SubZero ICT Pro

- Uzman Danışmanlar

- Kago Kebaetse

- Sürüm: 1.0

- Etkinleştirmeler: 10

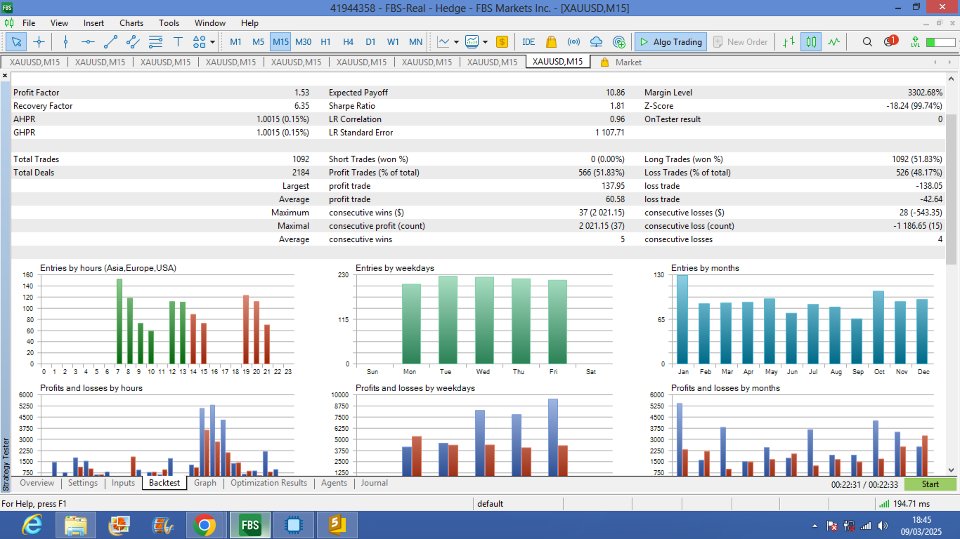

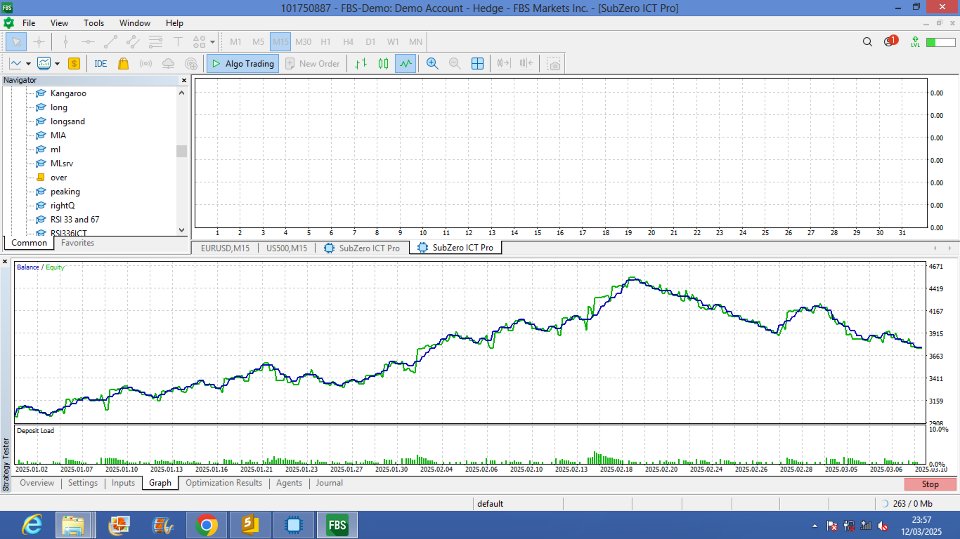

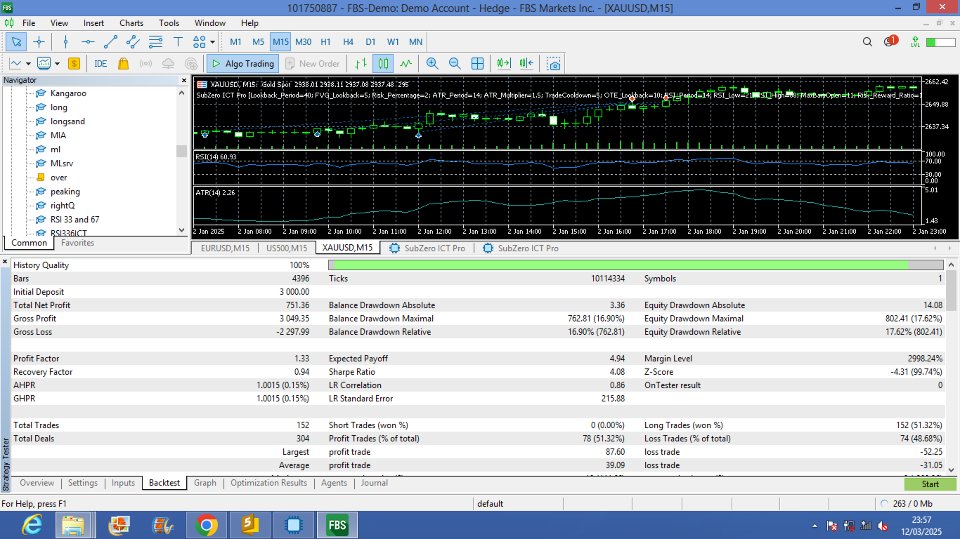

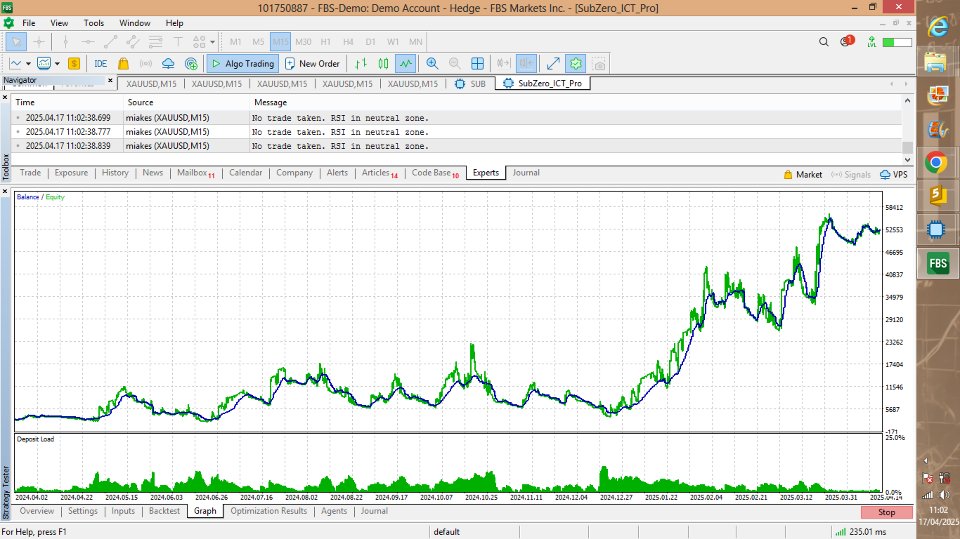

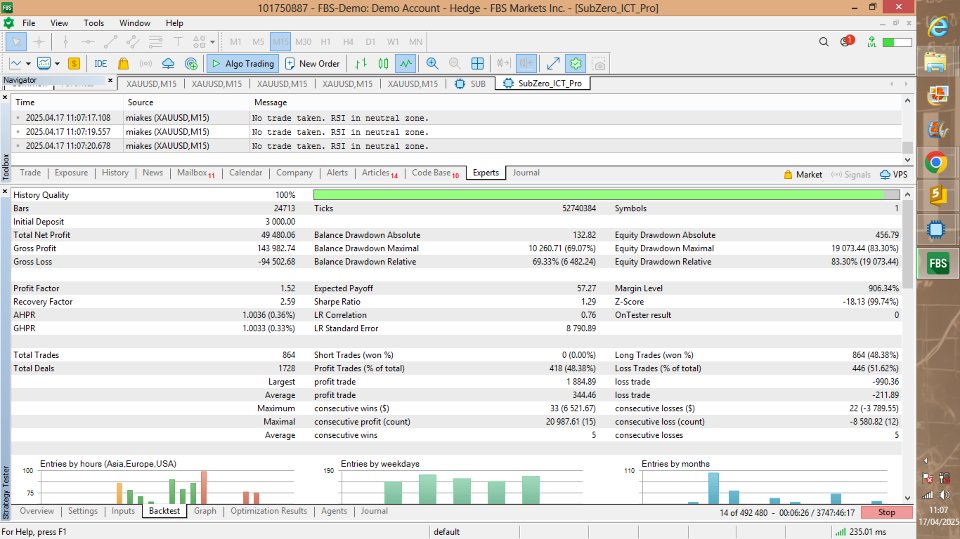

This Expert Advisor (EA), SubZero ICT Pro.mq5, is designed for the MetaTrader 5 (MT5) platform and incorporates several advanced trading concepts inspired by the ICT (Inner Circle Trader) methodology. It aims to identify and capitalize on high-probability trading opportunities by using a combination of technical analysis tools, including liquidity sweeps, Fair Value Gaps (FVG), market structure shifts, optimal trade entries (OTE), and risk management techniques. The EA is equipped with several risk control mechanisms, such as dynamic stop-loss and take-profit levels based on the Average True Range (ATR), trailing stop functionality, and daily drawdown limits. Depending on risk apatite, recommended deposit is $3000.00 for a moderate investor looking for a rate of return of 28Xfactor in a year, optimization results were based on these initial deposits.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!DISCLAIMER!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Before activating the EA, change the following;

Lookback_Period=40

FVG_Lookback=15

Risk_Percentage=2.0

ATR_Period=14.0

ATR_Multiplier=2.5

TradeCooldown=5

OTE_Lookback=10

RSI_Period=14

RSI_Low=30.0

RSI_High=70.0

MaxBarsOpen=33

Risk_Reward_Ratio=3

CurrencyStaker=1 !!!!!!!!!!!!!!!!!!!!!!!!!

Precision_Threshold=0.5

TrailingStopMultiplier=1.208

BreakEven_ProfitPoints=20.0

Daily_Drawdown_Limit=5.0

Volatility_Filter=30

Money_FixLot_Lots=0.08

-

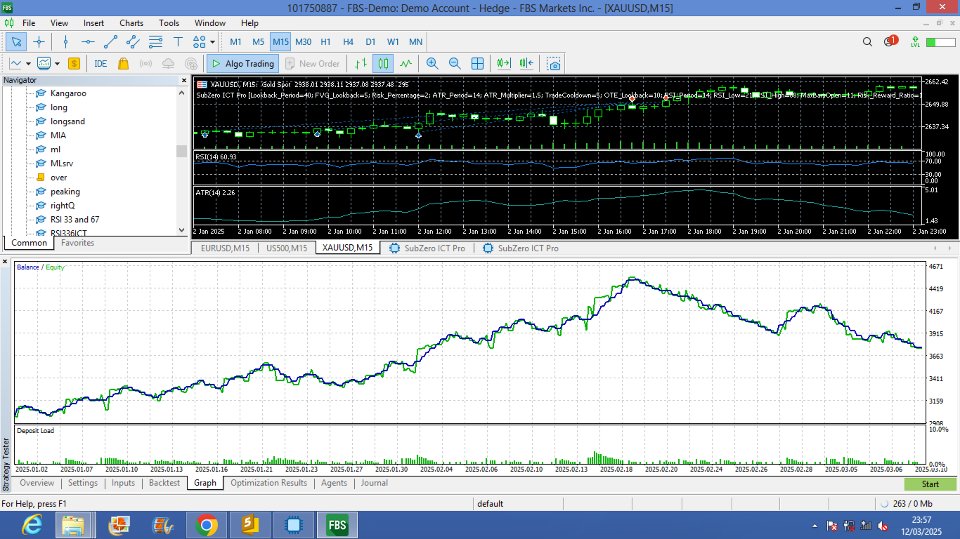

Liquidity Sweep Detection:

- The EA detects liquidity sweeps, where large market participants may cause price movements that clear out stop-loss levels. This helps identify potential market reversals.

-

Fair Value Gap (FVG) Detection:

- The EA identifies Fair Value Gaps, which are price inefficiencies in the market. These gaps are often filled by price movements and are used as potential entry points.

-

Market Structure Shift (MSS):

- The EA checks for market structure shifts, where price breaks above previous highs or below previous lows. This signals a potential change in the prevailing market trend.

-

Optimal Trade Entry (OTE):

- The EA utilizes Fibonacci retracements (specifically the 0.618 and 0.79 levels) to determine optimal entry points after a significant price move. The idea is to enter the market when price retraces to these key levels before continuing in the direction of the prevailing trend.

-

RSI Filtering:

- The EA uses the Relative Strength Index (RSI) as a filter to identify overbought or oversold conditions. It considers trades only when the RSI is outside a predefined range (below 21 for buying or above 88 for selling), helping avoid trades in neutral or range-bound markets.

-

Dynamic Risk Management:

- ATR-based Stop-Loss and Take-Profit: The EA adjusts stop-loss and take-profit levels dynamically based on the ATR, providing a flexible approach that adapts to market volatility.

- Trailing Stop: As the trade moves in the desired direction, the EA adjusts the stop-loss to lock in profits using a trailing stop multiplier.

- Risk Percentage: The EA calculates position size dynamically based on a specified risk percentage of the account balance.

-

Trade Cooldown:

- To avoid overtrading, the EA has a cooldown period that prevents placing trades if a position has been opened recently (in this case, 15 bars).

-

Drawdown Protection:

- The EA includes a daily drawdown limit to protect against excessive losses. If the drawdown exceeds the predefined limit, the EA halts further trades for the rest of the day.

-

Time-Based Filters (Kill Zones):

- The EA trades only within specific time ranges known as "Kill Zones," when the market tends to have higher liquidity and more favorable conditions for trading.

-

Order Block and Breaker Block Detection:

- The EA detects order blocks (consolidation areas where large orders are placed) and breaker blocks (zones of reversal after a previous order block is broken), which are key for identifying areas of strong support or resistance.

-

News Filter:

- While the current version has a placeholder, the EA can be modified to include a news filter to prevent trading during high-impact news events that may cause significant market volatility.

The EA waits for a confluence of several factors before placing a trade:

- Liquidity Sweep and Market Structure Shift: The EA checks for liquidity sweeps and confirms a shift in market structure to identify potential reversal points.

- Fair Value Gap and Order Block Detection: The EA looks for price inefficiencies or order blocks that suggest a price reversal is likely.

- Optimal Trade Entry (OTE): If a valid entry point is found based on Fibonacci retracement levels, the EA enters the trade.

- RSI Filter: The EA ensures that the RSI indicates overbought or oversold conditions to filter out neutral market phases.

If these conditions align, the EA enters a buy or sell trade with appropriate stop-loss, take-profit, and position size based on the risk settings. It also includes drawdown protection, a trailing stop, and a maximum trade duration to optimize trade management.

Risk Management and Optimization- Risk Management: The EA dynamically calculates position sizes based on the user's risk percentage and the ATR, ensuring that each trade aligns with the desired risk exposure.

- Trailing Stop: If the market moves in the favor of the trade, the trailing stop mechanism ensures that profits are locked in as the position moves in the desired direction.

- Drawdown Limit: The daily drawdown limit helps avoid large losses by ceasing trading once the loss threshold is reached.

In essence, SubZero ICT Pro.mq5 is an advanced, multi-layered EA that combines several ICT-inspired techniques with dynamic risk management to identify high-probability trade setups. Its sophisticated logic helps reduce the risk of overtrading and ensures the EA adapts to different market conditions, making it a powerful tool for both novice and experienced traders.

DisclaimerThe SubZero ICT Pro Expert Advisor (EA) is designed for educational and informational purposes only. It is important to understand that past performance does not guarantee future results. Trading involves significant risk, and it is possible to lose more than your initial investment. The use of this EA is at your own risk, and you should fully understand the risks involved before applying it in live trading.

Before using this EA in live markets, it is recommended to test it thoroughly on a demo account to ensure that it aligns with your risk tolerance and trading objectives. The developers are not responsible for any financial losses that may occur due to the use of this EA. Always trade responsibly and seek independent financial advice if needed.