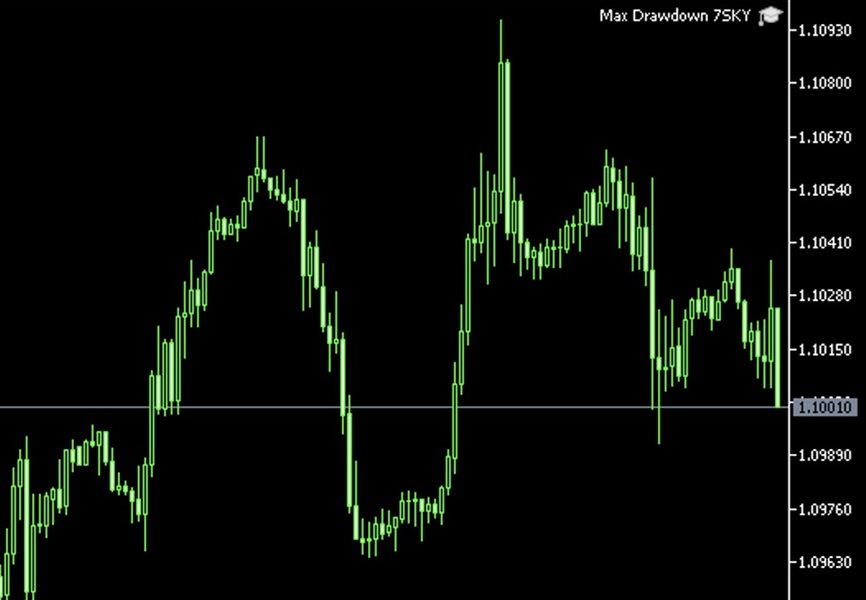

Max Drawdown 7SKY

- Yardımcı programlar

- Muhamad Ridzuan Bin Zulkiffli

- Sürüm: 1.0

- Etkinleştirmeler: 5

Simple instruction : Just enter drawdown percentage value, it will monitor the equity and close all position if it reach our max drawdown.

It also known as hard stop loss.

Max drawdown refers to the maximum loss an investment or portfolio experiences from its peak value to its lowest point, before it eventually recovers. In other words, it measures the largest drop from the highest point to the lowest point of an investment's value.

For example, let's say that an investment's value was at $100 at its peak, and it later fell to $60 before it eventually bounced back to $80. In this case, the maximum drawdown would be $40 ($100 - $60), which represents the percentage decline in value from the peak.

Max drawdown is an essential measure for investors because it helps them understand the risks associated with a particular investment or portfolio. It can also help investors to determine the risk-adjusted return of an investment by comparing the potential reward to the potential risk.

Investors typically use the max drawdown to determine whether an investment or portfolio is suitable for their risk tolerance. If an investment or portfolio has a high max drawdown, it may be too risky for some investors. Conversely, if an investment has a low max drawdown, it may be more suitable for conservative investors.

Overall, max drawdown is an important metric for investors to consider when evaluating the performance of their investments or portfolios.