OrderBlocks MTF MT4

- Göstergeler

- Cao Minh Quang

- Sürüm: 1.0

- Etkinleştirmeler: 5

Order Block Multi Timeframe

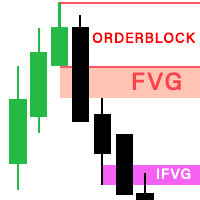

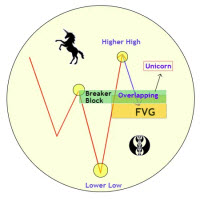

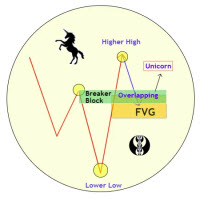

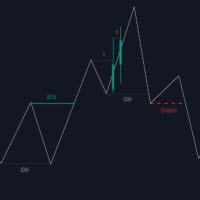

The Order Block Multi Timeframe is a powerful tool for Smart Money Concept (SMC) traders, combining high-accuracy Order Block detection with real-time Break of Structure (BOS) and Change of Character (CHoCH) analysis across multiple timeframes.

Smart Money Insight, Multi-Timeframe Precision

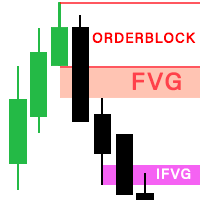

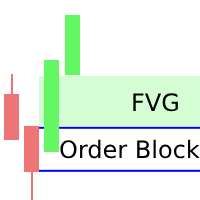

This indicator automatically identifies institutional Order Blocks—key price zones where large players have entered the market—and plots them directly on your chart. It also tracks structural shifts via BOS and CHoCH to help confirm potential reversals, breakouts, or continuations.

Core Features:

-

Multi-Timeframe Order Block Detection

View OBs from H1, H4, Daily, and other higher timeframes on your active chart—giving you the bigger picture at a glance. -

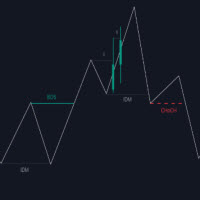

Break of Structure (BOS) & Change of Character (CHoCH)

Clearly marked BOS and CHoCH levels for structure validation, trend shifts, and trade confirmation. -

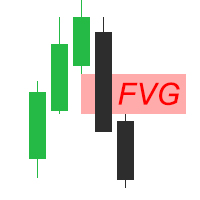

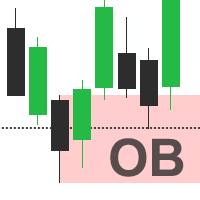

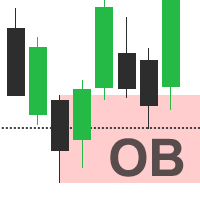

Clean Visual Markings

Color-coded OB zones and labeled structure breaks make the chart clean and easy to read—even when analyzing multiple timeframes. -

Dynamic Zone Update

Order Blocks auto-update as market structure evolves, ensuring the freshest data is always on your screen. -

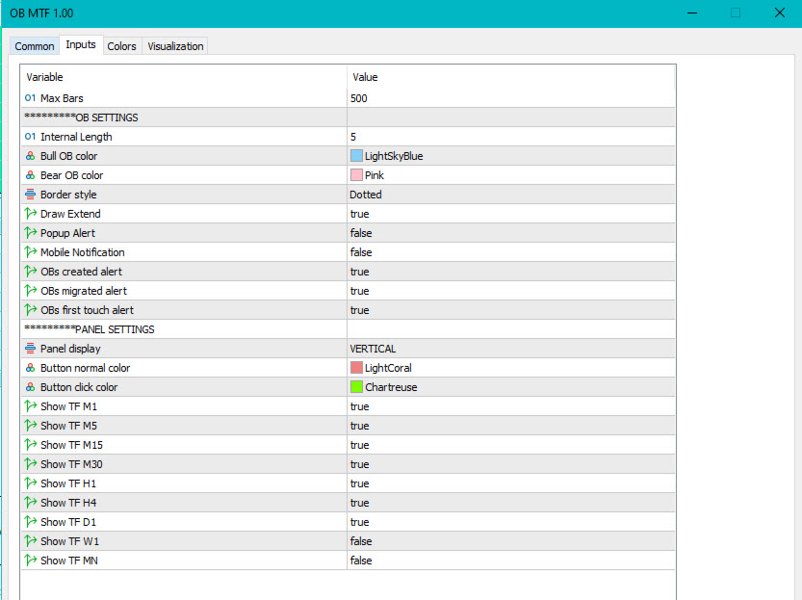

Custom Settings

Choose which timeframes to display, how far back to scan, and how to display the structure lines and labels.

Perfect For:

-

ICT/SMC-based traders

-

Price action analysts

-

Traders seeking institutional entry zones

-

Day traders and swing traders alike

Why Use This Indicator?

Order Blocks show where smart money is active. BOS and CHoCH confirm whether structure aligns with institutional intent. Together, they form one of the most reliable entry confirmation systems available to modern traders.

Get a true edge with the Order Block Multi Timeframe—where structure meets precision.