EuroDollar Printer

- Uzman Danışmanlar

- Robin Amede Aleksic

- Sürüm: 1.0

- Etkinleştirmeler: 10

Here’s a brief list of steps to follow after purchasing the EA or when backtesting it:

- EUR/USD Chart or Dataflow from any broker (i did my tests and developement on Dukascopy Dataflow)

- Change the Input Deviation Multiple: From 2.5 to 2

- Change Minimum Bars Since Last Trade: From 50 to 1

- Set Maximum open positions on 2

- Timeframe doesnt matter, because its predifined as costant not as input parameter

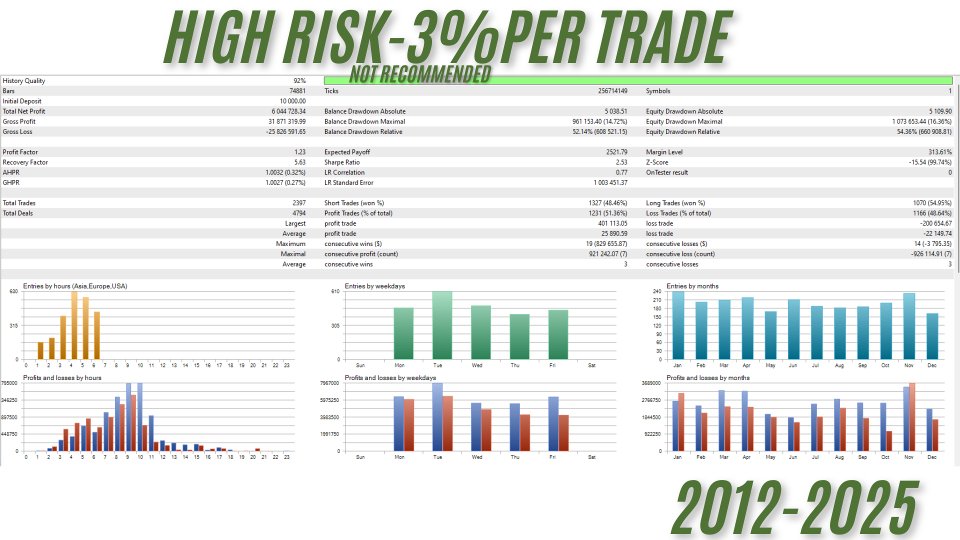

- set Risk per trade within a range from 0.5% to 5%, dependant on your risk appetite

- "Max Drawdown" and "Minimum required margin" are just optional safety options, you can set them either on a level you are comfortable with or set them to 80% for drawdown and 10$ for minimum margin.

This Expert Advisor trades exclusively on the EUR/USD during the Asian session, capitalizing on the typically lower volatility.

It employs a strategy based on the premise that price extremes within the Asian session are often treated as inefficiencies, with a high probability of returning to a mean or starting point.

Why is the EA before 2012 not Profitable?

After 2012, the presence of institutional investors in the market, especially in EUR/USD trading, increased. These market participants have played a larger role in determining price movements during the Asian session, leading to a more stable and efficient market structure.If you have any questions, dont hesitate contacting me on Telegram: @SixOneEight618