Case Automat v4

- Uzman Danışmanlar

- Tatiana Savkevych

- Sürüm: 1.7

- Etkinleştirmeler: 5

Case Automated: Your reliable guide in the Forex World

Case Automated is an advanced trade bot for the Forex market, specially designed for traders, striving for effective and automated trade. This innovative tool offers a wide range of functions and capabilities, allowing traders to effectively manage their deals and strategies.A special offer for the first users: the price is reduced, but in the future it will be increased.

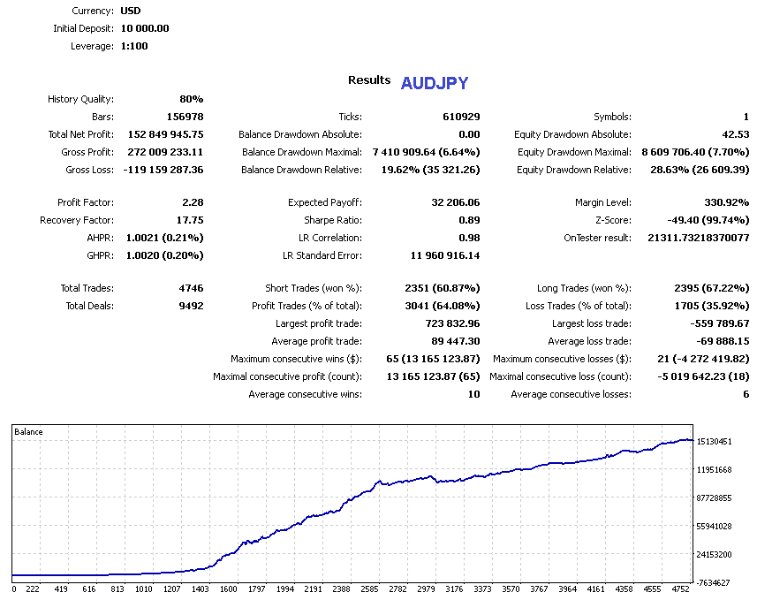

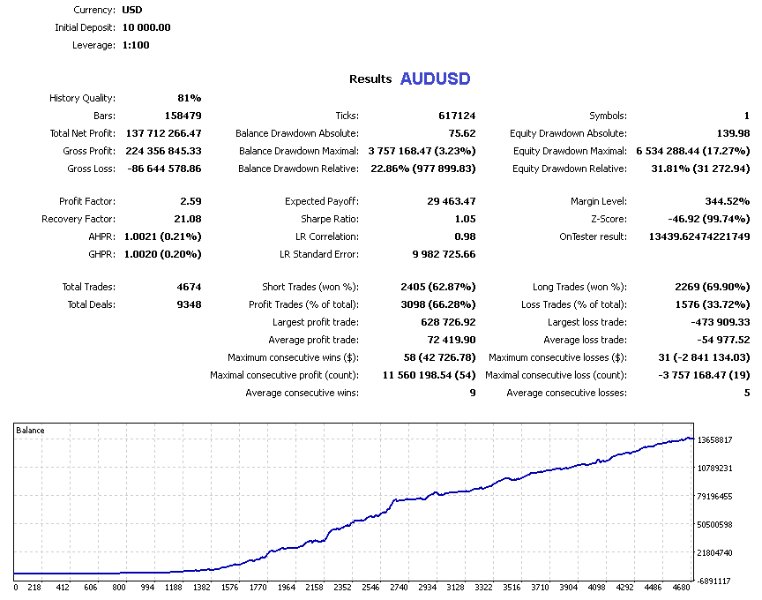

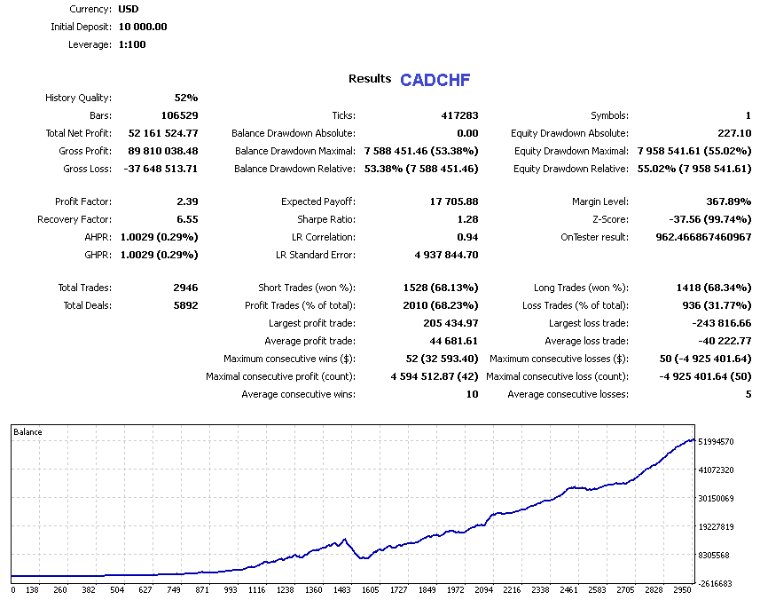

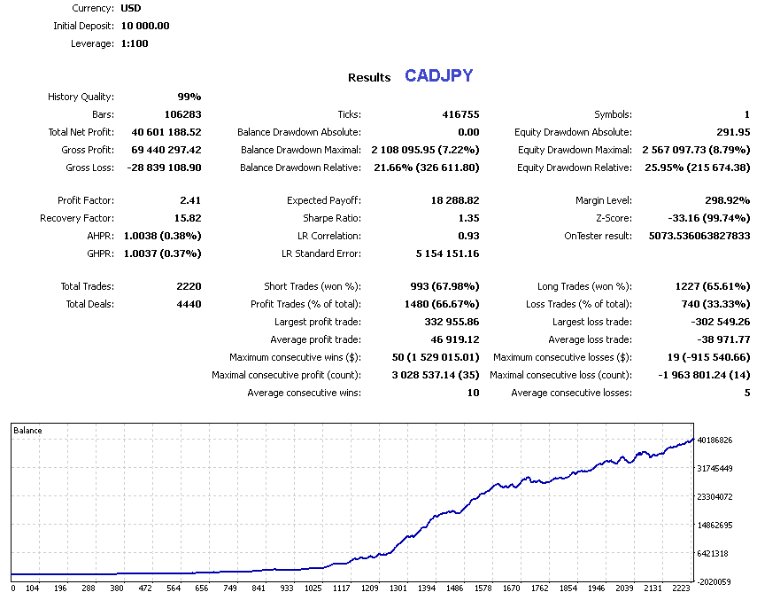

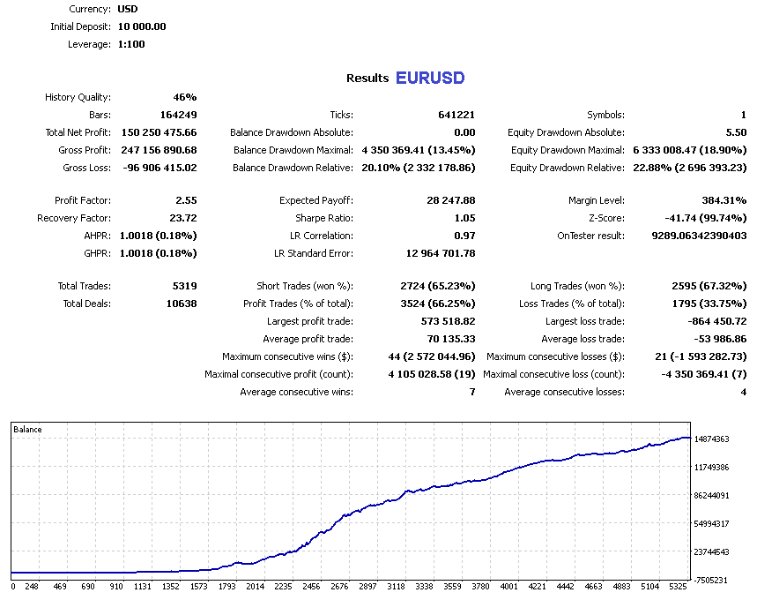

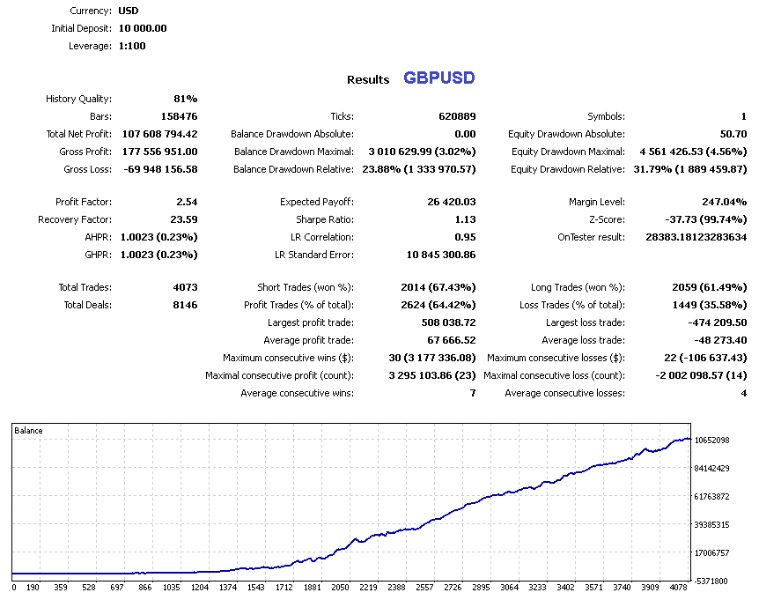

Work tools:

- EURUSD, AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, GBPSEK, GBPSGD, GBPUSD.

Advantages of Case Automated:

- Reliability and stability: developed taking into account high standards of reliability and stability.

- Smart risk management: Built -in Capital Management (Money Management) allows you to control the risk level and optimize trade, protecting capital.

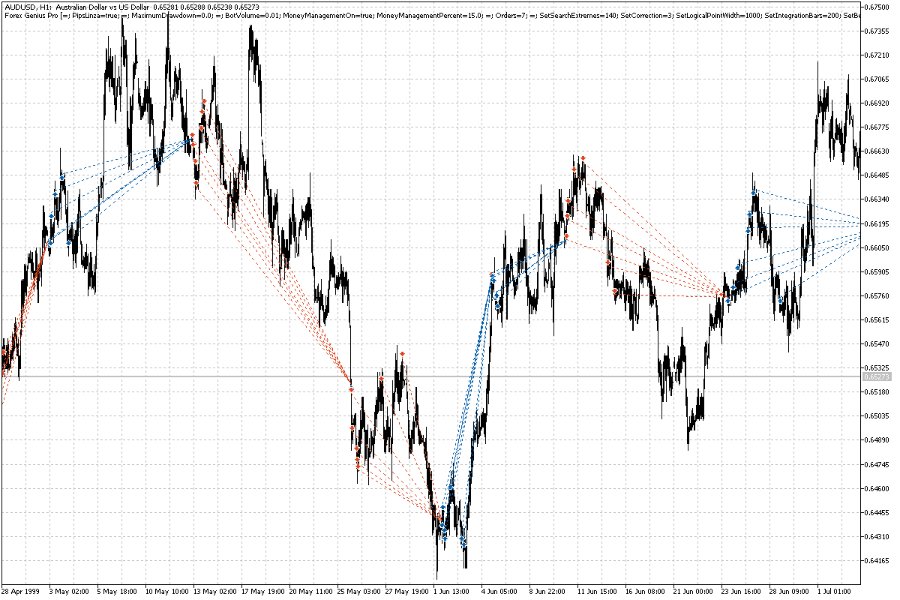

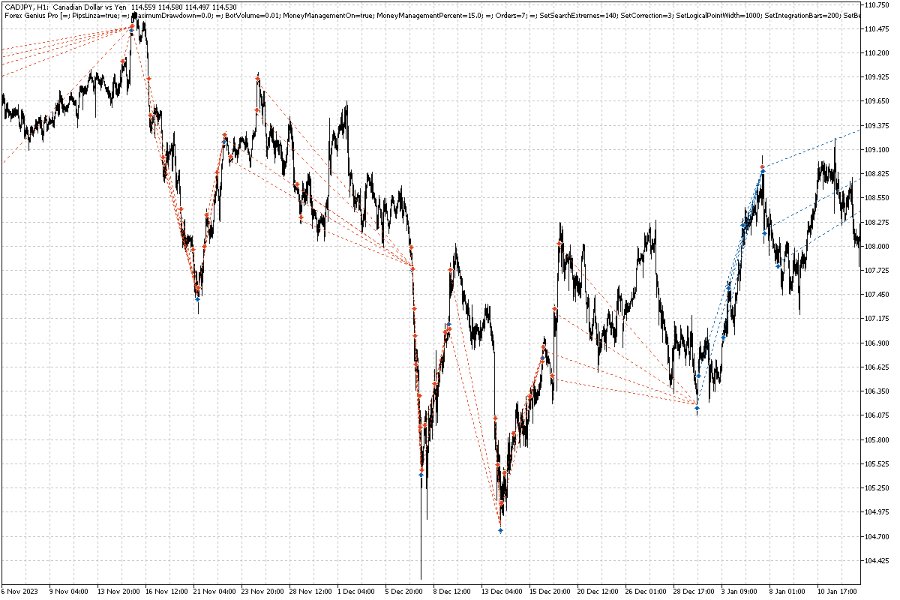

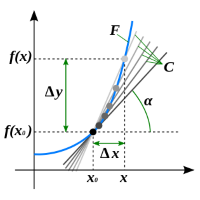

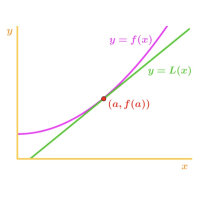

- Market analysis in real time: analyzes all key aspects of the market to accurately determine the current trend and make reasonable decisions.

- Flexible settings: Provides a wide range of parameters for thin tuning for individual requirements of the trader and market conditions.

- Profiting profit: TakeProfit, Stoploss and Trailing Stop functions protect profit from sharp changes in the market price and minimize losses.

- Risk minimization: Spread filtering and taking into account market volatility help minimize risks and ensure trading stability.

- Simplicity of use: Even traders without deep programming knowledge can easily configure and launch Case Automated for successful trading.

The main capabilities of the Case Automated:

- Order Management: Using the OrderFilling function, traders can choose the type of filling out the order, and using ORDERCOMMMENT add comments to their transactions.

- Orders identification: each order is automatically assigned a unique Ordermagic number, which facilitates the tracking and identification of transactions.

- Money Management: allows you to configure the volume of bidders (Botvolume) and manage the risk using the MoneyManagementon and MoneyManagementPercent parameters.

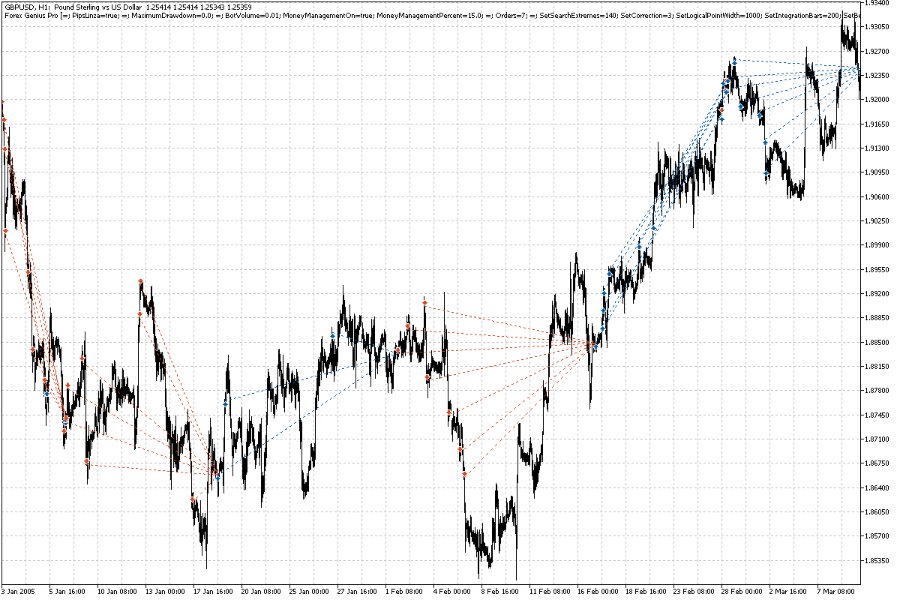

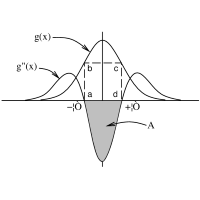

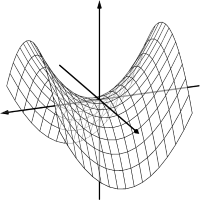

- Market analysis: The market analysis using various parameters to determine the optimal entry points and exit from transactions.

- Order restriction: installing the ORDERS parameter allows you to determine the number of orders for trading.

- TakeProfit and Stoploss levels: allows you to configure the levels of TakeProfit and Stoploss to protect profit and minimize losses.

- Trailing Stop: Trailing function activates the trailing stop, which allows you to protect profit from sharp changes in the market price.

- Spread filtering: using Spreadfilteron and Spreadfilter, traders can configure filters to control spreads and reduce risks.

- Filtration of volatility: Spreadvolatilityfilteron allows the bot to adapt to changes in market volatility for more accurate trade decisions.

List of parameters and their description for the Case Automated bot:

- Orderfilling (enum_order_type_filling): Determines the type of filling of the order (Order_filling_fok - Fill or Kill).

- Ordercomment (String): Allows you to add a commentary on the order (default "FFN").

- ORDERMAGIC (Uint): a unique order identifier (default 11358).

- Maximumdrawdown (Double): Maximum drawdown (0 - disconnected).

- Pipslinza (Bool): inclusion of the Pipslinza function (default True).

- BOTVOLUME (Double): The volume of transactions (by default 0.01 lots).

- MoneyManagementon (Bool): inclusion of Money Management (default True).

- MoneyManagementPercent (Double): percentage of balance for Money Management (25%by default).

- SetSearchextreme (Uint): the number of bars for the search for extremums (default 34).

- SetintegrationBars (Uint): the number of bars for integration (default 144).

- SetCorrection (Uint): Correction level (default 8).

- SetlogicalPointwidth (Uint): Width of the logical point (by default 3).

- SetBeam (Uint): Trend beam (default 15).

- ORDERS (UINT): Orders limit (default 12).

- TakeProfit (Uint): TakeProfit level in relative units (default 2000).

- Stoploss (Uint): Stoploss level in relative units (default 1044).

- Trailingon (Bool): Triling Stop (by default True).

- Trailingstart (Uint): the starting point for trailing stop in relative units (by default 300).

- Trailingstop (Uint): distance for trailing stop in relative units (default 50).

- Spreadfilteron (Bool): Turning on the filtering of spreads (by default True).

- Spreadfilter (Uint): restriction on a spread in relative units (default 30).

- Spreadvolatilityfilteron (Bool): inclusion of filtering on the volatility of the spread (by default True).

These parameters allow you to configure the CASE Automated bot in accordance with your trading strategies and market conditions.

Why is it worth buying Case Automated:

Case Automated provides the possibility of fine setting up strategies for individual needs and a trader preference. This bot combines advanced technologies, reliability and flexible settings, making it perfect A cop for traders of all levels of experience.

The wide capabilities of the product allow traders to effectively manage transactions, protect capital and increase the likelihood of successful trade in the Forex market. Do not miss the opportunity to work with Case Automateded. Get access to this powerful tool today!