FVG Instantaneous Mitigation Signals for MT4

- Göstergeler

- Minh Truong Pham

- Sürüm: 1.0

- Etkinleştirmeler: 5

The FVG Instantaneous Mitigation Signals indicator detects and highlights "instantaneously" mitigated fair value gaps (FVG), that is FVGs that get mitigated one bar after their creation, returning signals upon mitigation.

Take profit/stop loss areas, as well as a trailing stop loss are also included to complement the signals.

🔶 USAGE

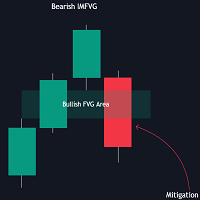

Figure 1

Instantaneous Fair Value Gap mitigation is a new concept introduced in this script and refers to the event of price mitigating a fair value gap one bar after its creation.

The resulting signal sentiment is opposite to the bias of the mitigated fair value gap. As such an instantaneously mitigated bearish FGV results in a bullish signal, while an instantaneously mitigated bullish FGV results in a bearish signal.

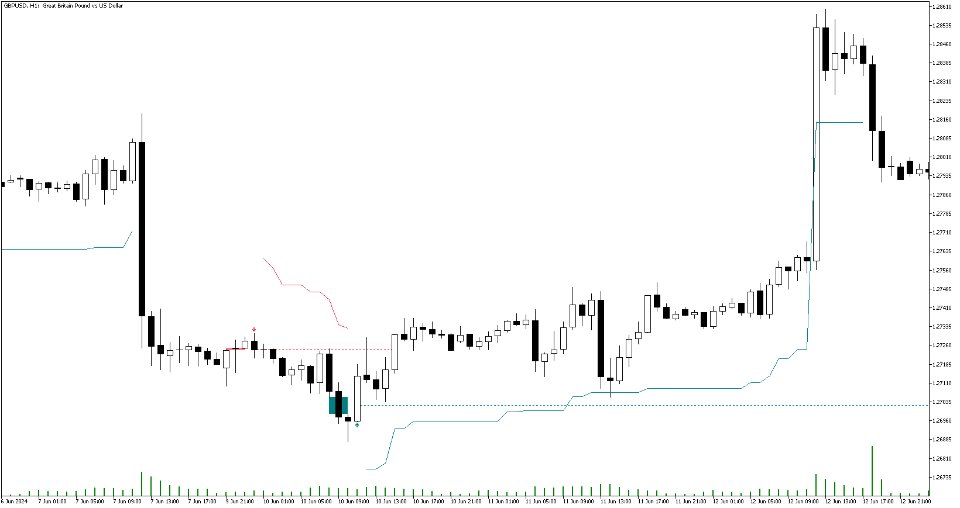

Figure 2

Fair value gap areas subject to instantaneous mitigation are highlighted alongside their average level, this level is extended until reached in a direction opposite to the FVG bias and can be used as a potential support/resistance level.

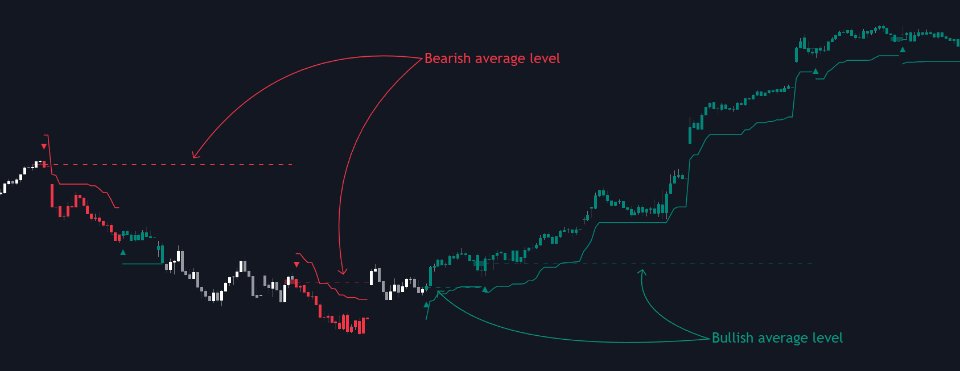

Figure 3

Users can filter out less volatile fair value gaps using the "FVG Width Filter" setting, with higher values highlighting more volatile fair value gaps subject to instantaneous mitigation.

🔹TP/SL Areas

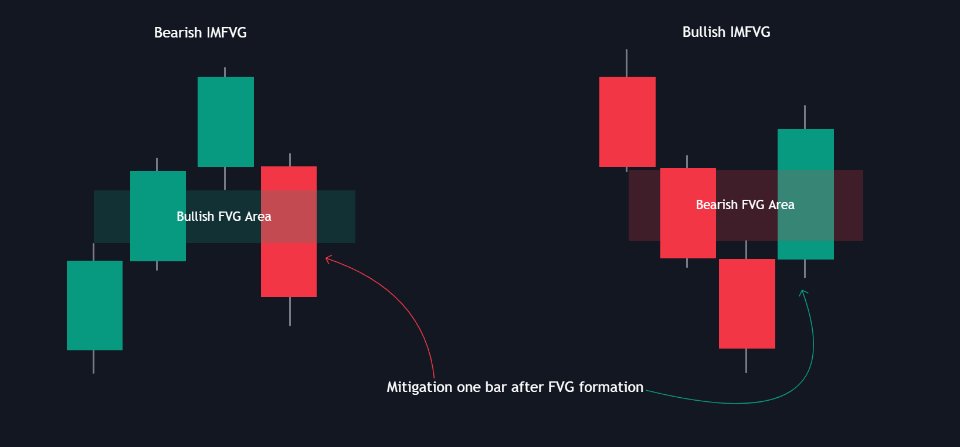

Figure 4

Users can enable take-profit/stop-loss areas. These are displayed upon a new signal formation, with an area starting from the mitigated FVG area average to this average plus/minus N ATRs, where N is determined by their respective multiplier settings.

Using a higher multiplier will return more distant areas from the price, requiring longer-term variations to be reached.

🔹Trailing Stop Loss

Figure 5

A trailing-stop loss is included, increasing when the price makes a new higher high or lower low since the trailing has been set. Using a higher trailing stop multiplier will allow its initial position to be further away from the price, reducing its chances of being hit.

The trailing stop can be reset on "Every Signal", whether they are bullish or bearish, or only on an "Inverse Signal", which will reset the trailing when a signal of opposite bias is detected, this will preserve an existing trailing stop when a new signal of the same bias to the present one is detected.

🔶 DETAILS

Figure 6

Fair Value Gaps are ubiquitous to price action traders. These patterns arise when there exists a disparity between supply and demand. The action of price coming back and filling these imbalance areas is referred to as "mitigation" or "rebalancing"."Instantaneous mitigation" refers to the event of price quickly mitigating a prior fair value gap, which in the case of this script is one bar after their creation. These events are indicative of a market more attentive to imbalances, and more willing to correct disparities in supply and demand.

If the market is particularly sensitive to imbalances correction then these can be excessively corrected, leading to further imbalances, highlighting a potential feedback process.

🔶 SETTINGS

- FVG Width Filter: Filter out FVGs with thinner areas from returning a potential signal.

🔹TP/SL

- TP Area: Enable take-profit areas for new signals.

- Multiplier: Control the distance from the take profit and the price, with higher values returning more distant TP's.

- SL Area: Enable stop-loss areas for new signals.

- Multiplier: Control the distance from the stop loss and the price, with higher values returning more distant SL's.

🔹Trailing Stop

- Reset Trailing Stop: Determines when the trailing stop is reset.

- Multiplier: Controls the initial position of the trailing stop, with higher values returning more distant trailing stops.