Master candle strategy

- Göstergeler

- Jan Flodin

- Sürüm: 1.0

- Etkinleştirmeler: 5

Features

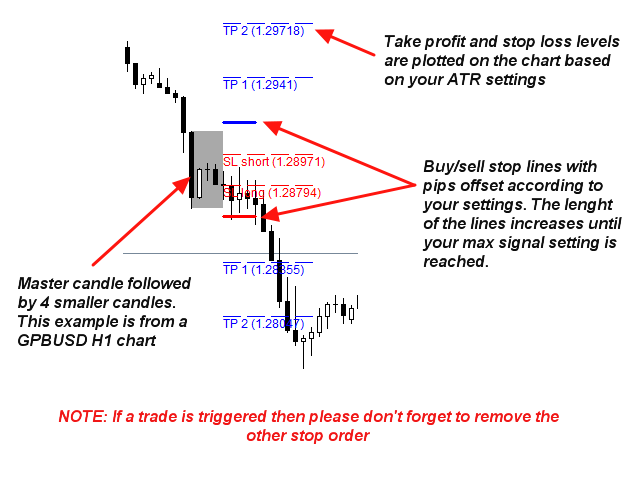

- This is an indicator that recognizes a special type of Inside Bar formation which is formed by a Master candle followed by 4 smaller candles (please see the strategy explanation below).

- Plots buy/sell stop lines on the chart as well as well as take profit and stop loss levels. The TP/SL levels are based on the Average True Range (ATR) indicator.

- Object colors are changeable.

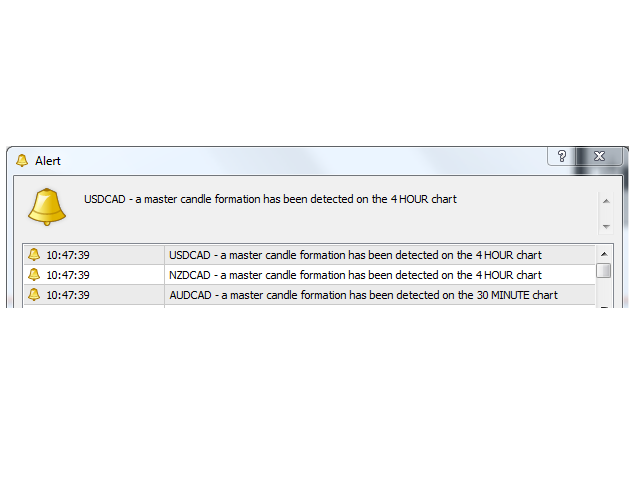

- Sends you a real-time alert when a Master candle formation is identified - sound / pop-up / email / push notification.

Once a suggestion is given, you can confirm it with your own chart analysis. Generally the best setups to be traded are the ones occurring around important supports/resistances, round numbers, supply and demand zones, etc.

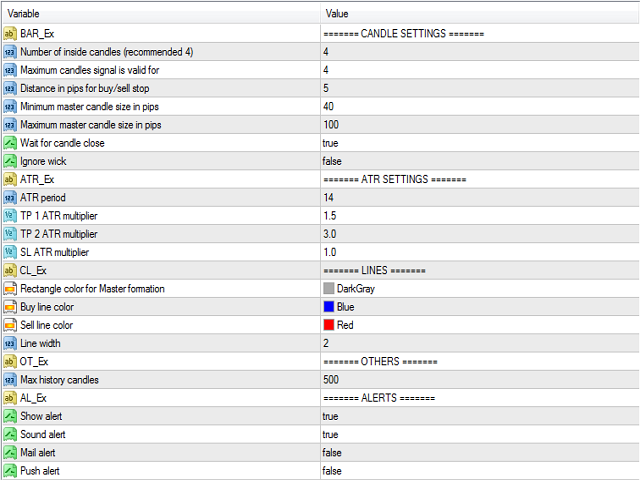

Input parameters

- Number of inside candles: For best signal quality it is recommended to set it to 4. Please see the strategy explanation below.

- Maximum candles signal is valid for: This setting controls how for how long the suggested entry level lines will expand.

- Distance in pips for buy/sell stop: The offset/buffer for the entry lines. Recommended at least 5 pips away for Master candle high/low.

- Minimum master candle size in pips: Please see the strategy explanation below.

- Maximum master candle size in pips: Please see the strategy explanation below.

- Wait for candle close: true/false. Default is True. If set to False then the alert will come already when the 4 thcandle opens.

- Ignore wicks on inside bars: true/false. Default is False. If set to True then wicks are allowed above/below the Master candle high/low.

- Ignore wicks on master bar: true/false.

- ATR Period: Period for the Average True Range indicator. Default is 14.

- TP 1 ATR multiplier: Used for the first take profit level.

- TP 2 ATR multiplier: Used for the second take profit level.

- SL ATR multiplier: Used for stop loss level.

- Objects: In this section you can change the colors of the Master formation rectangle and the buy/sell stop lines. You can also set the width of the buy/sell stop lines.

- Max history candles: For how many candles back in time the formation will be drawn on the chart.

- Alerts: Set to true for each alert type you would like to receive. All alert types are supported.

Strategy

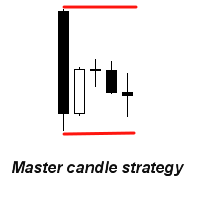

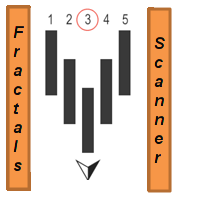

Master Candle (MC) is a trading strategy based on a candle formation where the first (master) candle is followed by 4 smaller candles which are inside the first candle. The whole formation is built of 5 candles, independent of if bearish or bullish.

Timeframes: H1 and H4 charts. Even if the MC strategy works best on H1 it can be traded on all timeframe and currency pairs. Mainly on H4, H1 and M30 charts.

Currency pairs: Trades best on volatile pairs such as GBPUSD and GBPJPY.

After breaking MC high/low a position will be taken in the direction of the break. It is recommended that the MC has a size of 40 to 100 pips (but it depends on the volatility of the currency pair in question). It is also recommended to put stop orders for instance 5 pips above and below the MC high/low.

Some traders also use the rule that a break in any direction should occur during the next 3 candles after the MC creation (5 thcandle). Anyway, it is highly recommended to cancel any stop order if there is no break after 24 hours.

Finally it is for better results recommended to trade in the direction of the trend as well as to avoid trading at strong and important price levels - resistances and supports. It is also advisable not to trade MC which appears inside another MC.

Great!