AIS Adaptive Trend Smoothing

- Göstergeler

- Aleksej Poljakov

- Sürüm: 1.0

- Etkinleştirmeler: 5

In order to isolate long-term and non-random components, it is necessary to know not only how much the price has changed, but also how these

changes occurred. In other words - we are interested not only in the values of price levels, but also in the order in which these levels

replace each other. Through this approach, one can find long-term and stable factors that influence (or may influence) the price

change at a given point in time. And knowledge of these factors allows you to make a more or less accurate prediction.

Let's determine what specific results we want to get from the analysis of financial series in time:

• first of all we need to highlight the trend, if it is present in the market;• secondly, we need to identify periodic components;• thirdly, the results should be sufficiently stable to be used for forecasting;• and finally, our analysis method should adapt to the current market situation.

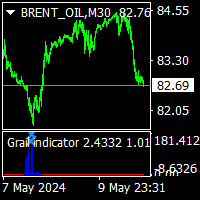

In order to fulfill the specified conditions, we use a regression analysis of relative price changes, and make an indicator based on this

model. The algorithm of this indicator is based on learning from historical data, and its work is under the complete control of the

trader.

- LH is a parameter that determines the number of bars used to smooth the financial series. Its allowable value is between 0 - 255.

- UTS is a parameter that affects the speed and depth of learning. Its value also lies within 0 - 255. If the value of UTS is zero, then learning occurs throughout the history. In all other cases, the training set is updated from time to time. This update occurs the more often the smaller the UTS value.

The main disadvantage of this indicator is that when smoothing the financial series are considered as stationary, which may cause some

delay.

Kullanıcı incelemeye herhangi bir yorum bırakmadı