Range Breakout EA with Range Filters

- Uzman Danışmanlar

- Jimmy Peter Eriksson

- Sürüm: 1.40

- Güncellendi: 13 Eylül 2024

- Etkinleştirmeler: 10

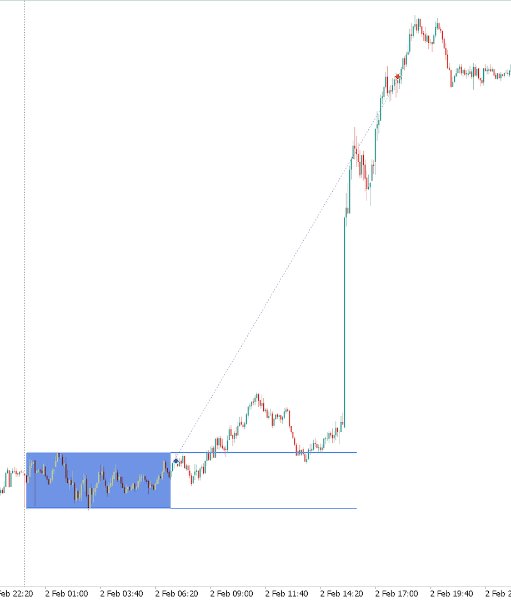

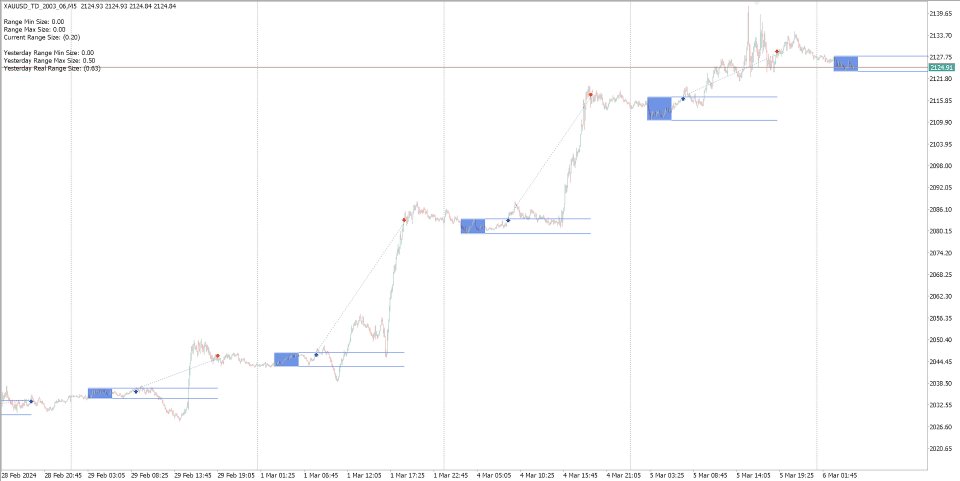

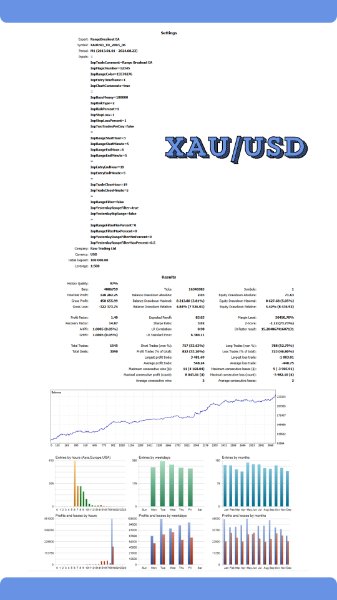

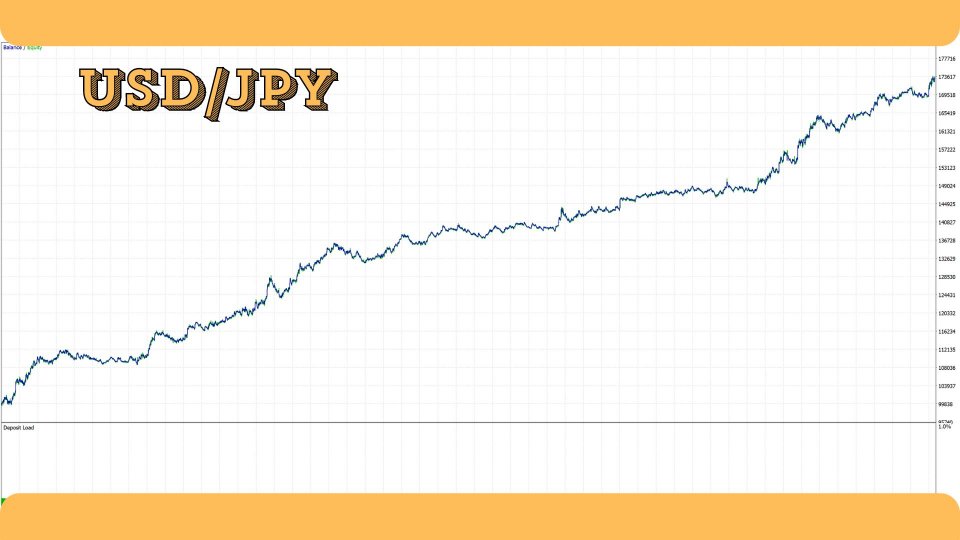

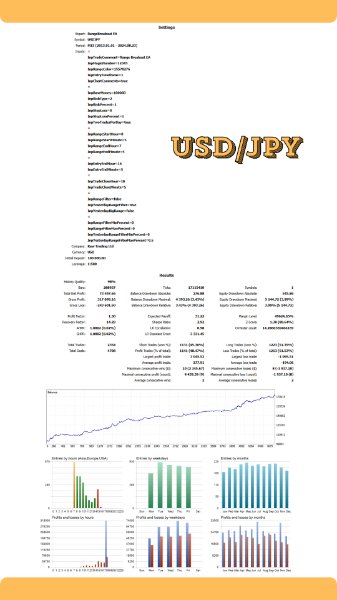

This bot utilizes a proven trading concept: markets often see significant movements during active periods, particularly around the London and New York sessions. Instead of predicting market direction, the strategy sets a range during the quieter Asian session hours and trades the breakout, riding the momentum until the New York session slows down.

Using the 1-minute timeframe, the bot enters trades at the start of the next candle after a breakout, ensuring realistic backtesting results without the need for specialized tick data. It also includes filters to avoid trading in exhausted markets, following the principle that breakouts are stronger after smaller price movements—a concept used by renowned trader Andrea Unger.

This strategy is especially effective in trending markets with significant intraday moves, such as XAU/USD and USD/JPY, but can be applied to many other markets as well.

Optimization Tips:

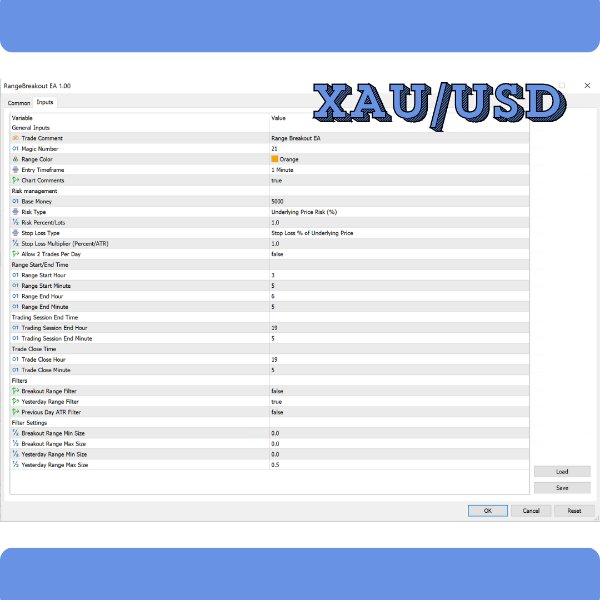

To achieve the best results with this EA, aim to create the range during the low-volatility hours of the Asian session. Then, set the bot to trade breakouts during the London session and close positions at the end of the New York session.

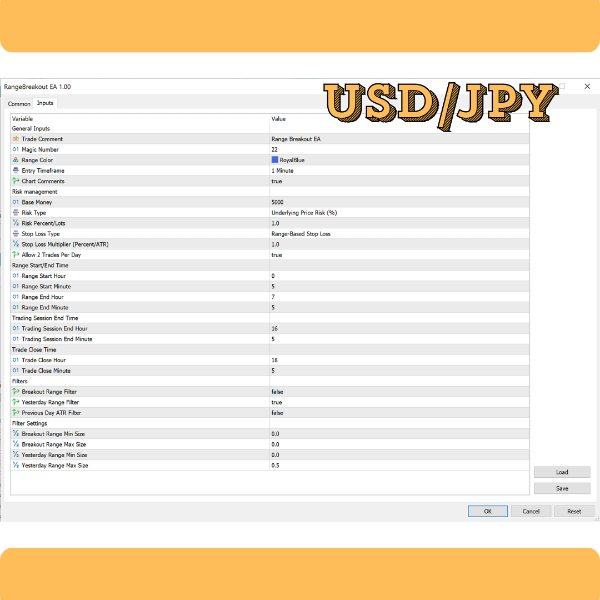

For convenience, screenshots are provided showing optimal settings for XAU/USD and USD/JPY, both optimized for GMT +3. Ensure you adjust your settings according to your local time zone to align with the recommended hours.

Got questions about setting up the bot? Feel free to reach out—I'm happy to help!

<General Inputs>

Trade Comment: A label for all trades made by the EA.

Magic Number: Unique identifier for the EA's trades.

Range Color: Color of the price range on the chart.

Entry Timeframe: Timeframe used for trade entries (recommended M1).

Chart Comments: Enables or disables comments on the chart.

<Risk Management>

Base Money: Reference account balance for calculating risk.

Risk Type: Method for calculating trade risk (Lots, underlying price percent, or percent based on stop loss distance).

Risk Percent/Lots: Amount of risk per trade (Percentage or fixed lots).

Stop Loss Type: Method for setting stop loss (Daily ATR value, underlying price percent, or range-based stop loss).

Stop Loss Multiplier: Sets the stop loss distance based on a percentage of the underlying price or ATR.

Allow 2 Trades Per Day: Enables up to two trades per day (if enabled, one buy and one sell trade are allowed; if disabled, only one trade is allowed).

<Range Start/End Time>

Range Start Hour: Hour when the EA starts identifying the price range.

Range Start Min: Minute when the EA starts identifying the price range.

Range End Hour: Hour when the EA stops identifying the price range.

Range End Min: Minute when the EA stops identifying the price range.

<Trading Session End Time>

Trading Session End Hour: Hour when no more trades will be entered for the day.

Trading Session End Minute: Minute when no more trades will be entered for the day.

<Trade Close Time>

Trade Close Hour: Hour when open trade is closed.

Trade Close Minute: Minute when open trades is closed.

<Day Of The Week Filter>

First Trading Day Of The Week: Sets the first day to allow trades, starting from 1 (Monday) through 5 (Friday). For crypto, 6 is Saturday, and 0 is Sunday.

Last Trading Day Of The Week: Sets the final day to allow trades, with 5 being Friday. For crypto, 6 is Saturday, and 0 is Sunday.

<Breakout Range Filter>

Breakout Range Filter: Blocks trades if the current day’s breakout range is too large or small.

Breakout Range Min Size: Minimum range size compared to the underlying price in percent.

Breakout Range Max Size: Maximum range size compared to the underlying price in percent.

<Yesterday Range Filter>

Yesterday Range Filter: Blocks trades if yesterday's total range is too large or small.

Yesterday Range Min Size: Minimum size of yesterdays total range compared to the underlying price in percent.

Yesterday Range Max Size: Maximum size of yesterdays total range compared to the underlying price in percent.

<Previous Day ATR Filter>

Previous Day ATR Filter: Prevents trading if yesterday's total range exceeded the daily ATR Filter.

ATR Filter Multiplier Max Size: The maximum allowed range for the previous day is the daily ATR multiplied by this value.

Jimmy is just a smart guy. He help me with all my questions. Nice to see a guy here at mql5 woh is no scammer! The Bot works perfect! Thank you!