Omega Trend Indicator

- Göstergeler

- Lachezar Krastev

- Sürüm: 1.2

- Güncellendi: 9 Ekim 2020

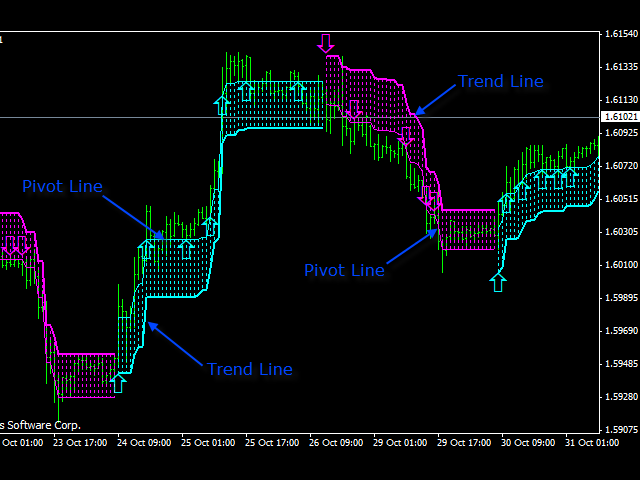

The Omega Trend Indicator is an advanced tool that has been specifically designed to detect market trends early, and follow them efficiently. The indicator draws two lines. The main (thicker) Trend Line represents the presumed lower or upper volatility limits of the current market trend. A break in the main Trend Line indicates a potential reversal or shift in the movement of the trend. The Trend Line also indicates the best point to place a stop loss order. In Omega Trend Indicator, the Trend Line indicates the exact point of the initial stop loss, as well as where the trailing stop is moving. For uptrends the Trend Line is blue, for downtrends it is pink (see the first image below).

There is an EA which use Omega Trend Indicator signals for trading. It is Omega Trend EA. You can check it here: https://www.mql5.com/en/market/product/56222

Omega Trend Indicator MT5 version: https://www.mql5.com/en/market/product/121966

The secondary (thinner) Pivot Line represents the presumed Pivot level of the market. Breaks in this line can be used for short-term/scalping trades following the current market trend indicated by the Trend Line.

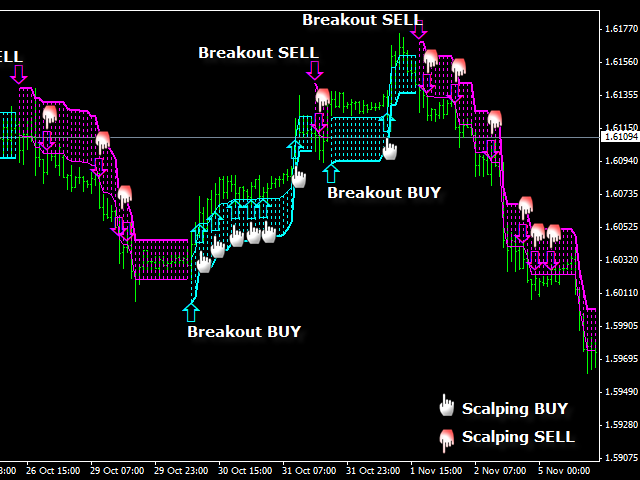

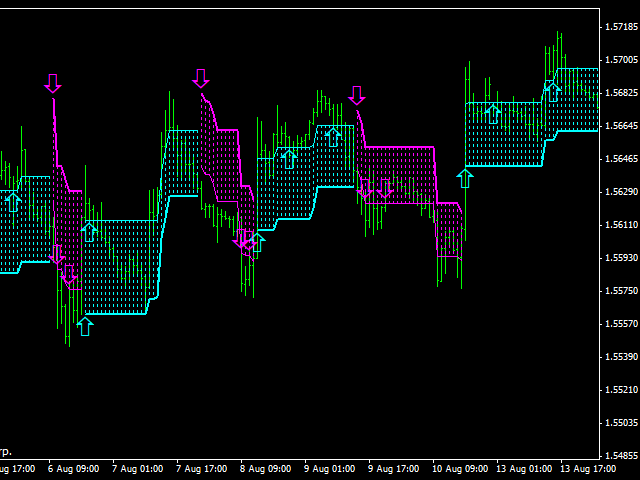

Although the Omega Trend Indicator’s signals are clear and easy to interpret (see the second image below), there are a few steps you should follow to filter out false trading signals. First, you need to be able to recognize a choppy market and try to ignore it. A choppy market is a market that is highly volatile but results in no overall price movement, in either direction. These price spikes and sharp rebounds from the range borders can generate a series of poor signals. In the third image below, you can see an example of a choppy market. A choppy market presents the worst possible conditions for any breakout or impulse trading strategy. If you use the Omega Trend Indicator under these conditions, do not be surprised if you have poor results.

Omega Trend Indicator signals are at their most reliable, when following the market in trend or swing mode. Avoid trading in periods of low liquidity. In these periods, the market is generally in a narrow range. Periods of low liquidity normally occur after the close of the NY trading session and often throughout the entire Asian session. The best signals from the indicator could be expected during the London and the NY trading sessions (8-21 GMT).

I recommend Omega Trend Indicator for the EURUSD, EURJPY, USDCHF, GBPJPY and GBPUSD pairs. As well all market instruments with a trending behavior are appropriate. You can use it on all timeframes, for scalping, day trading or long-term investing.

I strongly recommend that you adapt visually the indicator lines to the chart. The default settings are not suitable for all chart periods and all market instruments. The most important settings you should try to adapt are: Volatility_Period, TrendLine_Level, PivotLine_Level and Bar_Acceleration.

The default settings are not suitable for all timeframes and all market instruments. The most important settings you should try to adapt are: Volatility_Period, TrendLine_Level, PivotLine_Level and Bar_Acceleration.

Settings

- Show_Arrows - show/hide the signal arrows on the chart.

- Show_Histogram - show/hide the indicator histogram.

- Show_PivotLine - show/hide the pivot line.

- Alerts - activate/deactivate the signal alerts.

- Send_Push_Notifications - activate/deactivate sending notification to mobile phones.

- Volatility_Period - the indicator period of the volatility calculation.

- Smooth_Factor - the smoothing factor of Omega Trend Indicator lines. The default value of the Smooth_Factor is zero, which means that smoothing is not used.

- ...........

For more info and complete list of settings, click here to visit the blog!

If you like my product, please write a review! I will be very grateful!

You can check out my other products in my profile!

If you want to be notified of my new products, please add me as a friend!

great