One day relative performance FINVIZ 1

- Yardımcı programlar

- Taman Talappetsakun

- Sürüm: 1.0

- Etkinleştirmeler: 5

In Forex trading, the 1-day relative performance statistic gives an overview of the movements of various currency pairings in a single day. For traders who want to quickly make trading decisions and comprehend short-term market movements, this statistic is essential. Here's a thorough explanation of the 1-day relative performance, its importance, and a closer look at several particular Finviz cases.

Understanding 1-Day Relative Performance

The percentage change in a currency pair's value between the close of the prior day and the close of the current day is measured by 1-day relative performance. For day traders and short-term investors who must monitor daily market changes, this performance statistic is essential. It offers insights into possible trading opportunities by assisting in determining whether currencies are strengthening or weakening in relation to one another.

Important Elements

- Percentage Change: This shows the percentage change in value of a currency pair over the previous day. A positive percentage denotes appreciation and a negative percentage denotes depreciation of the currency pair.

- A currency pair is any pair of two currencies that are being compared, such as EUR/USD, GBP/JPY, etc. For traders that concentrate on particular economies or areas, the performance of these pairs is critical.

- Volatility: Daily performance information can also reveal a currency pair's volatility. strong percentage changes frequently indicate strong volatility, which may be brought on by changes in market mood, geopolitical events, or economic news.

Significance of 1-Day Relative Performance

- Sentiment in the Market: Daily performance measurements offer perceptions into the mood of the market. A currency like the USD, for example, may be a sign of strong investor confidence in the US economy if it is performing well across various pairs.

- Trading signals: To determine when to enter and quit the market, short-term traders employ these variables. A currency pair that has been trending higher for a few days, for instance, would indicate a buy opportunity.

- Risk management: Traders can better control their risk by knowing which currencies are volatile. Although they may present greater gains, pairs with high volatility also carry a higher risk.

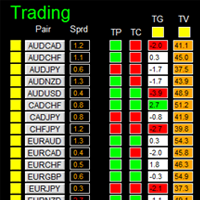

Finviz offers comprehensive measures for Forex performance, such as relative performance over one day. These are a few instances derived from the available data:

- BTCUSD: The one-day relative performance of the cryptocurrency pair BTC/USD was -0.21%. This suggests that during the previous day, Bitcoin lost 0.21% of its value relative to the US dollar

- EURUSD: The EUR/USD currency pair, another significant one, may display a distinct performance indicator. A 0.40% increase, for example, would mean that the value of the Euro increased by 0.40% in a single day relative to the US Dollar.

- GBPJPY: The British Pound has depreciated by 0.10% vs the Japanese Yen, according to the GBP/JPY pair's 1-day relative performance of -0.10%.

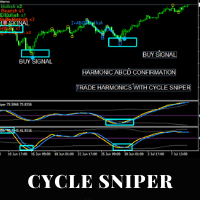

- Click here to view an example of applying the FINVIZ theory to create the EA Forex.

Interpretation of Data

In analyzing 1-day relative performance data, traders frequently search for trends. constant daily gains, for instance, might point to an upward trend, whereas constant losses might point to a downward trend. To prevent making judgments based on short-term volatility, single-day performance should be considered in the larger context of weekly and monthly performance.

Practical Use in Trading Strategies

- Scalping: Traders who engage in scalping look for small profits from minute-to-minute price changes. The 1-day relative performance helps identify which pairs are experiencing significant movement and might offer scalping opportunities.

- Day Trading: Day traders, who open and close positions within the same trading day, use 1-day performance metrics to make informed decisions. They might look for pairs that have moved significantly to capture profit from reversals or continuation patterns.

- Swing Trading: Even swing traders, who hold positions for several days, can use 1-day performance data to confirm the direction of their trades.

Conclusion

The 1-day relative performance is a crucial metric in Forex trading, providing valuable insights into daily market movements. Tools like Finviz offer comprehensive data that traders can use to gauge market sentiment, identify trading opportunities, and manage risk effectively. By understanding and utilizing this performance data, traders can make more informed and strategic decisions in the fast-paced Forex market. If you want to buy a .mq file, please get in touch with us via eaforexcenter.com