Cyberos

- Uzman Danışmanlar

- Maryna Shulzhenko

- Sürüm: 1.8

- Etkinleştirmeler: 5

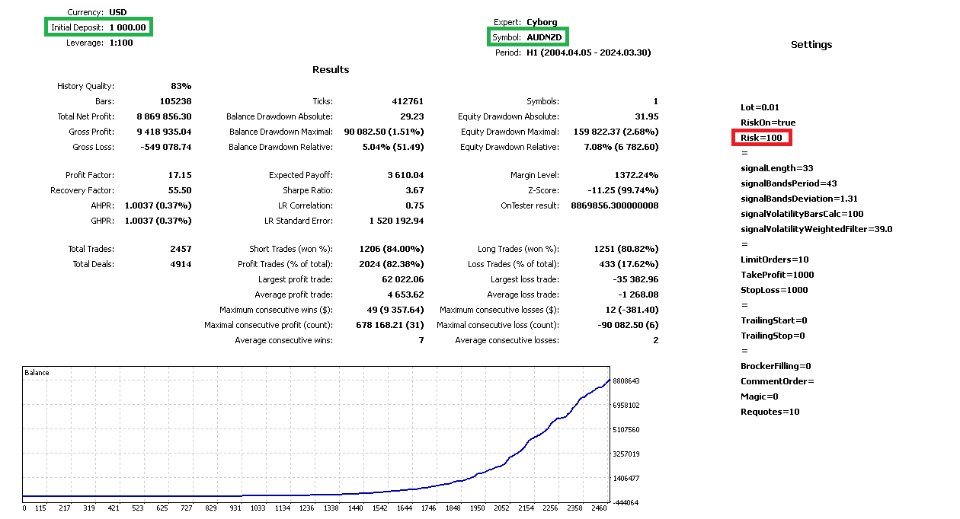

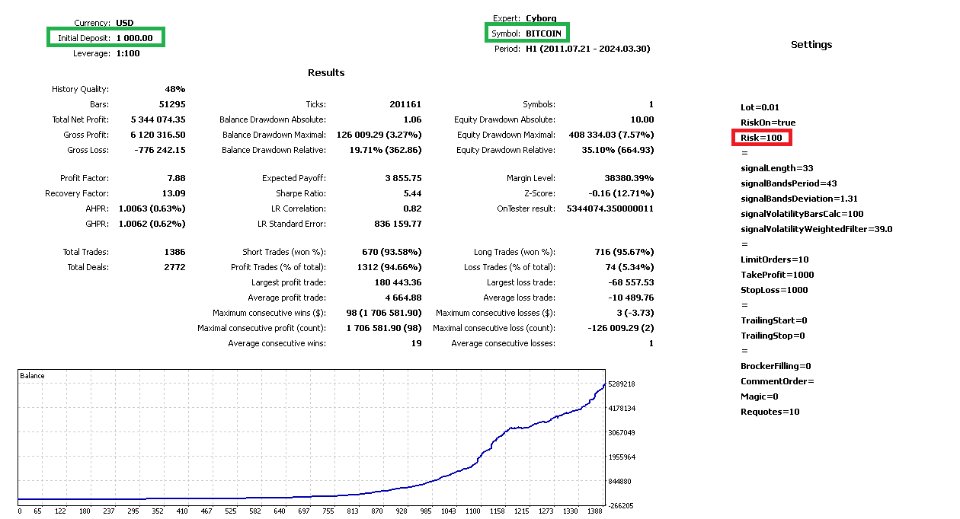

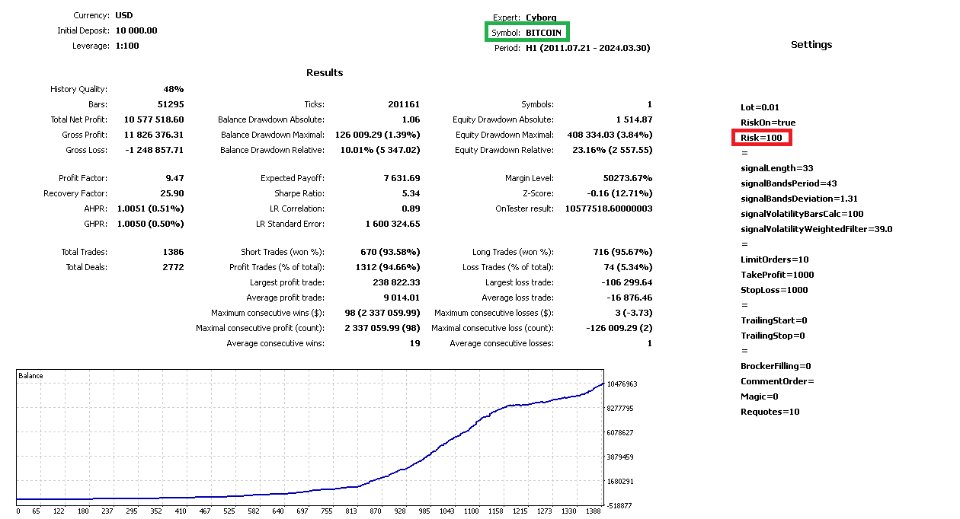

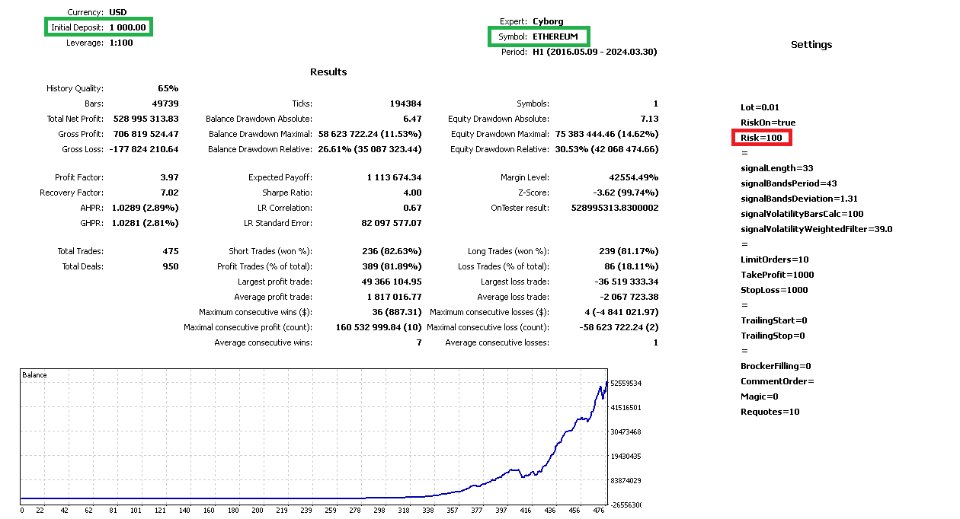

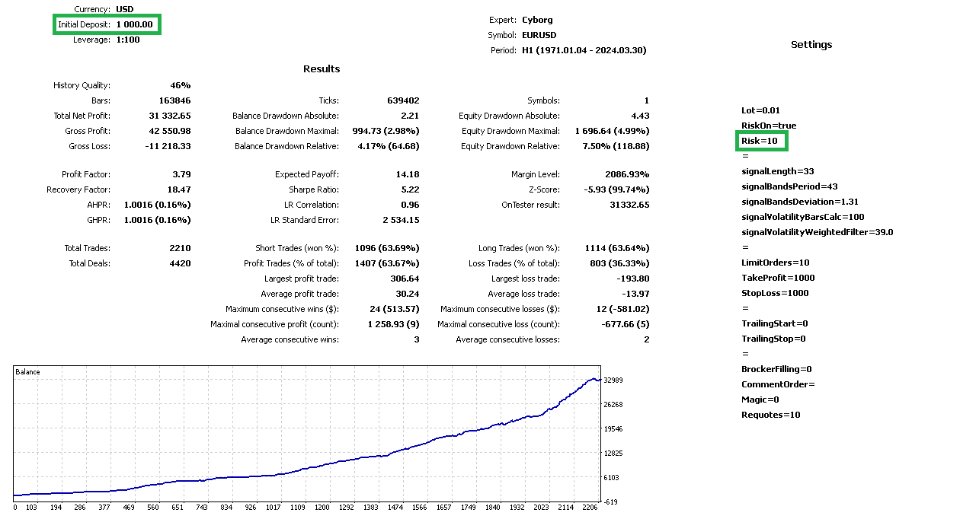

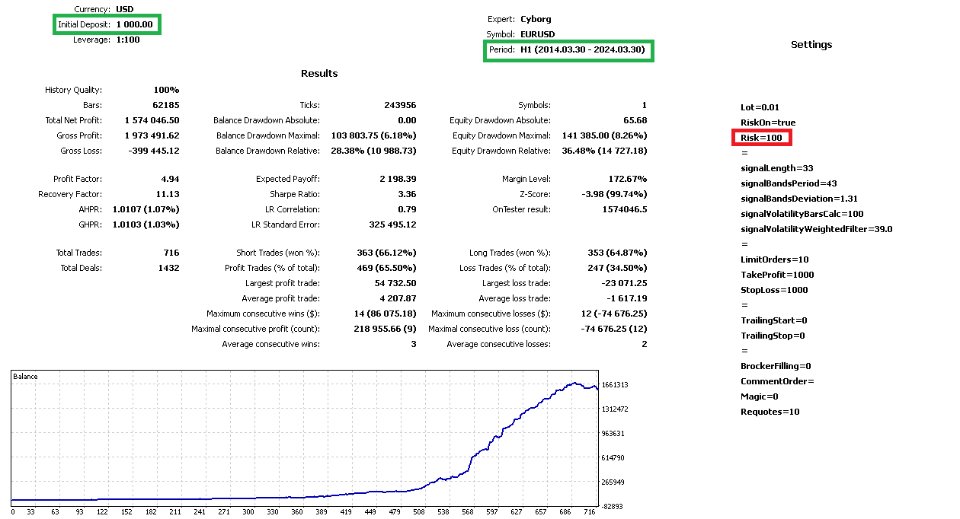

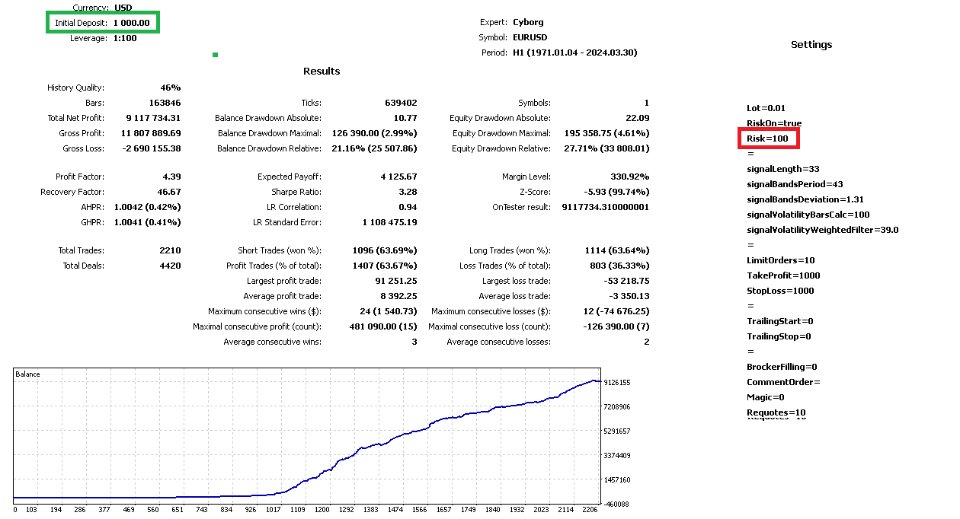

The Cyberosaurus bot is an innovative next-generation bot that serves as a powerful tool for trading in the classic Forex market and with cryptocurrencies (for corresponding brokers). It operates with the majority of pairs, so it is advisable to test it before using it on a specific pair. It is specifically designed to work with these markets, without the ability to trade other assets such as stocks or indices.

The main control parameters of the bot are presented in a convenient and concise management interface. This allows traders to easily adjust and monitor the bot's operation.

The bot includes the key requirements of modern trading systems. It provides capital management through risk regulation, allowing traders to effectively control the level of risk on their accounts. Additionally, the bot supports multicurrency trading, meaning it can work simultaneously on multiple currency pairs.

Special attention is given to the protection of each order. The bot automatically sets stop-loss and take-profit for each trade, helping to protect capital and provide a balanced approach to trading. The bot also offers the option to use a classic trailing stop-loss, which helps traders protect profits and minimize losses during price movements in the desired direction.

For the bot to work optimally on different Forex currency pairs and cryptocurrency pairs, stop-loss, take-profit, and trailing parameters are individually adjusted. These parameters depend on the volatility and price scale of each pair, meaning they will vary for the same currency pair over different time intervals. The parameters you set in the settings are conditional units that the bot automatically scales to fit the market realities.

The bot program has a complex architecture, which leads to a multitude of internal settings. However, the most important ones are grouped into convenient settings for user convenience:

- Risk (Risk Management): Responsible for parameters related to risk management in trading. This includes parameters such as the size of the trading lot, the percentage of the deposit used to open a position (fixed lot or percentage risk).

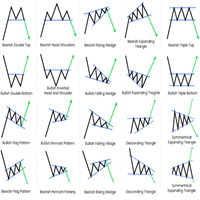

- Signal (Signal Control): This group of settings is responsible for basic signals for entering a trade. Here, you can adjust parameters that determine the conditions for opening a position.

- Limits (Order Limits): This group sets limitations on the number of simultaneously opened orders for buying and selling. It allows setting stop-loss and take-profit for the group of buy trades and separately for the group of sell trades.

- Trailing (Trailing Orders): Parameters for trailing are set here, which automatically adjusts the stop-loss in favor of profit. You can specify when trailing starts and ends, as well as set the trailing stop-loss shift.

- Environment: In this group of settings, parameters related to the environment and trading conditions on the Forex market are set.

Each of these groups contains settings that allow precise customization of the bot's behavior according to the strategy and risk management requirements.

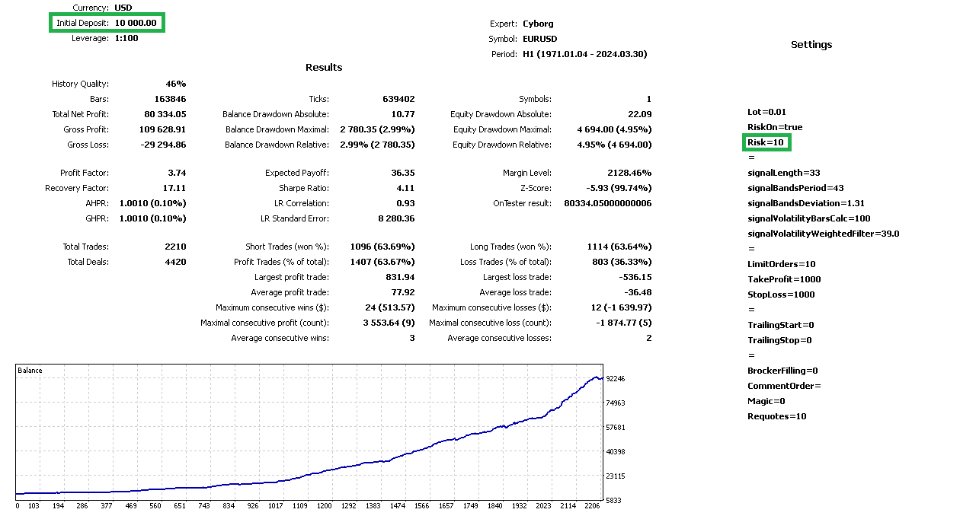

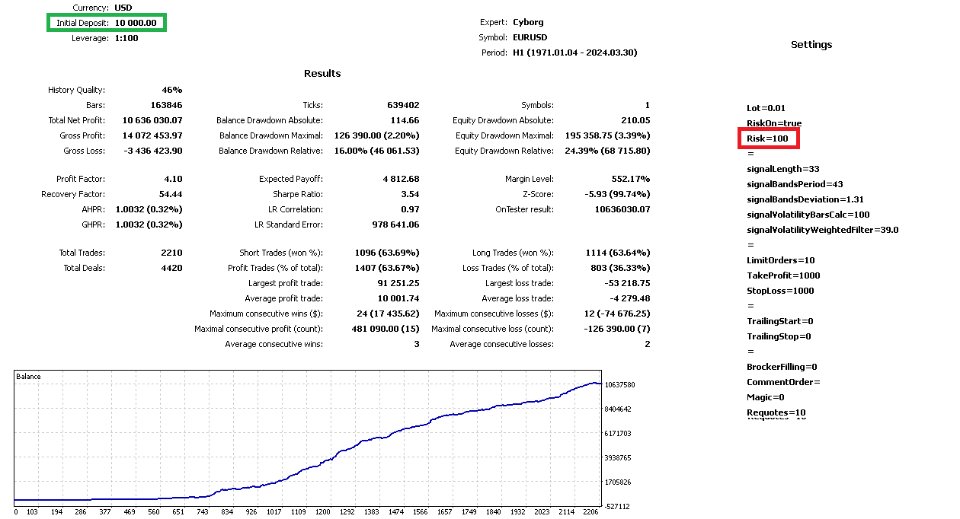

Risk (Risk Management):

- Lot: This parameter determines the size of the trading lot for each trade. You can specify a fixed lot size (e.g., 0.1 lot) or use automatic calculation based on other parameters.

- RiskOn: This parameter activates or deactivates risk management. If set to "true," the bot will use risk management to determine the lot size.

- Risk: This parameter allows you to set the risk percentage of the current balance or free margin. For example, if you set "Risk" to 10, the bot will calculate the lot size so that the risk of loss is not more than 10 units of your balance.

Signal (Signal Control):

- Length: Period length for calculating signal lines of the indicator.

- BandsPeriod: The period of the indicator used for calculating the standard deviation of the price.

- BandsDeviation: The value of the standard deviation used in calculations.

- BarsCalc: The number of bars used for signal calculation.

- WeightedFilter: Weighted coefficient for signal filtering.

Limits (Order Limits):

- LimitOrders: The maximum number of orders the bot can open simultaneously, divided into buy and sell.

- TakeProfit: Price level to set the take-profit. When the price reaches this level, the opened trade closes with a profit.

- StopLoss: Price level to set the stop-loss. When the price reaches this level, the opened trade automatically closes with minimal losses.

Trailing (Trailing Orders):

- TrailingStart: The price level at which trailing stop-loss begins.

- TrailingStop: The distance in points from the current price to the trailing stop-loss level.

Environment:

- BrockerFilling: Broker order execution mode (e.g., Instant Execution or Market Execution).

- CommentOrder: Comment on orders for easy identification.

- Magic: Unique order identification number for tracking and distinguishing orders opened by the bot or other products. It is advisable to use the bot exclusively on an account.

- Requotes: The allowable number of re-quotes (broker refusals) when opening an order. If the re-quotes level is exceeded, the order will not be executed.

In conclusion, this bot combines advanced technologies with a user-friendly management interface and a wide range of features for efficient and secure trading in the Forex and cryptocurrency markets.