OB Breakout Indi

- Göstergeler

- Lungile Mpofu

- Sürüm: 1.10

- Etkinleştirmeler: 5

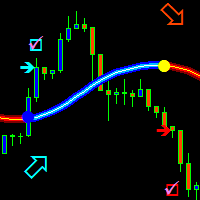

OB Breakout is alert indicator that identifies when a trend or price move is approaching exhaustion(Supply and Demand) and ready to reverse. It alerts you to changes in market movement which typically occur when a reversal or major pullbacks are about to or have happened.

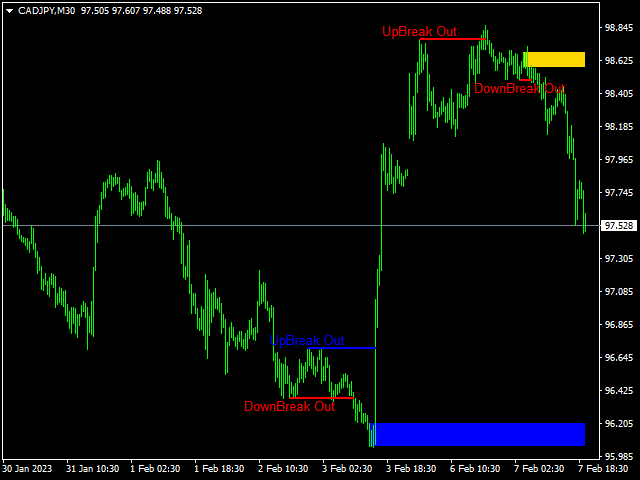

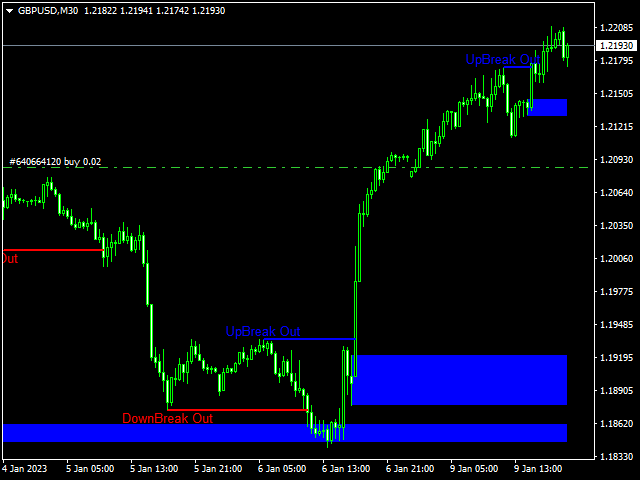

The indicator identifies breakouts and price momentum initially, every time a new high or low is formed near a possible Supply or Demand level point. The indicator draws in a rectangle on Supply or Demand Zones. Once price weakens enough that it closes back above or below the rectangle this would indicate a potential shift in market structure is taking place. The indicator then alerts you to a potential shift in direction and the start of a possible reversal in trend or major pullback.

Features

- Alerts you to potential changes in market structure at key Supply and Demand zones

- Automatically draws in short term market structure as price approaches Supply and Demand levels

- Changes colour to a solid block rectangle on alerts to show where potential reversals in market structure have occurred

- Works on all symbols and timeframes

- Integrated pop-up, push and email alerts built in

- Can also draw potential line breaks

- Alerts when a re-test of a reversal alert has happened confirming the entry as being more likely

- Allows you to view higher time frame reversal rectangles on your lower trading time frame. Great for trend traders and identifying higher time frame trend direction

Strategy & How To Trade With The OB Breakout Indicator

When a reversal alert occurs:

- Check if there is a supply/demand or support/resistance level that we're turning at.

- Market movement reversals usually occur when price is retesting an old supply or demand level or a stop hunt has just happened above that support or resistance level.

- Consult a higher time frame to see if there is an area of support/resistance we are turning at.

- As above changes in market movements will often happen on lower time frames when at major levels on a higher time frame.

If the above conditions are met simply place a trade in the direction of the reversal.

You can add additional indicators as validation or use this indicator to add further validation to your existing indicators or strategy!

Stop Loss and Take Profit

Always set stop loss just above the most recent high or below the most recent low. The size of your stop will be dependent on how aggressive the last move to create the recent high was.

Take profit is up to the individual but using a 1.5:1 or 2:1 risk to reward is easily achievable.