Emberhaven Expert MT5

- Uzman Danışmanlar

- Ruengrit Loondecha

- Sürüm: 24.806

- Etkinleştirmeler: 10

---------------------------------------------------------

---------------------------------------------------------

Emberhaven Expert MT5

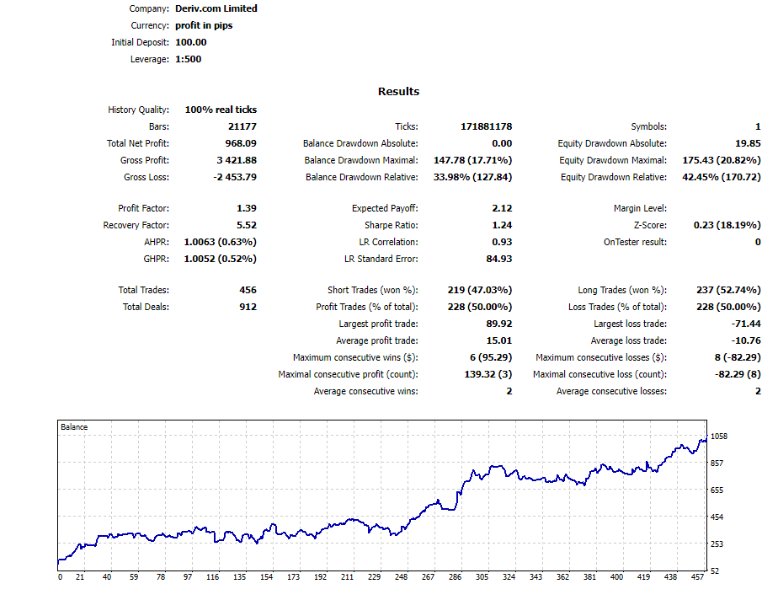

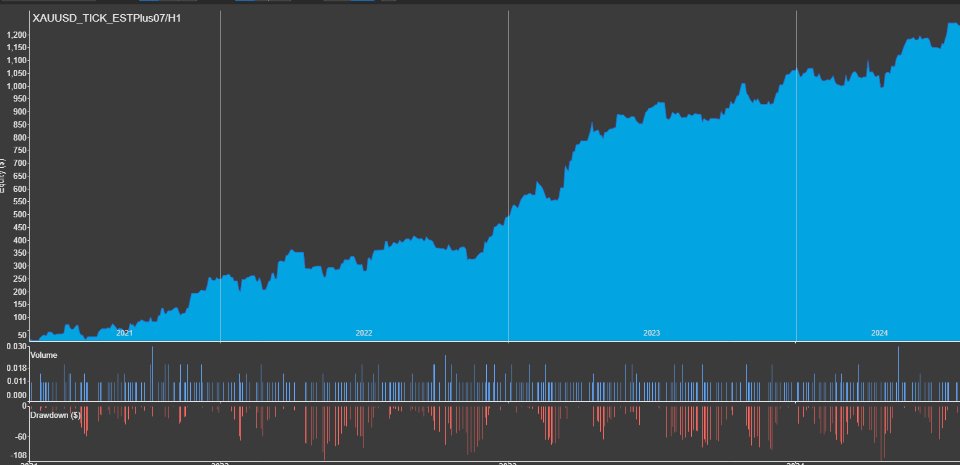

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$300 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Emberhaven Expert MT5

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$300 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Indicators and Concepts---------------------------------------------------------

-

SuperTrend:

- SuperTrend is a trend-following indicator that combines the Average True Range (ATR) with a multiplier to set dynamic support and resistance levels. It helps identify the direction of the trend and provides signals for potential entries and exits.

-

Quantitative Qualitative Estimation (QQE):

- QQE is an advanced version of the RSI, incorporating volatility filters to provide smoother and more reliable trend signals. It helps identify market trends and potential reversals by analyzing price momentum and volatility.

-

Average True Range (ATR):

- ATR measures market volatility by calculating the average range between the high and low prices over a specified period. It helps determine the size of stop-loss and take-profit levels, adjusting for market volatility.

-

Average Volume (AvgVolume):

- AvgVolume calculates the average trading volume over a specific period. It provides insight into market activity and liquidity, helping confirm the strength of price movements.

-

Stochastic Oscillator (Stoch):

- The Stochastic Oscillator measures the closing price relative to the high-low range over a specific period. It ranges from 0 to 100, with readings above 80 indicating overbought conditions and readings below 20 indicating oversold conditions. It helps identify potential market reversals and momentum.

Trade Style

-

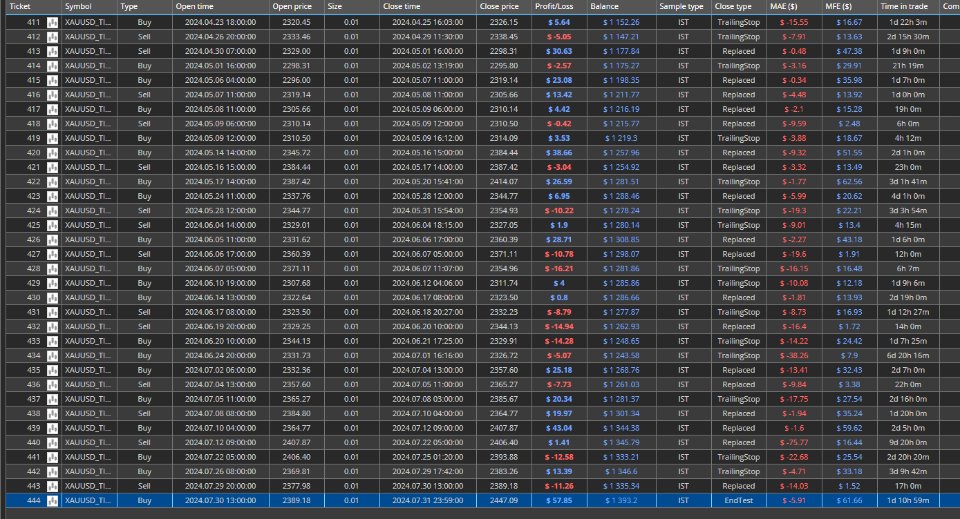

Open/Reverse Order:

- This strategy involves opening a new position or reversing an existing one based on market signals. For example, if a trend changes or a new signal is generated, the trader might open a new position or reverse their current position accordingly.

-

Trailing Stop by Session Time:

- A trailing stop is adjusted based on the highest or lowest price achieved during the trading session. This approach locks in profits by trailing the stop-loss level as the market moves favorably, following the session's price action.

-

Take Profit (TP) and Stop Loss (SL) with Percentage:

- TP and SL levels are set as fixed percentages from the entry price. This method provides clear exit points for both profits and losses, allowing for a consistent approach to managing risk and potential gains.