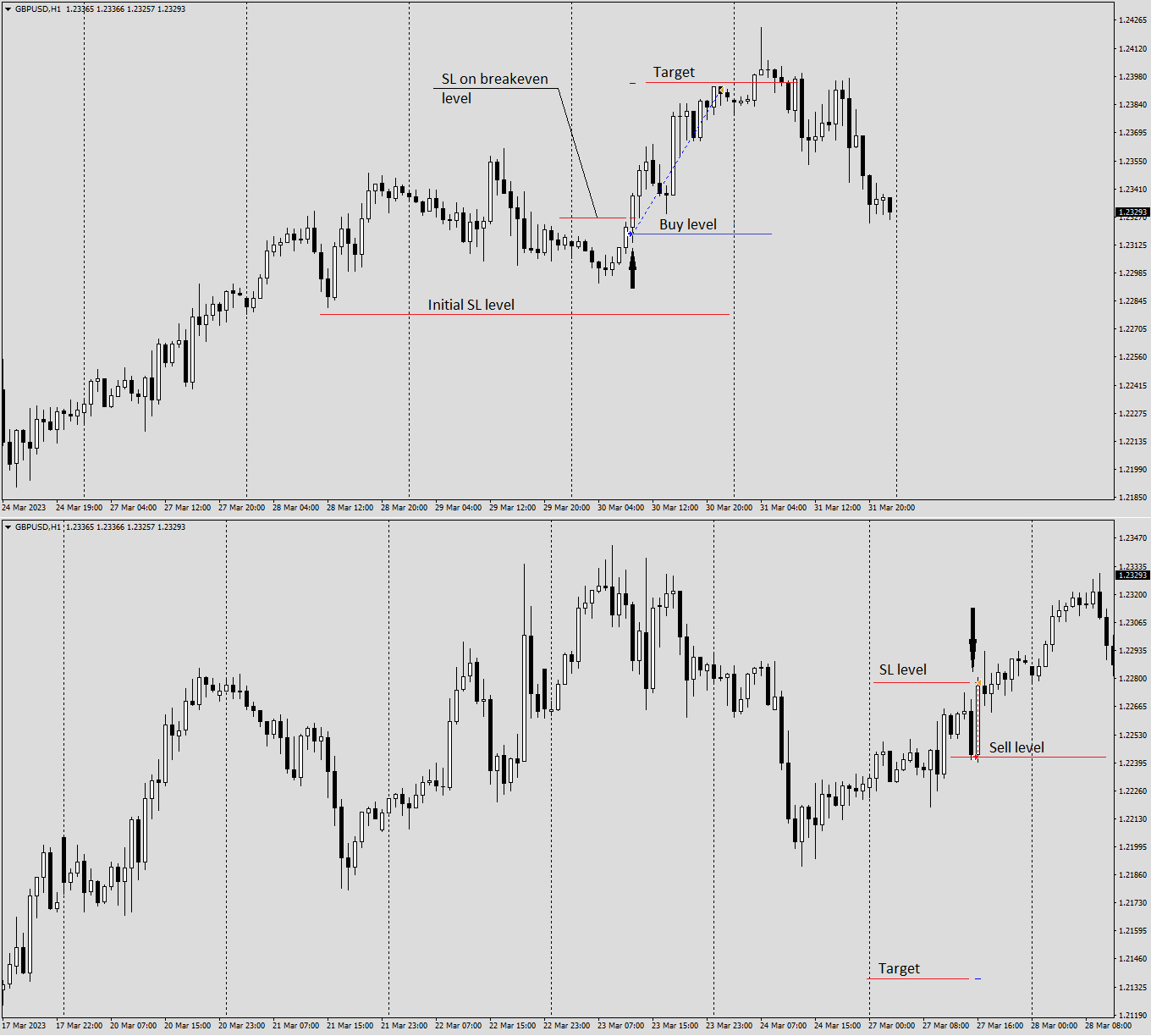

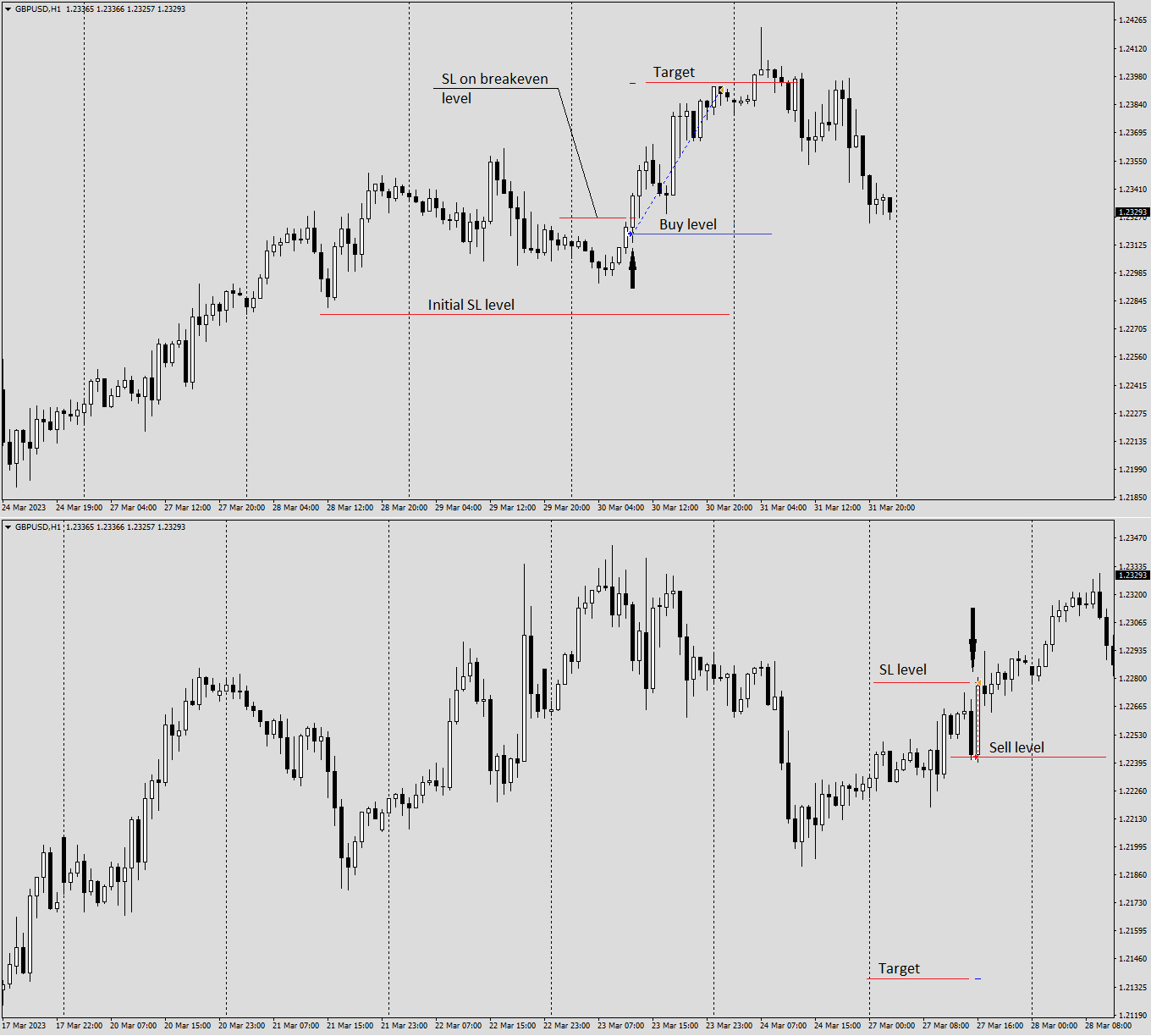

A good trade goes in your favor almost immediately after you open it.

A bad trade makes you nervous after you open it.

A bad trade makes you nervous after you open it.

Yegor Koshechko

Patience is one of the main components of successful trading.

I mean patience in all aspects of trading:

- patience to wait for your signal to open a trade;

- patience to allow an open trade to realize its potential;

- patience to avoid emotional trading when you hit a drawdown;

- patience to let your strategy show results in a long run.

I mean patience in all aspects of trading:

- patience to wait for your signal to open a trade;

- patience to allow an open trade to realize its potential;

- patience to avoid emotional trading when you hit a drawdown;

- patience to let your strategy show results in a long run.

Yegor Koshechko

Basic principles that I follow:

1. One trading approach. One strategy.

2. Determination of the advantage on the daily chart. Search for entry points on the hourly chart.

3. Every trade has a stop loss order.

4. Profit potential in a trade must be at least twice the risk potential.

5. The risk per trade should not exceed 1-1.5% of the capital.

6. The risk per day is 3% of the capital.

7. I can't trade without a plan and a vision for the day.

8. A good trade goes in your favor almost immediately after you open it. A bad trade makes you nervous after you open it.

9. Each trade must be recorded in a trading journal and analyzed.

1. One trading approach. One strategy.

2. Determination of the advantage on the daily chart. Search for entry points on the hourly chart.

3. Every trade has a stop loss order.

4. Profit potential in a trade must be at least twice the risk potential.

5. The risk per trade should not exceed 1-1.5% of the capital.

6. The risk per day is 3% of the capital.

7. I can't trade without a plan and a vision for the day.

8. A good trade goes in your favor almost immediately after you open it. A bad trade makes you nervous after you open it.

9. Each trade must be recorded in a trading journal and analyzed.

Yegor Koshechko

A professional trader is a professional loser.

The idea is not to learn to win all the time. The idea is to learn how to play correctly. This is the paradox of this business.

The idea is not to learn to win all the time. The idea is to learn how to play correctly. This is the paradox of this business.

Yegor Koshechko

For a trader, the ability to accept defeat is very important.

Quickly abandon your idea and take a loss if the situation is not in your favor.

Imposing your own opinion on the market can greatly harm the trader both financially and psychologically.

Quickly abandon your idea and take a loss if the situation is not in your favor.

Imposing your own opinion on the market can greatly harm the trader both financially and psychologically.

Yegor Koshechko

Every achievement has its price. It is impossible to achieve something without paying something in return. In trading, it's usually money, time, rejecting temptations, keeping yourself in the right mindset and physical shape, eradicating bad habits, hammering the right beliefs into yourself, and giving up toxic beliefs. By and large, this is a complete remake of oneself as a person. And those who are not ready to go for it will not achieve results in trading.

Yegor Koshechko

Why does an academic education prevent a large number of people from succeeding in trading?

Most likely, the answer lies in the fact that theoretical knowledge in trading can do little to help, but rather, on the contrary, they harm. A diligent student is sharpened to solve a problem that has a strictly defined framework and only one correct answer. In trading, there is no right answer, because all decisions are made under conditions of uncertainty. Academic knowledge does not provide an answer on how to correctly solve a problem under conditions of uncertainty.

How to be?

The answer is practice, trial and error.

Most likely, the answer lies in the fact that theoretical knowledge in trading can do little to help, but rather, on the contrary, they harm. A diligent student is sharpened to solve a problem that has a strictly defined framework and only one correct answer. In trading, there is no right answer, because all decisions are made under conditions of uncertainty. Academic knowledge does not provide an answer on how to correctly solve a problem under conditions of uncertainty.

How to be?

The answer is practice, trial and error.

Yegor Koshechko

Asymmetry is the most important property of antifragility (according to Nassim Taleb). To succeed in the long run, you must only take risk when the potential reward far outweighs the initial risk.

Yegor Koshechko

Profitable trading is not an intellectual task, but a psychological one. Profitable trading means going against natural human instincts, fears, emotional pain. That is why the majority in this case loses.

Yegor Koshechko

Psychologically, it is difficult for a person to lose or bear losses. The pain of losing is always greater than the joy of an equivalent win. That is why most traders and investors cannot calmly survive periods of drawdowns and losses. Without the skill of accepting losses in trading and investing, it is difficult to succeed.

Yegor Koshechko

Why is there no breakeven trade?

Each open position of a trader is fraught with risk. Regardless of how the trade is conducted, risk is always present. It is not for nothing that there is an expression that the best position is a monetary position, that is, when you are out of the market. At the same time, sitting constantly in this position, it is impossible to earn money, which means that the trader must take risks to get a reward - a profit.

But the main thing here is what risks a trader takes to achieve his goal. Agree that the risk of 1-3% of the deposit is much more harmless than the risk of the entire deposit.

Usually, those traders who trade without stops and use martingale risk the entire deposit. And such a trade is 100% likely to end sooner or later, if not by a complete drain, then by the loss of the lion's share of the funds, and most likely that all the earnings from the previous time and initial investments will be lost.

This is because the market cannot be predicted and predicted with 100% probability. Any news can come out at any time, and the price will go through several figures in a split second. This has happened more than once in recent years. Therefore, there is always risk, no matter how the trader is careful and attentive, losses and entire series of unsuccessful transactions will always overtake him.

If you look at the statistics of large hedge funds, you will find there are many unprofitable months and even years. And in these offices pros are traded, who have much more money and sources of information than private traders. Therefore, losses in trading are normal. That is how it should be. A series of unprofitable transactions is replaced by a series of profitable ones, and most importantly, this is what we get at the exit.

Therefore, control your risks.

Remember that the probability of loss is always there.

Do not chase the momentary result, work for the future.

Each open position of a trader is fraught with risk. Regardless of how the trade is conducted, risk is always present. It is not for nothing that there is an expression that the best position is a monetary position, that is, when you are out of the market. At the same time, sitting constantly in this position, it is impossible to earn money, which means that the trader must take risks to get a reward - a profit.

But the main thing here is what risks a trader takes to achieve his goal. Agree that the risk of 1-3% of the deposit is much more harmless than the risk of the entire deposit.

Usually, those traders who trade without stops and use martingale risk the entire deposit. And such a trade is 100% likely to end sooner or later, if not by a complete drain, then by the loss of the lion's share of the funds, and most likely that all the earnings from the previous time and initial investments will be lost.

This is because the market cannot be predicted and predicted with 100% probability. Any news can come out at any time, and the price will go through several figures in a split second. This has happened more than once in recent years. Therefore, there is always risk, no matter how the trader is careful and attentive, losses and entire series of unsuccessful transactions will always overtake him.

If you look at the statistics of large hedge funds, you will find there are many unprofitable months and even years. And in these offices pros are traded, who have much more money and sources of information than private traders. Therefore, losses in trading are normal. That is how it should be. A series of unprofitable transactions is replaced by a series of profitable ones, and most importantly, this is what we get at the exit.

Therefore, control your risks.

Remember that the probability of loss is always there.

Do not chase the momentary result, work for the future.

: