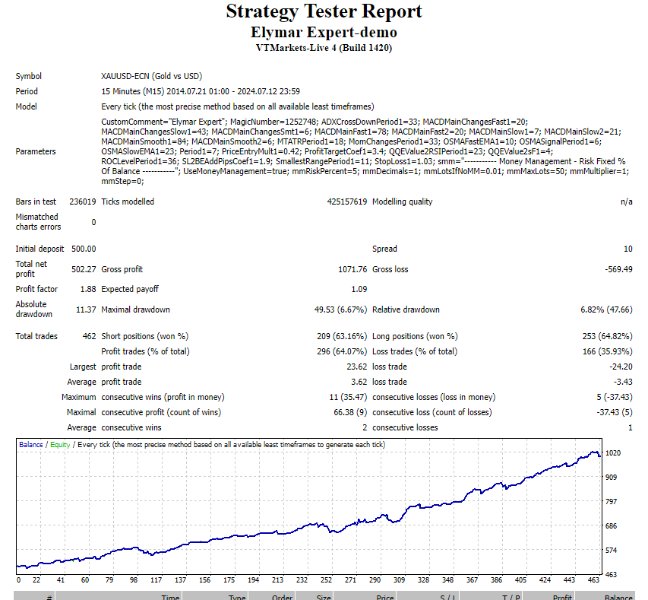

Elymar Expert

- Uzman Danışmanlar

- Ruengrit Loondecha

- Sürüm: 1.1

- Etkinleştirmeler: 10

- Elymar Expert

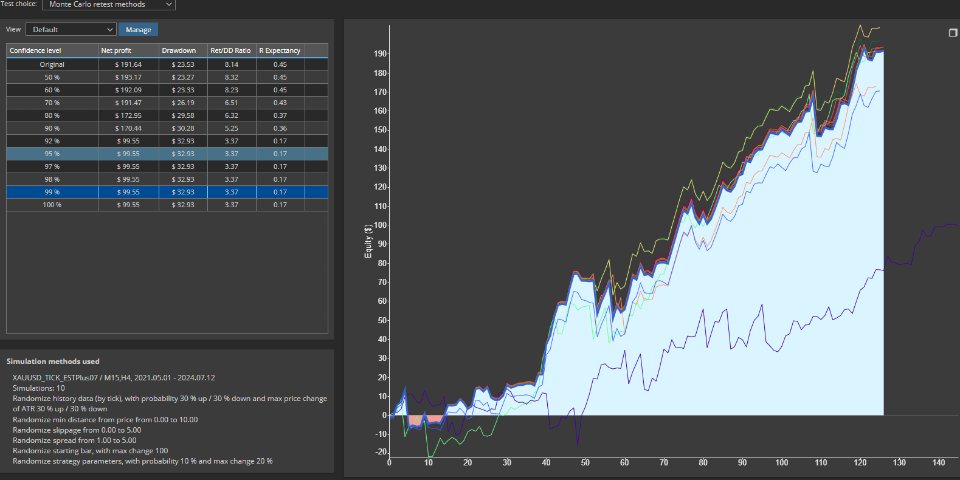

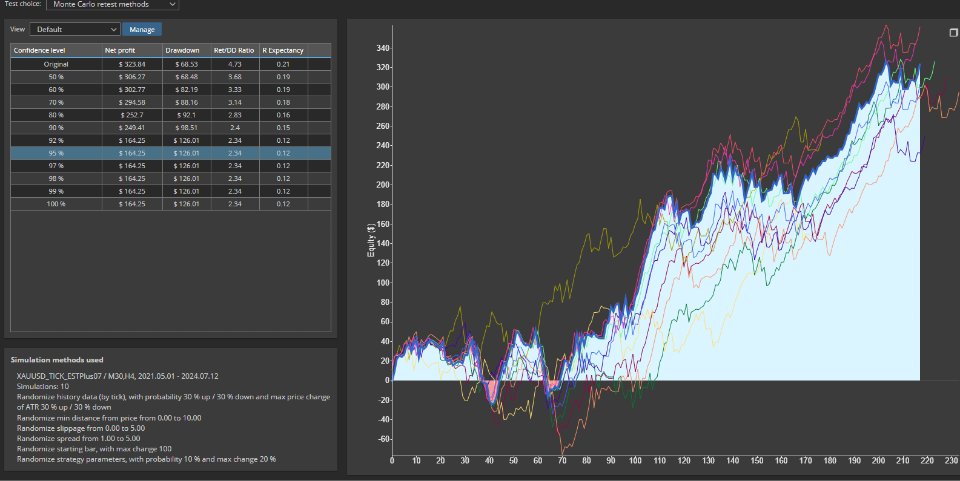

- Working best with GOLD - M15

- Require minimal 100$ for 0.01 (AutoLot feature inside)

- Optimize update monthly. stay in Comment

- Live trade @ https://t.me/lullfrx

Indicators and Concepts

-

Rate of Change (ROC):

- ROC measures the percentage change in price over a specified period, indicating the speed of price movements. It helps identify momentum shifts and potential reversals.

-

Momentum:

- Momentum measures the rate at which a security's price is changing. Positive momentum indicates an uptrend, while negative momentum suggests a downtrend. It helps in assessing the strength and direction of the trend.

-

Oscillator of Moving Average (OSMA):

- OSMA is the difference between the MACD line and its signal line. It indicates the momentum behind the MACD and helps confirm trend strength and potential reversals.

-

Awesome Oscillator (AO):

- AO measures the difference between a 34-period and a 5-period simple moving average of the median price. It helps identify market momentum and potential trend reversals.

-

Average Directional Index (ADX):

- ADX measures the strength of a trend, regardless of direction. High ADX values indicate strong trends, while low values suggest weak trends or a range-bound market.

Trade Style

-

Highest in Range Stop Order:

- A stop order is placed based on the highest price achieved during a specified range (e.g., daily or weekly). This helps enter or exit trades based on significant price levels within that range.

-

Lowest Trailing:

- The trailing stop is adjusted to follow the lowest price achieved within a specified range. This approach locks in profits as the market moves in your favor, by adjusting the stop-loss level to the lowest point during the trend.

-

Session Close Move to Break Even (MOVE2BE):

- The move-to-break-even strategy is triggered at the end of the trading session. Once the market has moved favorably, the stop-loss is adjusted to the break-even point to protect gains and avoid a loss.

-

Take Profit (TP) with ATR:

- The take-profit level is set based on a multiple of the Average True Range (ATR). This dynamic approach adjusts the TP level according to market volatility, providing a flexible profit target.

-

Stop Loss (SL) by Percentage:

- The stop-loss is set as a fixed percentage away from the entry price. This method limits potential losses to a specific percentage of the trade's value, managing risk effectively.