Eldoria Expert MT5

- Uzman Danışmanlar

- Ruengrit Loondecha

- Sürüm: 24.806

- Etkinleştirmeler: 10

---------------------------------------------------------

---------------------------------------------------------

Eldoria Expert MT5

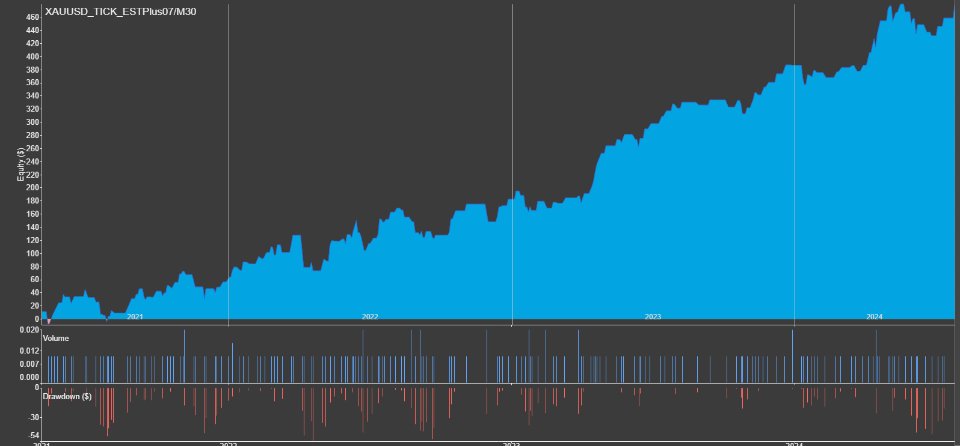

- Optimal Performance: Designed to work best with GOLD on the M30 timeframe.

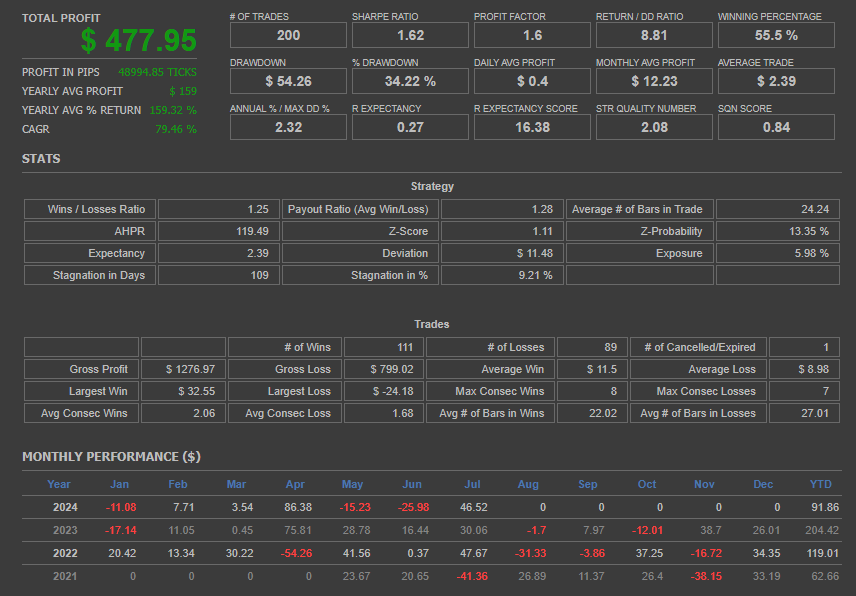

- Capital Requirements: Minimum starting capital of $300-$500 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Eldoria Expert MT5

- Optimal Performance: Designed to work best with GOLD on the M30 timeframe.

- Capital Requirements: Minimum starting capital of $300-$500 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts

-

Fast KAMA (Kaufman's Adaptive Moving Average):

- Fast KAMA is an adaptive moving average that adjusts its sensitivity based on market volatility. It reacts quickly to price changes, offering a smooth and responsive trend indicator that helps identify trend direction and potential reversal points.

-

Moving Average Convergence Divergence (MACD):

- MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. It consists of the MACD line, the signal line, and the histogram, helping to identify trend changes, buy and sell signals, and the strength of momentum.

-

Oscillator of Moving Average (OSMA):

- OSMA measures the difference between the MACD line and its signal line, highlighting the momentum behind the MACD. It is used to confirm trends and potential reversals by showing the strength of price movements.

-

Quantitative Qualitative Estimation (QQE):

- QQE is an enhanced version of the RSI that includes smoothing and volatility filters. It helps provide clearer trend signals and reduce market noise, offering a refined view of momentum and potential reversals.

-

Awesome Oscillator (AO):

- AO measures the difference between a 34-period and a 5-period simple moving average of the median price. It helps identify market momentum and potential trend reversals by showing the strength and direction of trends.

Trade Style

-

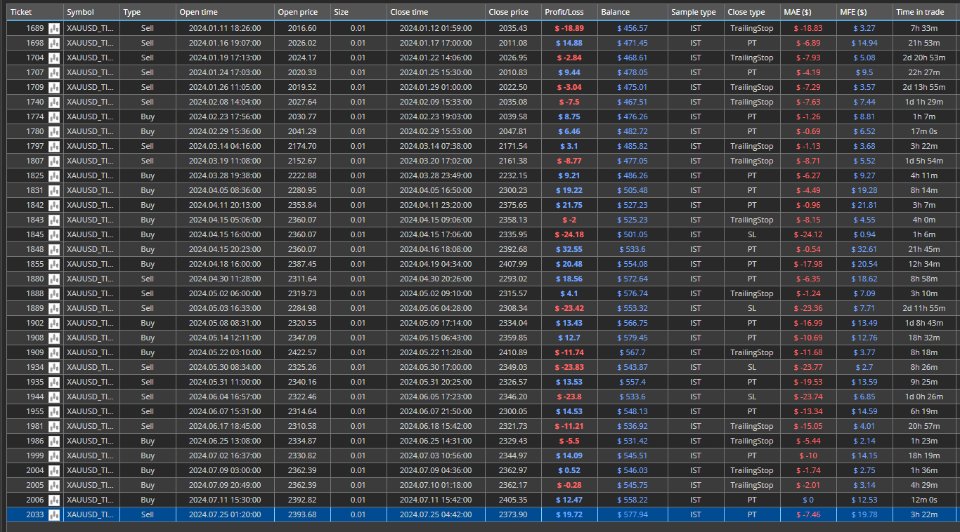

Stop Loss (SL) by Percentage:

- The stop-loss level is set as a fixed percentage away from the entry price. This method helps manage risk by defining a clear exit point if the market moves against the position.

-

Take Profit (TP) by ATR Coefficient:

- The take-profit level is determined by a multiple of the Average True Range (ATR). This method adjusts the profit target based on market volatility, allowing for flexible and adaptive profit-taking.

-

Move SL to Break Even (MoveSL2BE) with LowDaily:

- Once the trade has moved favorably, the stop-loss is adjusted to the break-even point (entry price). Additionally, the move to break-even is adjusted by the LowDaily value, which represents the lowest price of the trading day. This ensures that the stop-loss is set to minimize risk while capturing some profit if the market moves in favor.

-

Trailing Stop by SMMA (Smoothed Moving Average):

- The trailing stop is set using the Smoothed Moving Average (SMMA). SMMA smooths out price data to reflect the overall trend direction with less noise. The stop-loss follows the SMMA line, adjusting to price changes and helping lock in profits while allowing the trade to continue in the trend's direction.