New QQE with confirm

- Göstergeler

- Minh Truong Pham

- Sürüm: 1.0

- Etkinleştirmeler: 5

New QQE with confirm

The relative strength index (RSI) is a technical indicator of momentum that measures the speed and change of price on a scale of 0 to 100, typically over the past 14 periods.

Cause RSI measures the speed and change of price, trader normally use this indicator in two way:

+ Buy when oversold, sell when overbougth.

+ buy or sell when identifying divergence from rsi with price.

In two way, it wrong when rsi in overbouth (for example) for long time or divergence. Even price just going up where rsi going down.

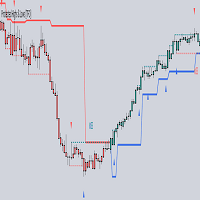

To solve this problem, I studied a lot of RSI and found Quantitative Qualitative Estimation (QQE) indicator. In essence, the QQE is a heavily smoothed RSI. After many test, I change some thing in how QQE calculated as folowing:

1. Base of standard RSI (can change rsi period in indicator setting), I calculate EMA of RSI standard with rsi smoothing period =>( RsiMa)

2. Calculate AtrRsi= RsiMa (canlde before)- RsiMa (current)

3. Calculate MaAtrRsi = EMA of AtrRsi

4. Calculate dar= EMA of MaAtrRsi in Wilders_Period = (inp_RSI_Period * 2 – 1)

5. Calculate lower_line(red_line) and upper_line(blue line) base on dar and rsi ma and rate QQE (default is 4.238). This two line defined band that rsi should inside.

6. Alert buy and put arrow on chart when candle before have rsi in oversold ; rsi<lower_line AND candle current have rsi>lowerline. (opposite to the case of selling)

This indicator just suggest buying or selling direction. To make a decision, it is necessary to combine other indicators such as trend indicator…