LookAtTrend V2 MT4

- Uzman Danışmanlar

- Yue Zhang

- Sürüm: 2.10

- Güncellendi: 30 Mart 2025

- Etkinleştirmeler: 10

Finding a REAL profitable trading strategy online is like searching for a needle in a haystack. There are simply too many pitfalls in backtesting to “decorate” a good result.

We are a team of proficient traders and engineers who have built this trading system to deliver consistent profitability in live trading. We use this system to trade REAL money for ourselves and our clients.

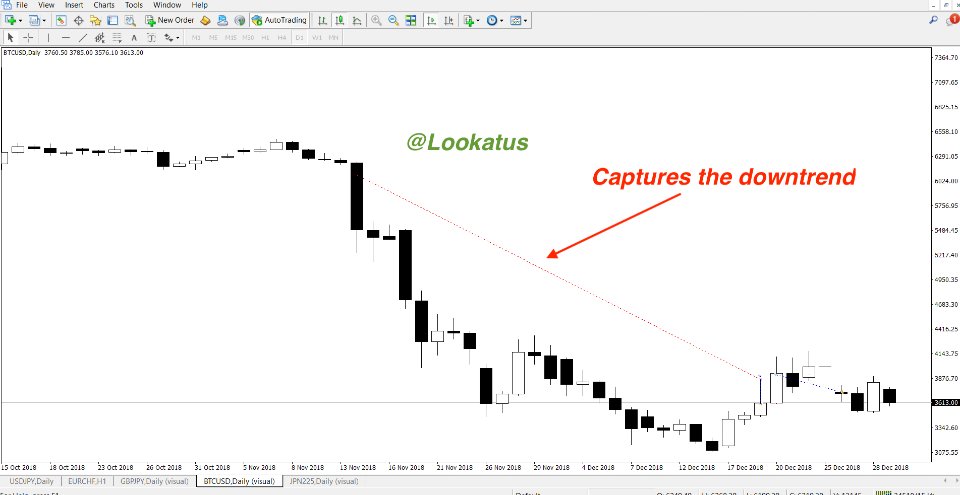

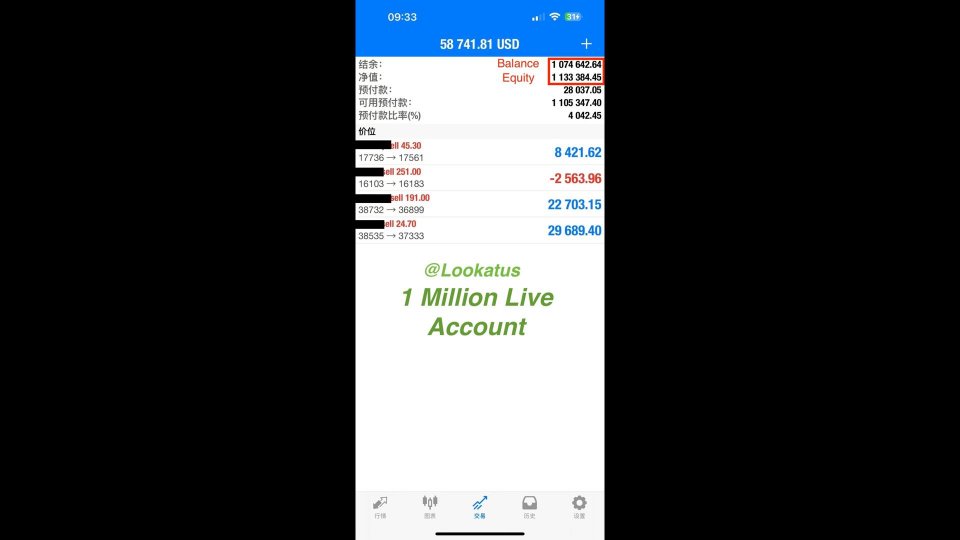

- Proven Performance: Over the past year, this strategy has achieved a 70+% gain on a LIVE account with a 10,000 initial deposit. (see the gif below)

- Trusted by High-Value Clients: This strategy is also actively running on a LIVE account with a $1 million USD deposit for one of our clients. (see the gif below)

Strategy Edge

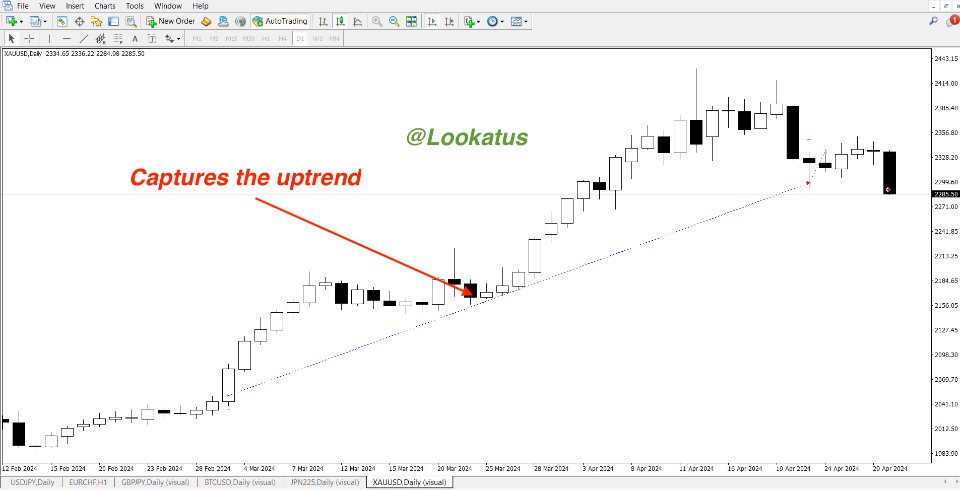

Our trading system is built on a breakout, trend-following approach that capitalizes on the fundamental dynamics of market movement. This strategy originates from a REAL hedge fund's trading method.

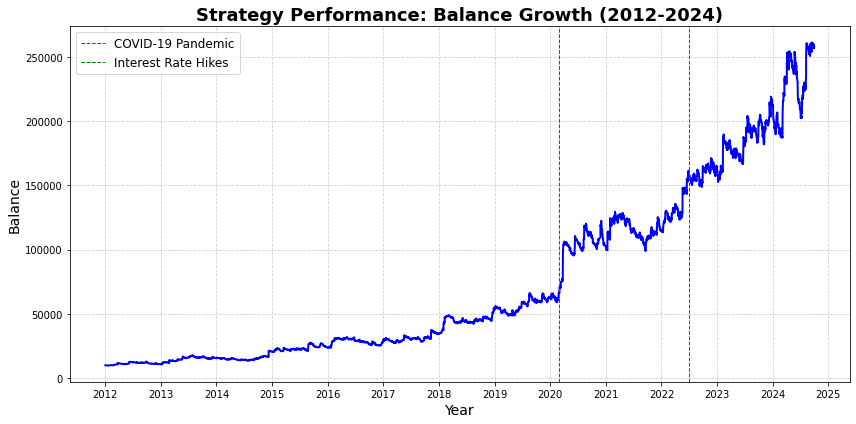

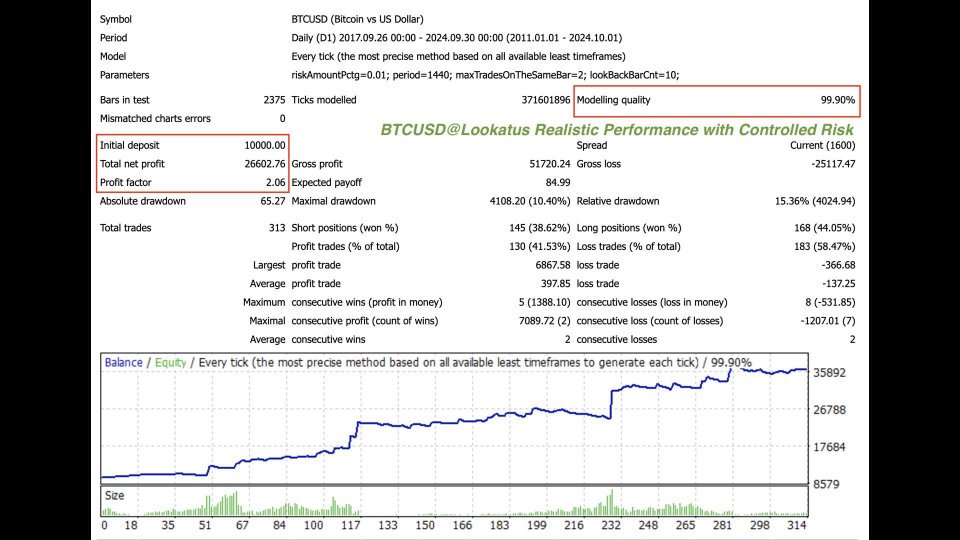

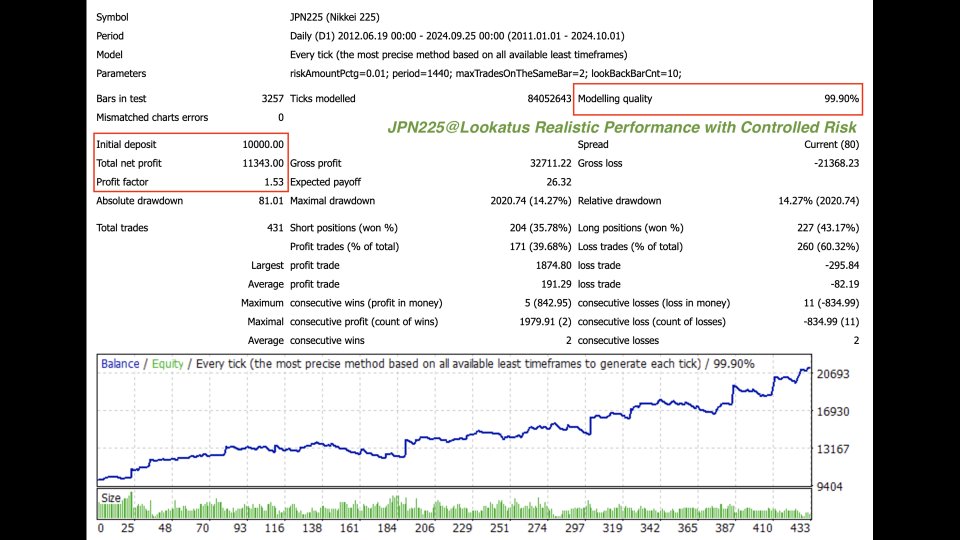

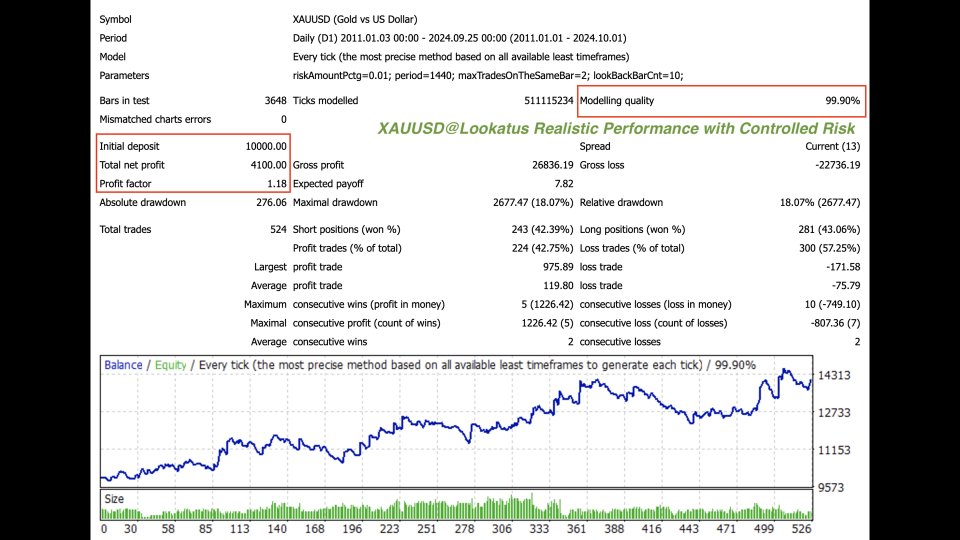

We enhance this approach by combining it with disciplined risk management and effective profit-taking mechanisms, ensuring a consistently favorable reward-to-risk ratio. Over the past 13 years, we've rigorously backtested the strategy across 12 different instruments in multiple markets—including equities, commodities, energy, crypto, and forex. Throughout this period, our combined portfolio has shown robust and consistent performance across various market conditions, achieving a total cumulative return of 16,608%—an average of 48.2% return per annum.

| Mean Return | 48.251% |

| Standard Deviation | 23.1% |

| Sharpe Ratio | 1.65 |

| Calmar Ratio | 2.38 |

| Maximum Drawdown | 20.24% |

| Win Rate | 37.37% |

| Profit Factor | 2.02 |

| Correlation with S&P500 | -0.3 |

Discounted price at $1999, for every 10 purchases, we will increase the price by $1000, final price at $9999.

Limited to 200 copies ONLY!

We have built our strategy to be easy to use and configure for both beginners and professional traders. For each purchase, please reach out to us through private chat and we will provide a detailed setup and disclose our full trading system, including

- Full portfolio

- Trading configs

- Diversification weightage

- Risk management

We strongly recommend you to read through our trading system white paper before use.

Refer to the manual for the EA configuration.

Welcome to join our channel: Team@Lookatus

Usage

| Instruments | XAUUSD, JPN225, BTCUSD etc. |

| Timeframe | 1D (recommended) |

| Trading Capitals | 10k ~ 2.5Million USD |

| Leverage | >= 1:20 |

| Require VPS | Highly recommended for uninterrupted trading |

| Brokers | Any Licensed and Regulated brokers. |

Unique Advantages

Beginner traders can be easily deceived by good backtesting results. In fact, a highly profitable backtesting curve does NOT mean real-world profitability! Highly recommend you to read about why backtesting can be misleading to understand the numerous pitfalls in backtesting.

Our team is fully aware of the traps in backtesting. And throughout the development phase, we have employed rigorous measures to ensure our system is built for REAL PROFITABILITY.

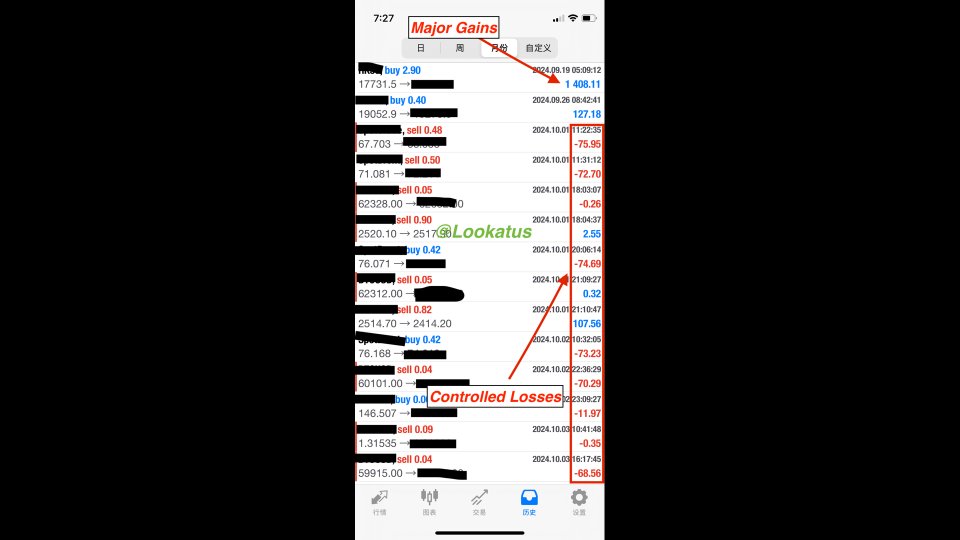

1. Live Performance

Real performance must be tested through verified brokers. See our shared gif below: we've been using this strategy for live trading over the past year with an initial deposit of $10,000, demonstrating a profit of over 70%.

2. Effectiveness Across Various Markets

A robust strategy that captures market inevitabilities should work across multiple markets instead of ONLY optimizing for one or a few instruments. Our trading portfolio applies well across various sectors, including Indexes, Energy, Metals, Forex, and Cryptos.

3. Prolonged Years of Testing

For a strategy to be considered reliable, it should be validated with at least 10 years of backtested data. Our strategy has been tested with over 13 years of data and has demonstrated consistent profitability.

4. Simplicity Prevents Overfitting

Our strategy's core is built with less than 5 parameters. This simplicity makes it impossible to overfit past performance across various markets for extended periods.

An overfitted strategy appears highly optimized for past data, pinpointing ideal buy and sell points in historical prices, but struggles to perform consistently in real-world conditions.

Be wary of strategies or algorithms with too many parameters and emphasize complexity, as these are recipes for overfitting and beautiful charts. Read more about How to identify a profitable trading strategy.

5. High Modeling Quality

Data quality significantly affects a strategy's profitability (sometimes producing opposite results for the same strategy). All our backtesting results come from high-precision data with 99.9% modeling quality. See the results below.

6. Rigorous Cost Simulation

For active trading strategies, costs play a crucial role in determining profitability. According to the law of active portfolio management, one should be extremely careful with the costs involved in active trading. Unfortunately, many costs CANNOT be fully expressed by MetaTrader backtesting.

To compensate for that, we've implemented an offline simulation system with cost estimates from live trading accounts to simulate real trading environment costs. All numbers you see here are post-cost.

Here are the costs we considered:

- Commission: The charge for opening and closing a trade, generally related to your position size.

- Swap: The cost of holding a position overnight. While sometimes positive, for most trend-following strategies, this cost can significantly impact profitability.

- Execution cost: Also known as slippage. For market orders, when you place a trade at $71, you might end up buying/selling at $71.1 or $70.9, meaning some profit can be lost to slippage.

- Spread cost: Some brokers have implicit charges in the spread. You need to review the fee structure to understand how it's charged.

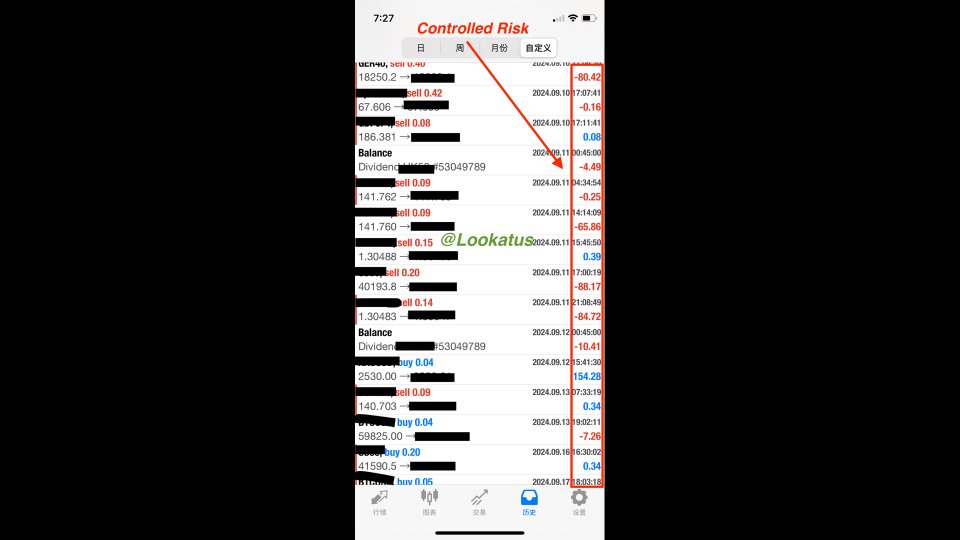

7. Disciplined Risk Management

No trading strategy can discuss returns without addressing risk. Be cautious of any strategy that claims to offer high returns with minimal risk. Our system is designed to deliver strong returns while maintaining well-contained risk. Our risk management framework consists of two key components:

- Small Risk Percentage per Trade: For each trade, we risk only a small percentage of our account. Additionally, we place stop-losses that are dynamically adjusted based on market volatility, ensuring risk is well-contained in every position.

- Diversification: We place our trades across a well-diversified portfolio, including equities, commodities, energy, crypto, and forex to reduce systematic risk. This approach helps spread risk and ensures that any drawdowns remain moderate.

8. Realistic Performance

In the financial markets, there is no such thing as a perfect trading strategy. A trading system that delivers high returns with low drawdowns and minimal risk simply DOES NOT exist. For a deeper understanding of the fundamentals of trading strategies and realistic performance expectations, check out the Realistic Performance of Trading Strategy.

Our trading system is a REAL profitable approach based on a trend-following strategy. It features a positively skewed performance, characterized by a 37% win rate and an annual return of 30%, with well-controlled drawdown and deviations. This system typically incurs small, frequent gains and losses, which are offset by infrequent but significant wins.

9. Solid Infrastructure

- Error Handling and Recovery: Our EA design incorporates a comprehensive error-handling mechanism.

- Seamless Operation: Our EA is designed for user convenience and flexibility. It handles reloading or setting changes smoothly(including chart windows switches), even with open trades.

- Low Latency & Resource Efficiency: We fully understand the importance of fast execution in trading. Our EA is designed to be lightweight, and it does NOT rely on any external APIs, ensuring all trades are executed with minimum latency.

- Proven Stability: Last but not least, our EA has a strong track record in real-world trading, demonstrating reliability and consistent performance.

About Pricing

We've extensively tested this strategy and traded it with our own capital. In fact, offering this trading system to the public hasn’t always been our first option. However, we decided to make it available for two purposes only:

- To raise funds for reinvestment in the strategy.

- To support further strategy development.

Thus, to maintain exclusivity, we're limiting sales to ONLY 200 copies. Once these are sold, no additional copies will be available.