Green Dragon

- Uzman Danışmanlar

- Mick Prater

- Sürüm: 3.6

- Güncellendi: 23 Ağustos 2017

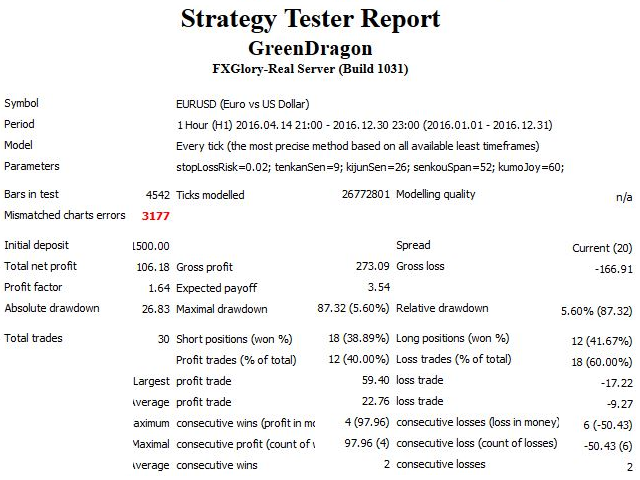

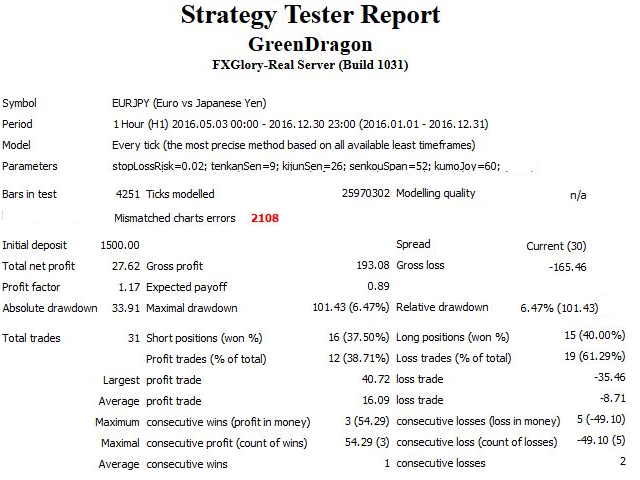

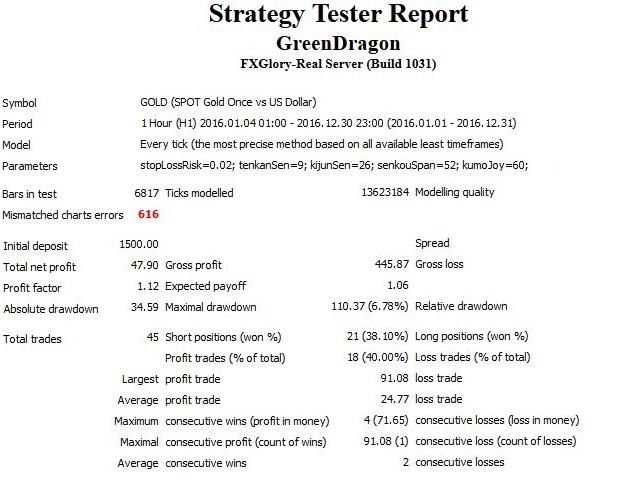

The Green Dragon is a strategy that uses the Ichimoku Kinko Hyo system to place trades. The primary element of the Green Dragon is the use of the Chinkou Span as it crosses price action to place trades. This is a classic strategy of the Ichimoku even though its not as popular as some of the other strategies. The Chinkou Span is normally thought of as a market momentum indicator and used to give a trade set up more conviction when analyzing price movement. I find this description somewhat vague and not useful. The Chinkou Span is better used as an indicator to show how current price action has crossed an area of support or resistance. When the Chinkou is above its historic price action you know that somewhere since then the current price has crossed support or resistance and its usually fairly visible where that line is. This aspect of the Chinkou Span is what is exploited in the Green Dragon strategy because these crosses tend to occur during a breakout of a consolidation period.

The rules of the strategy use Chinkou/price cross confirmed by other signals to place trades

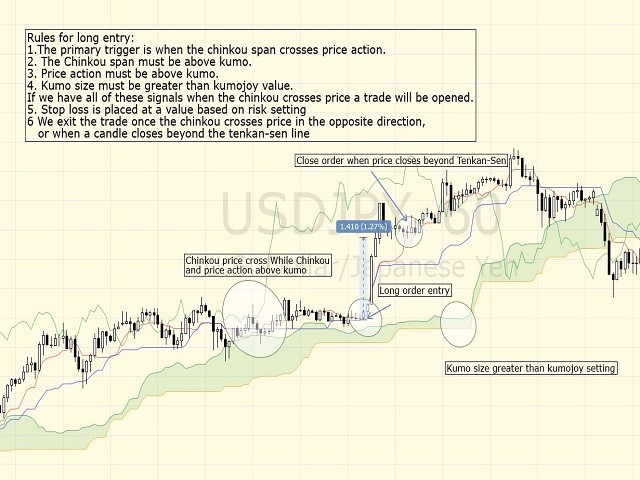

For long entry:

- The Chinkou Span must cross price action in the direction of the trade and is the primary entry trigger

- The Chinkou must be above the kumo

- Price action must be above kumo

- The kumo must be larger than the size preset it the settings (the kumojoy setting)

If these three signals are present when the Chinkou crosses price a trade is opened.

We exit the order once the Chinkou crosses back through price or there is a close below the Tenkan-Sen line.

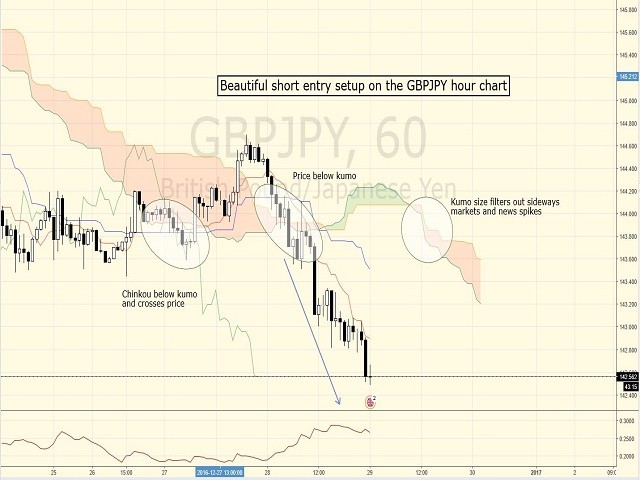

Short entry is the opposite. After an order entry an email will be sent according to your MetaTrader email settings.

Position sizing uses a simplified 12 period ATR formula. The formula is: Account equity / (ATRMultiplier*12periodATR) then converted into lots by multiplying it with the currency pair tick size. This converts the result to a lot size, eg. 50,000 to .50

The stop loss is calculated as a percentage of account balance divided by the resulting lot size. So, a setting of .02 for stop loss risk would be 2% of account balance divided by the lots used.

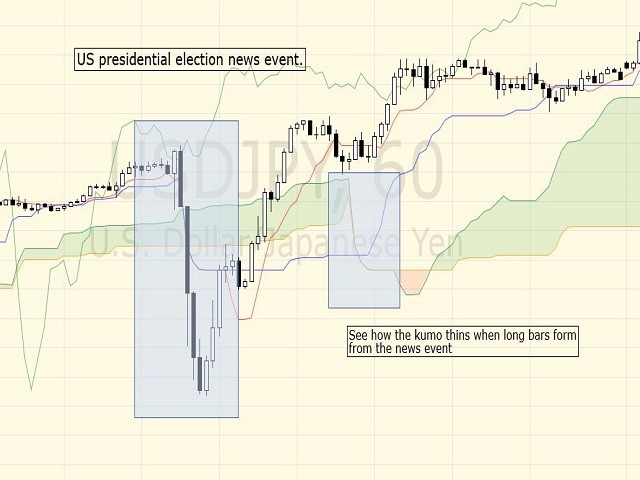

The best part of the strategy is the use of the kumo size to filter trades. The Ichimoku system is a trend based system so when you have a market that is moving sideways or ranging, The Ichi doesn't do so well. Fortunately the kumo reacts to these kind of markets so that we can use the kumo to filter trades. When the market moves in a linear fashion, being sideways or vertical, the kumo will thin out. So, by setting a size limit we can effectively filter out undesirable markets. This is true for sideways markets and also for news spikes. With the kumo there is no need turn off trading during news cycles, just increase the size threshold of the kumo (called Kumojoy).

The Kumojoy can also be used as a simple way to tune the EA in real time. If you see that the market is beginning to consolidate then you can increase Kumojoy to filter out more of the range bound setups. Likewise, if a major news event is coming you can increase Kumojoy to a safer level. Or, if the market is about to break into a trend you can reduce it, in some cases to 0, to capture more pips.

Finally, there are only a few settings that you need to deal with which makes optimizing the Green Dragon easy. You can select all the settings to be optimized and it wont take days to complete, whether you optimize monthly or quarterly.

Input Parameters

- ATR Multiplier - a value used to multiply the raw ATR value to a usable number. The larger the value the smaller the average lot size will be.

- Stoploss Risk - risk percentage of account balance to use for calculating the stop loss. It is entered in decimal form. Example, .02 = 2%

- TenkanSen - Ichimoku parameter settings, default 9

- KijunSen - Ichimoku parameter settings, default 26

- SenkouSpan - Ichimoku parameter settings, default 52

- KumoJoy - the kumo size threshold to use for filtering trades, kumo size in pips

--That's it!

"May the Green Dragon gather many pips for you!"

Excellent EA, does exactly what it should. Mick answered all my questions in a lightning-fast fashion. Follow the instructions and optimize on your broker's demo account. If you can't optimize get a different broker! I ran this EA on 7 different pairs unattended. In one day it has made 368.68 on a 10,000 demo account and has not had a losing trade...