Scalpel Universal

- Uzman Danışmanlar

- Andriy Sydoruk

- Sürüm: 1.1

- Güncellendi: 6 Şubat 2022

- Etkinleştirmeler: 5

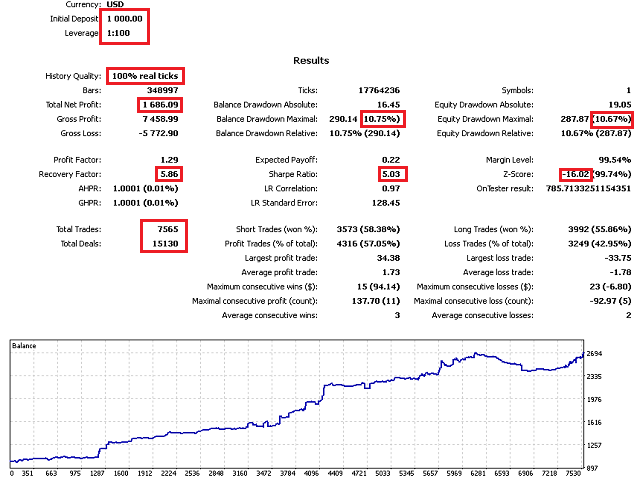

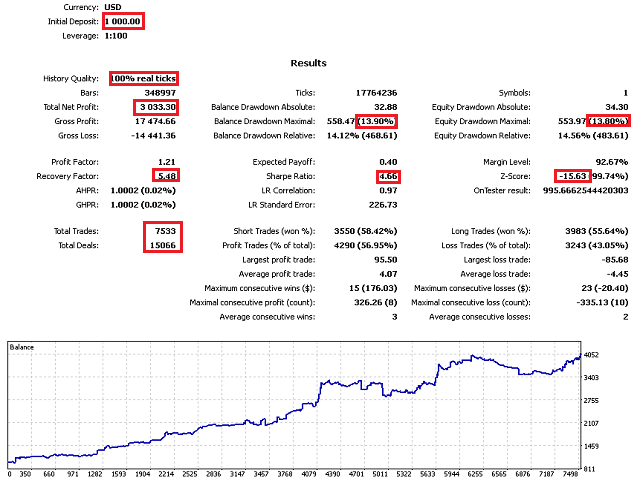

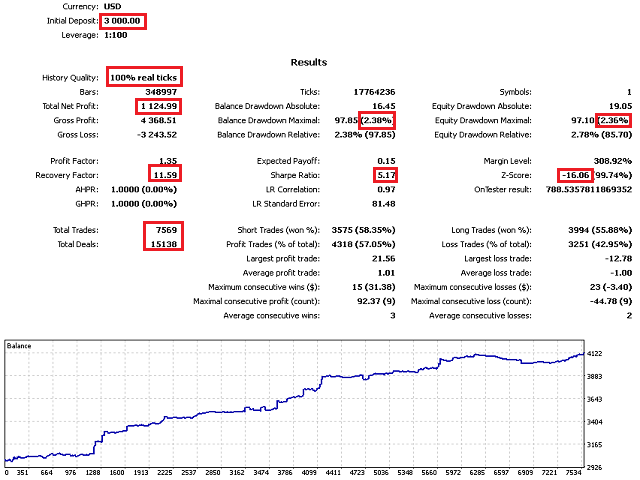

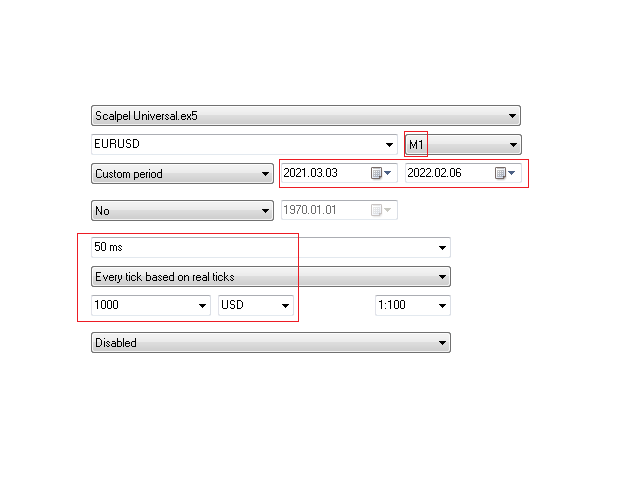

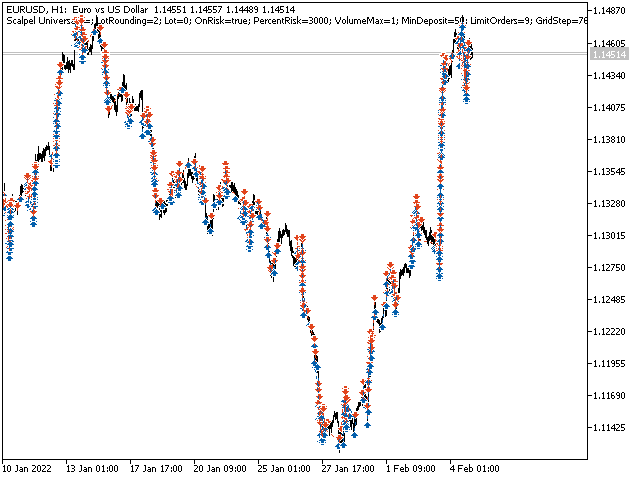

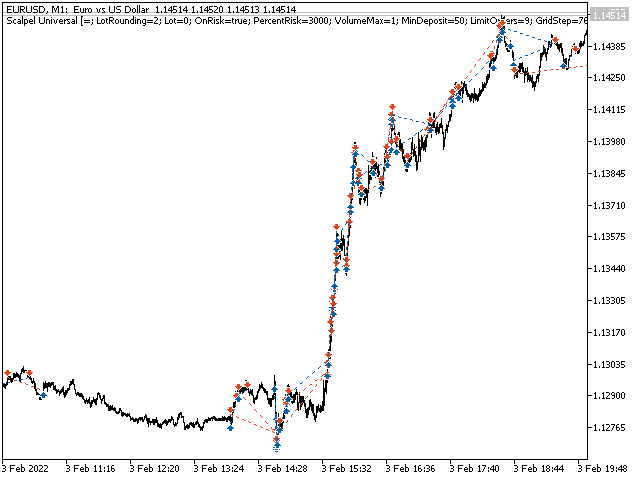

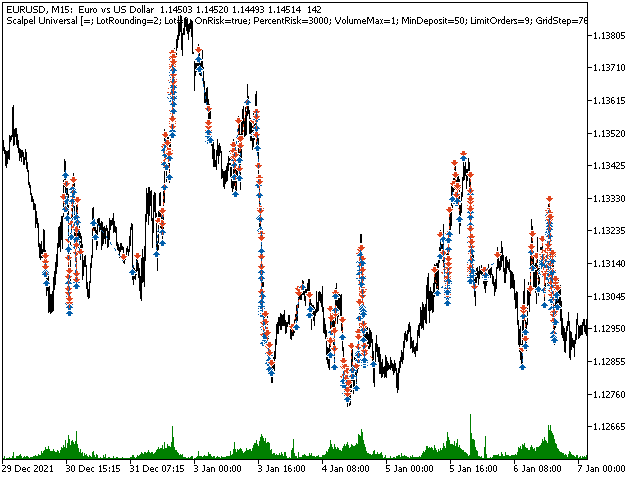

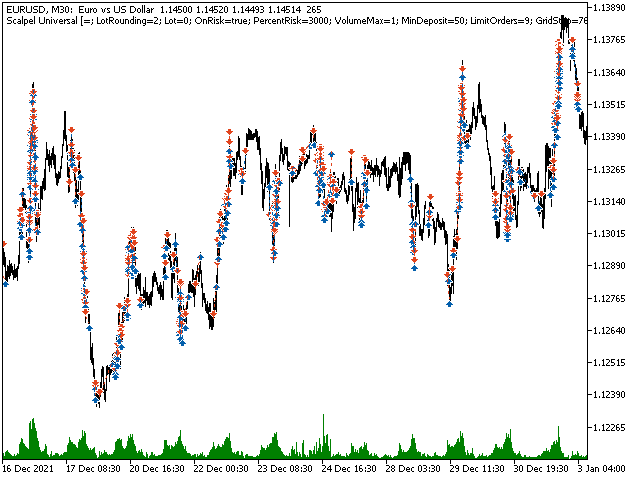

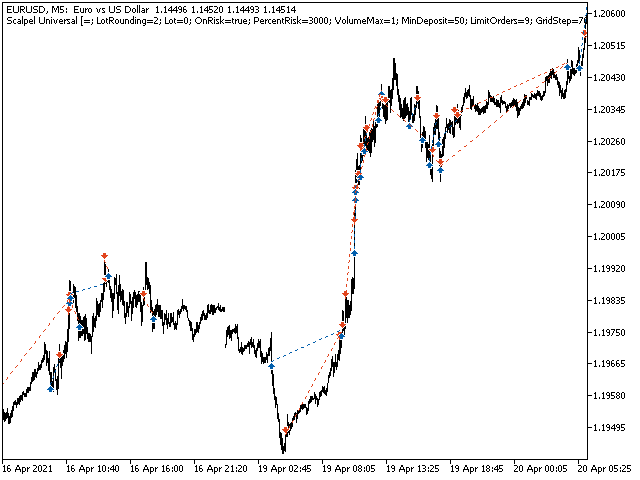

This bot is an attempt to create a scalpel for working with real ticks. Which is quite difficult because as a rule, scalpels in real work do not stand up to the test. This development only works with real ticks. Of course, the bot needs to be optimized for the story and the tool. Optimization is in the screenshots, and the file for optimization is provided in the discussion. The screenshots show one setting but with different risk and deposit. The larger the deposit, the less risky, this is set by the risk field. As a result, Scalpel Universal is a new generation universal scalpel bot. Can work on any type of account. On any instrument without exception. The bot works only on real ticks. There is a version for MT4, but you can't test it on real ticks.

The essence of the work is the following.

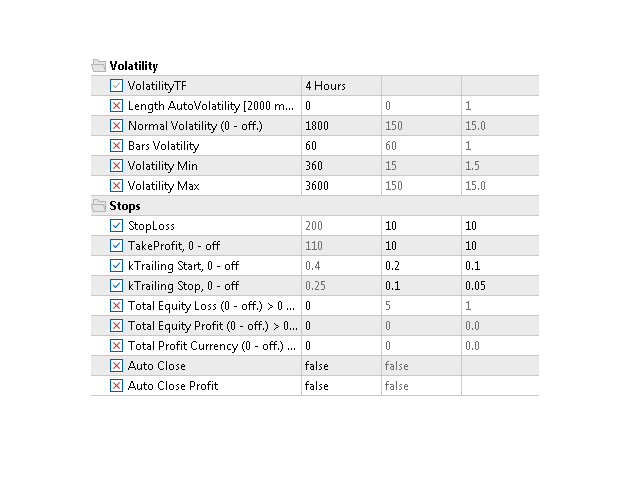

The robot analyzes the speed and acceleration of ticks, after which it makes a decision to enter the market. It works using a series with a martingale, but short and protected by a stop loss, the so-called limited martingale. There are two independent trading lines and, accordingly, current signals. One for buy and one for sell. A trailing stop is also used. Since it is difficult to hit the target with one order, we use a limited series of orders, which significantly improves the results.

Execution mechanics.

As you know, the real mode is not a tester, there are requotes, freezing of the market, the Internet, the inability to place an order, or many other surprises. The bot knows how to deal with all this as correctly as possible. There is a suitable sector of settings. The bot also uses the concept of basic volatility. Set on H4 and taken as a certain standard. When volatility changes, the bot automatically adjusts all pip parameters relative to the base volatility. For example, the stop loss is set to 200, and the volatility has doubled relative to the base one, then the stop loss is adjusted to 400 automatically, like all other parameters set in pips. There is also an additional functionality, for example, you can set a filter by spread. All settings are simple and intuitive. I will give an explanation only for the key ones.

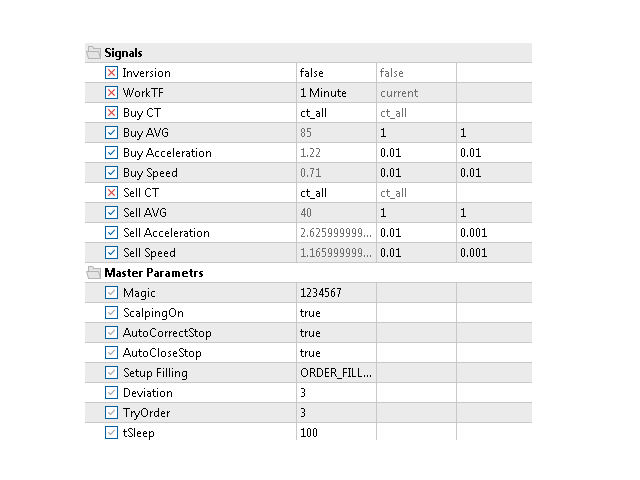

Key settings. These are the login system settings. For entry, an algorithm for analyzing the speed and acceleration of ticks is used.

- Buy CT - What set of ticks to use for buy.

- Buy AVG - averaging the number of recent buy folders.

- Buy Acceleration - acceleration of the tick impulse for entering buy.

- Buy Speed - the speed of the tick impulse for entering buy.

- Sell CT - What set of ticks to use for sell.

- Sell AVG - averaging the number of recent folders for sell.

- Sell Acceleration - acceleration of the tick impulse to enter the sell.

- Sell Speed - the speed of the tick impulse to enter the sell.

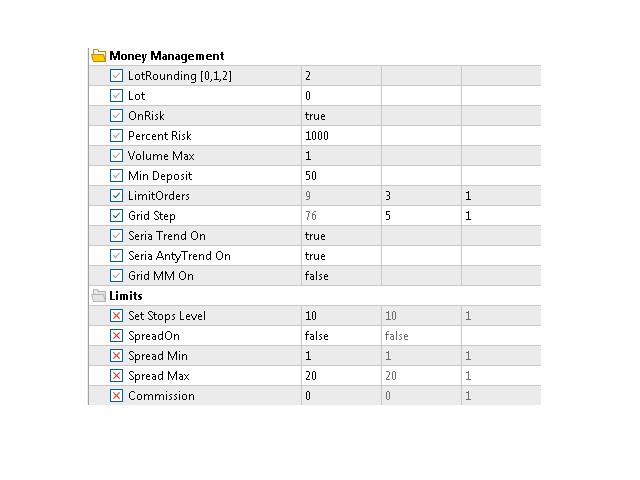

Money management parameters and others.

- OnRisk - We activate the work according to the money management algorithm.

- Lot - If the OnRisk field is disabled, then the work is carried out in the amount set in this parameter.

- Risk - Sets the risk itself.

- PercentRisk - Used to calculate the deposit.

- Min Deposit - The minimum possible deposit at which the bot is still working.

- Limit Max Lot - Limiting the maximum volume.