Heliodoros

- Uzman Danışmanlar

- Konstantinos Reppas

- Sürüm: 1.0

- Etkinleştirmeler: 5

| PROMOTION Price: $300 FOR THE FIRST 5 SALES Next Price $450 / Target Price $2000 |

|---|

INTRODUCTION

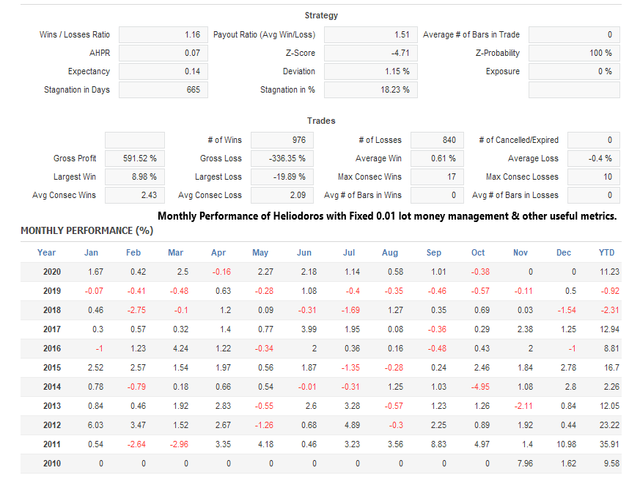

“Heliodoros” EA has been created, tested, and evaluated for the EUR/USD currency exchange rate, in the one-hour time frame. Consists of 9 different trading strategies which their philosophy is to capture “small” trends inside a mean reversion market environment. So, we can simply say that it’s a trend following EA but always considering the -proven-tendency of this currency pair to return to its mean.

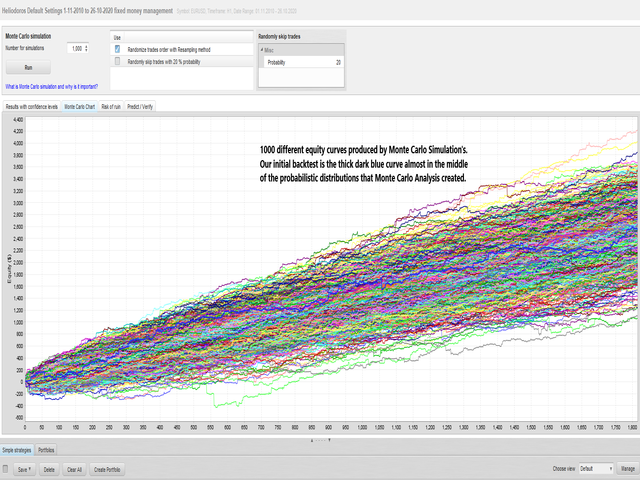

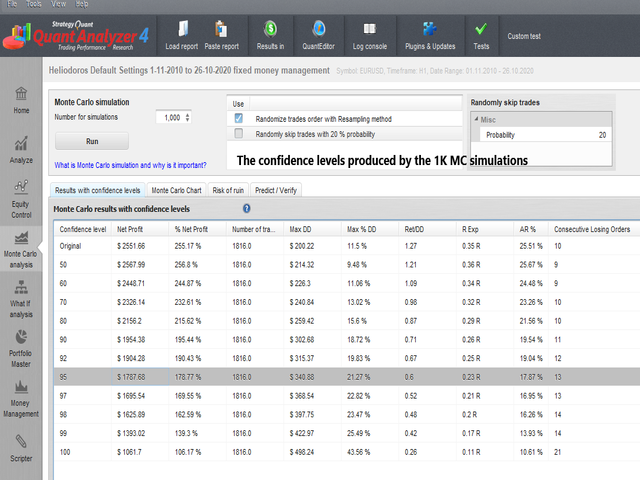

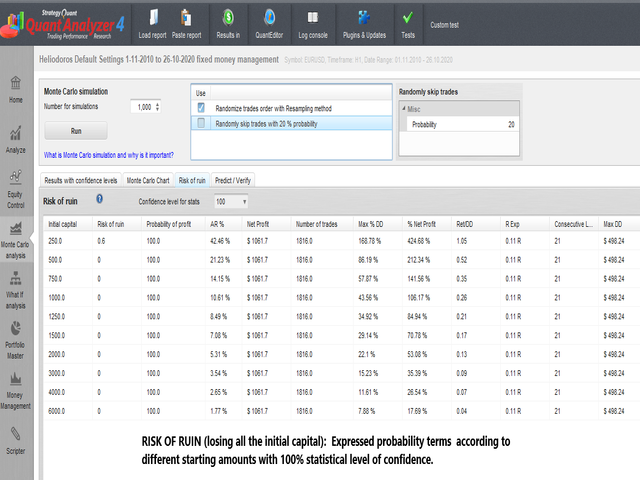

The creation, testing, development and final evaluation of "Heliodoros" EA was based to stochastic calculus methods implemented in Quantitate Finance. Specifically as example Hypothesis Testing based on the Monte Carlo Simulation principles have been made after the procedure of robustness checks that was a Rolling Walk Forward Matrixes.

EXPLANATION OF THE INPUTS SECTION & Author’s RECOMMENDATIONS

1. “Entry lots”: The number of lots per 1 lot of the account balance, that the EA will use as position size per trade. Put different values in this variable when the “Fixed” money management method option is chosen.

2. “Base Magic Number”: The “identity” of each trade that the EA places. You can use different magic numbers IF and only IF you chose to run “Heliodoros” on a different EURUSD chart with different settings.

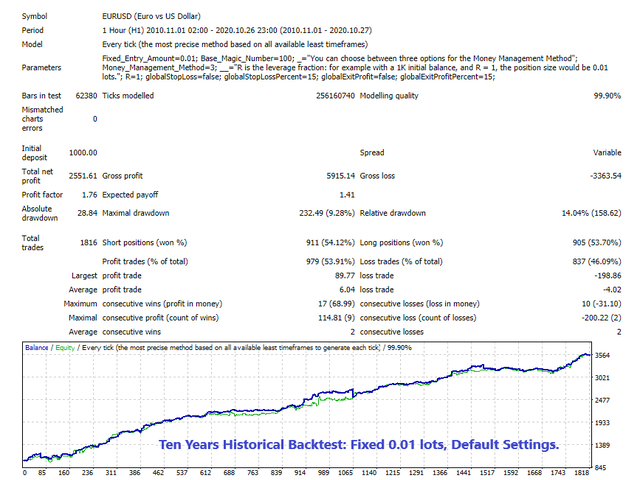

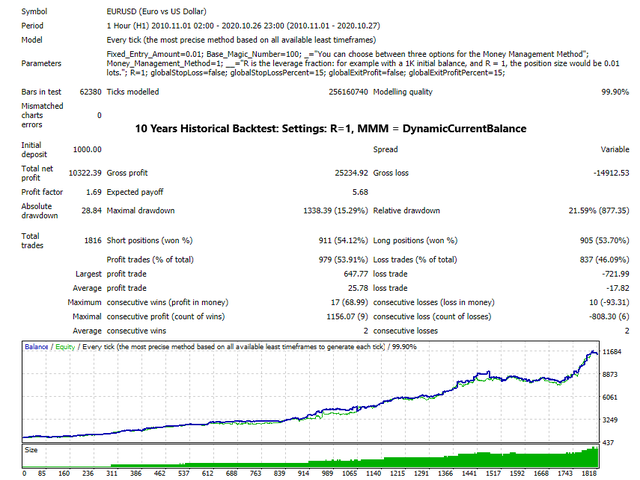

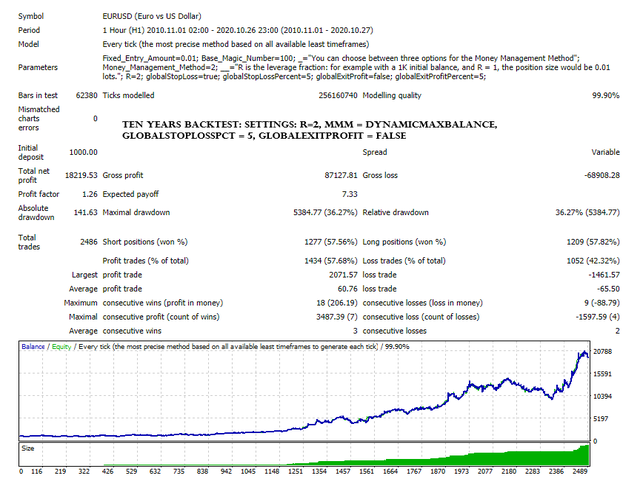

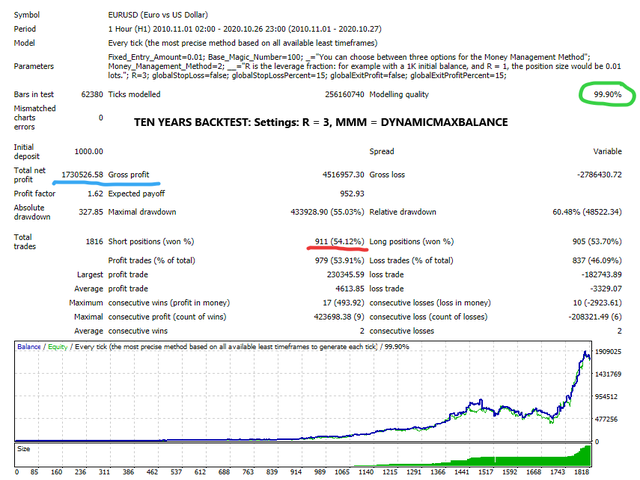

3. “Money Management Method”: According to your historical backtests and of course risk-reward personal preferences, you can chose between three options: a) “Fixed”, b) “Dynamic with Current Balance” and c) “Dynamic with MAX Balance”. Using (a) option the EA will place the same position size indifferently with the amount of your current balance in your trading account. If you chose the (b) option the EA will calculate the position size of each trade based on the progression of your account, either smaller if there’s a drawdown or higher if the balance is growing positively. Finally, using option (c), “Heliodoros” will calculate each trade's position size according to the maximum balance that the trading account has reached. Of course, as you can easily understand, the risk-reward metrics of the EA will be increased using this option of money management methods.

4. “R”: This variable’s arithmetic value is nothing else but the number of leverage you want to use per trade. For example, if you put R = 3, then the EA will place trades with a position size 3 times your current (or maximum point) of your trading account balance. The amount of lots that the EA will trade will be always calculated as a integer multiple of the smallest amount of lots that your broker offers.

5. “Global Stop Loss”: This input variable can take either “true” or “false” values. Use the “true” option if you want to have a general (global) stop loss for all running trades of the EA.

6. “Global Stop Loss Percent”: It refers to the previous input, and it’s the number in % that you may choose as the maximum drawdown for your equity concerning all trades that may are open and running. If the equity drops below this % number, the EA will close all the existing positions immediately.

7. "Global Exit Profit”: This input variable can take either “true” or “false” values. Use the “true” option if you want to have a general (global) take profit for all running trades of the EA.

8. “Global Exit Profit Percent”: It refers to the previous input, and it’s the number in % that you may choose as the maximum increase for your equity concerning all trades that may are open and running. If the equity surpasses above this % number, the EA will close all the existing positions immediately.

The author firmly recommends that before you use the EA in real trading, to conduct extensive historical back-testing using high quality tick data, or even to forward test it in a demo account, so you will understand the functioning of "Heliodoros" and most importantly to choose your preferable settings. Finally, the minimum recommended amount is $1000.

Kullanıcı incelemeye herhangi bir yorum bırakmadı