WeSpread

- Göstergeler

- Anchor Trading S.R.L.S.

- Sürüm: 3.2

- Güncellendi: 17 Ocak 2019

- Etkinleştirmeler: 5

The We-Spread mt4 indicator is a spread trading tools and it is suitable for those who want to study the markets with a different approach to the contents that are normally available in online trading bookstores.

I think the Spread Trading strategy is one of the best I've ever used in the last few years.

This is a unique indicator for spread trading because allow you to study till 3 spreads in one time.

What is Spread Trading on forex

The Spread Trading is the study of the strength of 2 currency pairs at the same time in order to assess which of the pair is able to outperform the other. The object of the study is the correlation, volatility in time and the strength of trend.

What are advantages of Spread Trading on forex

Benefits are numerous and can be summarized in the following points:

- Hedging portfolio by not using Stop Loss.

- Never suffering from Hunting Stop Loss that brokers are so good at doing!

- Do not need to worry about a market crash, like the recent decision of the Swiss National Bank to abandon the defense share of 1.20 EURCHF.

- The repercussions of the decisions of the ECB rate or policies of quantitative easing etc...

Why I spend time on Spread Trading on forex

The spread trader aims to evaluate and control the prices of an underlying with respect to the prices of the underlying asset with different maturities or with related underlying prices.

For example, check how the EURUSD price evolves against the GBPUSD price. Or how the price of the future on the DAX expires in March with respect to the one with an expiry in June.

Spread trading requires strong insight from the trader. A good trader must not only look at the current price but how this evolves over time compared to other factors.

Making spread trading requires the ability to maintain and view different future scenarios in a single moment.

Spread trading can be applied both in the phases of trending markets and in phases of severe turbulence.

Spread trading on forex

To study the cycles of spread trading in forex, it is necessary to use specific tools that I have built over time based on my experience of errors and successes.

To calculate the spread and its direction I created the We-Spread.

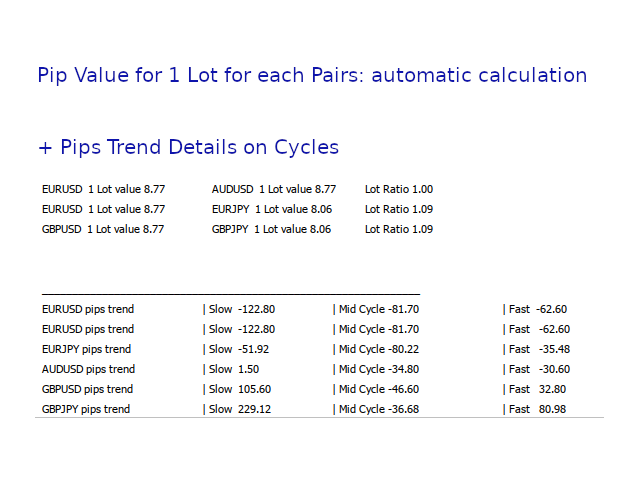

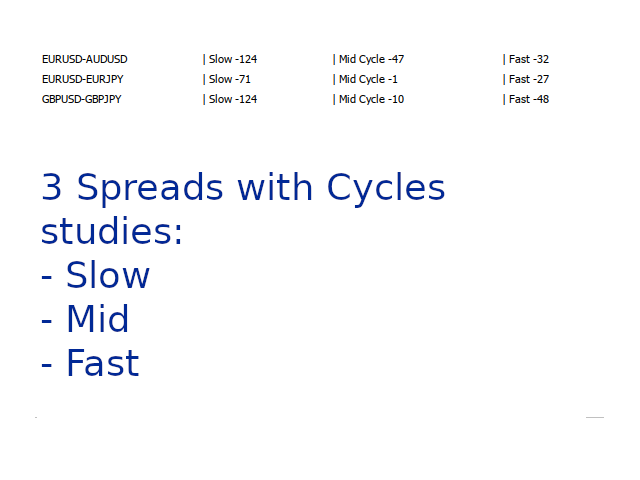

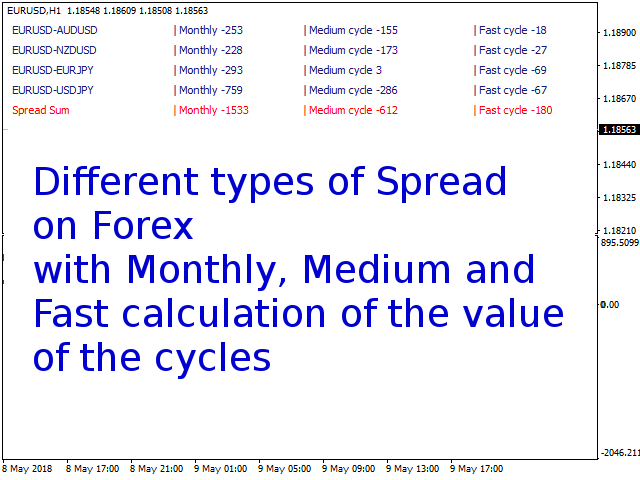

The We-Spread indicator allows to study the spread trend with Slow, Medium and Fast cycles.

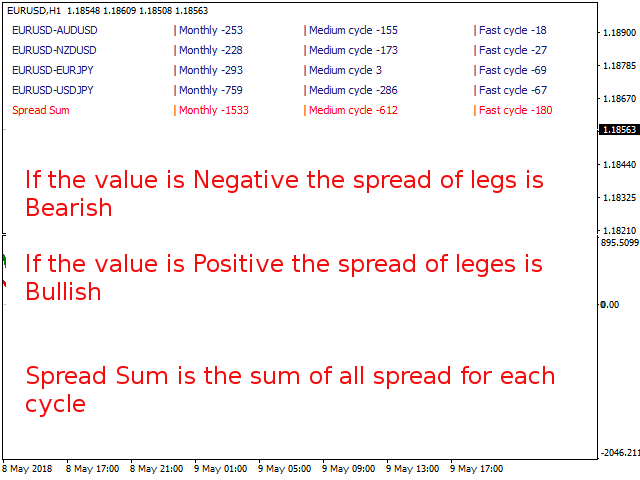

The value of the positive cycle (ideally buy of EURUSD and sell of LEG2) indicates that the spread is bullish while if it is negative it indicates that it is bearish (ideally sell of EURUSD and buy of LEG2).

My study focused on the trend of these synthetic numbers of cycles over time.

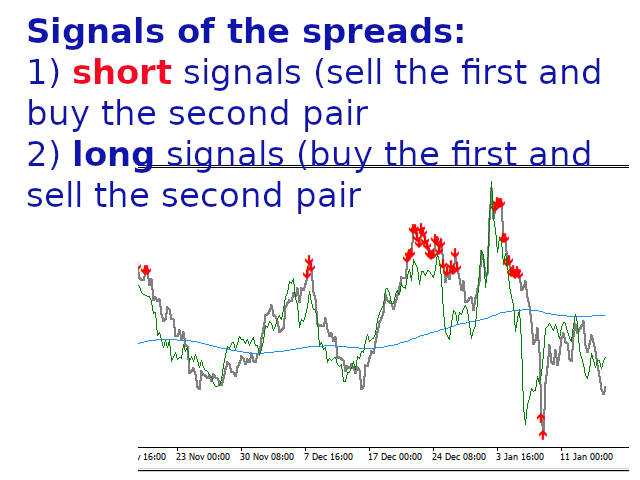

To this end, it creates signals on the spread chart:

- Short signals (see down arrow on the spread line - sell the first pair and buy the second for each spread - e.g. EURUSD vs AUDUSD)

- Long signals

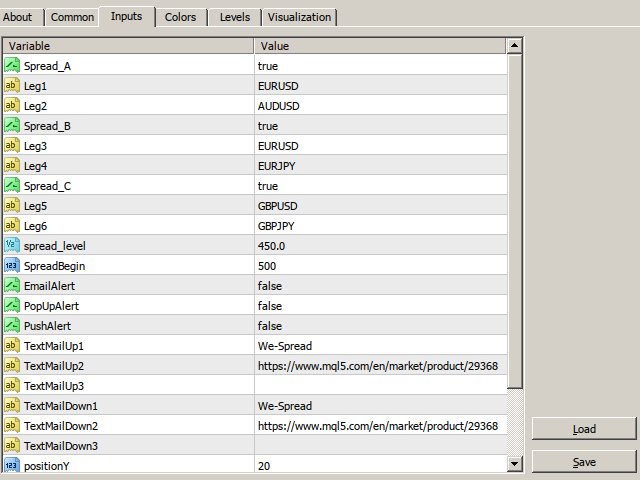

Indicator Parameters

The parameters to insert are the name of Forex pairs where the trader want to study the spread.

There are 6 Legs to fill.

Default names are:

- Leg1: EURUSD

- Leg2: AUDUSD

- Leg3: EURUSD

- Leg4: EURJPY

- Leg5: GBPUSD

- Leg6: GBPJPY

You can select to work till 3 spreads (true / false options):

- SpreadA (Leg1 vs Leg2)

- SpreadB (Leg3 vs Leg4)

- SpreadC (Leg5 vs Leg6)

SpreadBegin: it is a parameter that help you to decide how many spread line history print on the chart.

PositionY: you can use this parameter to move the print on the chart

Color_Text: you can choose the color for prints

Text_Dim: you can choose the text dimension for prints

Alerts inputs

This indicator help you to have alerts on signals with (true / false options):

- EmailAlert

- PopUpAlert

- PushAlert

and for Emails you can personalize the object and texts to send for UP and Down signals (see inputs TextMailUP and Down).

Important

The trader must respect one of the most important rules, that is, having a lot of patience and waiting for the right moment to align all the rules!