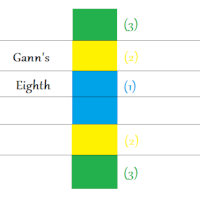

Gann s Eighth

- Göstergeler

- Francesco Rubeo

- Sürüm: 1.0

- Etkinleştirmeler: 20

| This indicator will let you have at disposal Gann's Eighth, with few clicks!! |

|---|

Gann's Eighth were used by this great Trader to obtain the maximum fluctuation price and the possible inversion points of it. Gann have always given importance to the number 8 in his studies, an it is the reason why we find the retracement points as 0.25(10/8=1.25).

Other than the number 8, also the numer 3 had is own importance in Gann, number founded in the eighth division, infact we have three eighth describing the possible fluctuation of the price.

The eighth are calculated using the average volatility, concept of great importance in Gann's studies

but very difficult cause at that time there were no computers.

It can be translated as technical indicator for reversal operations or for trend following strategies but more importantly we have to understand the concept of the indicator itself, that is the representation of the "future" points of importance for the price inside the eighth themselves.

Input Parameters:

Choose Price: Starting price of the eighth

Median Price: Median price of the previous candle.

Precedent Closure: Closure price of the previous candle

Choose Price Manually: Possibility to insert a price manually

Choose Price Manually: If chosen on the field Choose Price, use this field to insert the starting price to begin applying the eighth.

Time To Show: Timeframe on which apply.

Retracement Color: The color of the main lines composing the eighth

Line Retracement Color: The color of the vertical line composing the retracement

First Eight Color: The color of the first eighth

Second Eight Color: The color of the second eighth

Third Eight Color: The color of the third eighth

ATR Period: Bars to calculate per calcolare the average volatility

Atr shift: Starting bar on which begin to calculate the average volatility (0 meaning actual bar, 1 previous bar, etc...