CJ News Trading MT5

- Uzman Danışmanlar

- Nguyen Duc Tam

- Sürüm: 1.3

- Güncellendi: 28 Nisan 2023

Trading has never been easier!

Let's check this out!

MT4 version: https://www.mql5.com/en/market/product/72153

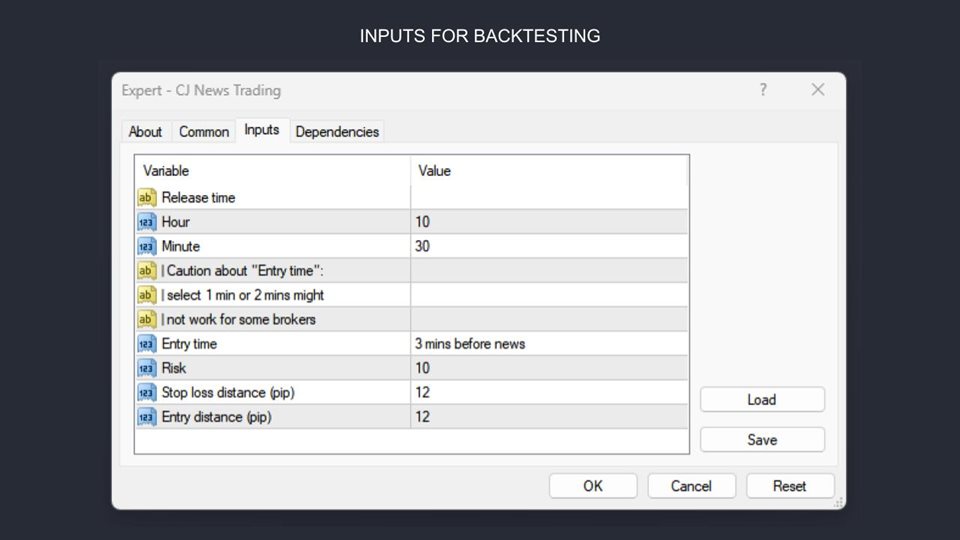

Strategy

There are some news within a day that can make the price jumps up or down very quickly and that is a good opportunity for traders to get some profits.

Looking to scalp a news release? Here's how you can do it:

-

Open two stop orders (a buy stop and a sell stop) 3 to 5 minutes before the news release. Place them about 15 to 20 pips away from the current market price.

-

When the news is released, there are three possible scenarios:

-

The price doesn't move much and neither of your orders is triggered. In this case, simply close both pending orders and finish your scalping session.

-

The price moves up and triggers your buy stop order. Close your sell stop order and let the buy order continue to run.

-

The price moves down and triggers your sell stop order. Close your buy stop order and let the sell order continue to run.

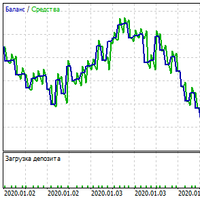

By scalping the news in this way, you can take advantage of sudden market movements and potentially make a quick profit. However, it's important to note that scalping can be a high-risk strategy, and it's important to carefully manage your trades and limit your exposure to the market.

Notice: Some brokers lock the chart from making order within 1-2 minutes before and after the news, so it is better if we open the trader sooner than 2 mins before the news release time.

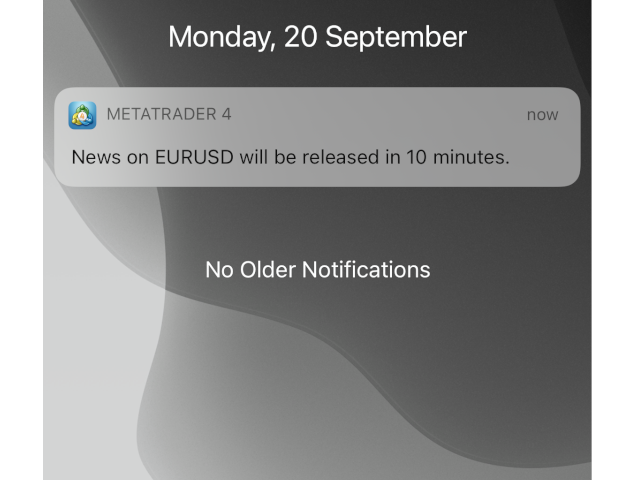

Features

- Auto open pending orders before new released

- Auto send notification to MT4/MT5 apps on mobile

- Can be handled manually

- Open pending orders

- Close pending orders

- Close all orders (orders opened by this EA, the other orders are still remained)

Some news that can make significant impact on forex market when they are released:

-

Non-Farm Payrolls (NFP): This is a monthly report released by the US Bureau of Labor Statistics that shows the number of jobs added or lost in the US during the previous month.

-

Gross Domestic Product (GDP): GDP measures the total value of goods and services produced by a country in a given time period. A higher GDP indicates a stronger economy, which can lead to a stronger currency.

-

Central Bank Interest Rate Decisions: Interest rate decisions made by central banks such as the Federal Reserve (US), European Central Bank (EU), and Bank of Japan (Japan) can have a significant impact on the forex market, as they can affect the value of a country's currency relative to others.

-

Consumer Price Index (CPI): CPI measures the change in prices of a basket of goods and services over time, and is used as an indicator of inflation. Higher inflation can lead to higher interest rates, which can strengthen a currency.

-

Retail Sales: Retail sales measures the total value of goods sold by retailers in a country. Strong retail sales can indicate a strong economy and can lead to a stronger currency.

-

Trade Balance: Trade balance measures the difference between a country's exports and imports. A positive trade balance (exports greater than imports) can strengthen a currency, while a negative trade balance can weaken a currency.

-

Manufacturing Data: Manufacturing data such as the Purchasing Managers' Index (PMI) can be used as an indicator of economic growth or contraction. Strong manufacturing data can indicate a strong economy and can lead to a stronger currency.

satisfied