Ethereal Expert MT5

- Uzman Danışmanlar

- Ruengrit Loondecha

- Sürüm: 24.806

- Etkinleştirmeler: 10

---------------------------------------------------------

---------------------------------------------------------

Immaculate Expert MT5

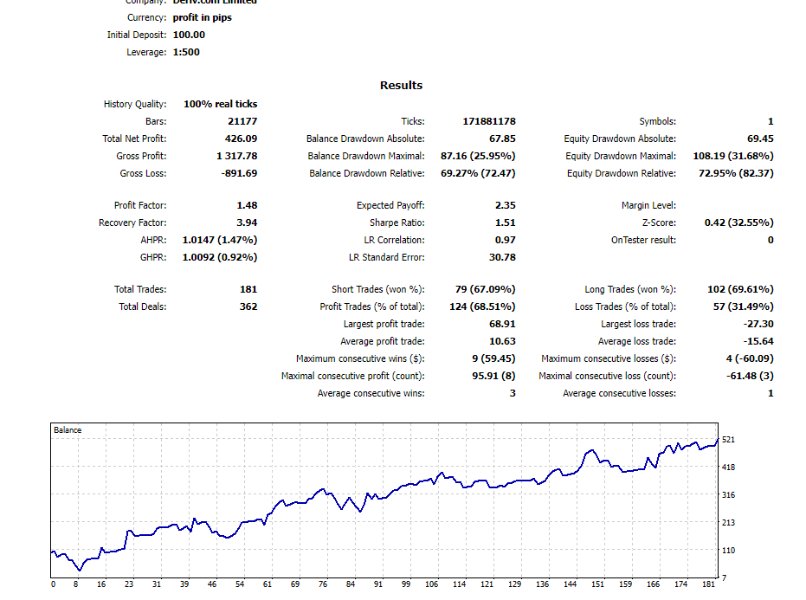

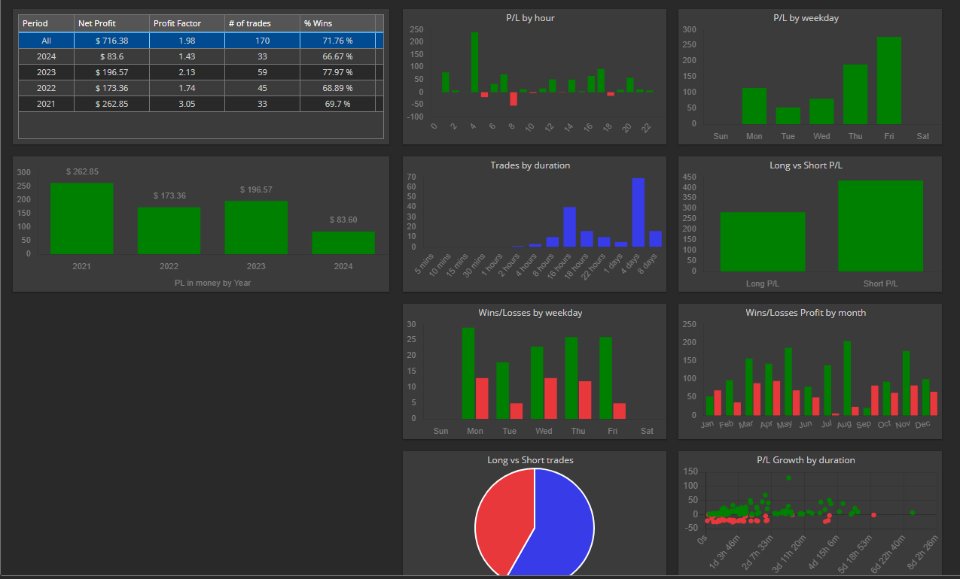

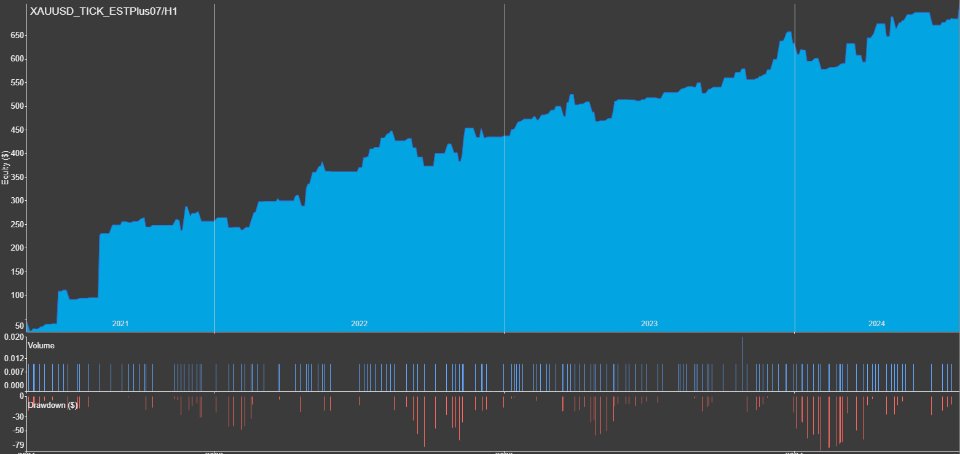

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$300 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Immaculate Expert MT5

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$300 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts

-

Bears 'n Bulls:

- Bears 'n Bulls is a market sentiment indicator that visualizes the balance between bearish and bullish market pressure. It provides insights into the strength of the current trend and potential reversal points by comparing the number of bearish versus bullish signals.

-

Laguerre RSI:

- Laguerre RSI is a variation of the traditional RSI that uses Laguerre filters to smooth out the indicator and reduce lag. It provides a more responsive measure of momentum, helping to identify overbought or oversold conditions with reduced noise.

-

Ulcer Index:

- The Ulcer Index measures the volatility and drawdowns of a trading strategy or asset. It quantifies the depth and duration of price declines, providing insights into the risk associated with a particular asset or strategy.

-

Commodity Channel Index (CCI):

- CCI is a momentum-based oscillator that measures the deviation of the price from its average over a specified period. It helps identify overbought or oversold conditions and potential trend reversals by comparing the price level to its average.

-

Vortex Indicator:

- The Vortex Indicator consists of two lines: the VI+ and VI-. These lines measure the strength of positive and negative price movements. When the VI+ crosses above the VI-, it signals an uptrend, while a cross below indicates a downtrend. The Vortex Indicator helps identify trend direction and strength.

Trade Style

-

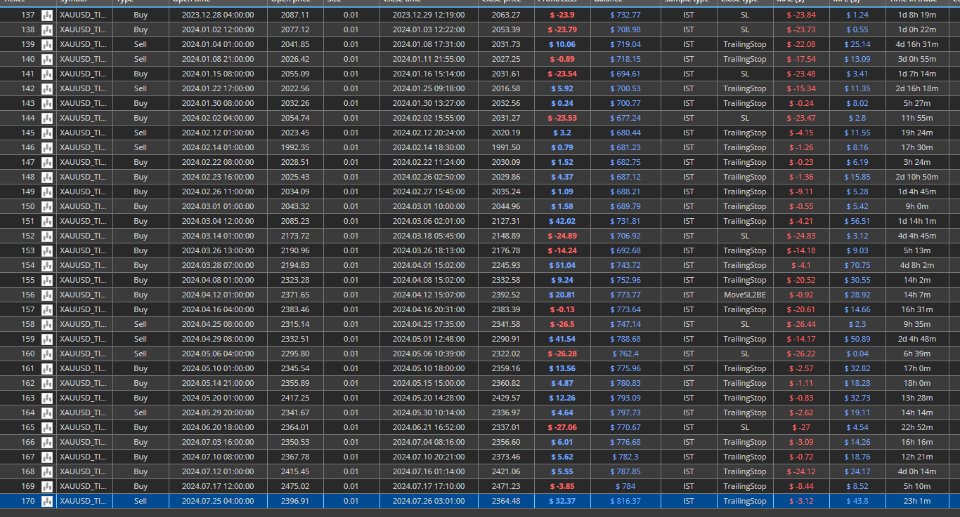

Instant Entry:

- An instant entry order involves entering a trade at the current market price. This approach is used when a trading signal indicates a strong potential for a favorable price movement, necessitating immediate action.

-

Stop Loss (SL) and Take Profit (TP) by Percentage:

- SL and TP levels are set as fixed percentages from the entry price. This approach establishes clear exit points based on predetermined percentages, providing consistent risk and reward management.

-

Move SL to Break Even (MoveSL2BE) with Keltner:

- The stop-loss is moved to the break-even point (entry price) once the trade has moved favorably by a distance defined by the Keltner Channel. The Keltner Channel, based on ATR, provides a volatility-adjusted distance for moving the stop-loss, ensuring that initial risk is minimized while locking in gains.

-

Add Pips for MoveSL2BE:

- In addition to moving the stop-loss to the break-even point, a certain number of pips are added to secure some profit. This is done by calculating the distance based on the ATR and adding pips to the break-even level.

-

Trailing Stop by LWMA:

- The trailing stop is set using the Linear Weighted Moving Average (LWMA). LWMA places more weight on recent price data compared to other moving averages, providing a more responsive trailing stop. The stop-loss follows the LWMA line, adapting to price changes while locking in profits as the trend continues.