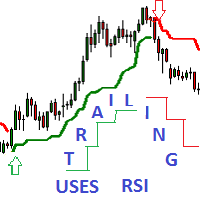

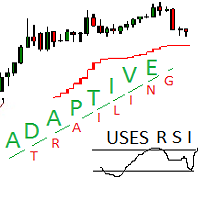

Adaptive Trailing Uses RSI Indicator

- Göstergeler

- Vladimir Komov

- Sürüm: 1.0

- Etkinleştirmeler: 5

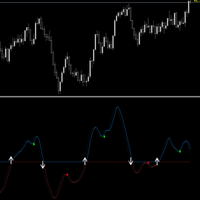

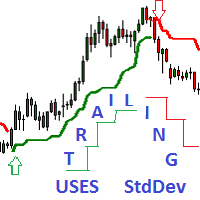

Adaptive Trailing uses RSI Indicator - an indicator of directional movement that allows you to determine the trend at the

time of its inception and set the levels of a protective stop.

Trailing can be carried out both from below, when the stop level is below the current price and is pulled up behind the price if it increases, and

above, when stop levels are above the current price.

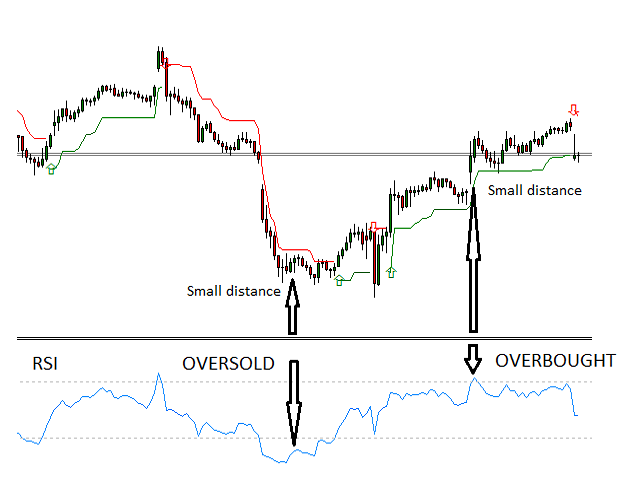

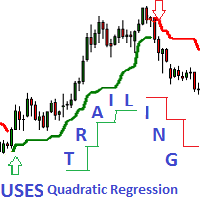

There are two modes for calculating the stop level. Simple trailing is done with a constant distance of Npoints to the current price. Adaptive

trailing takes into account the readings of the rsi indicator. If the trailing mode is set from below, then the distance is reduced for

rsi values above 50, the distance reduction coefficient is calculated as K = (100 - rsi) / 50. If the trailing mode is set from above,

then the distance is reduced for rsi values below 50, the distance reduction coefficient is calculated as K = rsi / 50.

Example. The adaptive trailing mode is set from below, the constant distance is 100 points, the value rsi = 75. Distance reduction coefficient K =

(100-75) /50=0.5. The distance to the price is 100 * 0.5 = 50 points.

Thus, the trailing method adapts to price volatility.

Moments of trend change are indicated by arrows.

Benefits

- Stable trend recognition from its inception to the end.

- It is easily perceived and interpreted.

- It works on any instrument.

- It works on all timeframes.

- Not redrawn, not recounted.

Inputs

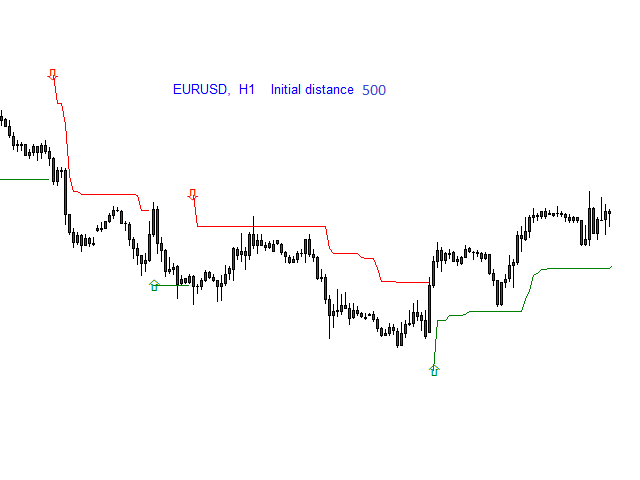

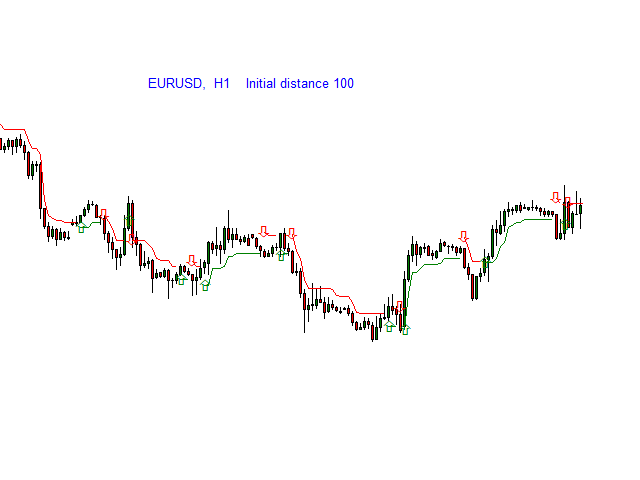

- initial trailing distance (points) - the initial distance to the price, saved if adaptive mode is not used

- RSI period- period of the RSI indicator

- Is_Adaptive_Mode - flag to enable adaptive mode

- Shift - indicator shift, number of bars.

Using

The Adaptive Trailing uses RSI Indicator can be used in several ways.

As a sign of a trend.

To assess the strength of the trend: when the price significantly exceeds the indicator line, a growing trend is gaining strength. If the

price approaches the indicator line, then the growing trend is weakening. A falling trend is likewise recognized.

To generate buy / sell signals when the price crosses the indicator line.

Features

The longer the calculation period of the RSI indicator, the less often the indicator signals about a trend change.