Natural Gold

- Uzman Danışmanlar

- Angel Torres

- Sürüm: 1.0

- Etkinleştirmeler: 10

Natural Gold - Expert Advisor for XAUUSD (M30 Timeframe)

Overview

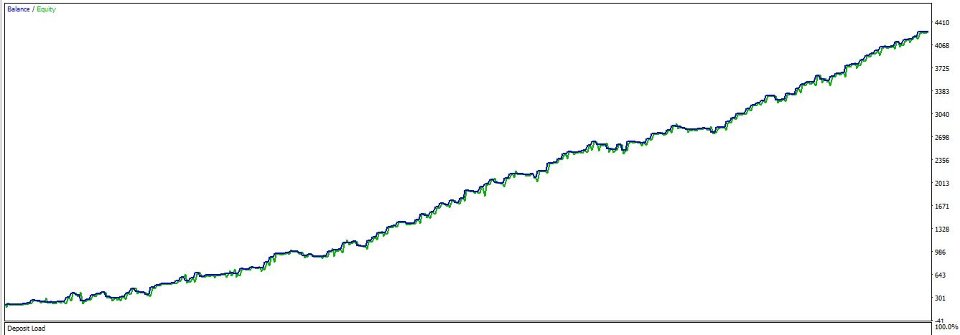

Natural Gold is a reliable Expert Advisor (EA) designed for trading XAUUSD on the M30 timeframe, optimized for the Exness broker. This EA combines trend-following and volatility-based strategies to deliver consistent performance, with a unique feature of closing all trades every Friday at 20:00 UTC, ensuring no positions are held over the weekend. With robust risk management and a proven track record, Natural Gold is ideal for traders seeking stability in the gold market.

Key Advantages

-

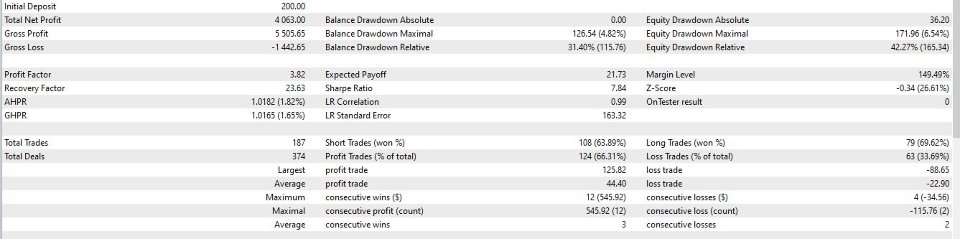

Impressive Returns: Achieves a Total Net Profit of $5058.65 with a Gross Profit of $6442.65, demonstrating strong profitability over 374 trades.

-

High Recovery Factor: Boasts a Recovery Factor of 23.63, indicating excellent recovery from drawdowns and resilience in adverse conditions.

-

Low Drawdown: Features a Balance Drawdown Maximal of 126.54 and an Equity Drawdown Maximal of 171.96, ensuring controlled risk exposure.

-

High Win Rate: Records a 63.89% win rate on short trades and a 69.62% win rate on long trades, with a Profit Factor of 3.82, reflecting a favorable reward-to-risk ratio.

-

Weekend Risk Mitigation: Closes all trades on Fridays at 20:00 UTC, avoiding exposure to weekend market gaps and volatility.

How It Works

Natural Gold uses a combination of technical indicators to identify high-probability trade setups:

-

Bollinger Bands (Period 23): Detects overbought or oversold conditions to time entries effectively.

-

Gann HiLo (Period 14): Confirms the trend direction, ensuring trades align with the market momentum.

-

ATR-Based Exits: Dynamically sets stop-loss (9.4x ATR) and take-profit (4.2x ATR) levels using ATR, adapting to XAUUSD's volatility.

-

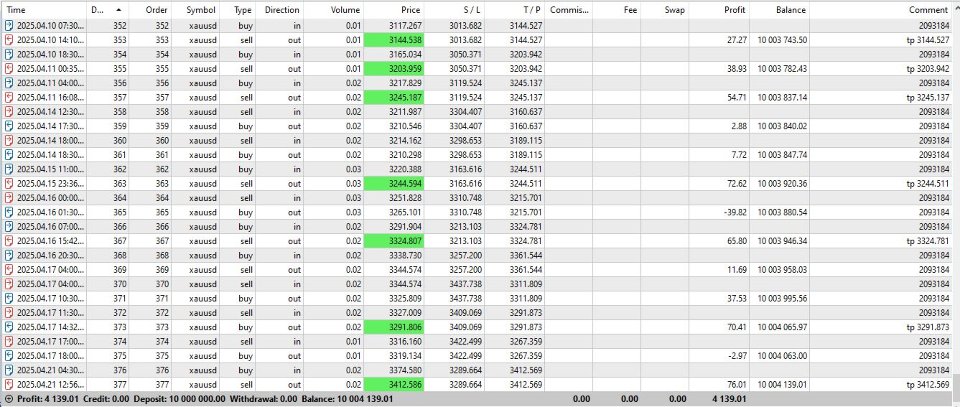

Risk Management: Implements strict stop-loss and take-profit levels, with a maximum loss capped at 115.76 (as seen in the largest loss trade).

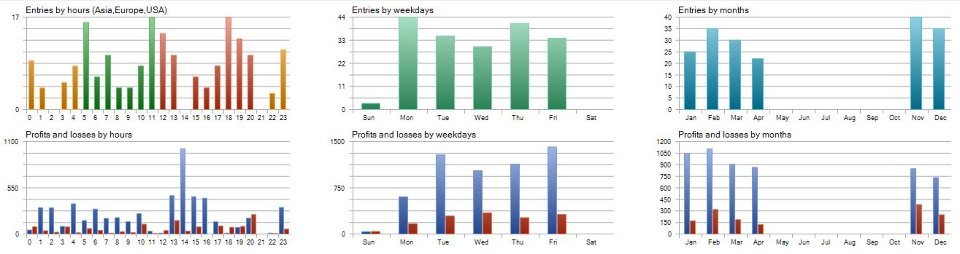

The EA focuses on active trading hours (6-18 UTC, as shown in the entries by hours chart) and performs best on weekdays like Tuesday to Thursday (entries by weekdays chart). It avoids low-volatility periods (e.g., June and July, as shown in the entries by months chart) and ensures no trades are held over the weekend by closing all positions on Fridays at 20:00 UTC.

Trading Logic

Natural Gold is designed to capitalize on gold's trending behavior while minimizing risk:

-

Trend-Following Core: Uses Bollinger Bands and Gann HiLo to identify strong trends, ensuring trades are taken in the direction of the dominant market movement.

-

Volatility-Driven Exits: Dynamically adjusts stop-loss and take-profit levels using ATR, optimizing trades for current market conditions.

-

Risk Control: With an Equity Drawdown Maximal of 171.96, the EA ensures losses are limited, protecting your account during volatile periods.

-

Weekend Safety: Closes all trades on Fridays at 20:00 UTC, reducing exposure to unpredictable weekend price movements.

-

Time Optimization: Targets high-probability trading hours (6-18 UTC) and active weekdays (Tuesday to Thursday), avoiding low-volume periods.

Broker Compatibility

Natural Gold is pre-optimized for the Exness broker. For other brokers, it’s recommended to perform backtesting to ensure similar results. If adjustments are needed, we offer free adaptation to your broker of choice—just contact us, and we’ll provide excellent support to ensure a seamless trading experience.

Suggested Starting Capital

Based on the Equity Drawdown Maximal of 171.96, a starting capital of $200 is recommended. This provides a buffer to cover the maximum drawdown, ensuring your account can handle potential losses while the EA operates. Adjust your lot size according to your risk tolerance, with the mmRiskedMoney parameter set to 350 for balanced risk management.

Why Choose Natural Gold?

-

Proven Results: Backtested with a Total Net Profit of $5058.65 and a Gross Profit of $6442.65, showcasing its profitability over 374 trades.

-

High Recovery: A Recovery Factor of 23.63 ensures the EA can recover quickly from drawdowns, as seen in the steady equity curve.

-

Risk-Averse Design: Closes trades before the weekend, protecting your account from unexpected market gaps.

-

Efficient Trading: Focuses on high-probability setups, with a Sharpe Ratio of 7.94, indicating strong risk-adjusted returns.