AI T3 MA Super Fill

- Göstergeler

- Xin You Lin

- Sürüm: 1.15

- Etkinleştirmeler: 5

MT4 platform AI T3 MA Super Fill indicator use introduction

I. Overview of indicators

The AI T3 MA Super Fill indicator is a powerful analytical tool that combines advanced algorithms and T3 moving average technology to provide traders on the MT4 platform with accurate market trend judgments and trading signals. It uses intelligent algorithms to deeply process the price data, and displays the changes of the T3 moving average in a unique way to help traders more effectively grasp the market dynamics, whether in the trend market or the shock market, can assist traders to make smarter trading decisions, suitable for foreign exchange, stocks, futures, precious metals and other financial trading markets.

Second, the composition and principle of indicators

T3 Moving Average Portfolio: This indicator is based on the T3 moving average and reflects the trend of the market over different time spans by calculating T3 moving averages for different periods, such as short (13 periods) and long (20 periods) averages. The intersection, separation and convergence of these moving averages are key factors in determining the change of market trend. The T3 moving average gives more weight to recent price data than traditional moving averages, allowing it to capture changes in price trends more sensitively while reducing the impact of lag.

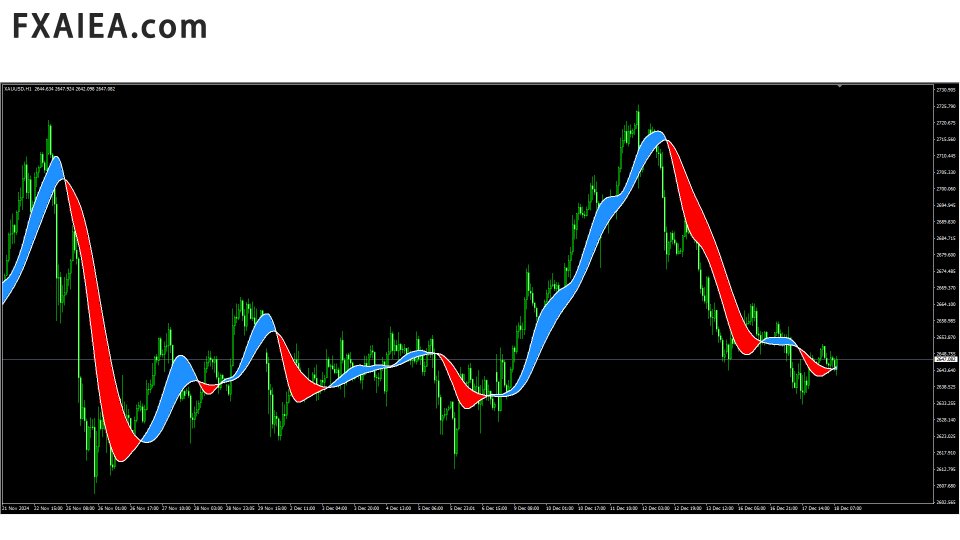

Smart fill area: The indicator is intelligently filled in the area between the moving averages to create a unique visual effect. When the market is in a bullish trend, the filled area appears blue, intuitively demonstrating the strength of the bullish trend; On the contrary, under the short trend, the filled area appears red, which intuitively shows the strength of the short trend. This filling method not only allows traders to quickly identify the dominant trend of the market, but also to sense the evolution of the trend from the dynamic changes in the filling area.

AI algorithm-driven: Indicators introduce artificial intelligence algorithms for real-time monitoring and analysis of market data. It automatically ADAPTS to price fluctuations in different market conditions and dynamically adjusts the sensitivity and parameter Settings of indicators to provide more accurate and reliable trading signals. For example, in the period of relatively violent market fluctuations, the algorithm will appropriately reduce the sensitivity of indicators to avoid too many false signals due to short-term price noise; When the market trend is more obvious, the algorithm will improve the response speed of the indicator to ensure that traders do not miss important trading opportunities.

Third, installation and setup

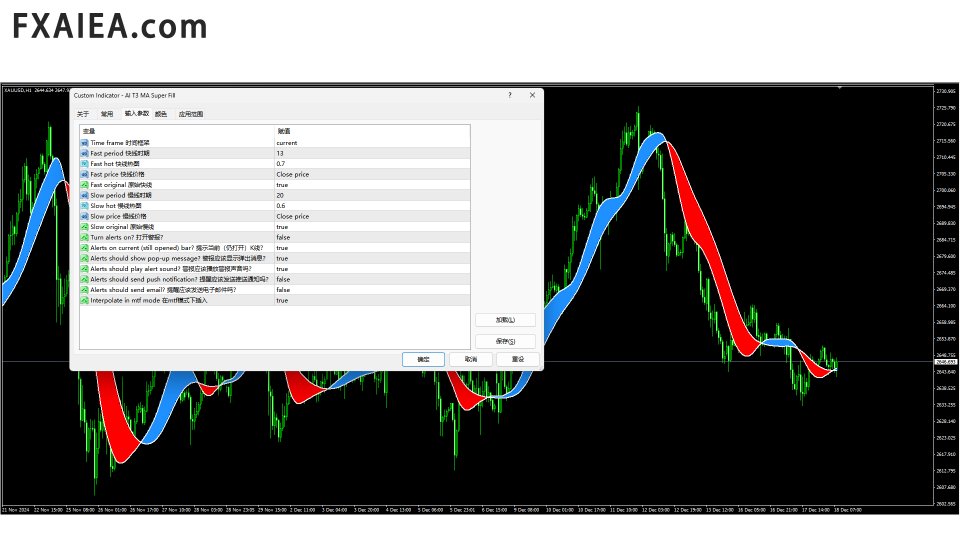

Installation steps: First, download the AI T3 MA Super Fill indicator file, usually in.ex4 format. Then, on the MT4 platform, click the "File" menu, select "Open Data folder", enter the "MQL4" folder, then find the "Indicators" folder, copy and paste the downloaded indicator file into this folder. Close and reopen the MT4 platform, select "Indicators" in the "Insert" menu, find the AI T3 MA Super Fill indicator you just installed in the list of custom indicators and click to add it to the chart.

Parameter setting: After the installation is complete, traders can adjust the indicator parameters according to their own trading strategy and traded varieties. Common parameters include T3 EMA Settings for different periods, such as adjusting the period parameters of short-term and long-term EMA to adapt to the volatility characteristics and trading cycles of different markets. In addition, there may also be parameters related to the intelligent algorithm, such as sensitivity adjustment parameters, trend recognition thresholds, etc., which can be optimized through trial and error and backtesting to find the combination of parameters that best suits their trading style and market environment, improving the effectiveness of indicators and the accuracy of trading signals.

Fourth, the interpretation of trading signals

Trend signal: When the indicator's fill area is consistently blue and expanding, and the T3 moving averages are long (short-term moving averages above long-term moving averages), it indicates that the market is in a strong bullish trend, which is a clear buy signal or a signal to continue holding long positions. Conversely, if the filled area continues to be red and widened, and the moving average is short (the short-term moving average is below the long-term moving average), the market is in a short trend, which is a signal to sell or hold a short position.

Trend reversal signal: If the color of the filled area gradually changes from blue to red, and the short-term T3 moving average crosses the medium - and long-term moving average downward, this may indicate that the long trend is about to end and the short trend is about to begin, and is a potential sell signal that traders should consider closing long positions and establishing short positions in due course. Conversely, when the filled area turns from red to green and the short-term moving averages move up through the medium and long-term moving averages, it may signal a reversal of the short trend, prompting traders to look for buying opportunities.

Oscillating signal: When the market is in the oscillating range, the color of the filled area may change frequently, and the moving averages are intertwined, at this time, the market direction is not clear, and the signal sent by the indicator is more chaotic. In this case, traders should be cautious and avoid blindly trading according to the indicator signal, can be combined with other volatility indicators, such as Bollinger band, RSI, etc., or wait for the market trend to become clear before making trading decisions based on the indicator.

V. Advantages

Advantages:

Accurate trend judgment: With the advantages of T3 moving average and intelligent algorithm, it can accurately identify the main trend of the market, reduce the trading losses caused by misjudging the trend, and improve the success rate and profitability of the transaction.

Timely signal prompt: Through real-time monitoring of market data and dynamic adjustment of parameters, indicators can quickly respond to market changes and send trading signals in time, so that traders can grasp market opportunities in the first time to avoid missing the best entry and exit time.

Intelligent adaptation to market changes: Whether in the market with strong trends or in the market with frequent shocks, the AI algorithm of the indicator can automatically adapt to market conditions, adjust the performance of the indicator, provide relatively stable and reliable trading signals, and reduce the difficulty of traders who need to frequently adjust trading strategies due to changes in the market environment.

Intuitive visualization: The unique way of filling areas and moving averages display market trends and trading signals at a clear sight, which can be easily understood and applied even by novice traders without rich trading experience, helping to improve the decision-making efficiency and confidence of traders.