DeMark TrendLine Trader

- Göstergeler

- George Njau Ngugi

- Sürüm: 1.2

- Etkinleştirmeler: 5

If you are unsure how to use this indicator, please feel free to reach out to me. I will explain it to you and provide reading materials to help you make the most of it.

Most effective with TD sequential :

MT4: https://www.mql5.com/en/market/product/129509?source=Site+Profile+Seller

MT5: https://www.mql5.com/en/market/product/129507?source=Site+Profile+Seller

My Other products: https://www.mql5.com/en/users/1700046313/seller

Here’s a brief description of how to use the indicator effectively.

How to Use the DeMark Trend Line Trader

The DeMark Trend Line Trader (TLT) is a technical tool designed to identify trendline breakouts and determine potential entry and exit points for trades. Developed by Tom DeMark, it focuses on drawing objective, rules-based trendlines to highlight critical market levels.

Steps to Use the DeMark Trend Line Trader

-

Identify Key Trendlines:

- The TLT automatically draws two types of trendlines:

- TD Resistance Line: Drawn over recent swing highs.

- TD Support Line: Drawn under recent swing lows.

- The TLT automatically draws two types of trendlines:

-

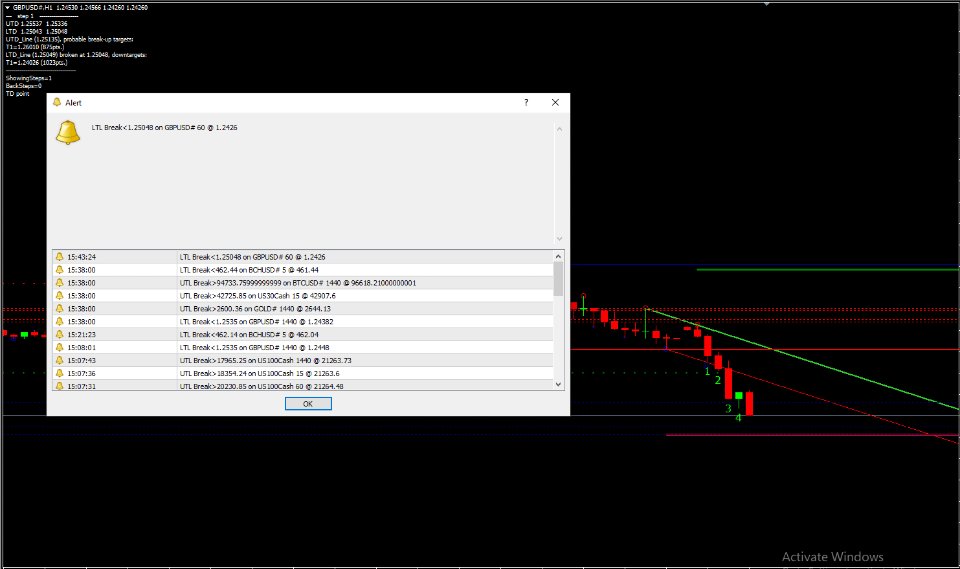

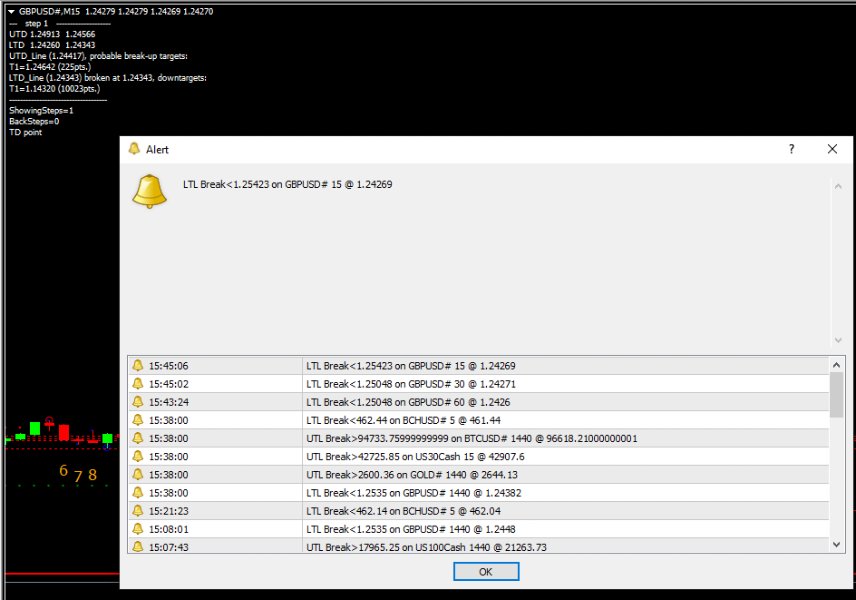

Look for Trendline Breakouts:

- A bullish breakout occurs when the price closes above the TD Resistance Line.

- A bearish breakout occurs when the price closes below the TD Support Line.

-

Confirm the Breakout:

- Use additional filters like volume, candlestick patterns, or other indicators (e.g., RSI or MACD) to confirm the breakout’s validity.

-

Set Entry Points:

- For a bullish trade, enter long after a confirmed close above the resistance line.

- For a bearish trade, enter short after a confirmed close below the support line.

-

Place Stop Loss:

- Set stops just below the breakout line for long positions or above it for short positions to minimize risk.

-

Determine Profit Targets:

- Use previous swing highs/lows, Fibonacci levels, or calculated risk-reward ratios to establish exit points.

Best Practices

- Timeframes: Works well on multiple timeframes; adjust settings to match your trading style (e.g., intraday, swing, or position trading).

- Combine with Other Tools: Improve accuracy by combining with other DeMark indicators like TD Sequential(https://www.mql5.com/en/market/product/129507?source=Site+Profile+Seller).

- Manage Risk: Always use proper risk management to protect capital.

The DeMark Trend Line Trader offers a systematic approach to trading trendline breakouts, helping traders make objective and disciplined decisions in various market conditions.