Orion 1

- Uzman Danışmanlar

- Emanuele Vazzoler

- Sürüm: 6.0

- Güncellendi: 23 Ekim 2022

- Etkinleştirmeler: 5

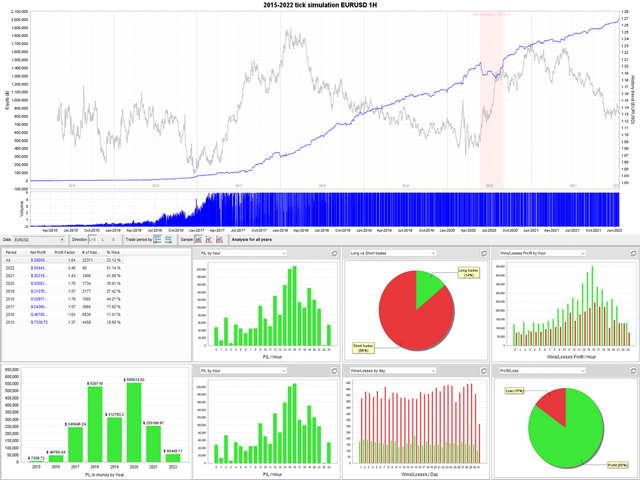

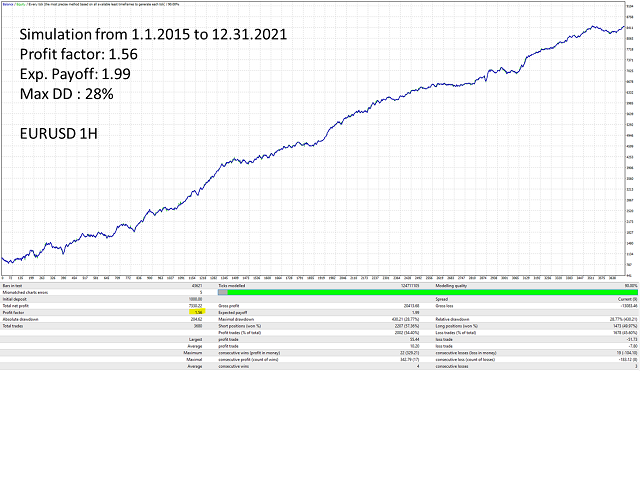

Orion I is a multi-strategy Expert Advisor: 13 different strategies has been embedded into a single Advisor with a logic able to select the best algorithm for each market phase!

Multi-strategy allows to achieve a smooth equity line keeping at the same time the risks at an acceptable level.

Money Management is based on fixed lot size OR fixed risk (i.e. maximum risk per trade expressed as % of available balance).

This EA has been developed for EURUSD with 1H time interval. Can be used on other currencies, but backtest is mandatory

In order to run the EA, please set in the parameters the correct account type under Money Management, setting 0 for standard lots, 1 for mini lots, 2 for microlots, otherwise the simulation will fail!

Orion I can be found also as signal on MQL5 signal market here.

| Symbol | EURUSD (Euro vs US Dollar) | ||||

| Period | 1 Hour (H1) 2015.01.02 09:00 - 2022.01.21 22:00 (2015.01.01 - 2022.01.22) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | MagicNumber=5000; smm="----------- Money Management - Risk Fixed % Of Balance -----------"; UseMoneyManagement=true; mmRiskPercent=1; mmDecimals=2; mmLotsIfNoMM=0.01; mmMaxLots=5; sdtw="----------- Dont Trade On Weekends -----------"; DontTradeOnWeekends=false; FridayCloseTime="08:00"; SundayOpenTime="08:00"; seod="----------- Exit At End Of Day -----------"; ExitAtEndOfDay=false; EODExitTime="08:00"; seof="----------- Exit On Friday -----------"; ExitOnFriday=false; FridayExitTime="08:00"; sltr="----------- Limit Time Range -----------"; LimitTimeRange=false; SignalTimeRangeFrom="08:00"; SignalTimeRangeTo="08:00"; ExitAtEndOfRange=false; OrderTypeToExit=0; smmmdfmp="----------- Max distance from market price -----------"; LimitMaxDistanceFromMarketPrice=false; MaxDistanceFromMarketPct=0; smtpd="----------- Max Trades Per Day -----------"; MaxTradesPerDay=0; smmslpt="----------- Min/Max SL/PT -----------"; MinimumSL=0; MinimumPT=0; MaximumSL=0; MaximumPT=0; sqDisplayInfoPanel=true; ModifyInsteadOfReplacing=true; OpenBarDelay=0; | ||||

| Bars in test | 44837 | Ticks modelled | 127271058 | Modelling quality | 90.00% |

| Mismatched charts errors | 20 | ||||

| Initial deposit | 2500.00 | Spread | 5 | ||

| Total net profit | 2005000.53 | Gross profit | 5152481.90 | Gross loss | -3147481.38 |

| Profit factor | 1.64 | Expected payoff | 239.55 | ||

| Absolute drawdown | 263.39 | Maximal drawdown | 196688.91 (13.36%) | Relative drawdown | 38.47% (2528.69) |

| Total trades | 8370 | Short positions (won %) | 5211 (60.97%) | Long positions (won %) | 3159 (56.82%) |

| Profit trades (% of total) | 4972 (59.40%) | Loss trades (% of total) | 3398 (40.60%) | ||

| Largest | profit trade | 8983.17 | loss trade | -11237.72 | |

| Average | profit trade | 1036.30 | loss trade | -926.27 | |

| Maximum | consecutive wins (profit in money) | 46 (117460.08) | consecutive losses (loss in money) | 55 (-60221.91) | |

| Maximal | consecutive profit (count of wins) | 117460.08 (46) | consecutive loss (count of losses) | -83605.70 (31) | |

| Average | consecutive wins | 3 | consecutive losses | 2 | |