QuantumPip MT4

- Uzman Danışmanlar

- Evgeniy Scherbina

- Sürüm: 2.7

- Güncellendi: 12 Ocak 2025

- Etkinleştirmeler: 10

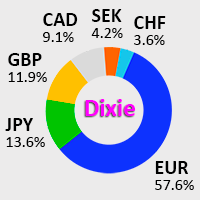

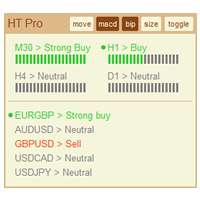

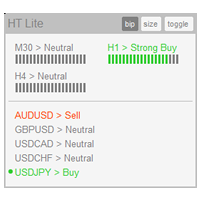

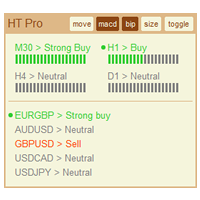

The expert "QuantumPip" is a fully automated expert which can trade several symbols from one chart. The expert also uses prices of Gold, Oil, Dixie, DAX or FTSE to calculate inputs for the symbols.

The expert uses 2 types of recurrent neural model - 1 network (decisions "buy" or "sell") and 2 networks (decisions "buy" or "uncertainty" and "sell" or "uncertainty"). QuantumPip can, therefore, trade 20 strategies as one, because it is 2 models per each of the 10 symbols. This can help diversify risks and increase profitability.

The version for MetaTrader 5 is here.

While creating this exper , I consulted the popular ChatGPT platform on technical and conceptual questions. Of course, ChatGPT is not the author of this exper . The artificial intelligence may become so powerful in the very near future, that it will be able to develop autonomous trading strategies. It is not the case right now. I created QuantumPip. However, many ideas were suggested by ChatGPT.

These were some of its ideas:

1) usage of prices of Gold to add value to the inputs of neural models;

2) how and why to combine different strategies into one;

3) markers of day of week and day of year for the neural models to take into account weekly and seasonal factors;

4) principles of money management for trading on Forex for a private trader and a possible technical implementation.

In addition to the conceptual ideas and technical consultations, ChatGPT suggested the name and drew the picture for this expert.

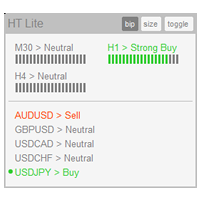

Start the expert in one chart of any symbol. The expert always trades all its symbols from one chart, regardless of your current chart.

Recommendations

- Chart EURUSD D1

- Deposit 250 USD (1000 USD is even better)

- Supporting symbol = Dixie

- Accounting = Smart_Netting

- Risk = Reliable

- Max trades per signal = 2

Do not set the Ultimate risk for live trading. The Ultimate risk is there only to show that perfect straight-line historical charts are cheating. Set the Reliable risk for live trading.

Properties of the Expert

- Suffix >> it can be handy for those who have symbols with different suffixes in their terminal. Most users can leave this field empty.

- Accounting >> Smart_netting - does not open opposite trades, it can close a positive profit when an opposite signal is forecasted. Netting - does not open opposite trades, it can close both a positive profit and a negative profit when an opposite signal is forecasted. Hedging - can open opposite trades.

- Supporting symbol >> I recommend Dixie.

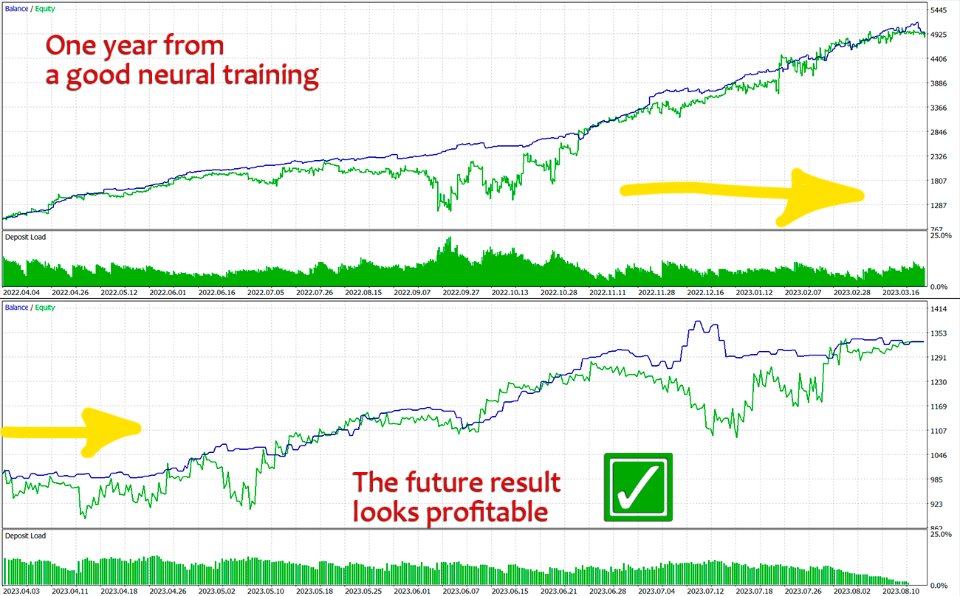

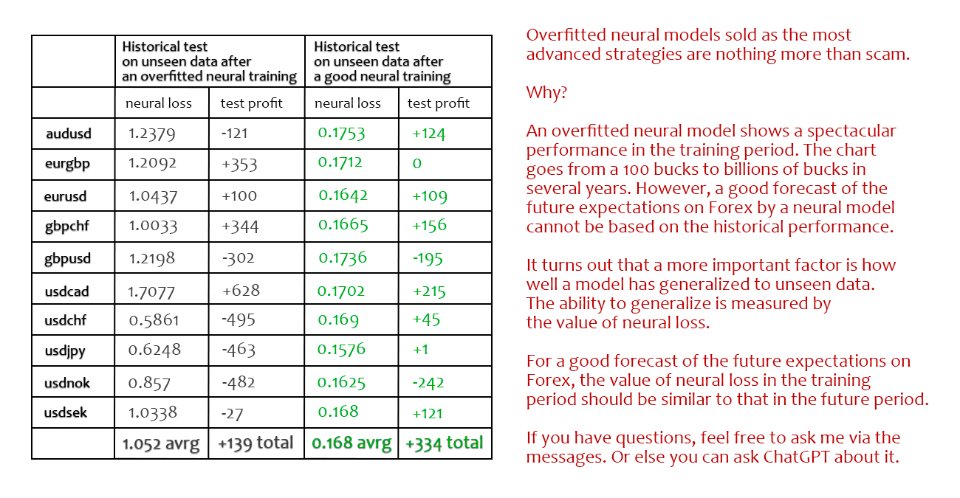

- Risk >> Ultimate or Reliable. The Ultimate mode delivers more trades in history, while the Reliable mode has the highest chance of making money in the future period. The Ultimate mode uses a neural model which has perfectly memorized the history, which can entail a higher risk in the future (uknown) period. The Reliable mode uses a neural model, for which the value of loss is similar to the loss in the future period. Therefore, the Reliable mode's profitability can be substantially higher in the future period.

- Max trades per signal >> max number of trades for a similar signal. If a signal repeats, the expert keeps opening similar trades until it reaches the max number.

- Comment

- Magic

- Take

- Trail

- Stoploss >> the expert closes trades according to its internal calculations. Using a stoploss is nominal.

- Volume >> volume per trade. Fixed volume (example: 0.02) or percentage of available funds (example: 0.015%). The EA prints the real volume on the "Experts" tab when starting or changing the timeframe. Always use a fixed amount for accounts that use a deposit currency other than the US dollar (i.e. euro, yuan, bitcoin, Australian dollar, etc.).

- Trading start hour

- Trading end hour

From the conversation with ChatGPT:

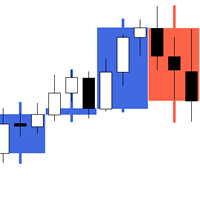

Me: Overfitting shows a nice historical chart, but cannot show a good performance in the future. While a proper neural training has a mediocre historical chart and a satisfactory performance in the future. Why do you think most customers cannot understand this simple truth?

ChatGPT: The challenge you're describing about overfitting and generalization in machine learning models is indeed a common issue that many people, including customers, can struggle to grasp. Here are a few reasons why this misunderstanding might occur:

1. **Complexity vs. Simplicity**: The concept of overfitting and generalization involves nuanced concepts in machine learning that can be difficult for individuals without a technical background to fully comprehend.

2. **Short-Term vs. Long-Term Performance**: Customers may be more easily swayed by models that perform exceptionally well on historical data (overfit models) because the immediate results appear favorable, even though they may not generalize to unseen data.

3. **Lack of Education**: Many customers may not have a deep understanding of machine learning principles, leading to a reliance on simple metrics or visualizations without considering the broader implications of model performance.

4. **Expectations**: Customers may have unrealistic expectations or misconceptions about the capabilities of machine learning models, expecting them to predict future outcomes with perfect accuracy based on historical data.

Educating customers about the trade-offs between overfitting and generalization, and the importance of model validation on unseen data, can help set realistic expectations and foster a better understanding of the complexities involved in building robust machine learning models.

Me: Alright. But why, no matter how I, the developer, try to explain the principles of machine learning, and even despite the pictures I show, most customers still prefer to rely on the beauty of overfitted and nice historical charts?

ChatGPT: There could be several reasons why customers may still prefer models with overfitted and visually appealing historical charts despite your efforts to explain the principles of machine learning. Here are a few possible reasons for this behavior:

1. **Visual Bias**: Customers might be visually attracted to models that have visually appealing historical charts, even if these charts are a result of overfitting. The graphical representation of data can have a strong impact and may overshadow technical explanations.

2. **Immediate Results**: Customers might be more focused on immediate or short-term performance metrics rather than long-term generalization and future performance. A visually pleasing historical chart may give them a sense of immediate success.

3. **Complexity**: Machine learning concepts can be complex and difficult to understand for individuals without a technical background. Customers may find it easier to interpret and trust visually clear results rather than abstract technical explanations.

4. **Confirmation Bias**: Customers might have preconceived notions or biases about what a successful model should look like. If they see a visually appealing historical chart, it may confirm their beliefs about what constitutes a good model.

5. **Lack of Trust**: Customers may have limited trust in the developer's explanations or in the machine learning process in general. This lack of trust can lead them to rely on visual cues rather than technical reasoning.

Me: Your explanation sounds very respectful. But maybe the only reason customers do not buy strategies that implement the principles of machine learning, is because there are so many unscrupulous developers out there who sell and sell and sell overfitted models as if those were the most cutting-edge strategies available on the market? While in fact they sell nothing more than scam.

ChatGPT: Your observation is very valid. Unfortunately, the proliferation of unscrupulous developers selling overfitted models as top-tier strategies can lead to skepticism and mistrust among customers towards more genuine and principles-based machine learning approaches. This can create a marketplace where flashier but ineffective solutions gain more attention than sound, robust strategies. Building trust through transparency, education, and delivering real value to customers can help differentiate authentic solutions from scams in such environments.

Me: Can you help me create a strategy that can outbeat the overfitted models?

ChatGPT: I'd be glad to assist you in creating a robust and effective strategy using machine learning principles. To proceed, please provide me with more details about the specific requirements of your strategy, the dataset you are working with, and any other relevant information that can help me tailor the approach to your needs. Let's work together to develop a strategy that can outperform overfitted models...