Reversal Composite Candles

- Uzman Danışmanlar

- MetaQuotes Ltd.

- Sürüm: 1.21

- Güncellendi: 31 Mart 2020

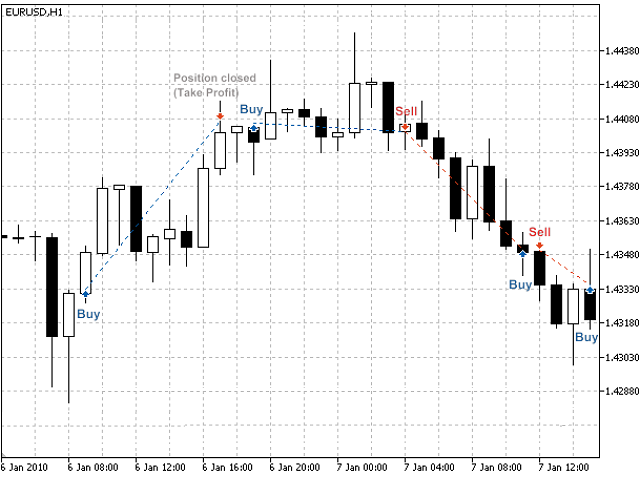

The idea of the system is to indentify the reversal patterns using the calculation of the composite candle.

The reversal patterns is similar to the "Hammer" and "Hanging Man" patterns in Japanese candlestick analysis. But it uses the composite candle instead the single candle and doesn't need the small body of the composite candle to confirm the reversal.

Input parameters:

- Range - maximal number of bars, used in the calculation of the composite candle.

- Minimum - minimal size of the composite candle (in conventional points).

- ShadowBig and ShadowSmall - shadows (in composite candle units).

- Limit, StopLoss and TakeProfit - open price, SL and TP levels, они задаются относительно цены закрытия композитной свечи (composite candle units).

- Expiration - order expiration time (in bars), used in trading with pending orders (Limit!=0.0).

The reversal candlestick patterns are determined as follows.

It calculates the composite candle parameters starting from the recent completed bar (with index 1) to the number of bars, defined by Range input parameter. If the composite candle size is greater than value, specified by Minimum input parameter, it checks the reversal conditions of the composite candle by analysis of its shadows.

The bears power is characterized by size of the upper shadow of the composite candle, the bulls power is characterized by size of the lower shadow.

- To confirm the reversal of the bearish trend (and start of the bullish) it is needed the following: the size of the lower shadow (bulls power) must be greater than value, defined by ShadowBig input parameter. The size of the upper shadow (bears power) must be less than value, defined by ShadowSmall input parameter.

- To confirm the reversal of the bullish trend (and start of the bearish) it is needed the following: the size of the upper shadow (bears power) must be greater than value, defined by ShadowBig input parameter. The size of the lower shadow (bulls power) must be less than value, defined by ShadowSmall input parameter.

In addition to the reversal strategy, it's possible to use the breakdown strategies by specifying the negative value of Limit input parameter.

Depending on Limit, three different ways of market entry are used:

- Limit>0. It will enter on back movement on the price, better than market price (The Buy Limit or Sell Limit pending orders will be placed depending on trade signal)

- Limit<0. It will enter in price movement direction (The Buy Stop or Sell Stop pending orders will be used depending on trade signal).

- Limit=0. It will trade using the market prices.

I think it's good