EA Budak Ubat Pro

- Uzman Danışmanlar

- Jan Isaac Rodriguez Castro

- Sürüm: 1.80

- Etkinleştirmeler: 5

🚀 How it Works

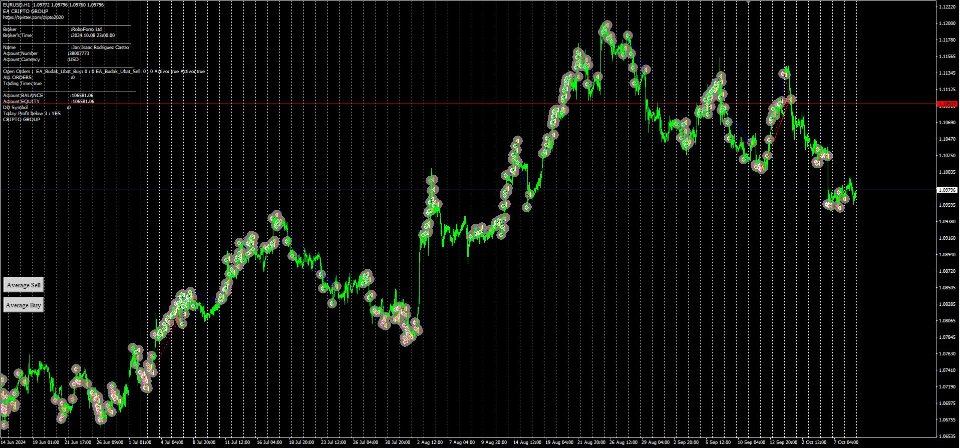

When the EA is active, it analyzes the chart based on the Execution Mode parameter.

-

No existing positions on the chart:

- 📈 If the trend is bullish, the EA enters a buy trade.

- 📉 If bearish, it enters a sell trade.

- 🔒 Sets a Stop Loss at a certain distance if the stop loss variable is > 0. (0 means no Stop Loss).

-

Existing positions with the last one in loss:

- The EA checks if the distance between the current market price and the order meets the minimum distance set by the user.

- It enters a trade based on the candle, calculates the lot size using the martingale method, and sets a Stop Loss if the variable is > 0.

⚙️ EA Parameters

-

Execution Mode:

- 🔄 Every New Bar: Analyzes on every new candle; enters trades only after a new candle appears, following distance settings for the new layer.

- 📉 Every Tick: Enters trades immediately when attached and a new layer immediately when the order distance is met.

-

Positions Mode:

- Default mode: Buy & Sell.

- Optionally configured to operate only in Buy or Sell.

-

🔍 Analysis Method:

- Determines the first trade direction if no positions exist. Options include:

- 📊 Classic Candle (Bull/Bear)

- 📈 SMA

- Determines the first trade direction if no positions exist. Options include:

-

Lot Management:

- Initial Lot Size: Defines the size for the first order.

- Martingale Multiplier: Increases lot size after the first trade based on the multiplier value.

-

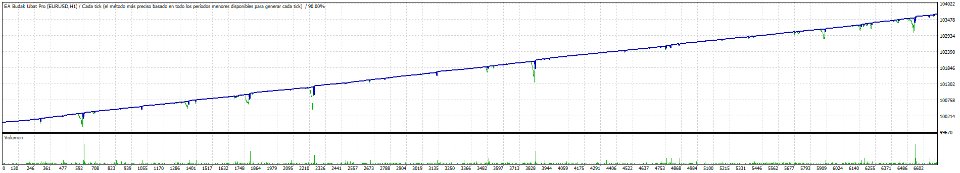

Take Profit:

- Defines the Take Profit for the EA if configured.

-

📏 Distance Settings Between Orders:

- Minimum/Maximum Distance: Defines the range between orders.

- Distance Increment Between Orders: Increases the distance for each additional layer.

-

🔒 Max Trade:

- Sets the maximum number of orders the EA can open in one direction.

✨ Key Features

- 📊 Efficient Trend Following: Utilizes advanced algorithms to identify and follow market trends in real-time, maximizing profits during prolonged market movements.

- 🧠 Low-Risk Martingale Strategy: Applies an optimized Martingale to manage risk safely, avoiding overexposure through calculated position size adjustments.

- 🔄 Smart Pyramiding: Takes advantage of winning trades by adding new positions in the direction of the trend, maximizing gains in strong movements without compromising capital security.

- 📉 Automatic Trailing Stop: Protects accumulated profits with a trailing stop that adjusts automatically as the price moves in your favor, ensuring that profitable trades close at their highest point.

- 🛡️ Intelligent Risk Management: Adjusts position sizes and applies predefined loss limits, maintaining a conservative approach to capital exposure.

- ⚙️ Easy and Customizable Setup: With a user-friendly interface, you can adjust Martingale aggressiveness, pyramiding parameters, trailing stop, and risk levels to suit your needs.

- 🌐 Adaptable to Different Markets: Operates in currency pairs, indices, and more, dynamically adjusting to market conditions.

- 🔒 Correlation Protection: Features a system that protects against correlated order openings, avoiding drawdown without the portfolio.

- 📈 Adjustable Profit Limit: Includes a customizable profit limit that can be adjusted according to your preferences and goals.