Raschke Oscillator

- Göstergeler

- Carmine Pinto

- Sürüm: 1.21

- Güncellendi: 9 Haziran 2020

- Etkinleştirmeler: 12

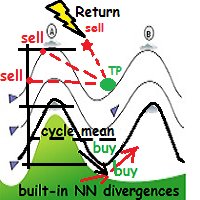

The Raschke Oscillator (LBR-RSI) indicator is the famous oscillator described in the book "Street Smarts: High Probability Short-term Trading Strategies"

This indicator is perfect for a variety of researchs and it can be suitable to be used in combination with your own strategy just for trend trading or range-bound trading. The personal preference is to use it when the trend is not too strong, for example you can combine it with ADX to measure the strength of the trend and use it when ADX is below a certain level.

Unlike many other fancy oscillators, it lends itself to well assess the market swings with a good accurancy degree and while the original version have a predefined setting, in this version it is coded with the purpose to give the opportunity to change the ROC and RSI period separately which lead for making your own searchs and optimizations to be used with your own strategy or in combinations with other tools. It can definitely be the right tool for timing your trades.

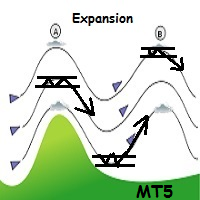

What is an oscillator?

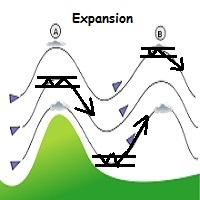

Just imagine a pendulum wich marks the rhythm of the market. There

are numerous studies that indicate the cyclical nature of the market, such as the Taylor's studies about the natural rithm of the market

in the short term moves or the of celestial bodies cycles (for

those who believe in the astral influence on human trading activities).

Also, the fibonacci proportions

within the fractal nature of the market impose a rhythm on the market's movement which can be recorded and synthesized

in a pendulum oscillation form.