Active Investment Management

- Uzman Danışmanlar

- Riccardo Moreo

- Sürüm: 6.0

- Güncellendi: 22 Nisan 2025

- Etkinleştirmeler: 5

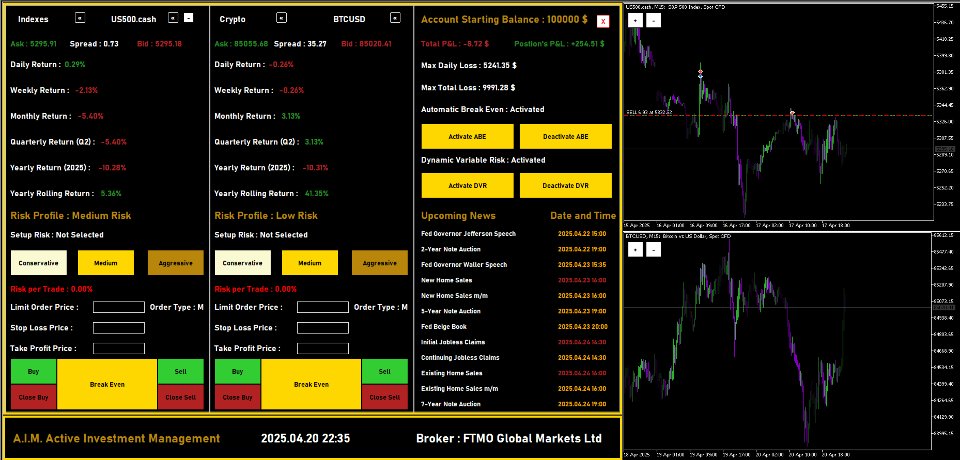

AIM – Active Investment Management

Overview:

AIM is a powerful Expert Advisor tailored for discretionary and semi-automatic traders who require professional-grade tools for precision trade execution and comprehensive risk management. Rather than functioning as a fully autonomous trading robot, AIM enhances the trader's operational workflow with a customizable execution panel and intelligent risk controls.

Key Features:

-

Multi-Instrument Compatibility:

AIM supports all symbols available from the broker, including Forex pairs, indices, commodities, and synthetic instruments. It adapts in real-time to the selected chart symbol. -

Advanced Trade Management Panel:

The built-in user interface enables direct interaction with the market, allowing traders to place orders, adjust stops and targets, activate break-even logic, and monitor exposure from a single control point. -

Granular Risk Management System:

AIM features an advanced position sizing engine that calculates lot sizes based on risk percentage, custom stop distances, and dynamic account metrics (balance or equity). Parameters include max risk per trade, max cumulative exposure, capital allocation controls, and more. -

Break-Even & Partial Take Profit Automation:

Users can activate automated break-even or partial TP functionality with custom thresholds and behavior logic, reducing manual intervention during trade management. -

Macro News Display:

Displays upcoming macroeconomic events directly on the interface, filtered by importance level, so users are informed before making trading decisions in sensitive market periods. -

Discretionary Execution Focus:

AIM does not open trades autonomously. It is built to assist skilled traders who operate manually or semi-manually and want to enforce consistent risk protocols while streamlining their execution workflow.

Ideal Use Case:

AIM is ideal for prop firm traders (e.g., FTMO), portfolio managers, and advanced retail traders who maintain control over trade entries but require institutional-grade infrastructure for execution, capital protection, and trade consistency.