Implied Fair Value Gap ICT Indicator MT5

- Göstergeler

- Eda Kaya

- Sürüm: 1.11

Implied Fair Value Gap ICT Indicator MT5

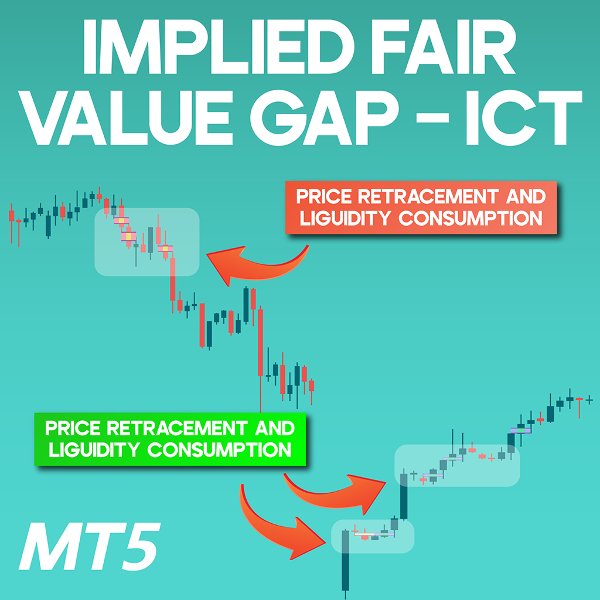

The Implied Fair Value Gap ICT Indicator MT5 is a powerful tool designed to uncover hidden price inefficiencies within the MetaTrader 5 platform. This indicator employs a specialized method by plotting two theoretical lines at the midpoint of the shadows of consecutive candles, marking the space between them as an implied fair value gap. It's important to note that if the shadows of the neighboring candles fully overlap, no hidden fair value gap is formed.

Indicator Specifications Table

| Category | ICT - Smart Money - Liquidity |

| Platform | MetaTrader 5 |

| Skill Level | Advanced |

| Indicator Type | Continuation - Reversal |

| Timeframe | Multi-timeframe |

| Trading Style | Scalping - Intraday |

| Trading Market | Cryptocurrency - Forex - Stocks - Commodities |

Indicator Overview

The key distinction between the Implied FVG and a conventional FVG lies in the method of identifying price gaps. A standard FVG is formed when there is no overlap between the first and third candles in a sequence. However, an Implied FVG is recognized when the gap is partially filled by the shadows of the middle candle, rather than by a direct price movement.

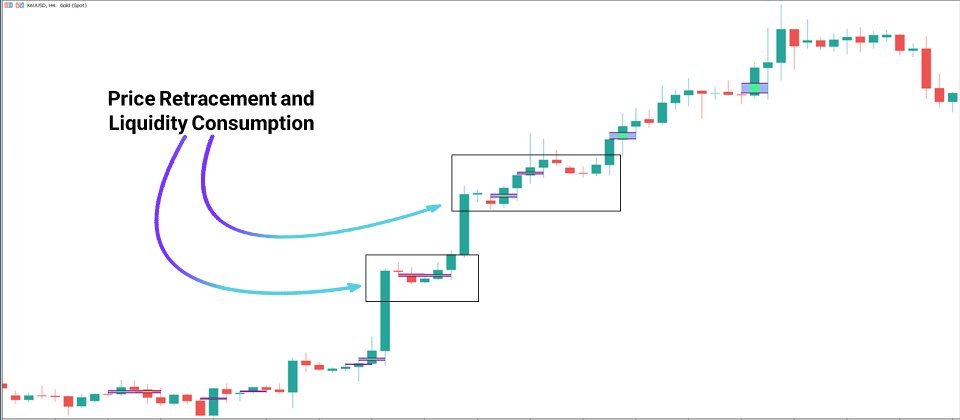

Conditions for an Uptrend

Based on the 4-hour price chart of Gold against the US Dollar (XAU/USD), when the price revisits the Implied Fair Value Gaps, it accumulates liquidity and tends to push higher. These retracement areas serve as potential entry points for long positions.

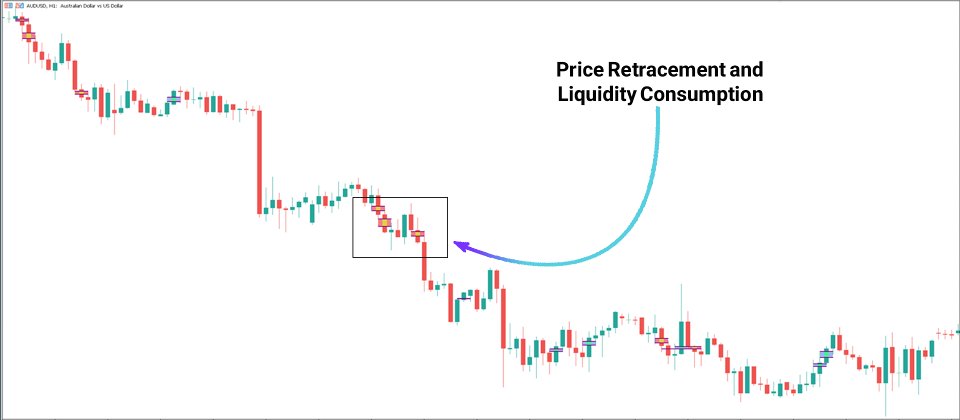

Conditions for a Downtrend

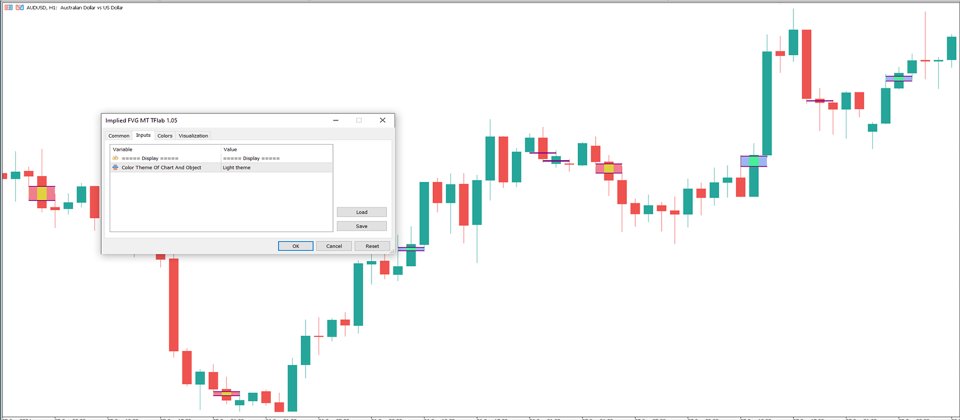

Observing the 1-hour price chart of the Australian Dollar against the US Dollar (AUD/USD), price action shows that upon revisiting the Implied Fair Value Gaps, liquidity is gathered, and the price tends to drop further. These levels often present suitable opportunities for short trades.

Indicator Settings

- Theme: Customizable indicator theme

Conclusion

The Implied Fair Value Gap ICT Indicator MT5 in MetaTrader 5 offers a distinctive way of identifying price inefficiencies compared to standard FVGs. The primary difference is that this indicator leverages a 50% overlap of candle shadows to detect hidden fair value gaps, whereas traditional FVGs rely solely on visible price gaps between consecutive candles.