Ashkan Hazegh Nikrou / Profil

Ashkan Hazegh Nikrou

- Bilgiler

|

5+ yıl

deneyim

|

21

ürünler

|

50

demo sürümleri

|

|

84

işler

|

0

sinyaller

|

0

aboneler

|

Hizmetimi kullanın ve aşağıdaki bağlantıya tıklayarak ticaret stratejilerinizi oluşturmama izin verin: https://www.mql5.com/en/job/new?prefered=ashkan.nikrou

Forex piyasası için güvenilir stratejiler geliştirmek için sıkı çalışıyorum. Lütfen ürün sayfamı ziyaret edin ve forex çözümlerimi test edin: https://www.mql5.com/en/users/ashkan.nikrou/seller#products

MSB (Market Structure Break Out) Article :

https://www.mql5.com/en/blogs/post/755387

YouTube'daki forex videolarımı izleyin: https://www.mql5.com/en/blogs/post/740668

ProEngulfing Kanalına katılın: https://www.mql5.com/en/channels/proengulfing

Forex piyasası için güvenilir stratejiler geliştirmek için sıkı çalışıyorum. Lütfen ürün sayfamı ziyaret edin ve forex çözümlerimi test edin: https://www.mql5.com/en/users/ashkan.nikrou/seller#products

MSB (Market Structure Break Out) Article :

https://www.mql5.com/en/blogs/post/755387

YouTube'daki forex videolarımı izleyin: https://www.mql5.com/en/blogs/post/740668

ProEngulfing Kanalına katılın: https://www.mql5.com/en/channels/proengulfing

Arkadaşlar

972

İstekler

Giden

Ashkan Hazegh Nikrou

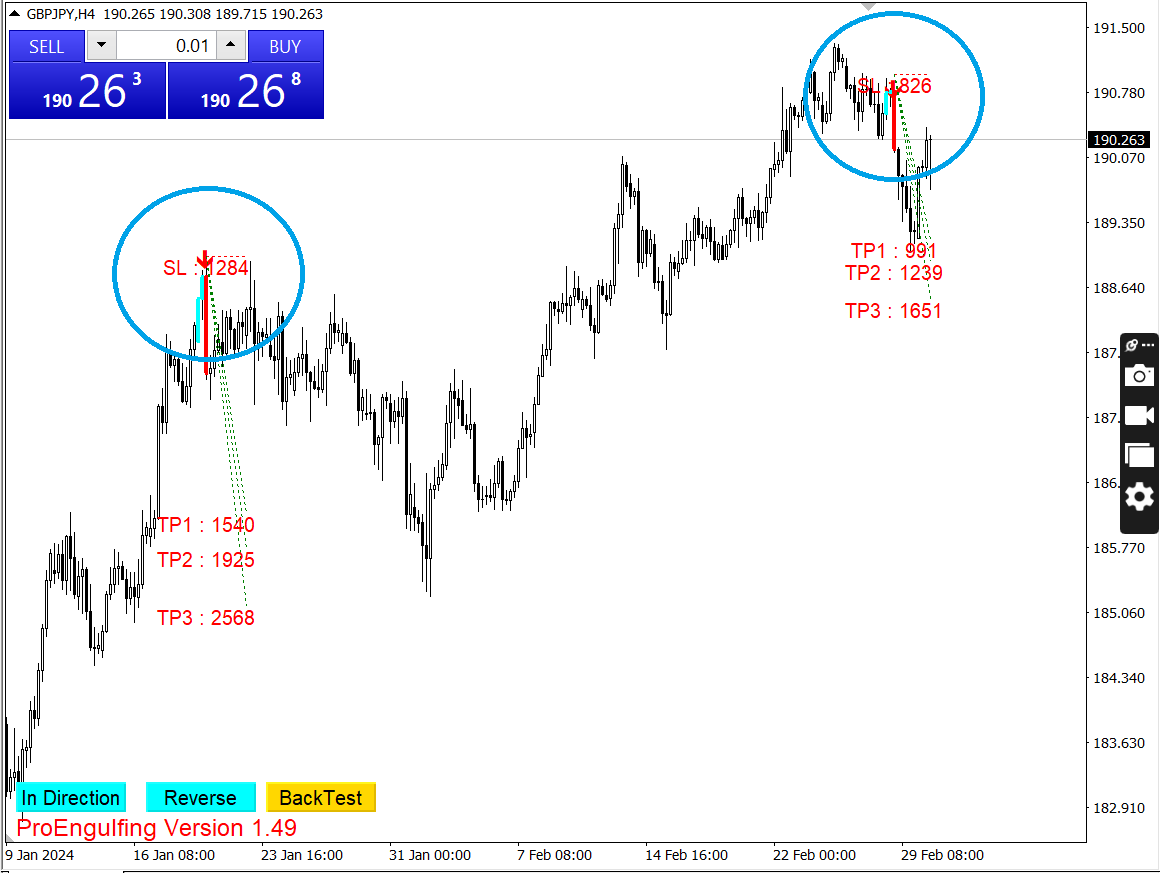

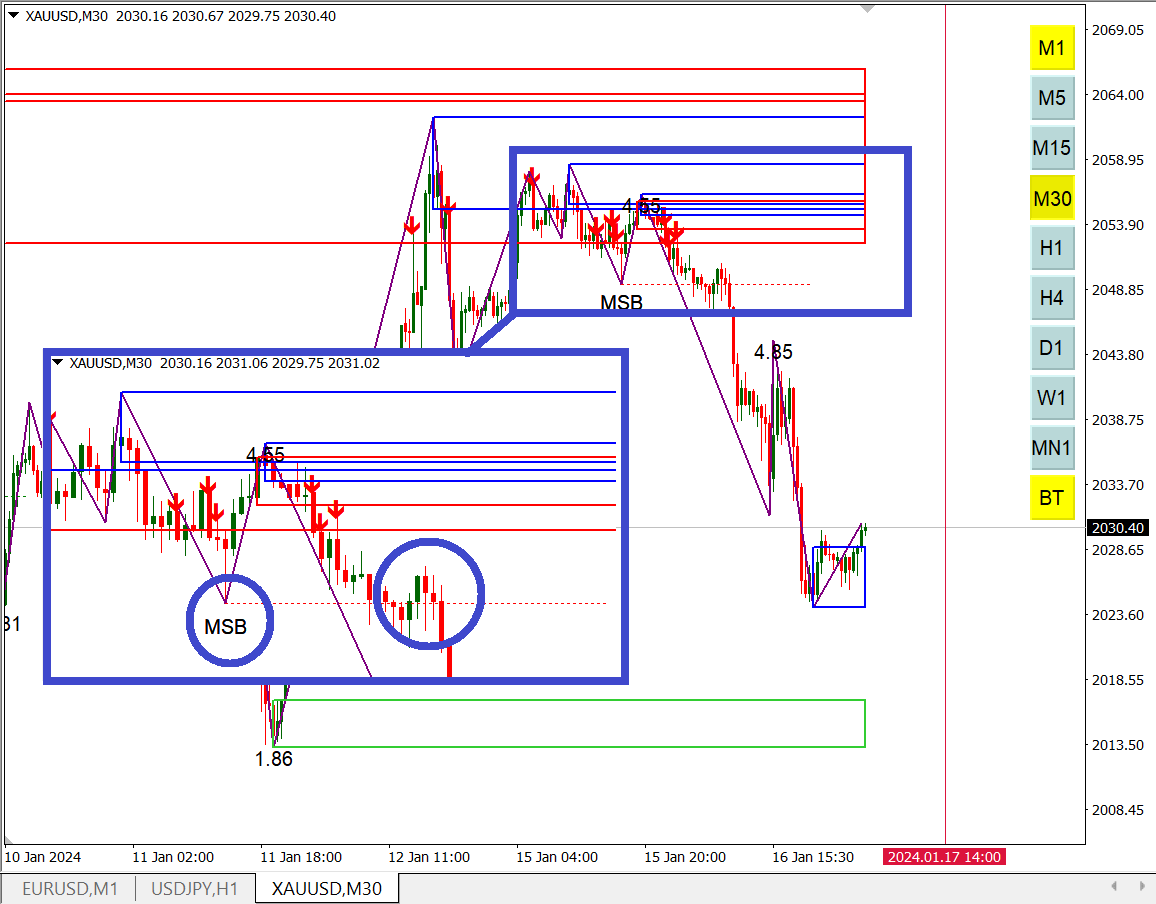

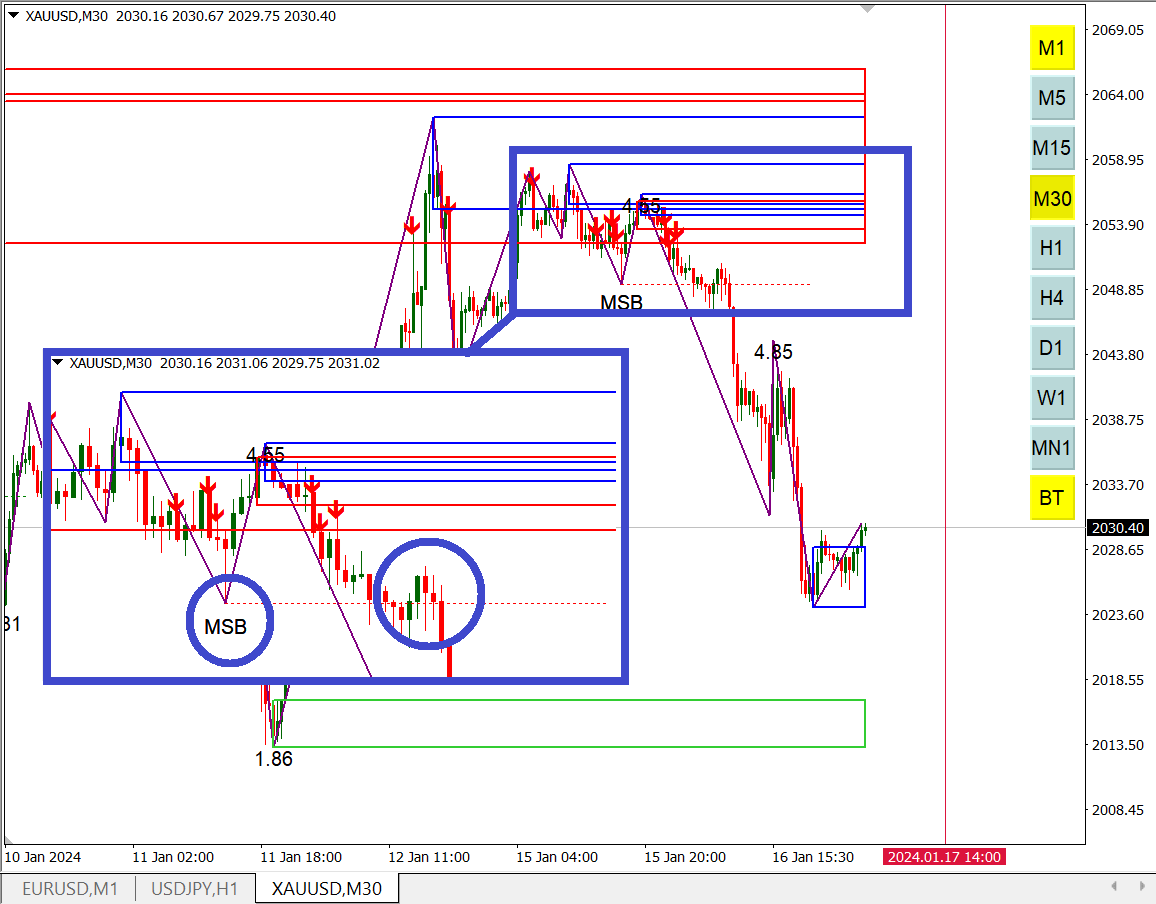

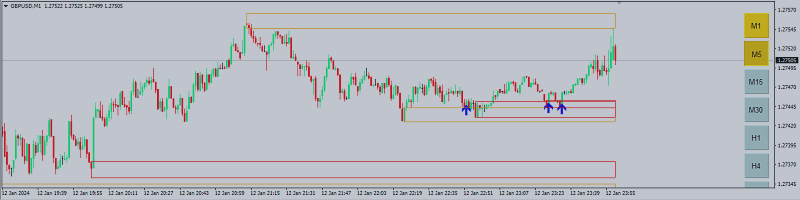

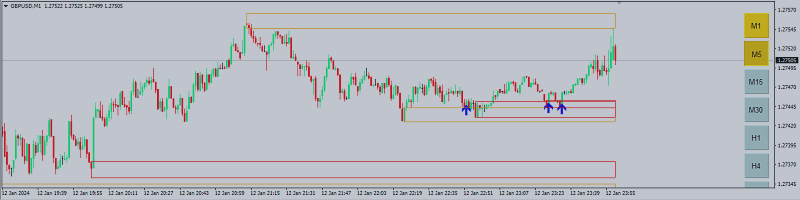

let we compare retrace signal vs primary signal, as I showed in this image Second circle that i showed by 2 number is retrace signal, and 1st circle that I showed by 1 number is primary signal , Based on my statistical analysis retrace (2) signal is much trustable entry, so in next update of Market Structure Break Out indicator I decide to show them by new color and allow user to hide primary one, based on our test we reached 20% more win on Retrace signal compare than primary one. keep in touch for new updates on indicator below: https://www.mql5.com/en/market/product/109958

Join channel for more :

https://www.mql5.com/en/channels/koalatradingsolution

Join channel for more :

https://www.mql5.com/en/channels/koalatradingsolution

Ashkan Hazegh Nikrou

https://www.mql5.com/en/channels/koalatradingsolution

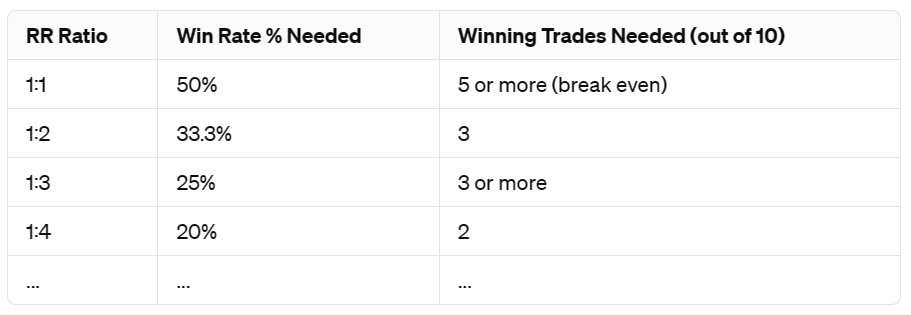

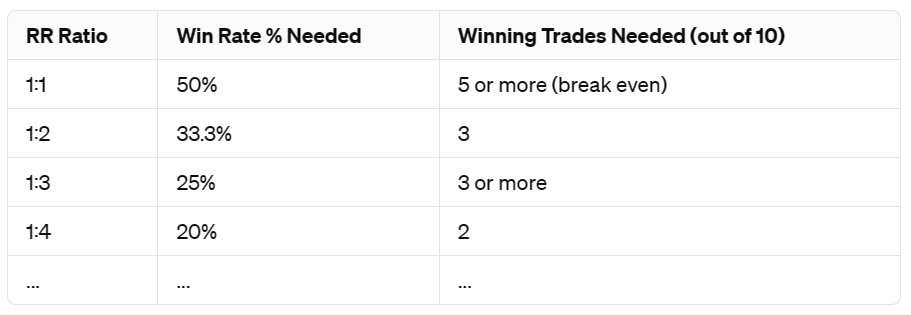

📚💡 Learning Tip: Mastering Risk to Reward (RR) in Trading! 💡📚

Hey traders,

Now, let's dive into a practical example. As you can see in the table above, it illustrates the win rate percentage and the number of winning trades needed to be profitable over 10 trades for different RR ratios.

RR measures the potential reward of a trade against the risk taken. It's a ratio that helps you assess whether a trade is worth taking based on the potential payoff compared to the amount you're risking.

Why is RR important? Because it's a key factor in managing risk and maximizing profitability. By maintaining a positive RR ratio, you ensure that your winning trades outweigh your losing ones, ultimately leading to long-term success.

As the RR ratio increases, the required win rate percentage decreases. This emphasizes the importance of maintaining a favorable RR ratio in your trading strategy.

Finally, a word of advice: Don't overlook the significance of stop loss orders and adhering to your RR rule. Strategies without stop loss and without proper consideration of RR can expose you to unnecessary risks and jeopardize your trading success.

So, remember to prioritize RR in your trading decisions, and watch your profitability soar!

Happy trading,

📚💡 Learning Tip: Mastering Risk to Reward (RR) in Trading! 💡📚

Hey traders,

Now, let's dive into a practical example. As you can see in the table above, it illustrates the win rate percentage and the number of winning trades needed to be profitable over 10 trades for different RR ratios.

RR measures the potential reward of a trade against the risk taken. It's a ratio that helps you assess whether a trade is worth taking based on the potential payoff compared to the amount you're risking.

Why is RR important? Because it's a key factor in managing risk and maximizing profitability. By maintaining a positive RR ratio, you ensure that your winning trades outweigh your losing ones, ultimately leading to long-term success.

As the RR ratio increases, the required win rate percentage decreases. This emphasizes the importance of maintaining a favorable RR ratio in your trading strategy.

Finally, a word of advice: Don't overlook the significance of stop loss orders and adhering to your RR rule. Strategies without stop loss and without proper consideration of RR can expose you to unnecessary risks and jeopardize your trading success.

So, remember to prioritize RR in your trading decisions, and watch your profitability soar!

Happy trading,

Ashkan Hazegh Nikrou

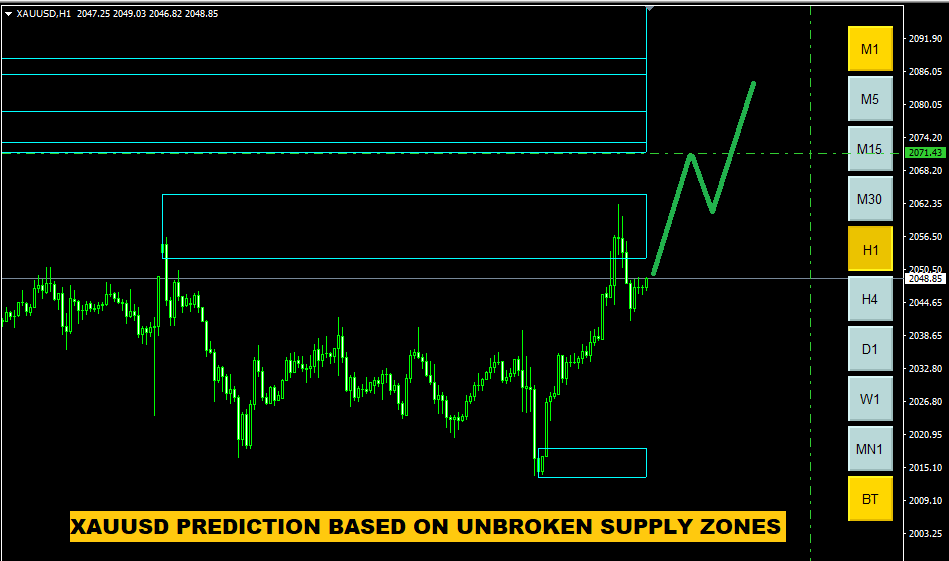

📈 XAUUSD still is in bullish trend 📈

Factors Driving Gold Prices Higher:

Interest Rates Outlook:

The Federal Reserve has been actively raising interest rates to combat inflation. However, recent inflation data suggests progress in controlling prices. Investors now anticipate that the Fed will pause rate hikes and potentially pivot to rate cuts sooner than expected. Historically, gold has had a negative correlation with interest rates, and the current outlook has contributed to its rally. 📈

Safe Haven Appeal:

Gold is often considered a safe-haven asset during times of economic uncertainty or geopolitical tensions. Rising interest rates can trigger a recession and weigh on corporate earnings. In such scenarios, investors turn to gold as a defensive play against stock market sell-offs. 🛡️

U.S. Dollar Relationship:

Gold is typically priced in U.S. dollars. When the dollar weakens, investors pay more for the same amount of gold. Psychological factors, including gold’s intrinsic value, beauty, and unique physical properties, contribute to its negative correlation with the U.S. dollar. 💰

Central Bank Purchases:

Central banks have been increasing their gold purchases, further supporting demand. Market turbulence and rising recession expectations have also fueled interest in gold. 💼

Record Highs and Speculative Demand:

Gold recently reached near-record highs, approaching its all-time peak of $2,075 per ounce. Speculative demand has played a role in driving prices upward. 🚀

Factors Driving Gold Prices Higher:

Interest Rates Outlook:

The Federal Reserve has been actively raising interest rates to combat inflation. However, recent inflation data suggests progress in controlling prices. Investors now anticipate that the Fed will pause rate hikes and potentially pivot to rate cuts sooner than expected. Historically, gold has had a negative correlation with interest rates, and the current outlook has contributed to its rally. 📈

Safe Haven Appeal:

Gold is often considered a safe-haven asset during times of economic uncertainty or geopolitical tensions. Rising interest rates can trigger a recession and weigh on corporate earnings. In such scenarios, investors turn to gold as a defensive play against stock market sell-offs. 🛡️

U.S. Dollar Relationship:

Gold is typically priced in U.S. dollars. When the dollar weakens, investors pay more for the same amount of gold. Psychological factors, including gold’s intrinsic value, beauty, and unique physical properties, contribute to its negative correlation with the U.S. dollar. 💰

Central Bank Purchases:

Central banks have been increasing their gold purchases, further supporting demand. Market turbulence and rising recession expectations have also fueled interest in gold. 💼

Record Highs and Speculative Demand:

Gold recently reached near-record highs, approaching its all-time peak of $2,075 per ounce. Speculative demand has played a role in driving prices upward. 🚀

Ashkan Hazegh Nikrou

🚀 Primary Signals VS Retrace Signals 🚀

Hey traders,

Let's talk about the difference between primary and retrace signals in our Market Structure Breakout indicator, which also identifies supply and demand zones. 📊

When a bullish pattern forms inside a demand zone for the first time, it's considered a primary signal. But when the market revisits an old demand zone and forms another bullish pattern inside, we call it a retrace signal. 📈

Here's the scoop: Our statistics reveal that retrace signals hold more reliability compared to primary ones. And guess what? They shine brightest on higher time frames like H1, H4, and D1. ⏰

So, why the preference for retrace signals? Because they've shown time and again to be more dependable for traders seeking consistent results. 🎯

Next time you're analyzing signals, keep this in mind: While primary signals are good, retrace signals might just be your golden ticket to success. 💡

https://www.mql5.com/en/market/product/109958

Hey traders,

Let's talk about the difference between primary and retrace signals in our Market Structure Breakout indicator, which also identifies supply and demand zones. 📊

When a bullish pattern forms inside a demand zone for the first time, it's considered a primary signal. But when the market revisits an old demand zone and forms another bullish pattern inside, we call it a retrace signal. 📈

Here's the scoop: Our statistics reveal that retrace signals hold more reliability compared to primary ones. And guess what? They shine brightest on higher time frames like H1, H4, and D1. ⏰

So, why the preference for retrace signals? Because they've shown time and again to be more dependable for traders seeking consistent results. 🎯

Next time you're analyzing signals, keep this in mind: While primary signals are good, retrace signals might just be your golden ticket to success. 💡

https://www.mql5.com/en/market/product/109958

Ashkan Hazegh Nikrou

https://www.mql5.com/en/market/product/51181

📊💪 Power of Currency Strength! 💪📊

Ever wondered which currency holds the upper hand in the forex market? Understanding the strength of each currency is like having a secret weapon in your trading arsenal. But how can you decipher this strength amidst the vast sea of currency pairs?

Enter the Currency Meter Indicator – your gateway to unveiling the true power dynamics at play. 🌟

Imagine this: You're eyeing the EUR/USD pair, contemplating whether to buy or sell. Now, instead of relying solely on technical analysis or gut feelings, picture having a tool that assesses the collective buy and sell requests across multiple currency pairs involving the euro and the US dollar.

Here's where the magic happens: The Currency Meter Indicator aggregates these buy and sell requests, providing a comprehensive snapshot of the relative strength of each currency. Let's break it down with an example:

🔍 Scenario: You're considering a trade on EUR/USD. The Currency Meter reveals a surge in buy requests for the euro across various pairs, indicating strong bullish sentiment. Meanwhile, sell requests for the US dollar are dwindling, suggesting weakening bearish pressure.

💡 Insight: With this insight, you gain a clearer understanding of the power dynamics between the euro and the US dollar. Armed with this knowledge, you can make more informed trading decisions, capitalizing on the prevailing market sentiment.

But remember, the Currency Meter is not a crystal ball – it's a tool to guide your analysis. Combine it with other indicators and your own expertise for a winning strategy.

So, fellow traders, harness the power of currency strength with the Currency Meter Indicator. Let's navigate the markets with confidence and precision! 🚀💰

Stay tuned for more tips and tricks to elevate your trading game.

Happy trading,

📊💪 Power of Currency Strength! 💪📊

Ever wondered which currency holds the upper hand in the forex market? Understanding the strength of each currency is like having a secret weapon in your trading arsenal. But how can you decipher this strength amidst the vast sea of currency pairs?

Enter the Currency Meter Indicator – your gateway to unveiling the true power dynamics at play. 🌟

Imagine this: You're eyeing the EUR/USD pair, contemplating whether to buy or sell. Now, instead of relying solely on technical analysis or gut feelings, picture having a tool that assesses the collective buy and sell requests across multiple currency pairs involving the euro and the US dollar.

Here's where the magic happens: The Currency Meter Indicator aggregates these buy and sell requests, providing a comprehensive snapshot of the relative strength of each currency. Let's break it down with an example:

🔍 Scenario: You're considering a trade on EUR/USD. The Currency Meter reveals a surge in buy requests for the euro across various pairs, indicating strong bullish sentiment. Meanwhile, sell requests for the US dollar are dwindling, suggesting weakening bearish pressure.

💡 Insight: With this insight, you gain a clearer understanding of the power dynamics between the euro and the US dollar. Armed with this knowledge, you can make more informed trading decisions, capitalizing on the prevailing market sentiment.

But remember, the Currency Meter is not a crystal ball – it's a tool to guide your analysis. Combine it with other indicators and your own expertise for a winning strategy.

So, fellow traders, harness the power of currency strength with the Currency Meter Indicator. Let's navigate the markets with confidence and precision! 🚀💰

Stay tuned for more tips and tricks to elevate your trading game.

Happy trading,

Ashkan Hazegh Nikrou

Correct Prediction On XAUUSD by using Market Structure Break Out, in this case we just see Green Unbroken Demand Zones, and there is no Red Supply Zone, it means market is in very bullish trend. best entry can be after Break Out and Retrace on demand zone.

Ashkan Hazegh Nikrou

USDJPY ANALYSIS : Based on Market Structure Break Out in H1 and D1 , Market still can go up

https://www.mql5.com/en/market/product/109958

https://www.mql5.com/en/market/product/109958

Ashkan Hazegh Nikrou

📚📈 Sunday Learning Tip 📈📚

Hey traders,

Let's talk about what really matters when it comes to trading smart. Here are some simple yet crucial rules to follow:

1️⃣ Take Care of Your Money: Protecting your cash should always be your top priority. Use strategies that help you keep your money safe.

2️⃣ Use Tools to Manage Risks: Make sure to set up tools like stop loss and take profit. They help you limit your losses and make sure you're making enough profit.

3️⃣ Get Good Entry Signals: It's important to know when to jump in, but don't expect miracles. Look for good chances to make money and stay flexible.

4️⃣ Don't Be Greedy: Being greedy can lead to big losses. Stick to your plan and don't take too many risks.

5️⃣ Make Things Easier: Consider using bots to do some of the work for you. They can help you avoid mistakes and stick to your plan.

Keep these tips in mind as you trade. It's all about being smart and staying disciplined. Watch out for more helpful advice to improve your trading game.

Happy trading,

Hey traders,

Let's talk about what really matters when it comes to trading smart. Here are some simple yet crucial rules to follow:

1️⃣ Take Care of Your Money: Protecting your cash should always be your top priority. Use strategies that help you keep your money safe.

2️⃣ Use Tools to Manage Risks: Make sure to set up tools like stop loss and take profit. They help you limit your losses and make sure you're making enough profit.

3️⃣ Get Good Entry Signals: It's important to know when to jump in, but don't expect miracles. Look for good chances to make money and stay flexible.

4️⃣ Don't Be Greedy: Being greedy can lead to big losses. Stick to your plan and don't take too many risks.

5️⃣ Make Things Easier: Consider using bots to do some of the work for you. They can help you avoid mistakes and stick to your plan.

Keep these tips in mind as you trade. It's all about being smart and staying disciplined. Watch out for more helpful advice to improve your trading game.

Happy trading,

Ashkan Hazegh Nikrou

2024.03.03

Join Koala Channel For More

https://www.mql5.com/en/channels/koalatradingsolution

https://www.mql5.com/en/channels/koalatradingsolution

Ashkan Hazegh Nikrou

📊📈 Weekend Learning Tip 📈📊

Let's dive into the fascinating world of price action patterns, focusing on the mighty bullish engulf pattern! 🐂

Did you know? Our statistical analysis reveals a compelling insight: bullish engulf patterns spotted on the M15 timeframe demonstrate their greatest potency and validity when nestled within unbroken demand zones observed on the H1 or H4 charts. 📈💡

Why is this significant? Because understanding the context in which these patterns emerge can elevate your trading game to new heights! When a bullish engulf pattern appears within a robust, unbroken demand zone on higher timeframes, it serves as a powerful confirmation of potential bullish momentum.

So, as you embark on your trading journey, keep an eye out for these golden opportunities where the M15 bullish engulf pattern aligns harmoniously with the broader trend indicated by H1 or H4 demand zones. By mastering this synergy, you unlock the keys to more accurate entries and higher probability trades! 🗝️💰

Stay tuned for more insightful tips and tricks to sharpen your trading skills. Remember, knowledge is power in the dynamic world of forex trading! 💪✨

Let's dive into the fascinating world of price action patterns, focusing on the mighty bullish engulf pattern! 🐂

Did you know? Our statistical analysis reveals a compelling insight: bullish engulf patterns spotted on the M15 timeframe demonstrate their greatest potency and validity when nestled within unbroken demand zones observed on the H1 or H4 charts. 📈💡

Why is this significant? Because understanding the context in which these patterns emerge can elevate your trading game to new heights! When a bullish engulf pattern appears within a robust, unbroken demand zone on higher timeframes, it serves as a powerful confirmation of potential bullish momentum.

So, as you embark on your trading journey, keep an eye out for these golden opportunities where the M15 bullish engulf pattern aligns harmoniously with the broader trend indicated by H1 or H4 demand zones. By mastering this synergy, you unlock the keys to more accurate entries and higher probability trades! 🗝️💰

Stay tuned for more insightful tips and tricks to sharpen your trading skills. Remember, knowledge is power in the dynamic world of forex trading! 💪✨

Ashkan Hazegh Nikrou

Hello! Are you ready to ride the waves of opportunity in the forex market? 🌊📈

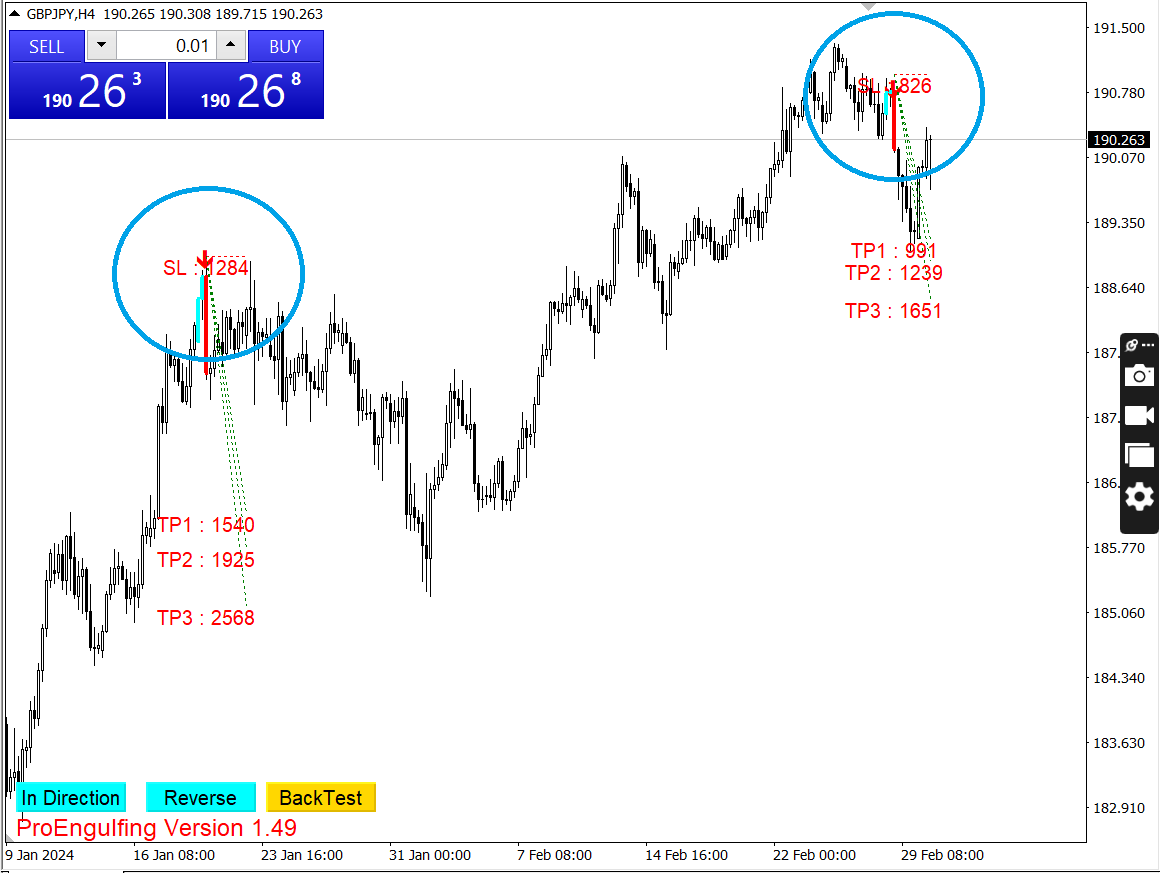

Check out these recent fantastic sell signals on GBP/JPY in the four-hour timeframe! Our cutting-edge indicator has pinpointed not just one, but two prime selling opportunities.

Want to stay ahead of the curve and maximize your trading potential? Join us and unlock the secrets of successful trading. Don't miss out on your chance to conquer the markets with precision and finesse. Act now and let's navigate the markets together! 💼💰

https://www.mql5.com/en/market/product/52023

Check out these recent fantastic sell signals on GBP/JPY in the four-hour timeframe! Our cutting-edge indicator has pinpointed not just one, but two prime selling opportunities.

Want to stay ahead of the curve and maximize your trading potential? Join us and unlock the secrets of successful trading. Don't miss out on your chance to conquer the markets with precision and finesse. Act now and let's navigate the markets together! 💼💰

https://www.mql5.com/en/market/product/52023

Ashkan Hazegh Nikrou

Prefect Sale Signal:

Engulf Pattern Plus RSI Divergence Formed Inside M5 Supply Zone When We Are In M15 Time Frame

Combination of pure analysis can give us nice entry signal

By below indicator you can reach Multi Time Frame Supply Demand Drawing :

https://www.mql5.com/en/market/product/110390

Engulf Pattern Plus RSI Divergence Formed Inside M5 Supply Zone When We Are In M15 Time Frame

Combination of pure analysis can give us nice entry signal

By below indicator you can reach Multi Time Frame Supply Demand Drawing :

https://www.mql5.com/en/market/product/110390

Ashkan Hazegh Nikrou

🌟 Mastering Monday Trading Wisdom! 🚀

Happy Monday, traders! 📈✨ Let's kick off the week with a powerful strategy to boost your trading game! 🌐💹

In today's session, we'll delve into the art of combining the Supply Demand and Market Structure Breakout indicators to pinpoint the perfect moments for executing Buy Limit orders in the upper regions of untouched Demand Zones. ⏰💡

🔍 Spotting the Ideal Time:

Keep an eye out for our clock icon on the chart! 🕒 It indicates the sweet spot in time when market forces align, creating prime opportunities for profitable trades. Timing is key, and we've got you covered.

📊 Using the Levels to Your Advantage:

Refer to the showcased levels in the image – those are your Buy Limit zones! 🎯📈 When the Market Structure Breakout and Supply Demand indicators align, these levels become your gateway to potential gains. 🚀✨

🤓 Here's Your Monday Trading Homework:

Familiarize yourself with the clock icon – that's your signal to pay close attention!

Identify the highlighted levels in the image as your Buy Limit entry points.

Combine Supply Demand insights with Market Structure Breakout strategies for precision.

🚨 Remember: Knowledge is Power!

Equip yourself with the right tools and strategies. Join us on this exciting journey of understanding when and where to place those Buy Limits for maximum impact! 🌐📊

Happy Monday, traders! 📈✨ Let's kick off the week with a powerful strategy to boost your trading game! 🌐💹

In today's session, we'll delve into the art of combining the Supply Demand and Market Structure Breakout indicators to pinpoint the perfect moments for executing Buy Limit orders in the upper regions of untouched Demand Zones. ⏰💡

🔍 Spotting the Ideal Time:

Keep an eye out for our clock icon on the chart! 🕒 It indicates the sweet spot in time when market forces align, creating prime opportunities for profitable trades. Timing is key, and we've got you covered.

📊 Using the Levels to Your Advantage:

Refer to the showcased levels in the image – those are your Buy Limit zones! 🎯📈 When the Market Structure Breakout and Supply Demand indicators align, these levels become your gateway to potential gains. 🚀✨

🤓 Here's Your Monday Trading Homework:

Familiarize yourself with the clock icon – that's your signal to pay close attention!

Identify the highlighted levels in the image as your Buy Limit entry points.

Combine Supply Demand insights with Market Structure Breakout strategies for precision.

🚨 Remember: Knowledge is Power!

Equip yourself with the right tools and strategies. Join us on this exciting journey of understanding when and where to place those Buy Limits for maximum impact! 🌐📊

Ashkan Hazegh Nikrou

📈 Our XAU/USD prediction was spot-on! 🌟 Let's dive into the magic of supply and demand along with market structure breakouts. In the image, I've highlighted a robust supply level at 2060. 📉 Witness the bearish price action marked by a sell arrow within the supply zone. Following that, observe the Market Structure Breakout (MSB), indicated by the circle – the second confirmation for our sell signal. 🔄 In this scenario, the optimal Stop Loss was set above the supply region, while the ideal Take Profit target was positioned at the unbroken Demand's top side. 🚀💰

Supply Demand Indicator :

https://www.mql5.com/en/market/product/110390

Market Structure Break Out Indicator :

https://www.mql5.com/en/market/product/109958

Supply Demand Indicator :

https://www.mql5.com/en/market/product/110390

Market Structure Break Out Indicator :

https://www.mql5.com/en/market/product/109958

Ashkan Hazegh Nikrou

How zone back test can work on chart by just click any where

https://www.mql5.com/en/market/product/110390

https://www.mql5.com/en/market/product/110390

Ashkan Hazegh Nikrou

In the dynamic world of financial markets, understanding and harnessing the power of key price regions is crucial for successful trading...

Sosyal ağlarda paylaş

186

1

Ashkan Hazegh Nikrou

🚀Trading Tip: Mastering Engulfing Patterns within Supply and Demand Zones

Understanding the engulfing pattern, coupled with its interaction within supply and demand zones, can significantly enhance your trading strategy. Let's delve into these concepts:

Engulfing Pattern:

An engulfing pattern occurs when a candle's body completely engulfs the body of the previous candle. There are two types:

Bullish Engulfing: The second candle (🟢) completely engulfs the first candle (🔴), signaling potential bullish momentum.

Bearish Engulfing: The second candle (🔴) completely engulfs the first candle (🟢), suggesting potential bearish pressure.

Why Engulfing Patterns Are Powerful:

✅Reversal Signals: Engulfing patterns often indicate a reversal in the prevailing trend, making them valuable for trend reversal traders.

✅Clear Visual Signal: The pattern provides a clear and visually recognizable signal on price charts.

✅Market Sentiment: The shift from buying to selling pressure or vice versa is visually captured in an engulfing pattern, reflecting changing market sentiment.

https://www.mql5.com/en/market/product/109524

Understanding the engulfing pattern, coupled with its interaction within supply and demand zones, can significantly enhance your trading strategy. Let's delve into these concepts:

Engulfing Pattern:

An engulfing pattern occurs when a candle's body completely engulfs the body of the previous candle. There are two types:

Bullish Engulfing: The second candle (🟢) completely engulfs the first candle (🔴), signaling potential bullish momentum.

Bearish Engulfing: The second candle (🔴) completely engulfs the first candle (🟢), suggesting potential bearish pressure.

Why Engulfing Patterns Are Powerful:

✅Reversal Signals: Engulfing patterns often indicate a reversal in the prevailing trend, making them valuable for trend reversal traders.

✅Clear Visual Signal: The pattern provides a clear and visually recognizable signal on price charts.

✅Market Sentiment: The shift from buying to selling pressure or vice versa is visually captured in an engulfing pattern, reflecting changing market sentiment.

https://www.mql5.com/en/market/product/109524

Ashkan Hazegh Nikrou

*EUR/USD consolidates gains below 1.1000 ahead of US CPI data*

EUR/USD is consolidating gains below 1.10000 in early Europe on Thursday.

The pair receives support as the US Dollar faces challenges due to a risk-on market mood ahead of the critical US Consumer Price Index (CPI) data release.

EUR/USD is consolidating gains below 1.10000 in early Europe on Thursday.

The pair receives support as the US Dollar faces challenges due to a risk-on market mood ahead of the critical US Consumer Price Index (CPI) data release.

Ashkan Hazegh Nikrou

**Tip: Prioritize Risk-Reward Ratio Over Win Rate**

One common mistake among traders is focusing too much on achieving a high win rate without paying enough attention to the risk-reward ratio. Some traders may find themselves in a pattern of small profits followed by significant losses, leading to overall negative results.

One common mistake among traders is focusing too much on achieving a high win rate without paying enough attention to the risk-reward ratio. Some traders may find themselves in a pattern of small profits followed by significant losses, leading to overall negative results.

: