Commodity Channel Index Corrected

- Göstergeler

- Safwan Rushdi Khalil Arekat

- Sürüm: 1.4

- Güncellendi: 18 Ekim 2024

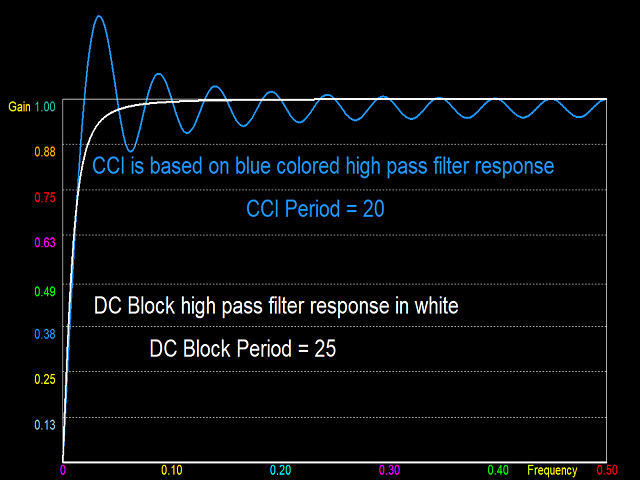

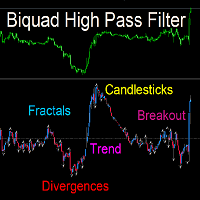

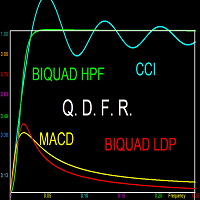

This indicator resolves an unrecognised defect in the Commodity Channel Index Oscillator (CCI). The CCI is based on a high pass filter calculated by subtracting the p-period simple moving average of a price signal (usually typical value) from the price signal itself. Then, the result is divided by the absolute mean deviation of the same period. The frequency response of a signal minus its simple moving average is shown in the first screen shot (in Blue). (see my free indicator : Q n D Frequency Response) . The presence of the oscillations produces undesirable artefacts in the CCI that do not correspond to price movement. If the CCI were based on the much cleaner DC Block high pass filter, whose frequency response is shown in white in the first screenshot, then the problem of the unsightly oscillations is eliminated. The DC blocker is a high pass filter similar to the Biquad high pass filter featured in two of this developers free indicators namely High Pass Filter Trading Signal and High Pass Filter Candlesticks .

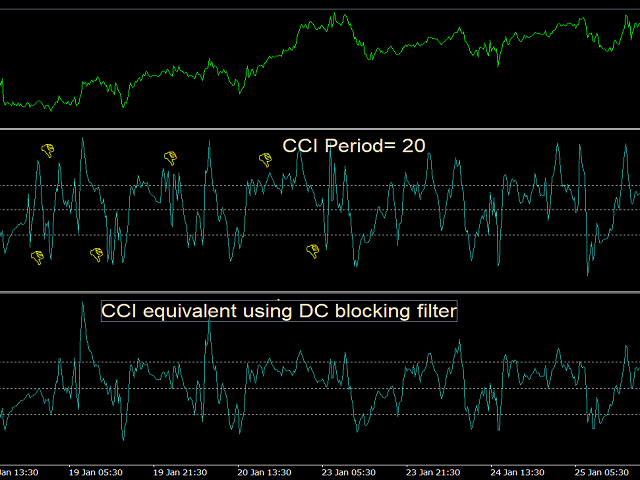

This present indicator performs the same CCI calculation for the typical price value based on the dc blocker hpf instead of the original oscillations-plagued high pass filter. The input of the indicator can be run in CCI_Mode, which converts it into a CCI indicator (but with new filter of course). This way direct comparisons can be made between them. Screen shot 2 shows a comparison for EUR/USD chart. The thumbs down on the conventional CCI show artefacts due to oscillations that do not correspond closely to price data, and do not agree with standard interpretation of the indicator about crossing level 100. These features cannot be eliminated by simply changing the period of the CCI. If they do disapear, then others will pop up. The CCI mode here is limited to periods betwen 5 and 25.

If you use CCI in your trading, consider this present indicator.

Thank you! You are the best!!!