KT Stoch Divergence MT5

- Göstergeler

- KEENBASE SOFTWARE SOLUTIONS

- Sürüm: 1.1

- Güncellendi: 24 Mart 2022

- Etkinleştirmeler: 5

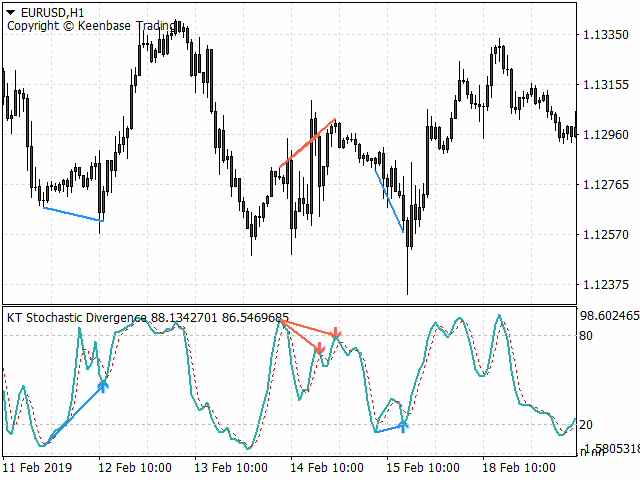

Divergence is one of the vital signals that depicts the upcoming price reversal in the market. KT Stoch Divergence shows the regular and hidden divergences build between the price and stochastic oscillator.

Limitations of KT Stoch Divergence

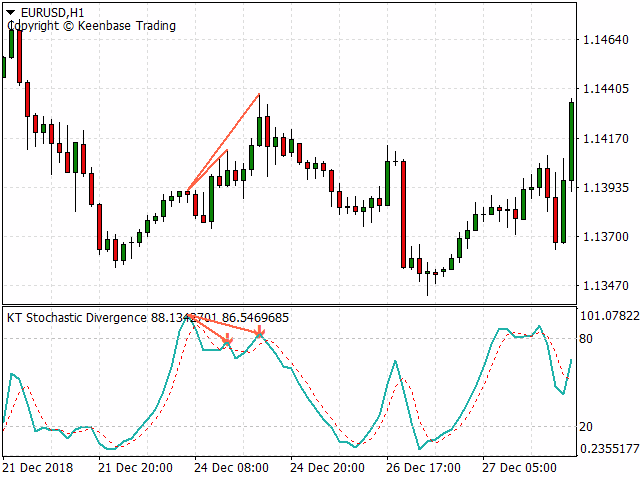

Using the Stochastic divergence as a standalone entry signal can be risky. Every divergence can't be interpreted as a strong reversal signal. For better results, try to combine it with price action and trend direction.

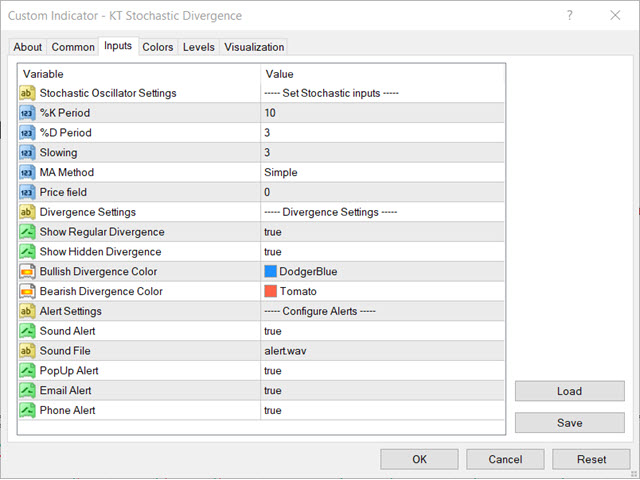

Features

- Marks regular and hidden divergences between the price and Stochastic oscillator.

- Support trading strategies for trend reversal and trend continuation.

- Fully compatible for embedding in Expert Advisors.

- Unsymmetrical divergences are discarded for better accuracy and lesser clutter.

- Can be used for entries as well as for exits.

- All Metatrader alerts are included.

What is a Divergence exactly?

Generally speaking, if the price is making higher highs, then oscillator should also be making higher highs. If the price is making lower lows, then oscillator should also be making lower lows. When this normal behavior is not followed, that means the price and oscillator are diverging from each other. There are two types of divergence:

Regular Divergence

- Regular Bullish Divergence: When the price is making lower lows, but the oscillator is making higher lows.

- Regular Bearish Divergence: When the price is making higher highs, but the oscillator is making lower highs.

Hidden Divergence

- Hidden Bullish Divergence: If the price is making higher lows, but the oscillator is making lower lows.

- Hidden Bearish Divergence: If the price is making the lower highs, but the oscillator is making higher highs.