Cool Wave EA with Verified Results

- Uzman Danışmanlar

- Ahmed Dwaib

- Sürüm: 1.0

- Etkinleştirmeler: 5

Important Notice:

The Fire Wave Expert Advisor is specifically designed to operate on the GBP/USD pair using the 5-minute timeframe. Using the EA on higher timeframes (such as H1 or above) significantly increases risk and could lead to higher-than-expected drawdowns. This is due to the unique calculations of the strategy, which are optimized for the 5-minute chart. However, if you prefer lower risk with lower returns, the EA can also be used on the EUR/USD pair, but with lower profit expectations.

Fire Wave Strategy Description

The Fire Wave Expert Advisor (EA) is a highly optimized trading algorithm designed to achieve stable results on the GBP/USD currency pair. Unlike most traditional Expert Advisors that rely on technical indicators, Cool Wave uses a precise cooling strategy based on carefully calculated price levels, allowing the EA to efficiently capitalize on market movements.

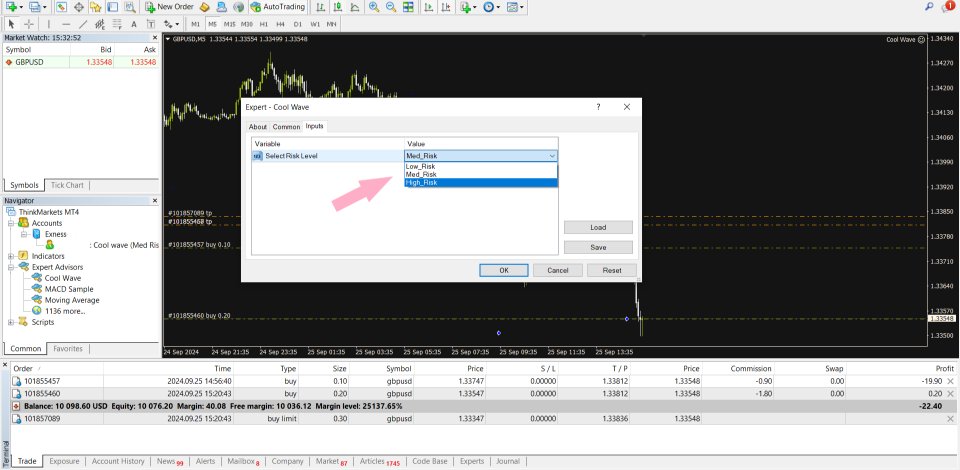

This strategy operates on three risk levels (High, Medium, Low), which can be controlled through a single simple setting in the Expert Advisor.

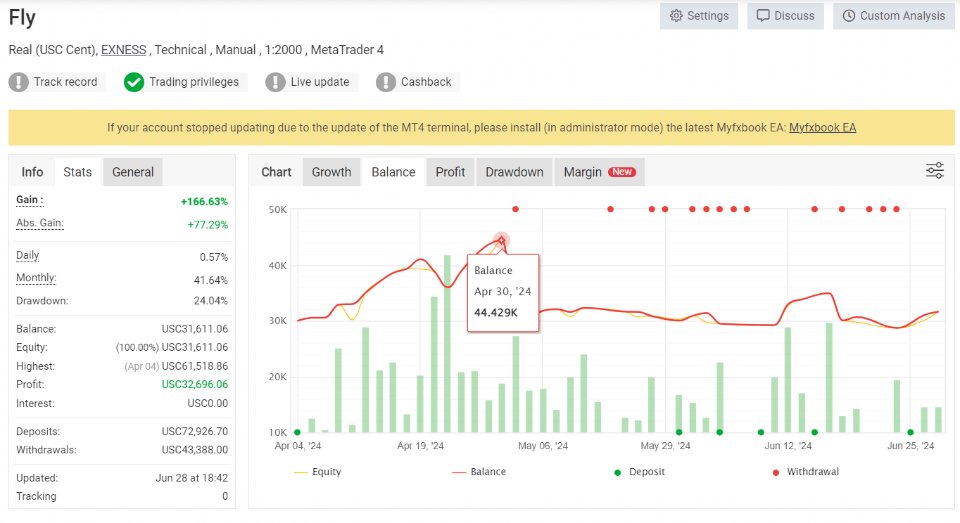

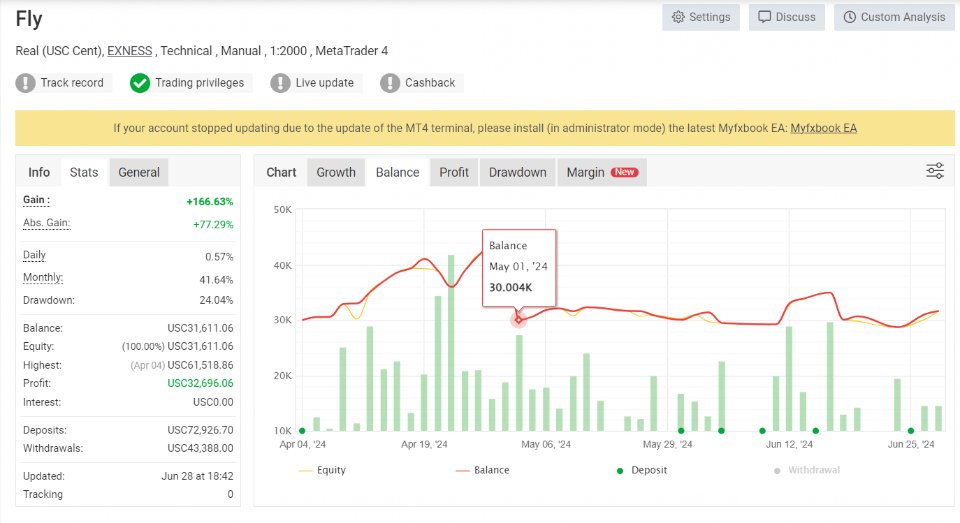

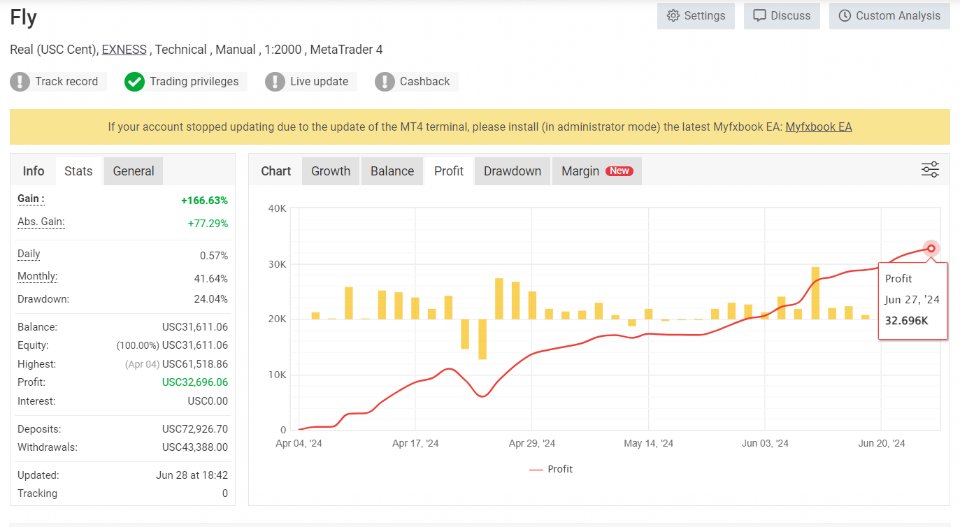

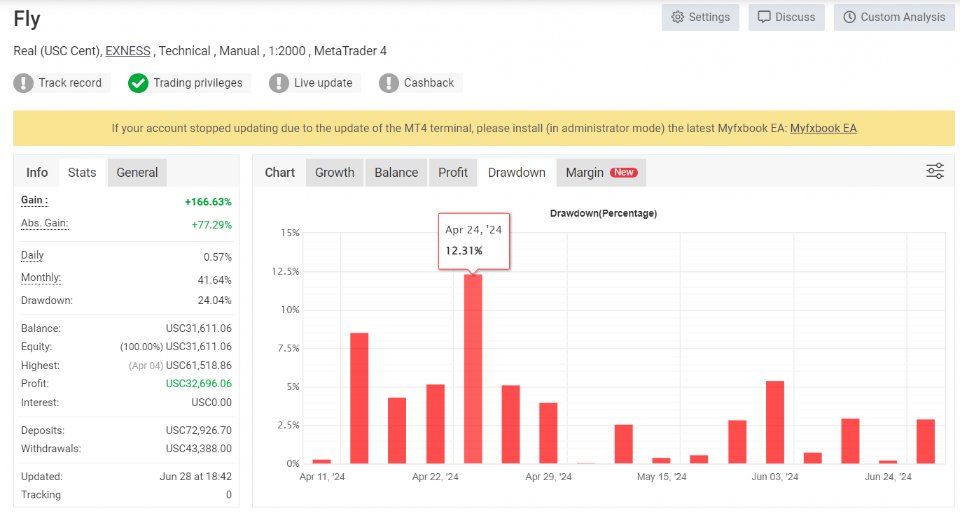

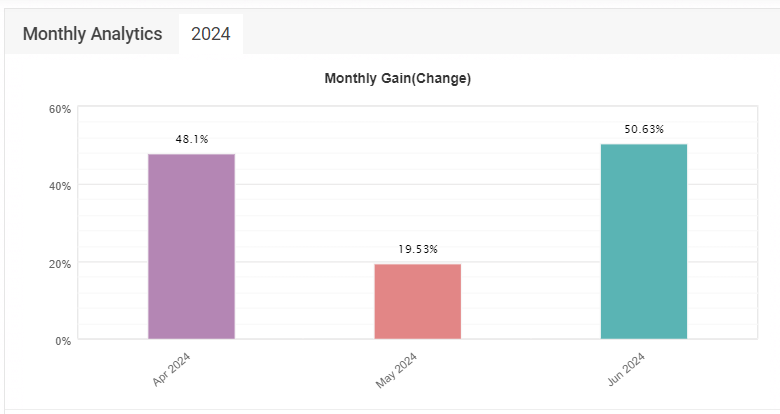

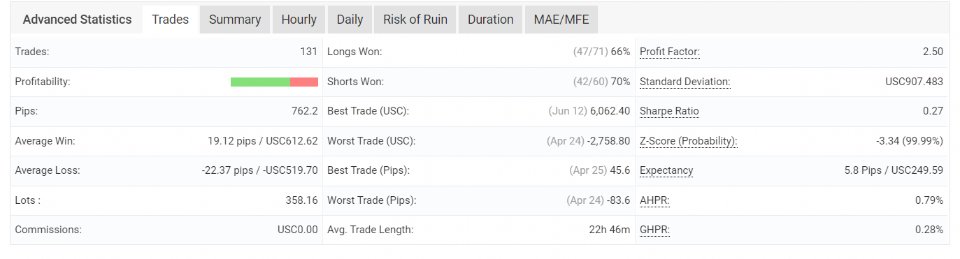

The strategy has been tested using precise data from Tick Data Suite over a span of three years, ensuring high accuracy in results. Additionally, real account performance on Myfxbook has shown excellent results, with the EA achieving a gain of 166% over three months, with an average monthly return of 41.64% and a drawdown of 24%.

General Features of the Strategy:

-

Calculated Risk Management: The strategy offers three different risk levels (High, Medium, Low) to suit various types of investors.

-

Reliable Results: All results and tests have been conducted over 3 years using precise data, ensuring high reliability.

-

Flexible Financial Management: The strategy offers the potential for large profits, with the ability to reinvest or withdraw profits regularly, according to the investor's preferences.

-

Compatible with Various Account Types: The strategy works with both Standard accounts and Cent or Micro accounts, making it suitable for all investment sizes.

-

Simple Control: With just one setting, users can easily control the risk level and achieve the ideal balance between risk and returns.

Risk Levels:

High Risk:

-

Monthly Returns: An average of 50% of capital.

-

Annual Compound Returns: Approximately 130 times the initial capital without withdrawing profits.

-

Annual Returns with 50% Monthly Withdrawals: Approximately 15 times the initial capital.

-

Minimum Deposit: $1000 for standard accounts (or $10 for cent/micro accounts).

-

Real Account Performance: A cent account with $300 achieved 166% in 3 months, with profit withdrawals in the last two months, and a maximum drawdown of 24%.

Medium Risk:

-

Monthly Returns: An average of 33%.

-

Annual Compound Returns: Approximately 30 times the initial capital without withdrawing profits.

-

Annual Returns with 50% Monthly Withdrawals: Approximately 6.25 times the initial capital.

-

Minimum Deposit: $1200 for standard accounts (or $12 for cent/micro accounts).

Low Risk:

-

Monthly Returns: An average of 20%.

-

Annual Compound Returns: Approximately 8.91 times the initial capital without withdrawing profits.

-

Annual Returns with 50% Monthly Withdrawals: Approximately 3.73 times the initial capital.

-

Minimum Deposit: $1500 for standard accounts (or $15 for cent/micro accounts).

Estimated Projections:

High Risk:

-

Without Profit Withdrawals: Using an annual compound calculation, an investment of $1000 could grow to approximately $130,000 after one year.

-

With 50% Monthly Withdrawals: The investment could reach approximately $15,000 after one year.

Medium Risk:

-

Without Profit Withdrawals: An investment of $1200 could grow to approximately $36,000 after one year.

-

With 50% Monthly Withdrawals: The investment could reach approximately $7,500 after one year.

Low Risk:

-

Without Profit Withdrawals: An investment of $1500 could grow to approximately $13,365 after one year.

-

With 50% Monthly Withdrawals: The investment could reach approximately $5,600 after one year.

How to Use:

-

Choosing a Risk Level: This is done through the settings in the Expert Advisor. You can choose the risk level based on your risk tolerance and investment goals.

-

Depositing the Appropriate Capital: Set the deposit amount based on the chosen risk level. Make sure to meet the minimum deposit requirement to achieve optimal performance.

-

Managing Profits and Withdrawals: You can either reinvest the profits to achieve compound returns or withdraw a portion of the profits monthly to balance growth and financial security.

Conclusion:

Whether you are seeking aggressive returns or steady growth, the Fire Wave EA offers a unique trading strategy designed for all types of traders. With an easy setup, verified real results, and three risk options, this EA provides an ideal solution for traders looking for a reliable and tested system in the forex market. Additionally, the documented performance on Myfxbook over three months further reinforces its credibility and ability to deliver consistent profits.

"For a detailed overview of account performance, please refer to the illustrative screenshots provided below from FX My Book."