Smart Tick Averager

- Uzman Danışmanlar

- Dmitry Homenkov

- Sürüm: 1.0

- Etkinleştirmeler: 7

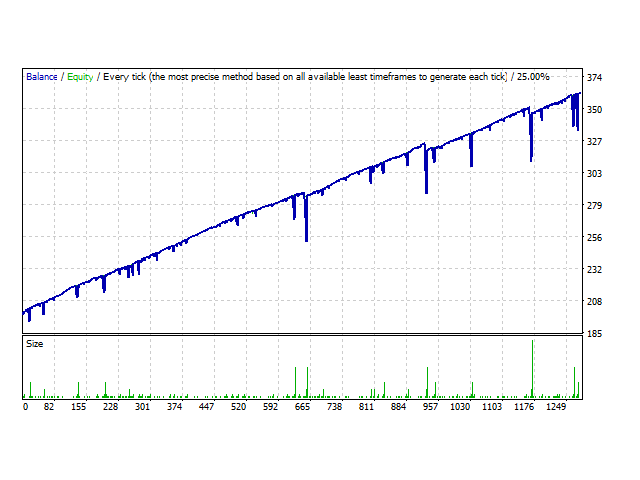

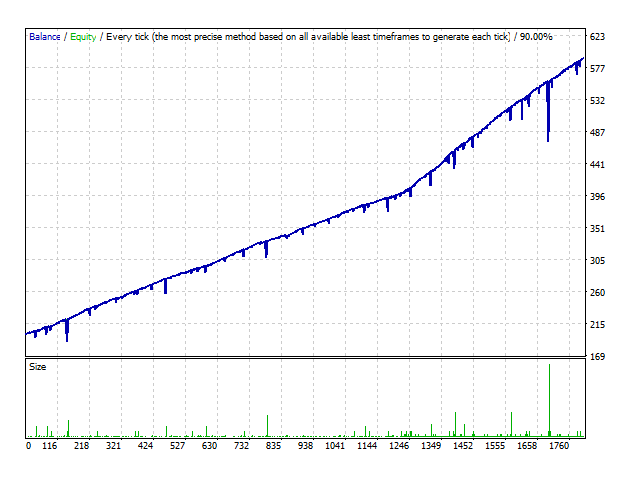

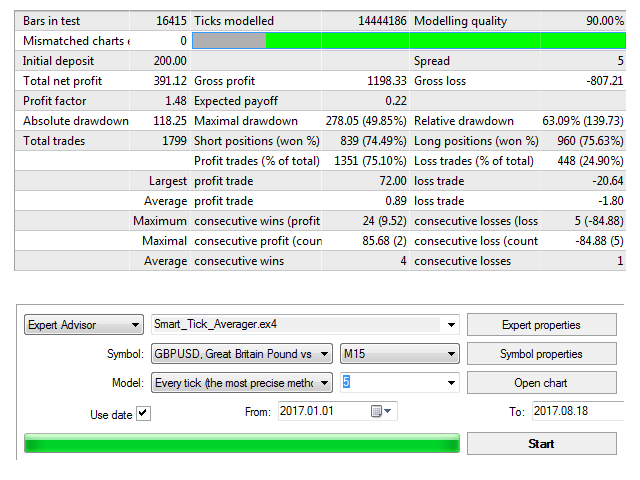

The Smart Tick Averager Expert Advisor is a cost averaging system, based on the analysis of the tick data. Smart Tick Averager finds a short-term trend impulse and attempts to capture a part of the rollback. In case the movement continues in the impulse direction, the EA chooses a moment for opening additional trades according to the grid step. It applies a filter, which minimizes the probability of falling into a strong trend movement. It also uses a filter of the segment, taking its amplitude into account. Profit targets are calculated automatically based on the parameters of the detected section of the trend impulse. When opening the subsequent trades, the EA recalculates the target in order to close all trades and take the initial profit.

Smart Tick Averager features

- Works the same on any timeframe. The EA automatically writes and analyzes the required depth of tick history.

- The EA can work simultaneously on several currency pairs. Trades are opened one by one. Thus, there is no conflict on deposit load.

- It applies filters fro finding the trend impulse, which allow selecting the most favorable moments for entering the market.

- Flexible control over the EA operation time with the help of the trading suspension module, where you specify the required time intervals.

- Spread filter allows avoiding market entries at unfavorable spread expansions.

- Control of maximum drawdown. You can set the maximum loss value, at which the loss will be fixed,

Smart Tick Averager parameter

Parameters of entry logic

- Ticks for trend detect - the number of ticks to search for a section with a trend impulse.

- Trend ratio - coefficient of trend segment filter. The higher the coefficient, the more prominent the trend should be.

- Ticks for signal - number of ticks to determine the entry signal. A reversal of the trend segment if tracked.

- EMA period - period of the moving average (ticks). EMA is plotted based on ticks. It is used for calculating the parameters of filters.

- Min grid step - the minimum grid step for opening subsequent trades. The subsequent trades are opened only after receiving the entry signal, but not closer than the given distance.

Suspension module parameters

- New trades pause - enable/disable the module (true/false)

- Pause intervals - intervals to prohibit opening new trades. Format - hh:mm-hh:mm;hh:mm-hh:mm. Different intervals a separated by the ";" character. This way multiple intervals can be set.

- Pause levels color - color to display the interval lines on the chart.

- Line style

Spread filter

- Spread filter - maximum allowable spread value.

Risk parameters

- Start trade volume - starting lot of the series.

- Volume multiplier - volume multiplier for subsequent trades.

- Max money loss (0 off) - maximum loss value. Once this value is reached, all trades in the series are closed with a loss. If set to 0, trading is performed until the Stop Out level is reached.

Interface Settings

- Panel header color

- Panel background color

- Panel text color

- Orders comment

- Magic

Recommendations on usage

- Use ECN accounts with acceptable commission, spread and execution of orders

- Use the maximum possible leverage (1:300 or higher)

- Select currency pairs during periods of range trading

- Avoid trading during important news releases and opening of sessions

If you have any questions, please contact me. Good luck in trading!