Eurusd lagging proxy trade

- Göstergeler

- GEORGIOS VERGAKIS

- Sürüm: 1.0

- Etkinleştirmeler: 5

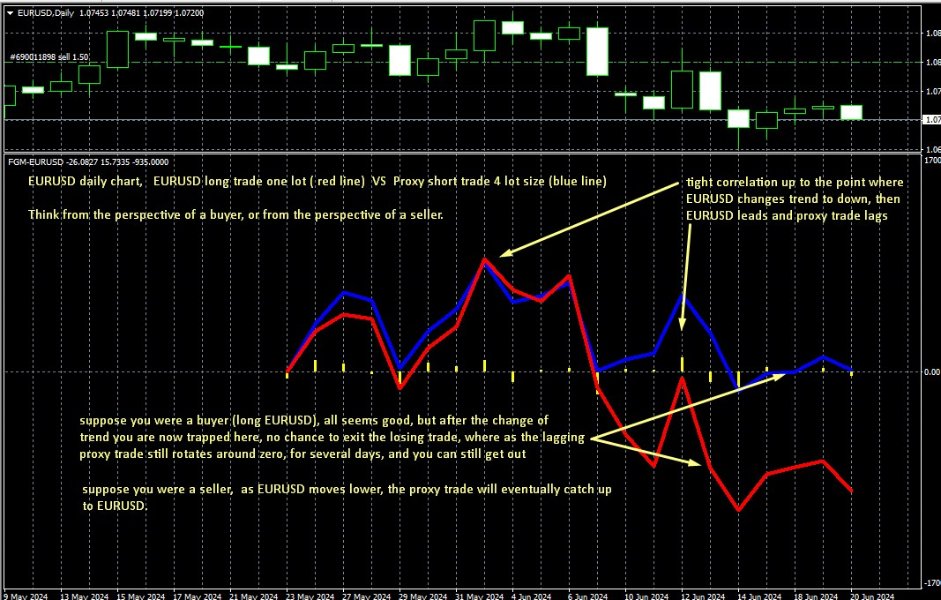

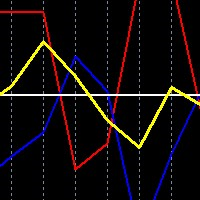

This is an obscure Hedge Fund like strategy, based one of our early indicators on EURUSD originally intended for day trading, while developing and testing the indicator we found out that the data used in this indicator (set of 4 currency pairs) follows EURUSD in a very peculiar way. On one hand these two are correlated, but the 4 currency proxy set tends to lag behind EURUSD, it lags on a day to day basis, and then catches up eventually after several days. And therefore can be used as a proxy for trading EURUSD.

Proxy Trade Edge: - if EURUSD makes a sudden intraday, or daily trend reversal, say by moving 200 pips, the proxy trade breaks correlation and stays behind in time, ie it will hardly move at all. Then gradually it will catch up over time and correlation will return, but you will have plenty of time to adjust your trades. Whereas trades on EURUSD alone have no such flexibility.

Out of multi year tests, only EURUSD and one more currency pair have been found to have proxy trades!

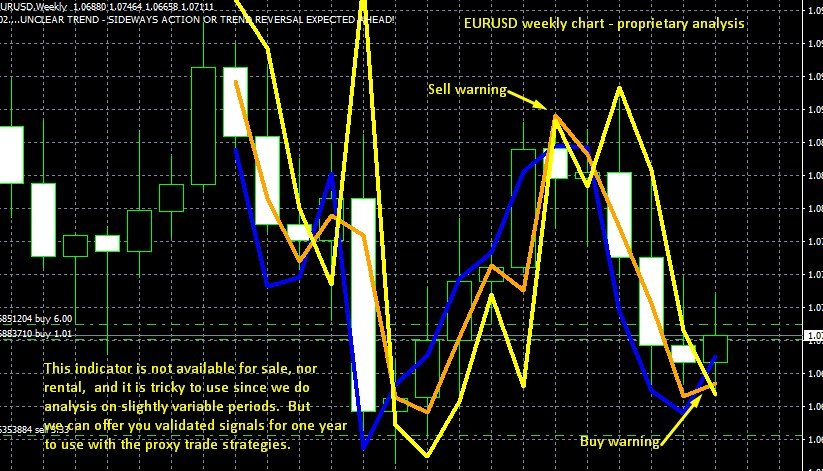

What you get for such a highly priced product - You get the trade indicator, full disclosure of the proxy trade, one year support and guidance on the strategies of interest, and guidance on broker selection, you will have to hide the trades from your own brokers by using two different brokers, so no one can see your strategy, plus one year worth of signals on weekly EURUSD direction.

More specifically:

1) Hedge Fund strategy for slow, high probability small profits, easy to replicate on very large accounts. Slow trading doesn't have liquidity issues.

2) Directionless approach to the market.

3) Extra bonus signals for one year, on EURUSD for directional approach, for those who want to get into a wider spectrum of possibilities. Signals are provided by 3rd party, and it's about trend detection in EURUSD. Trading strategy is up to you.

All in all this price is a bargain price to pay, since nobody will ever offer something of this caliber, and how often can someone come up with

proxy market equivalents? you probably have never heard of this concept before, but it is real.

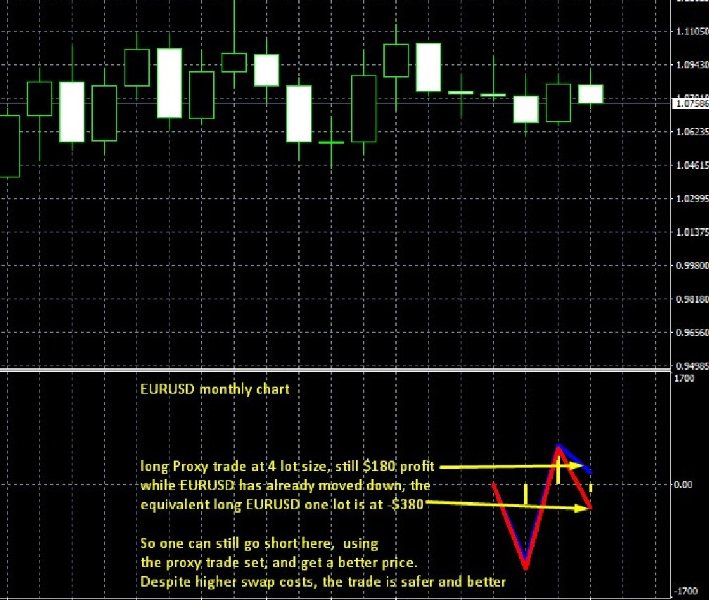

One interesting trade, which you can run throughout the year, is trading the EURUSD as normal, but then using an opposite trade through the proxy trade, as insurance. You end up making less money if you predict the market right, only a fraction of the normal profit. which could be 10% or 20% on the total margin used, but if your prediction is wrong, the proxy trade will offset all your losses at some point!

More pairs means overall less volatility, this is where the lagging effet comes from.

Simply follow the solid EURUSD trend, and then trade the proxy trade, the proxy trade tends to lag behind EURUSD by as much as a week in some cases.

Dynamic Correlation - It makes it possible to implement ultra low risk free trades from time to time, through divergence-convegrence, typical profitability is around 6% on those trades.

There are several ways to make us of this interesting proxy trade, the user will be given basic tips and advice.

The lagging proxy trade is forgiving of mistakes and adverse market moves, in ways that EURUSD itself is not. Most of the time you will see EURUSD making a move, such that an one lot trade in EURUSD will make ie $1,500 over 3 days, while the equivalent proxy trade set will not have moved at all, it may even be slightly negative. One week later EURUSD may be consoliding at that exact level, still showing $1500 profit, or having pulled back a bit, and the proxy trade now shows comparable profit.

#eurusd, #hedge fund, #bank strategy