Parabolic SAR plus

- Göstergeler

- Claus Dietrich

- Sürüm: 21.91

- Güncellendi: 22 Ekim 2021

- Etkinleştirmeler: 10

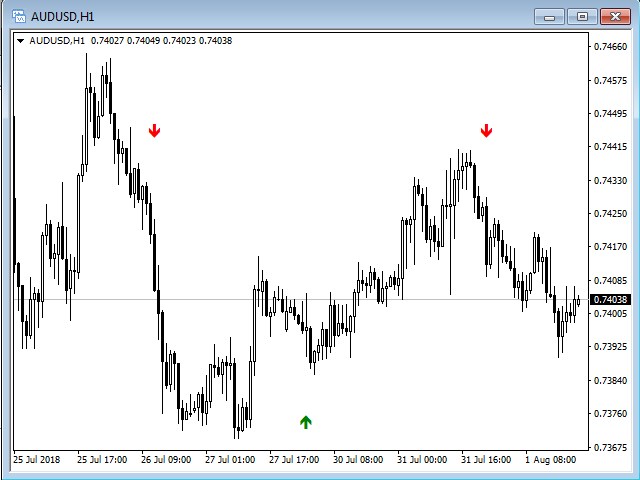

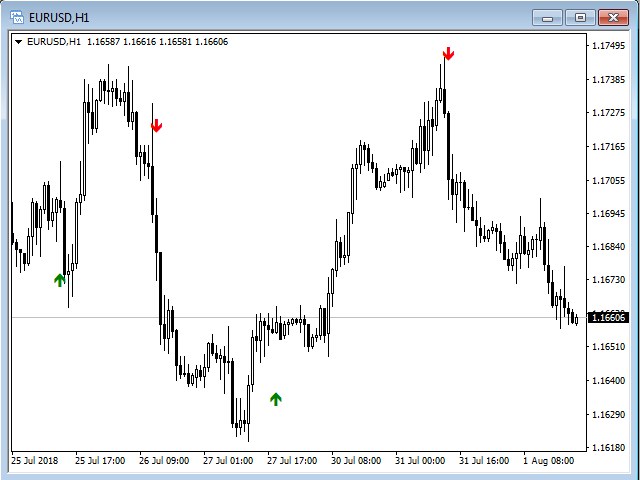

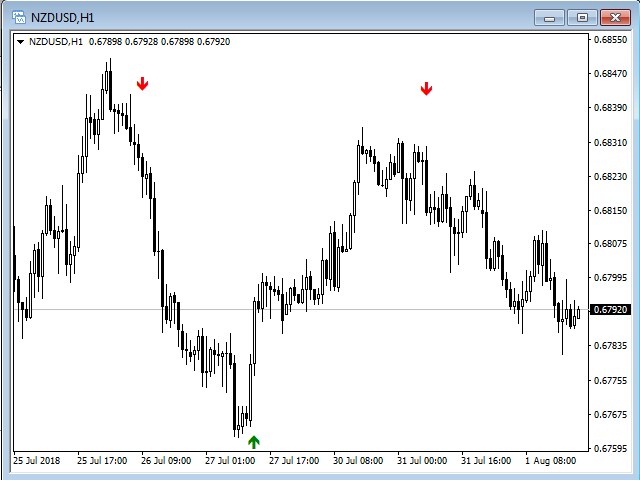

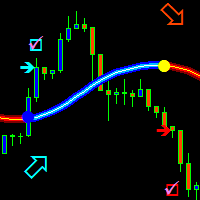

Parabolic SAR plus is a simple indicator that lets you know when the Parabolic-Sar might turn its direction.

- For long-term-trends activate an moving average and set a trend-value in these indicator

- Notice comes via screen-alert, email and notification

Filter

- MA, MA-Channel (high / low)

Alerts

- alert, push-notification, arrows, send email

Advantages

- Signal after close, no repaint, no cross-over signal

- best Timeframes: H1

- all Major-Forex-Pairs

- Send custom email header

Important rule

- Look for an instrument with an obvious upcoming movement in a clear direction on a higher timeframe.

- Entry after an Arrow => waiting for the pull back or wait for a second higher / lower candle, plus / minus a few pips.

- alternative Entry: the last point of the Parabolic-SAR

- Exit example => after a trailing stop (take the distance between SL and Entry).

- Exit example => major Fibonacci and dynamic support/resistance Lines. Use the same to move your stop and for taking first profits.

- If the trade still runs, ignore further arrows, when trendfilter is active

- SL below/above the second higher/lower candle.

Input parameters

- Bars to process - the number of bars of the chart you want to be analyzed (60 to 1000 is recommended).

- Time-Zone you will see in your Email-Alert with Date and Time

- Broker Time

- Local Time

- UTC / GMT Time

- Alert - activates the pop-up alerts.

- Alert - the chosen info will be in the header and the first line of an email, if Email is enabled.

- Email - if true, it shows the selected info in the header and the first line of the email.

- Notification - if true, it sends the alert to the MT4 APP of your smartphone.

- Arrow Style - choose a arrow style = thin, cross, normal, hollow, Thumbs, Triangle.

- Arrow Position - default is 0.6. Nice to have if you compare settings with a second/third indicator.

- Parabolic Sar Step - value for Step.

- Parabolic Sar maximum - value for Maximum.

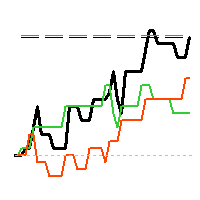

- MA Filter - Value of the MA-filter

- MA Shift - Value of the Shift for the MA-filter

- MA Mode - mode for the MA-filter

- MA Price long - price for the upwards direction of the MA-filter

- MA Price short - price for the downwards direction of the MA-filter

- upper MA Filter - Value of the upper MA-filter

- upper MA Shift - Value of the Shift for the upper MA-filter

- upper MA Mode - mode for the upper MA-filter

- upper MA Price - price for the upper MA-filter

if you like to follow 1 or 2 or 3 upper timeframes,multiplicate the favorite trend MA, e.g. you trade H1 with a 20 MA trend-filterand watch the H4 with a 20 MA trend-filter, which means 4 x 20 = set 80 MA for the 1. upper MAand watch the D1 with a 20 MA trend-filter, which means 24 x 20 = set 480 MA for the 2. upper MAfor the 3. upper MA - whatever you like or take the last value if you follow just 2 upper MAsIf you believe in the upper direction, you should :-)

Recommendations

- I don't trade after over-size-candles

- I only go for a clear trend on the higher timeframe

- I stay out before high-impact news hit the market

- Always on my mind, major Support and Resistance

- No trade without money-management, please calculate your risk, trade smart

- There is no guarantee of success as in any trading business / in my examples above

Hi, I really like this indicator. However, I don't understand the purpose of this new upgrade. What are the new 3 MAs for? BR Rui