EA Hedging for MT5

- Uzman Danışmanlar

- Vladimir Khlystov

- Sürüm: 1.31

- Güncellendi: 29 Temmuz 2022

- Etkinleştirmeler: 5

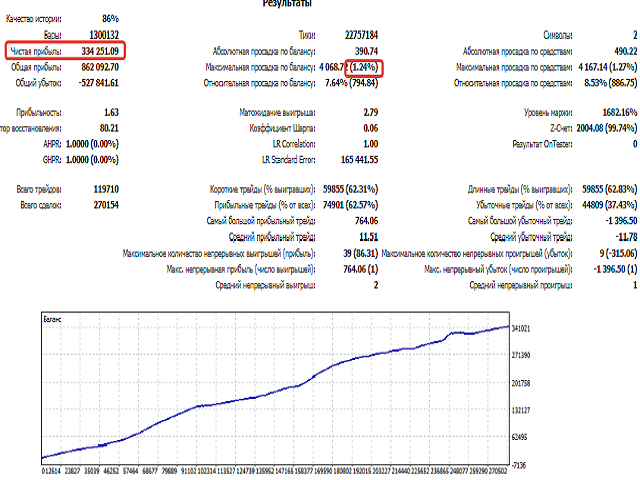

A trading robot based on the correlation of instruments is the safest strategy on the market!

Advisor's Strategy:

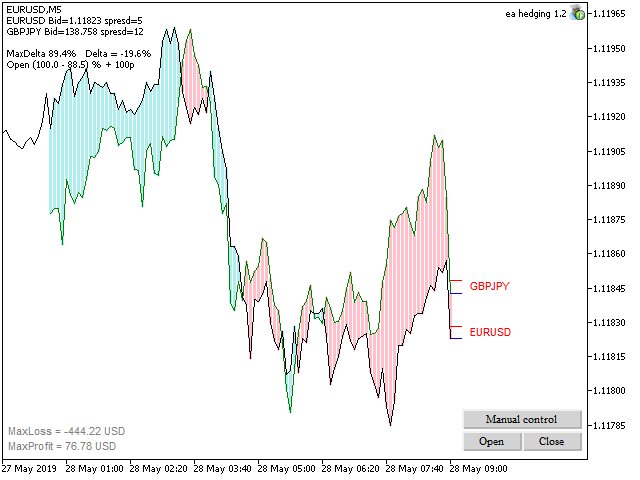

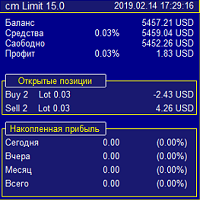

We know that highly correlated currencies almost always behave in a mirror way. But there are moments of deviation (divergence of currencies) from the normal value. The Expert Advisor opens orders in the direction of currency convergence. Further, when the total profit reaches CloseProfit (the value in the deposit currency at which all positions are closed), the ADVISER closes the transactions.

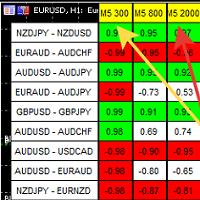

For trading, we choose instruments with high correlation, for example:

EURUSD - GBPUSD

AUDUSD - NZDUSD

USDCHF - USDCAD

In the parameters there is a point

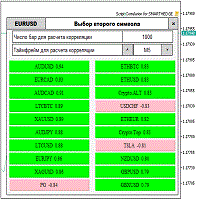

Instrument_2

This is the name of the second instrument (the second currency pair). The first instrument is the one on which the EA is installed.

If you leave Instrument_2 empty and set the EA to one of the above pairs, the EA will determine the second instrument itself.

If You need other options, you can write any instrument name in Instrument_2.

You can use other options, such as gold - silver or oil and gas or shares of state corporations.

The main thing that they have a high percentage of correlation.

The EA does not use indicators. It analyzes the divergence of instruments (in our case currency pairs) in a given area.

Option BarsWind is the number of candles on which the analysis of differences of currencies.

If the charts of the instruments diverge by a certain distance, the EA opens a pair of counter trades in the hope,

that the tools would come together again.

Delta (currency divergence) at which the first positions are opened is calculated by the following parameters:

K_Min_Points = 1.5 - coefficient of the minimum Delta for open positions.

For example, over the last 100 candles instruments diverged by a maximum of 200%.

The EA will not open positions if the current divergence is less than 133 = (200/1.5)

K_Max_Points = 1.01 - factor rollback of the maximum deltas for position opening.

For example, the maximum divergence for the entire period occurs on the current candle and is 150%.

We assume that the discrepancy may increase further and therefore do not open positions immediately.

To positions are not opened immediately and need this option. It does not allow trading until the Delta is reduced by a factor

up to level 148 = (150/1.01)

StartDelta1 - minimum Delta of position opening prevents opening when instruments do not diverge for a long time. This is the minimum Delta at which opening is allowed.

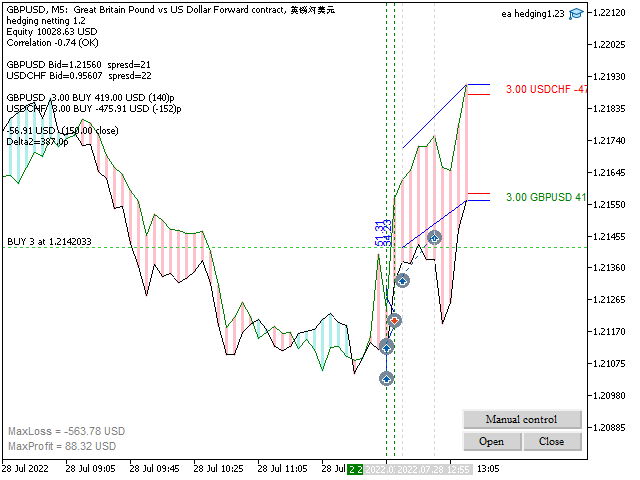

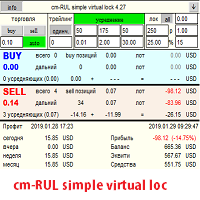

Dolivka - topping up additional positions. If, after opening positions, the prices of instruments continue to diverge,

the adviser produces topping up. Points of loss of positions are calculated and if the total difference is more than Dolivka open additional positions.

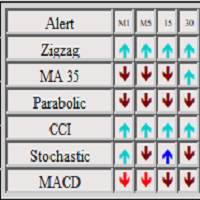

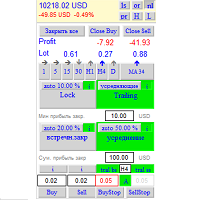

If you wish, you can transfer the EA to manual trading.

To do this, in the lower right corner there are three buttons

Manual - puts the EA into manual mode. At the same time he does not open or close positions.

The Open button opens a pair of counter positions for the two instruments in the direction of the Delta convergence.

The Close button closes all positions.

I have purchased the EA. Could you please sendo the instructions ? Cheers